- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ 11.24.2024

Welcome to Read Sunday☕️ 11.24.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

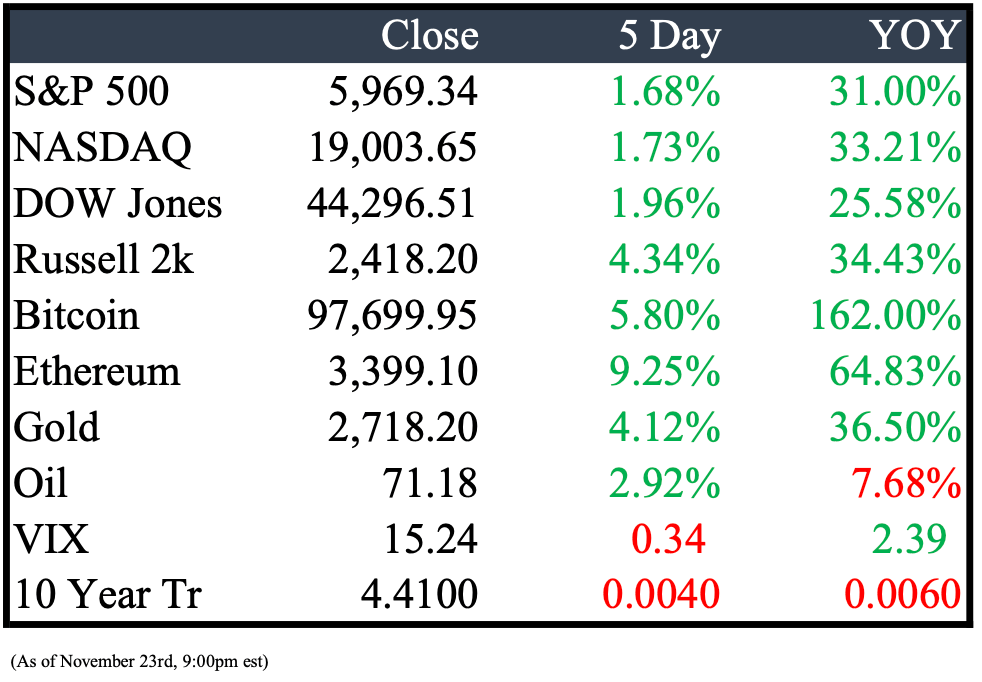

Market Recap

Last Week’s Headlines

Economy & World News

Gautam Adani Charged in Bribery Scheme Over Solar Contracts

Billionaire Gautam Adani faces charges for allegedly bribing Indian officials to win solar-energy contracts, according to a 54-page indictment that also accuses him of misleading U.S. investors and financial institutions about his company's practices.

ICC Issues Arrest Warrants for Netanyahu and Others Amid Gaza Conflict

The International Criminal Court has issued arrest warrants for Israeli Prime Minister Benjamin Netanyahu and former defense chief Yoav Gallant, as well as Hamas leader Ibrahim Al-Masri, citing alleged war crimes in Gaza. The decision, which has sparked significant reactions, hinges on ICC member states for any potential arrests.

Trump Picks Hedge-Fund Manager Scott Bessent as Treasury Secretary

Donald Trump has chosen Scott Bessent, a staunch supporter from the finance sector, to lead the Treasury Department and shape the incoming administration's economic policies.

Global Climate Fund Expansion Agreed at COP29 Amid Contentious Talks

Nearly 200 countries have committed to tripling financial aid to help developing nations tackle climate change, pledging at least $300 billion annually by 2035 at the fractious COP29 summit in Azerbaijan. Despite tense negotiations, the agreement sets a target of mobilizing $1.3 trillion yearly, primarily through private financing, to address the mounting existential crisis.

Greece to Fast-Track Repayment of Bailout Loans in Economic Turnaround

Greece is set to expedite the repayment of billions in bailout loans, signaling a robust economic recovery since its near exit from the eurozone over a decade ago. Prime Minister Kyriakos Mitsotakis announced plans to repay at least €5 billion by 2025, targeting loans due between 2033 and 2042.

U.S. Government and Commercial Plans Diverge in Obesity Drug Coverage

U.S. government health plans cover over 52 million Americans for new weight-loss medications, far outstripping the 24.4 million covered by commercial plans. State Medicaid programs are the largest single source, providing access to drugs like Wegovy and Zepbound to 31.6 million people. This extensive coverage, which reflects differing policies among states, highlights the ongoing disparities in how obesity is treated and understood in the healthcare system.

Hong Kong Sentences 45 Activists Under National Security Law

In Hong Kong's largest national security case, 45 former lawmakers and activists received prison sentences ranging from four to ten years. They were charged under the 2020 national security law for participating in an unofficial primary election, which prosecutors argued was intended to paralyze the government and force the city's leader to resign by potentially gaining a legislative majority to block government budgets.

Bill Hwang's Sentence May Be Reduced to 11.5 Years

Bill Hwang, founder of Archegos Capital Management, could see his 18-year prison sentence reduced to 11.5 years. This comes after his lawyer argued that the sentence was excessively harsh for the 60-year-old. At a recent Manhattan court hearing, the possibility of Hwang serving 6.5 years in home confinement was proposed, with the judge agreeing to consider the request.

Public Markets

Starbucks Considers Selling Stake in China Operations

Starbucks Corp. is exploring options to expand its presence in China, potentially including selling a stake to a local partner, with informal discussions already underway with domestic private equity firms.Target Lowers Financial Outlook After Disappointing Quarter

Target's shares plummeted 21% following poor quarterly results and revised downward forecasts for the year, contrasting sharply with competitors like Walmart and Costco who experienced strong sales growth.

US Treasury Investigates JPMorgan's Ties to Sanctioned Hedge Fund

The US Treasury Department is probing JPMorgan Chase & Co.'s dealings with Ocean Leonid Investments Ltd., a hedge fund linked to Iranian oil trader Hossein Shamkhani, to determine compliance with regulatory standards. This investigation follows the fund's recent suspension in Dubai's financial free zone, marking an early stage of scrutiny.

Blackstone Expands Private Equity for Wealthy Investors Amid Risks

Blackstone aims to increase the role of private equity in wealthy investors' portfolios, with its new fund amassing $6 billion since January and achieving a 9.2% return through September. While following traditional investment strategies, the fund is also pursuing unique deals, including acquiring stakes in companies owned by other private equity firms, thereby embracing higher risks.

Marijuana Prices Hit Record Low, Straining Cannabis Operators

Marijuana prices fell by another 6% in October, reaching a record low and intensifying the pressure on cannabis operators. This drop raises questions about whether the industry has reached its bottom.

Super Micro Shares Surge with New Auditor Appointment

Super Micro's stock has rallied more than 50% in two days following the appointment of BDO as its independent auditor. The rebound comes after a significant drop since March, with analysts from Mizuho suggesting that Nasdaq’s approval of the company's listing maintenance plan could take between two to five weeks.

Delta Partners with Shake Shack to Offer Burgers at 30,000 Feet

Delta Airlines has announced a unique partnership with Shake Shack to serve cheeseburgers on select flights, starting December 1 from Boston. First Class passengers on routes over 900 miles will soon enjoy the taste of Shake Shack at high altitude, with expansion plans set for more U.S. markets through 2025.

Real Estate

Blackstone Acquires SoHo Retail Properties Amid NYC's Retail Recovery

Blackstone, the world's largest commercial property owner, has secured a deal to purchase a four-property retail portfolio in Manhattan's SoHo neighborhood, signaling confidence in the area's retail rebound post-pandemic.

Municipalities Challenge State Renewable Energy Siting Law

Seventy-nine municipalities are disputing a 2023 state law on renewable energy facility siting, arguing that regulators unlawfully redefined essential terms of the legislation.

M&A, IPO’s, Bankruptcies

Comcast to Spin Off NBCUniversal Cable Networks

Comcast announces a strategic move to spin off its NBCUniversal cable networks, including MSNBC, CNBC, and others, despite a slight 0.07% decrease in shares. This decision comes as the company shifts focus from these channels that generated approximately $7 billion in annual revenue.

DirecTV Ends Acquisition Plans with Dish Network

DirecTV has officially notified EchoStar Corp of its decision to terminate the planned acquisition of Dish Network, citing the failure of bondholders to approve a crucial debt exchange. This move effectively dismantles the potential to form the largest US pay-TV service, with Dish Network not reopening negotiations with bondholders as the deadline approaches.

Amazon Boosts Investment in AI Startup Anthropic to $8 Billion

Amazon has announced a further investment of $4 billion into Anthropic, an AI startup led by former OpenAI executives, bringing its total contribution to $8 billion. Despite the significant investment, Amazon will remain a minority investor and establish Amazon Web Services as Anthropic's primary cloud and training partner.

Blackstone and Warburg Pincus Consider Selling IntraFi

Blackstone Inc. and Warburg Pincus are exploring strategic options for IntraFi, a fintech specializing in securing bank deposits, potentially including a sale that could value the company at over $12 billion. Early talks with investment banks suggest interest from major financial technology firms and the possibility of an initial public offering in early 2025.

Blackstone Adjusts Stake Bid in Haldiram's Amid Valuation Dispute

Blackstone has revised its investment strategy in Haldiram's, reducing its desired ownership from a majority stake to 20%, with the snack maker valued at $8 billion. However, negotiations hit a snag as Haldiram's insists on a higher valuation of $12 billion.

Peter Cancro Sells Jersey Mike’s to Blackstone in $8 Billion Deal

Peter Cancro, who began his career at Mike’s Subs as a teenager, sold Jersey Mike's to Blackstone for $8 billion, with Cancro retaining a 10% stake and continuing as CEO. This major transaction marks a milestone in Cancro's lifelong journey with the company he bought in 1975 at his mother's suggestion.

Spirit Airlines Files for Bankruptcy Amid Competitive Pressures

Spirit Airlines has filed for Chapter 11 bankruptcy in the Southern District of New York, aiming to restructure its significant debt and contend with increased competition from larger carriers targeting budget-conscious travelers.

Google May Have to Dissolve Anthropic Partnership Under DOJ Proposal

Alphabet Inc.'s Google could be compelled to end its partnership with AI startup Anthropic, following a recommendation from the US Justice Department to a federal judge. This proposal, aimed at addressing antitrust concerns in online search, would prohibit Google from any acquisitions, investments, or collaborations influencing where consumers search for information.

Oura Health Secures $75 Million from Dexcom in Latest Funding Round

Oura Health Oy, known for its smart rings, has received a $75 million investment from Dexcom Inc. during a Series D financing round, pushing Oura's valuation to over $5 billion. This partnership will allow the two companies to share data and cross-sell products, significantly increasing Oura's valuation from $2.6 billion in 2022.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply