- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday ☕️

Welcome to Read Sunday ☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Simplify with BILL. Get a BrüMate Backpack Cooler.

We love our customers—and the feeling is mutual! Demo BILL Spend & Expense and get $200 to spend with BrüMate.

“BILL gives me the capability to create as many virtual cards as I want. It makes budgeting easy. I use a different card for marketing, office expenses, etc and can set budget for each. All free, no hidden fees. Makes expense tracking extremely simple.” – Dylan Jacob, Founder @ BruMate

BILL gets you:

Customizable spending limits

Real-time tracking

Scalable credit lines

Take a demo and claim $200 to spend with BrüMate.1

1Terms and Conditions apply. See offer page for details. Card issued by Cross River Bank, Member FDIC, and is not a deposit product.

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

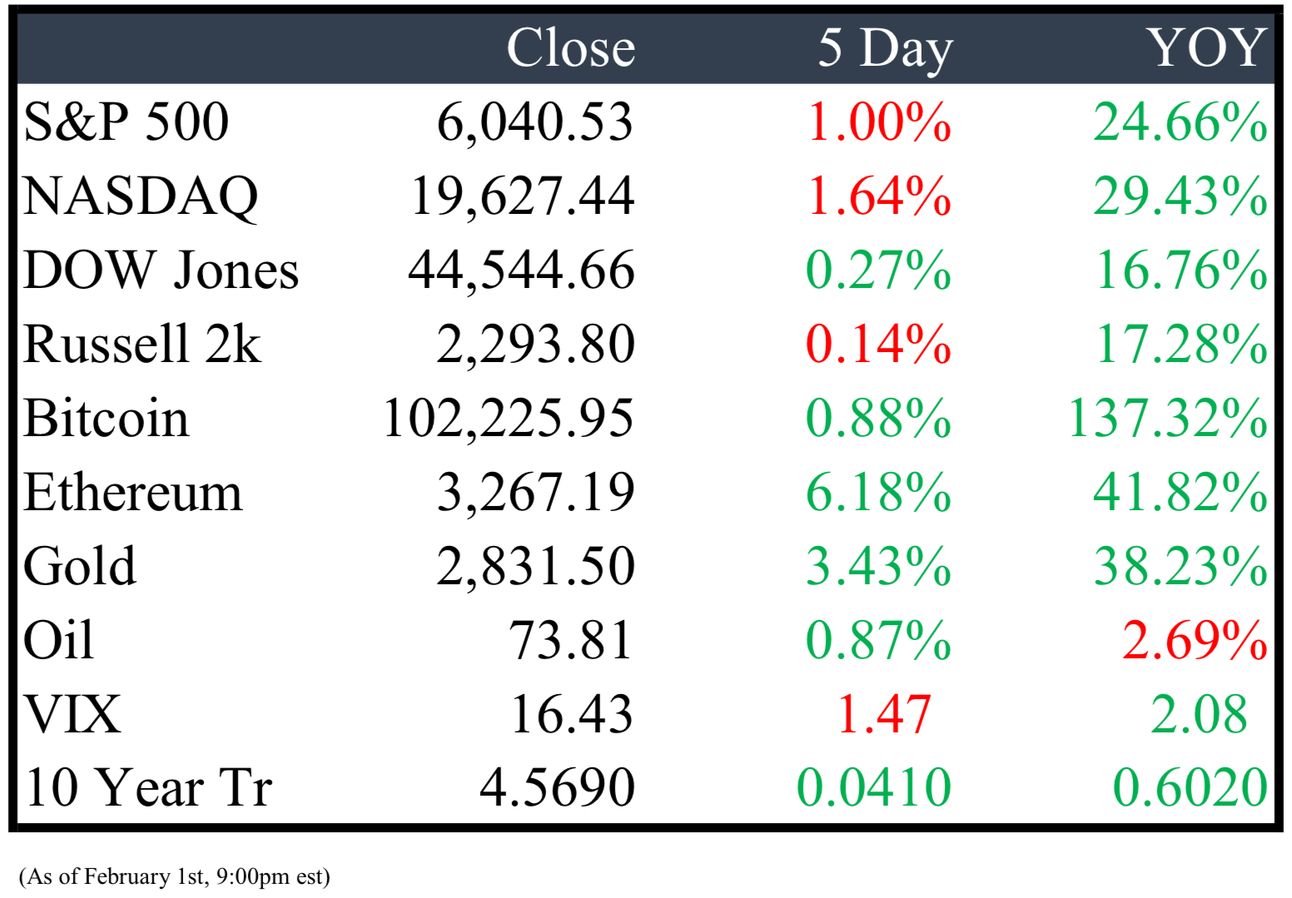

Market Recap

Last Week’s Headlines

Economy & World News

Federal Reserve Holds Rates Steady After Recent Cuts

The Federal Reserve has maintained its overnight borrowing rate at 4.25%-4.5%, halting adjustments after three consecutive reductions since September 2024. In their latest statement, the Fed expressed a more optimistic outlook on the labor market and notably omitted a previous reference to inflation nearing the 2% target from their December communication.

NATO Initiates Sharing Classified Capability Targets with Defense Industry

NATO has begun the process of sharing specific classified capability targets with the defense industry, aiming to boost production under the new "wartime mindset" directive from Secretary General Mark Rutte. This strategic move, designed to enhance production capacities, requires consensus among allies and is expected to unfold in the coming months.

Senate Confirms Scott Bessent as 79th U.S. Treasury Secretary

Scott Bessent, founder of Key Square Group and a Wall Street veteran, was confirmed by the U.S. Senate as the 79th Treasury Secretary with a vote of 68-29, demonstrating significant bipartisan support. Bessent faces critical challenges including managing the nation's debt, deficits, Trump's proposed tariffs, and the future of expiring tax cuts.

U.S. Navy Bans Use of DeepSeek AI Over Security Concerns

The U.S. Navy has officially warned its personnel against using DeepSeek, citing "potential security and ethical concerns." This directive, issued on Friday, prohibits Navy team members from utilizing the Chinese AI technology for both work-related tasks and personal use, amidst growing industry buzz around the startup.

White House Ultimatum: Federal Workers to Choose Between Office Return or Resignation

The White House has issued an ultimatum to federal employees: return to the office full-time or resign with eight months of pay and benefits. According to a recent directive from the Office of Personnel Management, workers have until February 6 to make their decision. This move is part of the Trump administration's broader effort to downsize the federal workforce, potentially impacting even those who choose to remain employed.

Trump Executive Order Limits Gender Therapy Access for Minors

President Trump signed an executive order on Tuesday that restricts access to gender-affirming treatments such as puberty blockers and hormones for transgender children and teens under 19. The order directs federal agencies to withhold funding from institutions that provide these therapies and excludes them from health insurance coverage for military personnel and their families.

Former Senator Bob Menendez Sentenced to 11 Years for Bribery

Bob Menendez, a former U.S. Senator from New Jersey, has been sentenced to 11 years in prison after being found guilty of exchanging his political influence for bribes, including gold bars. The conviction last summer on charges of bribery, fraud, and acting as an illegal foreign agent marked the end of his extensive political career. Menendez, who was 71 and previously chaired the Senate Foreign Relations Committee, resigned from the Senate following his conviction.

European Central Bank Cuts Rates Again Amid Economic Stall

The European Central Bank has reduced borrowing costs for the fifth time since June, lowering the deposit rate by a quarter-point to 2.75% as the region's economy shows signs of stalling and the 2% inflation target becomes attainable. Despite the cuts, ECB officials maintain a "restrictive" monetary policy stance but suggest further easing may be ahead. ECB President Christine Lagarde emphasized the decision's unanimity and cautioned against solid forward guidance due to current uncertainties.

Euro Zone Economy Stagnates in Fourth Quarter

The euro zone economy experienced zero growth in the fourth quarter, according to preliminary data from Eurostat. This outcome fell short of economists' expectations surveyed by Reuters, who had anticipated a modest 0.1% growth following a stronger 0.4% expansion in the previous quarter.

U.S. GDP Growth Slows in Fourth Quarter; Consumer Spending Remains Strong

The U.S. GDP grew at a 2.3% annualized rate in the fourth quarter, according to the Commerce Department, slightly below economists' expectations of 2.5% and down from 3.1% in the third quarter. For the entire year, GDP growth was 2.8%, marginally less than the 2.9% seen in 2023. Meanwhile, consumer spending, which constitutes about two-thirds of all economic activity, increased robustly by 4.2%. In related news, the Labor Department reported that initial unemployment claims dropped to 207,000 for the week ending January 25, significantly below the anticipated 228,000.

German Economy Contracts in Fourth Quarter Despite Rising Domestic Consumption

The German economy experienced a contraction in the fourth quarter, following a slight increase in GDP in the preceding three months. Although analysts had anticipated a modest decline of 0.1%, the drop was underscored by a significant decrease in exports, which offset gains in household and government consumption, according to the German statistics agency, Destatis.

Public Markets

Tech Stocks Tumble as Chinese AI Model Challenges Nvidia

Global investors retreated from tech stocks, particularly Nvidia, which saw a historic $593 billion erased from its market value amid fears that DeepSeek's new low-cost AI model could disrupt the industry. The Chinese startup's AI assistant, boasting fewer data requirements and lower costs, has quickly surpassed U.S. counterpart ChatGPT in popularity, causing a major shift in investor confidence and a search for safer investments.

Alibaba Launches Advanced AI Model Qwen 2.5, Challenging DeepSeek

Alibaba unveiled its new Qwen 2.5 AI model, surpassing the capabilities of the acclaimed DeepSeek-V3, in a strategic release on the first day of the Lunar New Year. This timing reflects the intense competition from DeepSeek, which has significantly impacted both international and domestic AI markets within just three weeks.

DeepSeek Limits Registrations Amid Security Concerns

DeepSeek has announced a temporary halt to new user registrations following "large-scale malicious attacks" on its services. The Chinese AI startup recently surpassed OpenAI's ChatGPT as the most-downloaded free app on Apple’s App Store.

Morgan Stanley Capitalizes on Musk's White House Connections in $3 Billion Debt Offering

Just months after struggling with unsold debt from Elon Musk's 2022 takeover of Twitter, now X, Morgan Stanley is leveraging Musk’s ties with President Trump to attract investors to a $3 billion debt offering. With X showing financial rebound and links to Musk’s AI project, xAI, the bank reports a notable increase in X’s earnings, boosted by election-related activity, positioning the offering as an enticing opportunity for exposure to Musk’s ventures.

X Partners with Visa to Launch X Money Account

Elon Musk's X has announced a partnership with Visa, marking the social media platform's first venture into creating a financial ecosystem. Visa will facilitate fund transfers between traditional bank accounts and X's digital wallet, enabling instant peer-to-peer payments similar to Zelle and Venmo. This collaboration represents X's initial step towards integrating financial services.

JetBlue Faces Investor Disappointment Amid Cost-Cutting and Legal Setbacks

JetBlue's latest business outlook has left investors underwhelmed as the airline continues its cost-cutting efforts, including eliminating unprofitable routes. Additionally, JetBlue has faced significant legal challenges, losing two antitrust cases that obstructed its acquisition of Spirit Airlines and a regional collaboration with American Airlines.

Norway's Wealth Fund Earns Record $222.4 Billion Amid AI Boom

Norway's massive sovereign wealth fund reported a staggering full-year profit of 2.5 trillion kroner ($222.4 billion) on Wednesday. Managed by Norges Bank Investment Management, the fund achieved a 13% return on investment in 2024, largely fueled by the surge in tech stocks driven by the AI boom.

ChatGPT Dominates AI App Market with $529 Million in Sales

OpenAI's ChatGPT has catalyzed a significant uptick in artificial intelligence app spending, leading the sector with a gross of $529 million since its mobile app release in May 2023. According to Appfigures, AI app spending surged to $1.4 billion in 2024, with the US market driving approximately half of all sales. Chatbots, particularly ChatGPT and DeepSeek, dominate as the most popular and lucrative category, consistently outperforming other assistant apps in revenue across major platforms.

Apple Integrates Starlink Support in Latest iPhone Update

Apple Inc. has collaborated with SpaceX and T-Mobile to incorporate Starlink network support into the latest iPhone software, providing an alternative satellite communication service. This development, which was tested quietly, is now part of the smartphone's most recent software release. This unexpected move diversifies Apple's connectivity options beyond its existing partnership with Globalstar Inc., which offers emergency communication features.

Trump Media Launches Truth.Fi Focused on 'Patriot Economy'

In response to concerns over alleged unfair treatment of conservatives by banks, Trump Media has introduced Truth.Fi financial products. These products aim to bolster "American growth, manufacturing, and energy companies," aligning with investments that support the 'Patriot Economy.' President Donald Trump, through a revocable trust, indirectly owns 114,750,000 shares of the parent company.

HG Vora Initiates Proxy Battle at Penn Entertainment

Investor HG Vora is stepping up its engagement with Penn Entertainment by launching a proxy fight, nominating candidates for three independent board seats. This move aims to potentially reshape the board's composition at the casino operator, which recently saw its shares increase by 0.98%.

Meta Considers Shifting Legal Residence to Texas

Meta Platforms, led by Mark Zuckerberg, is exploring a move to change its legal residence from Delaware to Texas, according to sources familiar with the matter. This potential shift, which does not involve relocating corporate headquarters, aligns with Texas's appeal as a favorable destination for companies with controlling shareholders like Zuckerberg. This follows Meta's recent decision to relocate its trust and safety team to Texas.

Real Estate

New Treasury Secretary Scott Bessent Buys $12.5M Historic Mansion in Georgetown

Just days following his Senate confirmation, Treasury Secretary Scott Bessent has purchased a historic mansion in Washington, D.C., for $12.5 million. The property, sold by former ambassador to Malta Connie Milstein, was initially listed at $15.5 million in 2020 and adjusted to $13.5 million recently, per Zillow records. Milstein had previously acquired the home for approximately $11.11 million in 2010.

M&A, IPO’s, Bankruptcies

QXO Takes All-Cash Offer for Beacon Roofing Supply Directly to Shareholders

After multiple rejections, building-products distributor QXO is now bypassing executives and taking its all-cash acquisition offer directly to the shareholders of Beacon Roofing Supply.

Ancora Holdings Initiates Proxy Battle at U.S. Steel

Activist investor Ancora Holdings is launching a proxy battle at U.S. Steel, advocating for a strategic shift away from its unsuccessful partnership with Nippon Steel. Ancora's plan includes rallying shareholders to replace U.S. Steel’s CEO and to end litigation efforts to revive the merger. The firm has stated it is not seeking to sell U.S. Steel to another entity.

Mediobanca Rejects Monte Paschi's Takeover Bid as Hostile

Mediobanca SpA has officially rejected Banca Monte dei Paschi di Siena SpA’s takeover offer, declaring it hostile and lacking in both industrial and financial logic. The board stated that the bid, which proposed only a 5% premium over the closing prices and aimed to create one of Italy's top three asset-holding institutions, is "destructive" and not in the lender's best interests. This decision escalates tensions between the two banks, following Monte Paschi's unexpected all-share offer last Friday.

KKR Acquires Significant Stake in Henry Schein, Gains Board Influence

KKR has secured a substantial share in Henry Schein, a leading medical and dental supply company, planning to enhance its operational efficiencies. The private-equity firm announced on Wednesday that it has increased its stake to 12%, with an option to acquire an additional 2.9%. In conjunction with the investment, Henry Schein, which holds a market cap of approximately $9.5 billion, has granted KKR two seats on its board. This move comes amid an activist campaign by Ananym Capital Management, which has been advocating for CEO succession planning.

Frontier Airlines Renews Merger Proposal with Bankrupt Spirit Airlines

Frontier Airlines has made another attempt to merge with Spirit Airlines, currently in bankruptcy. Although Spirit executives declined the latest proposal, they remain open to considering a revised offer from Frontier.

Daniel Loeb Presses SoHo House for Fair Sale Process Amid Take-Private Offer

Daniel Loeb of Third Point has called on the directors of SoHo House to ensure a "fair" sales process in light of a take-private offer the hospitality group received last year. Labeling the $9 per share offer a "sweetheart" deal, Loeb suggests that other parties with hospitality sector experience might also be interested in acquiring the asset.

SoftBank Nears Up to $25 Billion Investment in OpenAI

SoftBank is reportedly in discussions to invest as much as $25 billion in OpenAI, potentially becoming the AI startup's largest supporter, CNBC reports. While the deal has yet to be finalized, this move follows a November event where OpenAI permitted employees to sell approximately $1.5 billion in shares to SoftBank in a tender offer.

Earnings this week

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply