- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday ☕️

Welcome to Read Sunday ☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

How do you invest currently?Some ways you allocate your investments: |

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

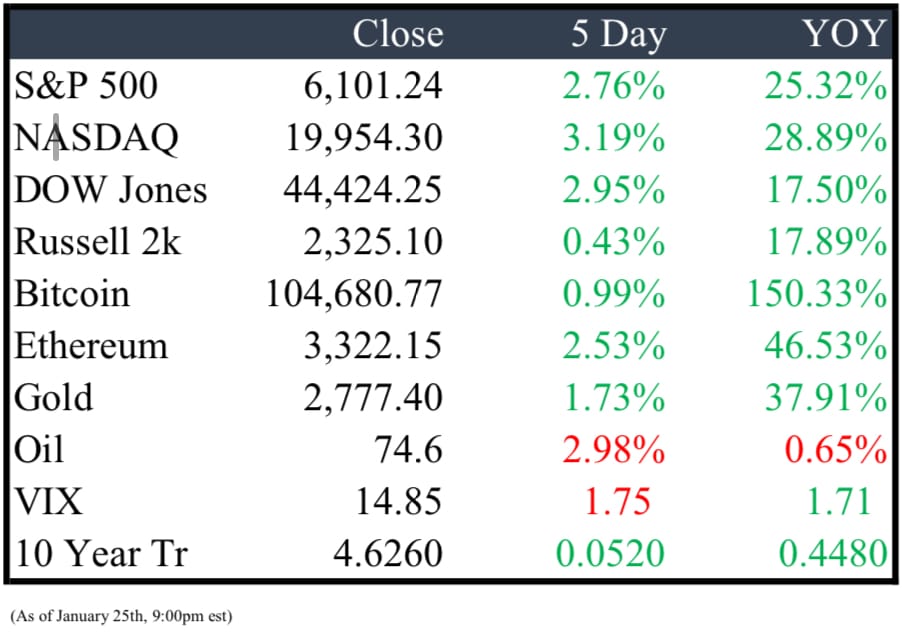

Market Recap

Last Week’s Headlines

Economy & World News

WHO Urges US to Reconsider Exiting Amid Funding and Global Health Concerns

The World Health Organization has appealed for the US to reconsider its decision to withdraw, warning that losing its top donor could jeopardize efforts to combat global health threats like HIV, polio, Ebola, and the Marburg virus.

Trump Floats New Tariffs on Mexico, Canada, and China Starting February

President Trump suggested imposing tariffs on Mexico and Canada by February 1 and hinted at escalated tariffs against China over issues with TikTok, amidst a flurry of executive orders affecting regulation, free speech, and immigration.

Biden Issues Preemptive Pardons Ahead of Trump's Inauguration

President Joe Biden granted preemptive pardons to Dr. Anthony Fauci, Gen. Mark Milley, and those involved in the Jan. 6 investigations, including Congress members, committee staff, and testifying police officers, just hours before President-elect Donald Trump takes office.

Japanese Policy Rate Hits 14-Year High, Yen Strengthens

The policy rate has been raised to 0.5%, the highest since October 2008, with an 8-1 vote featuring dissent from board member Toyoaki Nakamura. Following the hike, the Japanese yen appreciated by 0.6% to 155.12 against the dollar, and the Nikkei 225 saw a marginal increase.

Trump Launches $100 Billion AI Venture Backed by Global Tech and UAE Influence

President Trump announced a $100 billion initiative for AI infrastructure supported by OpenAI, SoftBank, Oracle, and MGX, an Abu Dhabi-based firm led by Sheikh Tahnoon bin Zayed Al Nahyan, a key figure in the UAE's $1.5 trillion empire.

Purdue Pharma Strikes $7.4 Billion Settlement Over OxyContin Lawsuits

Purdue Pharma and the Sackler family have agreed to a $7.4 billion settlement to address allegations that their drug OxyContin fueled the opioid crisis, following a Supreme Court decision that rejected an earlier bankruptcy settlement.

Trump Signs Executive Order to Develop National Digital Asset Stockpile

President Donald Trump has signed an executive order focused on creating a national stockpile of digital assets, signaling a shift from his previous skepticism of cryptocurrencies during his 2024 campaign.

U.S. Pensions Demand Greater Transparency from Private Equity Firms

A coalition of U.S. pensions and institutional investors is urging private equity firms to improve transparency in fees and returns. The Institutional Limited Partners Association, representing public worker retirement plans in California and Wisconsin, introduced guidelines for standardized financial reporting. With private-equity investments by public pensions, endowments, and foundations doubling since 2018, these major stakeholders are pushing for clearer insights despite traditionally high returns from private equity.

South Korea's Economic Growth Slows in Q4, Misses Expectations

South Korea's economy grew by 1.2% year-on-year in the fourth quarter, marking its slowest pace since Q2 2023 and falling short of the 1.4% growth expected by analysts. The quarter-on-quarter GDP growth also did not meet expectations.

Public Markets

Trump's Meme Coin Launch Skyrockets in Value Ahead of White House Return

Just days before his White House return, President Trump and Melania launched meme coins $TRUMP and $MELANIA, soaring to a $7 billion market cap, despite lacking economic utility.

Baupost Group Sees $7 Billion Withdrawal Over Three Years

Clients have withdrawn approximately $7 billion from Seth Klarman's Baupost Group due to subpar returns, with the fund gaining only about 4% annually since 2014, a stark contrast to its historical performance.

Musk Challenges Funding Claims for $500 Billion AI Project on Trump's First Day

Elon Musk casts doubt on the financial backing of OpenAI, Oracle, and Softbank for the ambitious Stargate project, asserting they lack sufficient funds despite Trump's promotion of the venture.

Netflix Shares Hit Record High with Historic Subscriber Surge

Netflix shares soared after the company reported an unprecedented subscriber increase of 18.9 million in the fourth quarter, surpassing 300 million global subscribers, fueled by live sports and the return of Squid Game.

Meta Expands Wearable Tech with AI-Infused Smart Glasses and Watches

Meta Platforms Inc. is developing upgrades to its smart glasses and exploring new wearables like watches and camera-equipped earbuds to integrate artificial intelligence more deeply into its product lineup, with plans for Oakley-branded glasses for athletes and high-end display glasses set for 2025.

Novo Nordisk Shares Surge on Promising Obesity Drug Results

Shares of Novo Nordisk soared after announcing that its experimental amycretin drug led to an average weight reduction of 22% in obese and overweight patients over 36 weeks, with gastrointestinal issues as the most common side effect.

Burberry Reports Smaller Decline in Sales, Beating Analysts' Expectations

Burberry's quarterly sales fell by only 4%, surpassing expectations of a 12% drop, as the company unveiled new initiatives to rejuvenate the brand. Despite the better-than-expected overall performance, sales were still down in Asia Pacific and EMEIA regions by 9% and 2%, respectively.

Boeing Forecasts $4 Billion Q4 Loss Amid Multiple Challenges

Boeing anticipates a fourth-quarter loss of around $4 billion, nearly triple what analysts expected, due to production issues, regulatory scrutiny, supply delays, and a U.S. West Coast strike. Shares fell 3.5% in after-hours trading following the announcement.

Real Estate

Santee Cooper Seeks Buyers for South Carolina Nuclear Reactor Project

Santee Cooper is exploring the sale of two dormant nuclear reactors, eyeing tech giants like Amazon and Microsoft for clean energy to power AI data centers, with proposals managed by Centerview Partners due until May 5.

Reliance to Build World's Largest Data Center in India Amid AI Demand Surge

Mukesh Ambani's Reliance Group is constructing what could become the world's largest data center in Jamnagar, India, with plans to harness three gigawatts of capacity. This move comes as global tech giants like Microsoft, Alphabet, and Amazon invest heavily in data centers to enhance AI services, paralleling the massive AI infrastructure investments in the US by OpenAI, SoftBank, and Oracle through the Stargate Project.

M&A, IPO’s, Bankruptcies

Banks to Sell $3 Billion Debt from Musk's X Acquisition

A consortium led by Morgan Stanley is set to offload up to $3 billion in senior debt related to Elon Musk's takeover of X (formerly Twitter), offering it to investors at 90 to 95 cents on the dollar. This move is part of an effort to clear $13 billion of debt accrued during Musk

Venture Global IPO Closes 4% Lower in Market Debut

Venture Global, now the second-largest U.S. LNG exporter behind Cheniere, closed its first day of trading down at $24 per share, resulting in a market capitalization of approximately $58 billion, marking the first major IPO under the Trump administration.

Monte Paschi Eyes Acquisition of Mediobanca Amid Italian Banking Consolidation

Banca Monte dei Paschi di Siena is considering acquiring full or partial control of Mediobanca, potentially announcing the move as soon as Friday. Monte Paschi, with a doubled share value over the past year reaching €8.8 billion, aims to capitalize on Mediobanca's €12.7 billion market value and its significant stake in Generali SpA. This interest marks another significant consolidation effort in the Italian financial sector.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply