- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ 10.27.2024

Welcome to Read Sunday☕️ 10.27.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

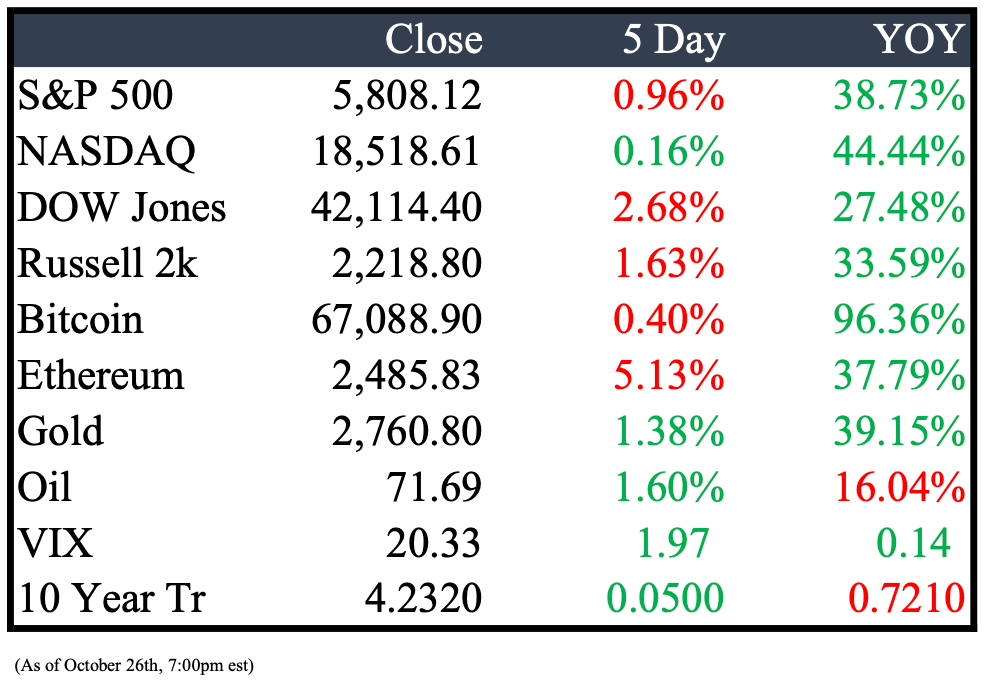

Market Recap

Last Week’s Headlines

Economy & World News

China Cuts Lending Rates Amid Economic Challenges

China’s commercial banks reduced their one-year and five-year loan prime rates by 25 basis points, lowering them to 3.1% and 3.6%, respectively, in a strategic push to revive the slowing economy. People’s Bank of China (PBOC) Governor Pan Gongsheng signaled these cuts in a recent speech, aligning with broader efforts, including reduced deposit rates by major banks, to support growth.

IMF Cuts Global Growth Forecast Amid Rising Geopolitical Risks

The International Monetary Fund has lowered its global growth outlook for next year, pointing to mounting threats from wars and trade protectionism. Meanwhile, the Bank of Canada accelerated interest-rate cuts, reducing its benchmark rate by 50 basis points to 3.75% and signaling the end of high post-pandemic inflation. In China, banks also reduced lending rates in a push to stimulate economic growth and support the struggling housing market.

US Urges Brazil to Weigh Risks of China’s Belt and Road Initiative

President Joe Biden’s top trade negotiator, Katherine Tai, advised Brazil to carefully assess the potential risks of joining China’s Belt and Road Initiative. Speaking at Bloomberg’s New Economy at B20 in São Paulo, Tai encouraged Brazilian leaders to consider the economic impacts with a focus on risk management and resilience, urging an objective approach to the Asian infrastructure program.

Medicare Advantage Insurers Received $4.2 Billion for Untreated Diagnoses from Home Visits

Private insurers offering Medicare Advantage plans received $4.2 billion in extra federal payments in 2023 for diagnoses made through company-initiated home visits that led to no subsequent treatment, according to a report from the Department of Health and Human Services' Inspector General. Each of these visits averaged a payout of $1,869 for insurers. The report, echoing similar findings from a Wall Street Journal investigation, underscores concerns over potentially inflated diagnoses that boost payments without actual treatment.

Single Trader Bets $28 Million on Trump in Political Betting Market

Polymarket has confirmed that four accounts with a massive $28 million pro-Trump position on its political betting platform are all controlled by a single trader. This individual, a French national with extensive trading experience, has significantly shifted the market's stance toward former President Donald Trump winning the 2024 election. While Polymarket remains off-limits to U.S. traders, other platforms like Kalshi and Interactive Brokers have recently introduced political betting contracts, fueling interest and scrutiny in this emerging market.

U.S. Investigates Tether for Potential Sanctions Violations and Money Laundering

The Manhattan U.S. attorney’s office has launched a criminal investigation into Tether, examining whether the cryptocurrency has been used to fund illicit activities, including drug trafficking, terrorism, and hacking, or to launder associated proceeds. Meanwhile, the Treasury Department is considering sanctions against Tether due to its suspected use by U.S.-sanctioned entities, such as Hamas and Russian arms dealers. Such sanctions would prevent Americans from conducting business with the company.

Public Markets

Starboard Pushes for Change at Tylenol Maker Kenvue

Activist investor Starboard Value has taken a significant stake in Kenvue, the $40 billion consumer-products company behind brands like Tylenol and Listerine. Starboard aims to drive changes to improve Kenvue's stock performance, which has lagged behind both competitors and the broader market since the company's spin-off from Johnson & Johnson last year.

Mat Ishbia Moves to Expand United Wholesale Mortgage Stock in Public Market

Mat Ishbia, CEO of United Wholesale Mortgage (UWM), is working on increasing UWM stock's public availability while potentially bolstering his investment in another prominent venture. Ishbia recently swapped a significant portion of his UWM shares with a Phoenix Suns co-owner, aligning with his long-standing goal to boost UWM's public footprint.

Disney Plans CEO Succession for Early 2026

Disney announced it will select a successor to CEO Bob Iger by early 2026. The search includes top executives like ESPN's Jimmy Pitaro, Disney Experiences Chairman Josh D’Amaro, and Disney Entertainment Co-Chairmen Dana Walden and Alan Bergman, all recently interviewed by the succession committee. Meanwhile, James Gorman, former Morgan Stanley CEO, is set to replace Nike’s Mark Parker as chairman in January.

McDonald’s Shares Drop Following CDC E. Coli Warning Linked to Quarter Pounders

McDonald’s stock declined in after-hours trading after the CDC linked an E. coli outbreak to its Quarter Pounder burgers. The outbreak has resulted in 10 hospitalizations and one death, with preliminary findings suggesting that onions used in the burgers may be the source of contamination.

Starbucks Shares Slide as Sales Decline for Third Straight Quarter

Starbucks shares dropped after the coffee giant reported a 7% fall in same-store sales for Q4, marking its third consecutive quarter of declining sales. The company withdrew its 2025 guidance, underscoring the challenges for new CEO Brian Niccol. Sales were notably weak in the U.S., with transactions down 10% year-over-year, and in China, where comparable sales fell 14%.

Kering Warns of Lowest Annual Profit Since 2016 Amid Gucci Sales Slump

French luxury group Kering SA expects its annual profit to hit an eight-year low, projecting a recurring operating income of around €2.5 billion ($2.7 billion)—below analyst expectations of €2.82 billion. The decline is driven by a significant drop in Chinese demand for luxury goods, impacting sales at Kering’s flagship brand, Gucci, where comparable sales fell 25% year-over-year in the third quarter.’

Boeing Union Rejects Contract, Extending Costly Strike

Boeing's largest union voted 64% against a new labor deal that included a 35% wage increase over four years, prolonging a six-week strike. The impasse continues to halt production of the 737, 767, and 777 jets, deepening Boeing's financial strain as its cash burn exceeded $10 billion in the first nine months of 2024. Shares dropped nearly 4% in Thursday’s early trading, with analysts estimating the walkout costs Boeing around $1 billion per month.

Boeing Considers Exiting NASA Business Amid Financial Woes

Boeing, once instrumental in putting the first men on the moon, is reportedly exploring the sale of its NASA-focused operations, including the Starliner space vehicle and support for the International Space Station. Led by CEO Kelly Ortberg, the move is part of a broader strategy to streamline operations and curb financial losses. Discussions are in early stages and may not lead to a finalized deal.

Nvidia Supplier SK Hynix Reports Record Profit Amid AI Demand Surge

SK Hynix posted a record 7.03 trillion won ($5.08 billion) operating profit for Q3, surpassing LSEG's forecast of 6.8 trillion won and rebounding from a loss of 1.8 trillion won in the same period last year. The South Korean chipmaker has capitalized on soaring demand for AI servers, fueling its impressive recovery.

Southwest Airlines Reaches Board Settlement with Elliott Investment Management

Southwest Airlines has struck a truce with Elliott Investment Management, granting the activist investor substantial board representation without ceding majority control. The deal, announced Thursday, avoids a potential proxy fight and concludes a four-month standoff over Southwest’s future direction. Five Elliott-backed directors, including former Virgin America CEO David Cush and former WestJet CEO Gregg Saretsky, will join the board, alongside former Chevron finance chief Pierre Breber. The board will slim down to 13 members in 2024.

Tesla Stock Rises After Strong Earnings and Optimistic 2025 Outlook

Tesla shares climbed over 3% on Friday, reaching their highest level since last September, following the company’s best market day since 2013. The two-day surge was driven by better-than-expected earnings and CEO Elon Musk’s optimistic forecast for 2025. Despite the recent rally, Tesla shares remain 34% below their 2021 peak.

Volkswagen Bets on U.S. Market with Electric Pickup and SUV Launch

Volkswagen’s Scout Motors brand revealed its first U.S.-focused electric vehicles: a retro-styled pickup and SUV, each priced around $60,000. Designed for towing and off-road capabilities, these boxy models aim to tap into America’s strong demand for robust trucks and SUVs. Scheduled for a 2027 launch, Volkswagen hopes these vehicles will strengthen its foothold in the U.S. market.

Real Estate

Bob Duggan Leverages Summit Therapeutics Rally to Buy $33M Miami Penthouse

Capitalizing on a 689% rise in Summit Therapeutics Inc. stock, Bob Duggan is purchasing a $33 million penthouse in Miami’s Brickell area. The two-story, 11,000-square-foot property features five bedrooms and an indoor pool, offering 360-degree views from the 57th floor. Duggan, a California native and surfer, noted that while he's “not a condo boy,” the unique views made the luxury purchase compelling, highlighting the soaring value of high-end Miami real estate.

Security Mogul Manuel Pires Lists Napa Valley’s Gandona Winery for $50 Million

Manuel Pires, who made his wealth in the security industry, has listed his beloved Gandona Winery for $50 million. Located on Pritchard Hill in Napa Valley, the 114-acre estate includes an 18-acre vineyard, a winery, a 4,600-square-foot main residence, and a guesthouse. Pires purchased the property in 2006 and invested around $17 million developing it, making it the only winery for sale in this prestigious area renowned for world-class Cabernet Sauvignon.

M&A, IPO’s, Bankruptcies

Hyundai Motor India’s Tepid Market Debut After Record IPO

Hyundai Motor India launched the largest-ever IPO in South Asia, raising $3.3 billion at 1,960 rupees per share, but debuted with lukewarm trading as shares opened 1.5% lower. The stock continued to dip, down 5.4% in afternoon trading on the BSE exchange, signaling investor caution despite a buoyant market. This listing surpasses the 2022 IPO of Life Insurance Corp. of India, which raised $2.5 billion.

Index and Haun Ventures Profit as Stripe Acquires Bridge Network for $1.1 Billion

Index Ventures and Haun Ventures are reaping rewards after Stripe’s $1.1 billion acquisition of Bridge Network, marking a 200% valuation increase since August. Chris Ahn, now a partner at Haun, led the original deal at Index, emphasizing the significance of personal connection after flying to northern Montana in 2022 to meet the founders—a move that set the stage for this successful exit.

Sanders Candy and Kar's Nuts Parent Acquires Smucker Cookie Brand for $305 Million

Second Nature Brands, the Madison Heights-based parent of Kar's Nuts and Sanders Candy, is expanding its portfolio by acquiring a Smucker cookie brand in a deal valued at $305 million. This acquisition strengthens Second Nature’s position in the snack and sweets market.

Japan’s Largest IPO in Six Years Raises $2.3 Billion Amid High Demand

A Japanese company raised 348.6 billion yen ($2.3 billion) in the country’s largest IPO in six years, pricing shares at the top end of the 1,100 to 1,200 yen range. According to Reuters, the IPO saw overwhelming demand, with overall subscriptions more than 15 times oversubscribed, and retail investor interest at nearly 10 times the available shares.

Spirit Airlines Considers Bankruptcy to Enable Merger with Frontier

Spirit Airlines is exploring a Chapter 11 bankruptcy filing as a strategy to enable a merger with Frontier Group Holdings, pending creditor approval. This move aims to streamline the acquisition, allowing Spirit to continue operations without depleting its cash reserves. Holders of Spirit’s approximately $2.5 billion in debt would need to agree to deal terms for a quick process. A previous sale attempt to JetBlue was blocked by the DOJ, making this new approach with Frontier a critical step forward.

Siemens Eyes $9B Acquisition of Software Firm Altair Engineering

Siemens AG is reportedly in discussions to acquire Altair Engineering Inc., a Troy-based software company valued at $9 billion. This would mark Siemens' largest acquisition to date, as the company seeks to expand its software capabilities in engineering and design.

Ingram Micro and Platinum Equity Raise $409 Million in IPO

Ingram Micro Holding Corp. and Platinum Equity secured $409 million through an IPO, pricing 18.6 million shares at $22 each, within their targeted range of $20 to $23. This positions the Irvine-based tech firm with a market value of about $5.2 billion. The offering, however, fell short of the $1 billion originally anticipated, as reported by Bloomberg News.

Federal Judge Blocks $8.5 Billion Merger of Coach and Michael Kors

A federal judge has halted the proposed $8.5 billion merger between Tapestry-owned Coach and Capri’s Michael Kors, though the exact reasoning wasn’t disclosed. The FTC previously argued that the merger could harm consumers by raising prices and reducing employee benefits. The deal, announced last year, has faced delays since the FTC filed a lawsuit to prevent it.

Marblegate Asset Management Eyes Takeover of NYC’s Insolvent Taxi Insurer

Marblegate Asset Management, the largest medallion owner and lender in New York City, is in talks with state regulators regarding a potential takeover of American Transit Insurance Co. (ATIC), the city’s largest taxi and rideshare insurer. ATIC, which has faced insolvency issues for decades, posted $700 million in losses in Q2, with a recent state audit revealing “massively deficient” reserves for covering claims. Marblegate has yet to make a formal proposal and is among several parties expressing interest to the New York Department of Financial Services.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply