- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday - 10.20.2024

Welcome to Read Sunday - 10.20.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Love Oscar ♥️

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

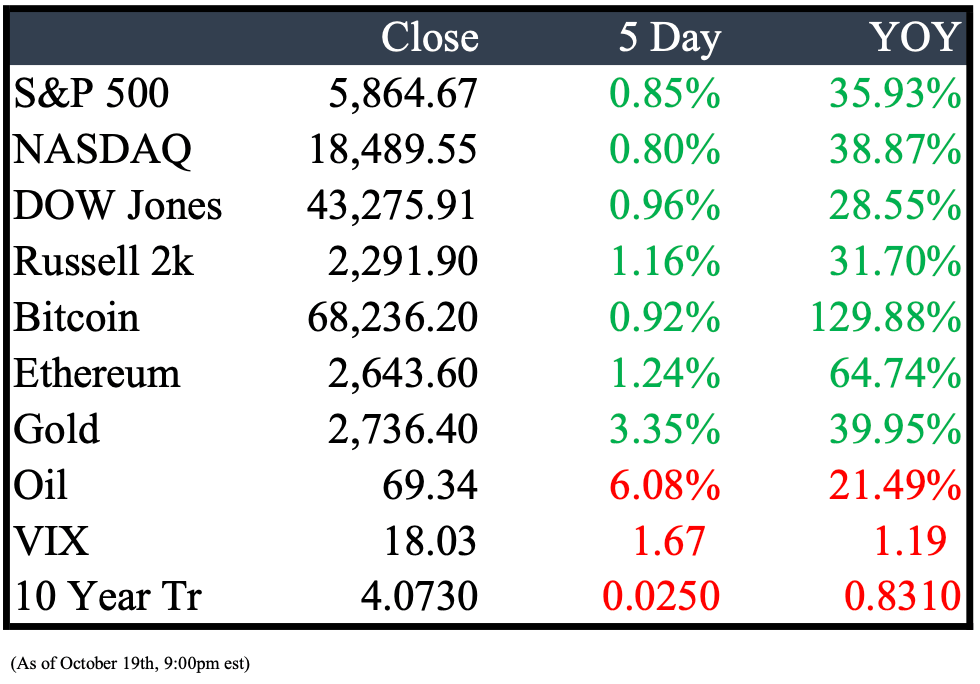

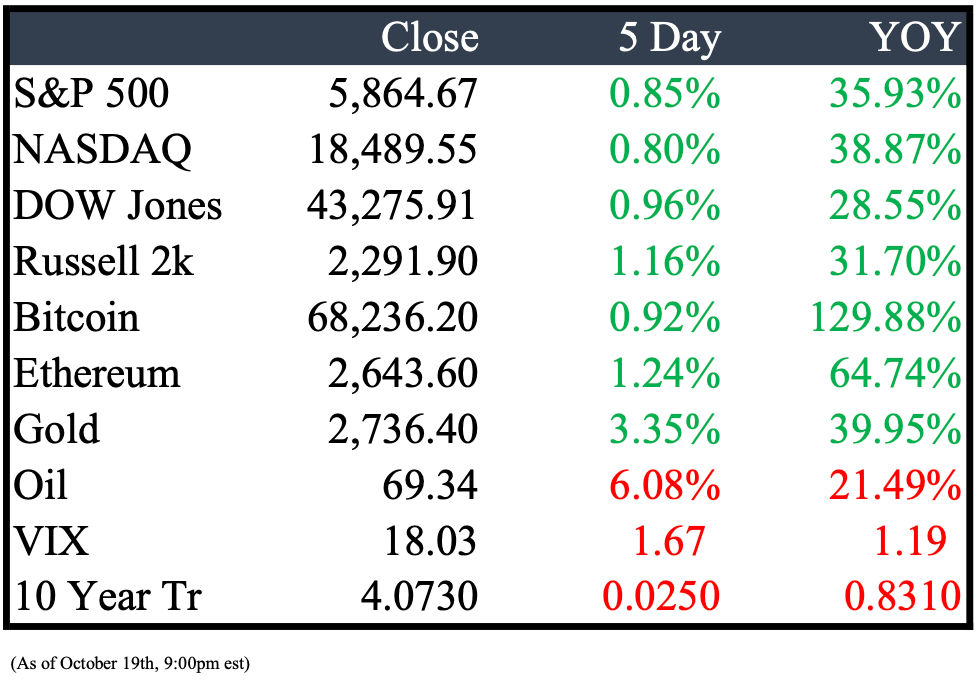

Market Recap

Please answer the following

Which investment type are you more likely to consider to add to your portfolio: a Registered Investment Advisor (RIA) or a Private Fund? |

A hedge fund can be either a Registered Investment Advisor (RIA) or a private fund. RIAs are regulated, ensuring more transparency and investor protection, while private funds face fewer regulations, allowing for greater flexibility in investment strategies but with less oversight.

Last Week’s Headlines

Economy & World News

Healthcare Workers Picket at Michigan Medicine's Taubman Center

Hundreds of healthcare workers, including technicians, therapists, medical assistants, and pathologists, held pickets twice last week in front of Michigan Medicine’s A. Alfred Taubman Health Care Center in Ann Arbor, voicing their concerns and demands.

OPEC Lowers Oil Demand Growth Forecasts for Third Consecutive Month

OPEC has reduced its oil demand growth forecasts for 2023 and 2024, acknowledging a global slowdown in fuel consumption. The organization now expects global oil consumption to rise by 1.9 million barrels per day in 2024, a revision of 106,000 barrels per day lower than previously predicted. OPEC attributes the downgrade to newly received data and slightly lower expectations for some regions.

Biden Administration Weighs AI Chip Export Caps for Certain Countries

The Biden administration is considering capping sales of advanced AI chips from companies like Nvidia on a country-specific basis, focusing on national security concerns. Persian Gulf nations, with increasing demand for AI data centers, are reportedly under review due to their financial capacity to fund these technologies. Discussions are in the early stages but have gained momentum in recent weeks. The potential policy builds on recent Commerce Department regulations that streamline AI chip exports to regions like the UAE and Saudi Arabia, with more rules expected soon.

ECB Lowers Rates for Second Consecutive Meeting Amid Economic Weakness

The European Central Bank (ECB) cut its key interest rate to 3.25%, down from 3.5%, in an effort to support a slowing economy. This marks the first time since 2011 that the ECB has made consecutive rate cuts. The central bank is now prioritizing economic growth over inflation control, citing recent "downside surprises" in economic activity indicators as the driving force behind its decision.

China’s Q3 GDP Grows 4.6%, Exceeding Expectations

China’s National Bureau of Statistics reported third-quarter GDP growth of 4.6% year-on-year, slightly surpassing the 4.5% forecast by economists. Other key indicators, including retail sales and industrial production, also exceeded expectations, offering a hopeful sign for the world’s second-largest economy. Despite this positive data, Beijing still faces public pressure to meet its annual growth target of "around 5%."

University of Michigan Receives $25 Million Gift for AI-Driven Health Care Leadership

University of Michigan endowed medical school professor Gilbert Omenn and his wife, Martha Darling, have donated $25 million to the Ann Arbor-based university to strengthen its leadership in artificial intelligence, specifically focused on advancing health care innovations.

Public Markets

Spirit AeroSystems to Furlough 700 Workers Amid Boeing Strike

Spirit AeroSystems plans to furlough around 700 workers as Boeing's machinist strike reaches its sixth week. The aerospace supplier, which manufactures fuselages and parts for Boeing's 777, 767, and 737 Max aircraft, will furlough employees assigned to the 777 and 767, while workers on the 737 Max remain unaffected.

Starbucks Names Tressie Lieberman as Global Chief Brand Officer

Starbucks has appointed Tressie Lieberman as its new global chief brand officer. Lieberman, who has previously worked with new CEO Brian Niccol at Chipotle, Taco Bell, and Pizza Hut, will focus on enhancing the company's branding efforts. Niccol identified brand improvement as one of his top priorities in his first week leading the coffee giant.

Southwest Airlines and Elliott Investment Management in Talks to Avoid Proxy Fight

Elliott Investment Management and Southwest Airlines are negotiating a potential settlement to avoid a proxy battle over control of the airline’s board. Elliott has proposed a framework for board representation without full control, though talks remain ongoing and could still fall through. The activist firm, holding a $2 billion stake in Southwest, has nominated eight directors and called for a special shareholder meeting on Dec. 10. Southwest, in response, has proposed appointing up to three of Elliott’s nominees and recently announced a $2.5 billion stock buyback plan alongside policy changes to improve operations.

McKinsey & Co. Nearing $500 Million Settlement Over Opioid Sales Consulting

McKinsey & Co. is close to reaching a deal with US prosecutors to pay at least $500 million to settle federal investigations into its consulting work for opioid manufacturers. The settlement, expected to be announced in the coming weeks, would resolve both criminal and civil probes by the Justice Department. While the terms are not yet finalized, the settlement aims to address McKinsey’s role in helping opioid makers boost sales. Both McKinsey and the Justice Department declined to comment.

CVS Replaces CEO Karen Lynch with Pharmacy Executive David Joyner

CVS has appointed longtime pharmacy benefits executive David Joyner as its new CEO, replacing Karen Lynch. The leadership change comes as CVS faces challenges in boosting profits and improving stock performance. Major shareholder Glenview Capital pushed for changes last month, contributing to the leadership shift.

Boeing Reaches Tentative Deal to End Machinists Strike

Boeing and its machinists union have reached a tentative agreement to end a strike that has halted most of the company's airplane production since September 13. Boeing's latest offer includes a 35% wage increase over four years, up from an initial 25% offer that was previously rejected by the union. The strike also led to significant layoffs during the production stoppage.

Bridgewater Associates Increases China Stock Exposure After 31% Year-to-Date Gains

Bridgewater Associates’ onshore China hedge fund is adding exposure to local stocks, following a strong rally that pushed its returns to 31% for the year. The fund noted that Chinese stocks remain attractive despite the recent rebound, with valuations still relatively low compared to profit outlooks. In its third-quarter letter, the fund also highlighted a long position on bonds and a neutral stance on commodities as of September 30.

Real Estate

Stellantis to Close Arizona Proving Grounds by Year-End

Stellantis plans to shutter and sell its 4,000-acre Arizona Proving Grounds, located between Phoenix and Las Vegas, by the end of this year. This move, part of CEO Carlos Tavares' ongoing cost-cutting efforts, marks a significant step for the automaker. The testing facility has been crucial for developing and testing its large vehicle fleet.

University of Michigan Set to Acquire More Detroit Land for Downtown Satellite Campus

The University of Michigan is poised to purchase additional land in Detroit as part of its expansion efforts for a new satellite campus currently under construction in the city's downtown area. This move aligns with the university's broader plans to establish a stronger presence in Detroit.

Microsoft Buys 316 Acres in Kent County for Potential Data Center Development

Microsoft has acquired 316 acres in southern Kent County from Steelcase Inc. for $45.3 million, with plans for a potential data center development, according to Crain’s Grand Rapids Business. This purchase signals Microsoft's growing interest in expanding its infrastructure in the region.

Saudi Arabia to Begin Construction on Cube-Shaped Skyscraper, "The Mukaab"

Saudi Arabia is set to start construction on "The Mukaab," a massive cube-shaped skyscraper capable of fitting 20 Empire State Buildings inside. Standing 400 meters tall and wide, it will be the largest built structure in the world. The Mukaab will serve as the centerpiece of New Murabba, a planned community within Riyadh aimed at becoming a major new destination.

M&A, IPO’s, Bankruptcies

Spirit Airlines Extends Debt Renegotiation Deadline Amid Financial Struggles

Spirit Airlines has once again extended a deadline with its credit card processor as it works to renegotiate over $1 billion in debt. With shares down more than 90% this year, the budget carrier has taken measures to cut costs, including furloughing pilots, offering staff buyouts, and deferring new aircraft purchases.

Billionaire Tom Gores to Acquire 27% Stake in Los Angeles Chargers for $750 Million

Private equity billionaire Tom Gores has agreed to purchase a 27% stake in the Los Angeles Chargers for $750 million. The deal values the team at $4 billion, reflecting a 30% discount from its $5.83 billion valuation, as per CNBC's 2024 NFL Team Valuations. Gores is also the owner of the NBA's Detroit Pistons.

GM Forms Joint Venture with Lithium Americas Corp., Investing $625 Million

GM has entered into a joint venture with Lithium Americas Corp., committing $625 million in cash and credit to the company. The partnership focuses on the Thacker Pass lithium carbonate mining project in Humboldt County, Nevada, aimed at supporting the automaker's electric vehicle production.

NFL Approves Tom Brady as Minority Owner of Las Vegas Raiders

Former NFL star quarterback Tom Brady has been approved as a minority owner of the Las Vegas Raiders. In addition to his stake in the Raiders, Brady also holds a small ownership in the WNBA's Las Vegas Aces. After retiring from the NFL in 2023, Brady secured a lucrative broadcast deal with Fox Sports.

Jana Partners Takes 5% Stake in Lamb Weston, Pushing for Sale

Activist investor Jana Partners has acquired a 5% stake in Lamb Weston and is urging the french-fry maker to explore a sale. The activist firm is also advocating for operational improvements and a better capital-allocation strategy. Jana may nominate directors to the board and is collaborating with former executive chairman Timothy McLevish. Following the news, Lamb Weston shares surged by 8%.

Self-Driving Startup Pony.ai Files for IPO Following Tesla's Autonomous Vehicle Reveal

Pony.ai, a self-driving startup, has filed for an initial public offering (IPO) just a week after Tesla unveiled its autonomous vehicle concept. While the Silicon Valley-based company hasn't disclosed the number of shares or price range, it previously received approval to list up to 98.2 million shares on the Nasdaq or NYSE. Founded in 2016, Pony.ai operates robotaxi services in several Chinese cities and has partnered with Toyota to mass-produce robotaxis in China.

China Resources Beverage Launches $650 Million IPO in Hong Kong

China Resources Beverage is testing investor interest with a nearly $650 million IPO, capitalizing on growing risk appetite in Asia's financial markets. The state-owned packaged drinking water company is offering 347.83 million shares, priced between HK$13.50 and HK$14.50 each. Investor orders open Tuesday, with the final price expected on October 21, and trading set to begin on the Hong Kong Stock Exchange on October 23.

Hyundai Motor India to Raise Over $3 Billion in Record-Breaking IPO

Hyundai Motor India is set to raise more than $3 billion in the largest-ever initial public offering (IPO) in India, surpassing the previous record of $2.5 billion by Life Insurance Corp. in 2022. The IPO was oversubscribed 2.37 times during a three-day bidding period, with strong demand from institutional buyers, who subscribed for nearly seven times the shares allocated to them. However, demand from non-institutional and retail investors was more subdued, with bids at 60% and 50%, respectively, according to the National Stock Exchange of India.

Boeing Eyes $25 Billion to Strengthen Balance Sheet Amid Credit Rating Concerns

Boeing announced plans to raise up to $25 billion to support its balance sheet, while also securing a $10 billion credit agreement with banks. The move comes as credit rating agencies warn that Boeing could lose its investment-grade rating, prompting the aerospace giant to take action to safeguard its financial standing.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply