- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday ☕️

Welcome to Read Sunday ☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

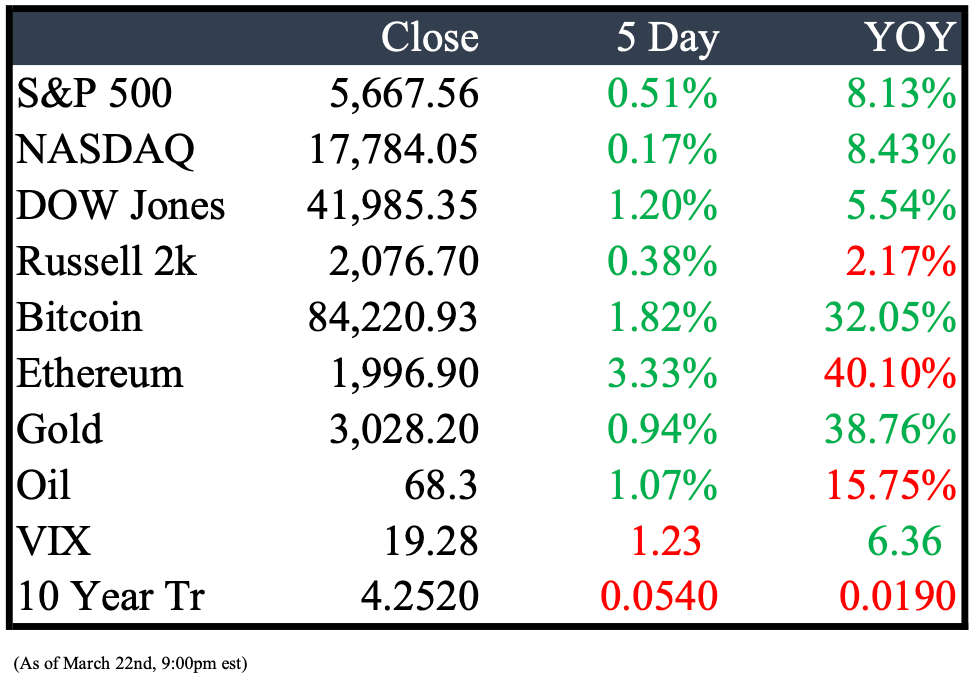

Market Recap

Last Week’s Headlines

Economy & World News

Retail Sales Rebound Slightly, But Factory Activity Falters

Retail sales rose 0.2% in February, outperforming January’s decline but missing expectations, while the core control group jumped 1%, offering a positive sign for GDP—meanwhile, New York factory activity plunged, signaling potential headwinds.Putin Opens Door for Western Funds to Exit Russian Securities

Ahead of talks with President Trump, Putin approved a decree allowing firms like 683 Capital Partners LP, Franklin Advisers, and Baillie Gifford to sell Russian assets—marking a rare financial concession amid ongoing tensions over the Ukraine war.Tensions Flare as Israel Strikes Hezbollah Targets in Lebanon

After rockets were launched from southern Lebanon, Israel responded with airstrikes, killing two and injuring several—though Hezbollah denied involvement and reaffirmed its commitment to the ceasefire in place since last November.Germany Approves $542 Billion Infrastructure Fund and Loosens Debt Rules

Germany’s upper house passed a constitutional amendment enabling a €500 billion infrastructure overhaul and unlimited defense spending, marking a significant shift in the country’s strict borrowing limits.Turkey Detains Erdogan Rival, Triggering Market Turmoil

Istanbul Mayor Ekrem Imamoglu, seen as President Erdogan’s top political challenger, was detained on corruption charges, leading to protests and a sharp selloff in Turkish stocks and the lira.Fed Holds Rates Steady, Cuts Growth Outlook

The FOMC kept interest rates at 4.25%-4.5%, lowered its GDP forecast to 1.7%, and slightly raised its inflation projection—while also announcing a slowdown in its quantitative tightening program.Columbia University Bows to Federal Demands Amid $400M Funding Standoff

After the Trump administration withheld $400M over concerns about antisemitism on campus, Columbia agreed to several new protest rules, including bans on identity-concealing masks and stricter ID requirements, though funding has not yet been reinstated.Bank of England Holds Rates Steady at 4.5%

As expected, the BoE kept its benchmark rate unchanged, with an 8-1 vote from the Monetary Policy Committee, signaling continued caution amid economic uncertainty.Trump Signs Order to Begin Dismantling U.S. Education Department

President Trump directed Education Secretary Linda McMahon to start eliminating the Department of Education, calling for its full abolition—a move that would require congressional approval and faces steep opposition despite support from some Republican lawmakers.Turkey’s Central Bank Surprises With Rate Hike to Stabilize Lira

In an unexpected move, Turkey’s central bank raised its overnight lending rate to 46% in an effort to stem the lira’s decline, which had dropped 3.2% the day before amid heightened political and economic tensions.Trump Weighs Extending Chevron’s Venezuela License, Penalizing Rivals

The Trump administration may allow Chevron to keep pumping oil in Venezuela while considering tariffs or financial penalties on countries like China that do business there—aiming to counter Beijing’s influence and preserve U.S. energy interests.Germany Approves €1 Trillion Investment Plan to Boost Economy and Defense

Germany’s $1.08 trillion civilian and defense spending package has passed its final hurdle, aiming to reduce U.S. military dependence and revitalize the economy—though experts warn it must be paired with deep structural reforms to deliver lasting impact.IRS Nabs Ex-Defense Contractor in $350M Offshore Tax Evasion Case

Douglas Edelman, a former military contractor turned globetrotting multimillionaire, was charged with hiding $350 million in income and failing to report foreign bank accounts—after a whistleblower tipped off the IRS about false filings and offshore trusts tied to his French wife.

Public Markets

Oil Prices Climb on Strong U.S. Demand and Fed Outlook

Brent and WTI rose 0.7% as U.S. gasoline inventories hit their lowest since January and the Fed signaled potential rate cuts, while rising geopolitical tensions and falling distillate stocks added support despite ongoing trade and oversupply concerns.Saudi Wealth Fund Expands Financing Strategy with New Bond Plans

The Public Investment Fund is exploring a euro-denominated bond and tapping U.S. investors for the first time, while encouraging subsidiaries like Neom Co. and AviLease to issue debt—part of a broader shift to reduce reliance on government funding.Feds Uncover $500M Money Laundering Operation Linked to Chinese Fentanyl Trade

On a gray day in Queens, federal agents watched Da Ying “David” Sze—suspected leader of a massive laundering ring—move bags of cash later funneled through banks like TD Bank, helping fentanyl dealers wash over $500 million in illicit funds.Starboard Prepares Proxy Fight at Autodesk Over Underperformance

Activist investor Starboard Value, with a $500M stake in Autodesk, plans to nominate directors amid concerns the company has lagged peers and needs margin improvements—Autodesk responded by highlighting its strong shareholder returns and ongoing dialogue with Starboard.DoorDash Partners with Klarna to Add Flexible Payment Options for U.S. Shoppers

DoorDash users will soon be able to pay with Klarna, choosing from options like Pay in Full, Pay in 4, or Pay Later—bringing flexible, interest-free payments to everything from groceries and electronics to DashPass memberships.Boeing Wins $50B Pentagon Contract for Next-Gen F-47 Fighter Jet

Boeing secured the F-47 fighter jet contract, edging out Lockheed Martin to build the Pentagon’s stealth jet successor to the F-22—boosting Boeing’s defense unit and marking a key shift in U.S. defense priorities toward software-driven, drone-integrated warfare.

Real Estate

Sandals Resorts Revives $6–$7 Billion Sale Effort Amid Family Feud

After years of internal disputes following founder Butch Stewart’s death, Sandals Resorts is once again exploring a potential sale that could become one of the biggest real estate deals of the year, drawing interest from hotel giants and private equity.UBS Considers HQ Move Over Switzerland’s $25B Capital Demand

Facing pressure from Swiss regulators to boost capital by $25 billion, UBS is weighing relocating its headquarters, arguing the stricter rules would make it uncompetitive globally—a response to measures aimed at preventing another Credit Suisse-style collapse.Johnson & Johnson to Invest $55B in U.S. Manufacturing Amid Trade Pressure

J&J plans to boost U.S. investments by 25%, including four new manufacturing facilities—starting in Wilson, NC—as it responds to Trump-era threats of drug import duties and emphasizes its commitment to domestic production.

M&A, IPO’s, Bankruptcies

Google to Acquire Cloud Security Leader Wiz for $32 Billion

In a major all-cash deal, Google Cloud announced it will acquire Wiz, a top cloud security platform, to strengthen its position in multicloud security and AI-driven protection—a move underscoring the growing demand for advanced cybersecurity solutions in the AI era.Elon Musk’s X Raises Nearly $1B, Maintains $44B Valuation

Musk's social platform X secured close to $1 billion in new equity, preserving its $44 billion enterprise value from the 2022 buyout, with backing from firms like Darsana Capital and 1789 Capital—funds may go toward reducing debt.SoftBank to Acquire Chipmaker Ampere for $6.5 Billion

SoftBank announced it will acquire Arm-based server chip startup Ampere for $6.5 billion, with Carlyle Group and Oracle agreeing to sell their stakes—Ampere will remain an independent subsidiary based in Santa Clara.Kraken Buys NinjaTrader for $1.5B to Expand Beyond Crypto

In a move to grow beyond digital assets, Kraken acquired futures platform NinjaTrader for $1.5 billion, gaining access to U.S. crypto derivatives markets and advancing plans to offer equities and payments—a deal buoyed by a more crypto-friendly regulatory environment.QXO Strikes $11B Deal for Beacon Roofing After Hostile Bid

QXO will acquire Beacon Roofing Supply for $124.35 per share, valuing the company at $11 billion including debt, marking founder Brad Jacobs’ first major move toward building a $50B-a-year distribution giant after months of tender offers and takeover defense.Boston Celtics to Be Sold for Record $6.1 Billion

A group led by Symphony Technology’s Bill Chisholm has agreed to buy the Celtics at a $6.1B valuation, setting a new North American sports franchise record and eclipsing the NBA’s previous high set by the $4B Phoenix Suns sale.BP Sells TANAP Pipeline Stake to Apollo for $1B Amid Asset Push

As part of its $20B disposal program, BP is selling its stake in the TANAP gas pipeline to Apollo Global for $1 billion, aligning with CEO Murray Auchincloss’s plan to shift focus from renewables to oil and gas and reduce net debt.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply