- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️10.13.2024

Welcome to Read Sunday☕️10.13.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

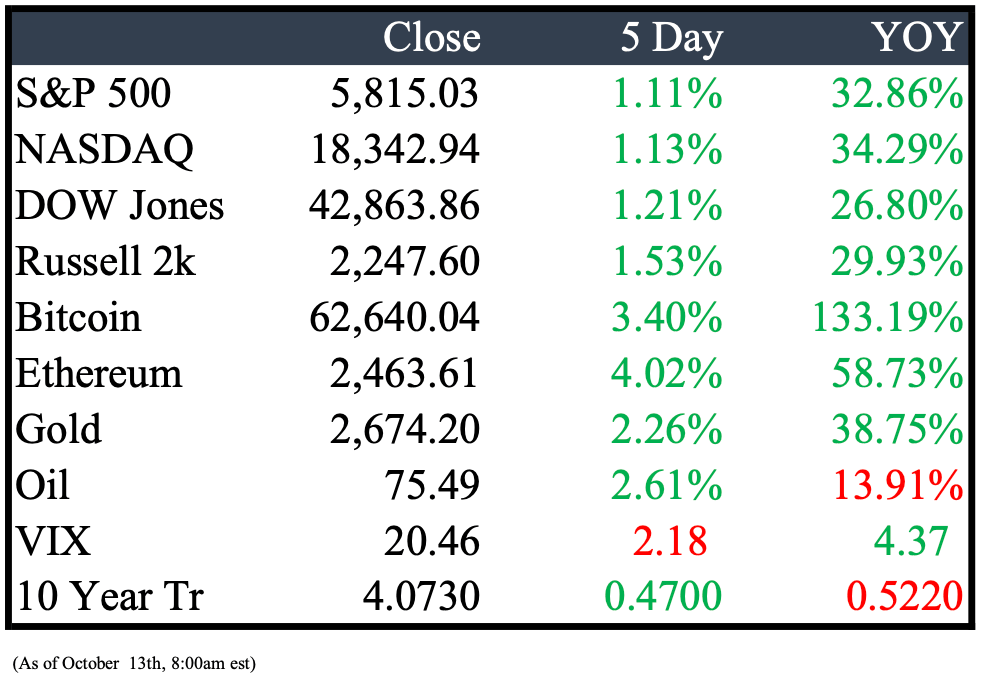

Market Recap

Last Week’s Headlines

Economy & World News

Inflation and Unemployment Rise Slightly Above Forecasts

The consumer price index increased by 0.2% in September, raising the annual inflation rate to 2.4%, both slightly above forecasts. Core prices, excluding food and energy, rose by 0.3% for the month, bringing the annual core inflation rate to 3.3%. Additionally, initial unemployment claims unexpectedly rose to 258,000, the highest level since August 2023.

Social Security Benefits to Increase by 2.5% in 2025

More than 72.5 million beneficiaries will receive a 2.5% increase in Social Security and Supplemental Security Income benefits in 2025, the Social Security Administration announced. On average, Social Security retirement benefits will rise by around $50 per month starting in January. This adjustment marks the smallest increase since 2021 due to the easing pace of inflation.

Japanese Atomic Bomb Survivor Movement Wins Nobel Peace Prize

Nihon Hidankyo, a grassroots organization of Japanese atomic bomb survivors, was awarded the Nobel Peace Prize for its relentless efforts to advocate for a nuclear-free world. The awards committee praised the movement for raising global awareness about the devastating humanitarian impacts of nuclear weapons. The Nobel Prizes will be presented on December 10 in Oslo, Norway, marking the anniversary of Alfred Nobel's death.

South Korea's Central Bank Cuts Interest Rate to 3.25%

South Korea's central bank lowered its benchmark interest rate by 25 basis points to 3.25%, aligning with economists' forecasts. The Bank of Korea cited stabilizing inflation, slower household debt growth, and easing risks in the foreign exchange market as key reasons for the rate cut.

FTX Wins Court Approval to Repay Customers in Full

FTX received court approval to fully repay customers whose digital assets were frozen during the platform's collapse nearly two years ago. U.S. Bankruptcy Judge John Dorsey approved the plan, which could also provide shareholders in Sam Bankman-Fried's fraud-tainted exchange a portion of $1 billion in seized assets. Initially, in November 2022, FTX’s advisers believed creditors would recover only a fraction of what they were owed due to the chaotic state of the exchange and plummeting crypto prices.

RBNZ Cuts Interest Rates to 4.75%, More Cuts Expected

The Reserve Bank of New Zealand (RBNZ) reduced its interest rate from 5.25% to 4.75% on Wednesday, marking its second consecutive rate cut since August. Paul Bloxham, HSBC’s chief economist for Australia and New Zealand, predicts the bank will likely cut rates by another 50 basis points at its next meeting in November.

Public Markets

DOJ Considers Breaking Up Google as Antitrust Remedy

The Department of Justice is weighing the possibility of breaking up Google to address antitrust concerns. They are exploring both behavioral and structural remedies aimed at stopping Google from leveraging products like Chrome, Play, and Android to gain an advantage for its search engine.

Boeing Withdraws Contract Offer After Union Talks Collapse

Boeing pulled its contract offer following failed negotiations with the machinist union. Over 32,000 machinists walked off the job on September 13 after rejecting a new contract. The union claims Boeing refused to offer wage increases and other improvements in the most recent discussions.

Boeing to Cut 17,000 Jobs Amid Ongoing Strike and $5 Billion in Charges

Boeing announced plans to cut 17,000 jobs, or 10% of its global workforce, delay the first deliveries of its 777X jet by a year, and record $5 billion in losses for the third quarter. The company is grappling with a month-long strike by 33,000 U.S. workers, which has halted production of key jets, including the 737 MAX, 767, and 777. CEO Kelly Ortberg stated that the downsizing is necessary to align with Boeing's financial challenges.

S&P Global Considers Downgrading Boeing’s Credit to Junk

S&P Global Ratings is evaluating a potential downgrade of Boeing’s credit to junk status due to the company’s rising cash needs amidst a machinists' strike. The firm estimates Boeing will burn through $10 billion in cash in 2024 and may need additional funding to cover operational costs and debt. Boeing is reportedly considering raising $10 billion through a share sale to preserve its investment-grade credit rating.

Stellantis CEO Carlos Tavares to Retire in 2026 Amid Management Shakeup

Stellantis, the parent company of Chrysler, confirmed that CEO Carlos Tavares will retire at the end of his contract in early 2026. The automaker also announced senior management changes as it faces declining earnings and sales in North America. Last week, the company cut its 2024 profit forecast and hinted at possible reductions in dividends and share buybacks.

GSK Shares Surge After $2.2 Billion Zantac Settlement

GSK shares soared by 6.5% after the company announced a $2.2 billion settlement resolving 93% of U.S. lawsuits related to claims that its discontinued heartburn drug Zantac caused cancer. The settlement, much lower than the anticipated $3.5 billion.

TD Bank Settles for $3 Billion Over Money Laundering Failures

TD Bank has agreed to pay over $3 billion in penalties and accepted growth limits in the U.S. as part of a settlement with regulators and prosecutors for failing to monitor money laundering by drug cartels and other criminal groups. The Office of the Comptroller of the Currency imposed an asset cap, restricting the bank's retail growth in the U.S. Additionally, TD's U.S. entity pleaded guilty to criminal charges as part of the Justice Department investigation.

Elon Musk Unveils Tesla's Cybercab and Robovan at 'We, Robot' Event

At Tesla’s exclusive "We, Robot" event, Elon Musk revealed the new Cybercab and Robovan, marking Tesla’s first product unveiling since the Cybertruck design in 2019. Musk arrived nearly an hour late in what he claimed was a fully autonomous vehicle with no steering wheel or pedals, showcasing Tesla's latest advancements in autonomous driving technology.

Former Jefferies Hedge Fund Manager Fights Fraud Allegations

Jordan Chirico, a former portfolio manager at 352 Capital under Jefferies' Leucadia Asset Management, is pushing back against a fraud lawsuit accusing him of knowingly investing over $100 million in a Ponzi-like scheme involving water machines. On Monday, Chirico asked a judge to dismiss the lawsuit, arguing that the fund failed to prove he was aware of any wrongdoing during the initial bond purchases from WaterStation Management and that Leucadia authorized all investments.

Former Pfizer Executives Withdraw from Activist Campaign, Back Current Leadership

Two former Pfizer executives, Ian Read and Frank D’Amelio, announced they are stepping back from activist investor Starboard Value’s campaign aimed at turning around the struggling drugmaker. The former CEO and CFO expressed full support for current CEO Albert Bourla and his management team. Starboard has taken a $1 billion position in Pfizer as part of its efforts to drive a turnaround.

Real Estate

GM Drops 'Ultium' Name for EV Batteries, Announces New Development Center

General Motors announced it will discontinue the "Ultium" name for its electric vehicle batteries and propulsion technology, despite years of investment in the brand. GM revealed plans to build a battery cell development center at its Global Technical Center in Warren, aiming to begin production by early 2027, though a groundbreaking date has not been provided.

Mortgage Rates Rise to 6.36%, Refinancing Applications Drop

The average interest rate for 30-year fixed-rate mortgages with balances of $766,550 or less rose to 6.36%. Refinancing applications, which had been climbing for months, fell by 9% this week but remain more than double compared to the same time last year. Meanwhile, home purchase mortgage applications were flat for the week.

M&A, IPO’s, Bankruptcies

Rio Tinto Eyes Potential Deal to Become a Top Lithium Supplier

While financial details remain undisclosed, Rio Tinto announced there is no guarantee a deal will be finalized. If successful, the company would position itself as one of the largest lithium suppliers, just behind Albemarle and SQM.

BlackRock Explores Acquisition of HPS Investment Partners

BlackRock Inc. is reportedly in talks to acquire HPS Investment Partners, a move that would bolster its position in the private-credit market. While HPS is also considering a potential IPO, which could value the firm at over $10 billion, an acquisition by BlackRock would likely come with a premium.

Lunate Eyes $1 Billion Stake in HPS Investment Partners

Abu Dhabi-based asset manager Lunate is exploring the purchase of a minority stake in HPS Investment Partners, as the private credit firm considers an IPO or sale. Sources familiar with the matter indicate Lunate is evaluating an investment of $1 billion or more. HPS may also seek additional capital as part of any potential transaction.

Warren Buffett Trims Bank of America Stake Below 10%

Warren Buffett’s Berkshire Hathaway has reduced its stake in Bank of America below the 10% regulatory threshold, allowing more time to disclose future trades. Starting in mid-July, Berkshire sold shares, netting around $10.5 billion from its long-term investment, lowering its holding to 9.99% of the bank’s outstanding shares.

Chevron Sells Oil-Sands and Shale Assets to Canadian Natural Resources for $6.5 Billion

Chevron is selling its stakes in oil-sands and shale assets to Canadian Natural Resources for $6.5 billion as part of its strategy to refocus operations. The deal includes Chevron's 20% interest in the Athabasca Oil Sands Project and a 70% stake in the Duvernay shale, both in Alberta. The all-cash transaction is set to close by the end of the year.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply