- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday ☕️

Welcome to Read Sunday ☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

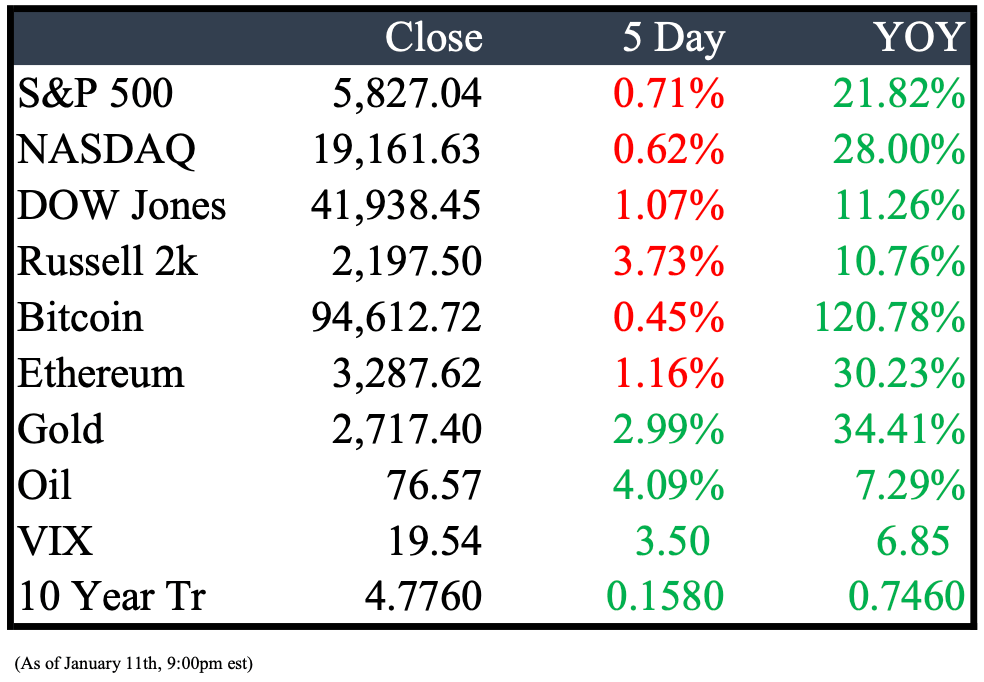

Market Recap

Last Week’s Headlines

Economy & World News

Italy Advances Talks with SpaceX for a €1.5 Billion Telecom Security Deal

Italy is in discussions with Elon Musk's SpaceX to secure a five-year contract aimed at enhancing government telecommunication security, making it the largest project of its kind in Europe.

German Inflation Surges to 2.8% Amid Political Uncertainty

December saw German inflation rise unexpectedly to 2.8%, surpassing Reuters analysts' predictions of 2.6%, as revealed by Destatis, coinciding with political turmoil and upcoming federal elections.

Justin Trudeau to Resign as Canada's Liberal Party Leader

Justin Trudeau will announce his resignation as leader of Canada’s Liberal Party on Monday, setting off a leadership contest for his successor as prime minister. His decision follows intense pressure from party lawmakers and the recent resignation of Finance Minister Chrystia Freeland.

Michael Barr to Step Down as Top Fed Banking Regulator

Michael Barr, the Federal Reserve's chief banking regulator, will resign his post on February 28 but will continue as a governor. His decision, amid speculations of replacement by President-elect Donald Trump, aims to prevent potential distractions from the Fed's mission.

Euro Zone Inflation Climbs to 2.4% in December

December's inflation in the euro zone increased to 2.4%, aligning with economist expectations and rising from November's 2.2%, according to Eurostat. Despite this uptick and a persistent 2.7% core inflation, experts like Jack Allen-Reynolds suggest it won't deter the European Central Bank from further rate cuts.

Investors Brace for Potential 5% U.S. 10-Year Treasury Yield Amid Trump Policy Concerns

Investors are increasingly betting on a rise in the U.S. 10-year Treasury yield to 5%, driven by concerns over the potential fiscal impact of the Trump administration's policies. This critical yield level, seen previously in October 2023, is viewed as a threat to U.S. stocks, highlighted by growing demand for rate protection in futures and swap options markets.

Nonfarm Payrolls Exceed Expectations, Unemployment Dips to 4.1%

December's nonfarm payrolls jumped to 256,000, surpassing forecasts and outpacing November's figures, while the unemployment rate fell to 4.1%, the lowest since June 2024. Despite average hourly earnings aligning with expectations, the stronger job data prompted a drop in stock market futures and a rise in Treasury yields, as traders adjusted expectations for Federal Reserve rate cuts.

US Intensifies Sanctions on Russia's Oil Industry to Support Ukraine

In a significant escalation, the US has imposed its most stringent sanctions yet on Russia's oil sector, targeting key firms and extending measures to insurers and traders involved in seaborne oil exports. Treasury Secretary Janet Yellen emphasized that these sanctions aim to increase the risks associated with Russia's oil trade, aiming to strengthen Ukraine's position in potential peace talks as the transition to Donald Trump's presidency approaches.

Public Markets

Disney Merges Hulu+ Live TV with Fubo, Excluding Streamer Hulu

Disney's integration of Hulu+ Live TV and Fubo creates a robust internet TV bundle, enhancing their linear TV network offerings; however, this merger does not involve Hulu's original content arm. Fubo's stock rose following the announcement.

Nippon Steel and US Steel Challenge Merger Block with Lawsuits

Nippon Steel Corp. and United States Steel Corp. have initiated legal action to overturn President Joe Biden's block of their merger, arguing the decision lacked national security justification and was politically motivated. Additionally, they are suing Cleveland-Cliffs Inc. and its CEO, along with the United Steelworkers President, for alleged anticompetitive behavior.

Meta Welcomes New Board Members to Drive AI and Social Media Innovation

Meta has appointed Dana White, John Elkann, and Charlie Songhurst to its board of directors, announced by CEO Mark Zuckerberg. White expressed his excitement about joining, emphasizing his passion for brand building and the potential of AI and social media. Elkann also highlighted his commitment to contributing his global experience to Meta’s future innovations.

Dell Adopts Simpler Branding Strategy to Boost PC Sales

Dell Technologies Inc. is revamping its PC branding, moving away from traditional names like “XPS” and “Inspiron” in favor of simpler, more memorable names centered around the word Dell. This change, announced ahead of CES, aims to make product names easier for consumers as the company seeks to invigorate a sluggish PC market.

Nvidia Debuts AI Tech and Gaming Chips at CES 2025

At CES 2025, Nvidia's CEO Jensen Huang introduced a range of new products, including AI technologies to enhance robot and car training, advanced gaming chips, and Nvidia's first desktop computer. This expansion highlights Nvidia's strategy to leverage its data center AI chip success into consumer markets, alongside announcing a new partnership with Toyota.

UBS to Settle Credit Suisse Tax Evasion Violations for Millions

UBS is expected to pay hundreds of millions of dollars to resolve Credit Suisse's breaches of a previous settlement with the U.S. Justice Department concerning tax evasion by American clients. This settlement, potentially finalized this week, marks a significant move by the Justice Department to address repeat corporate offenses under the soon-ending Biden administration.

Disney, Fox, and Warner Bros. Discovery Cancel Launch of Venu Sports Streaming Service

Disney, Fox, and Warner Bros. Discovery have decided not to proceed with the launch of Venu, their collaborative sports streaming platform. Initially announced in February, Venu was meant to integrate live sports from Fox, WBD, and Disney's ESPN. This cancellation follows a recent settlement and merger between Disney and FuboTV involving their internet TV services.

Real Estate

Wynn Resorts Acquires Crown's Aspinall Club in Strategic Expansion

Blackstone-owned Crown Resorts has sold the Aspinall Club, a prestigious members-only casino in London's Mayfair district, to Wynn Resorts. This move is part of Crown's strategic overhaul following its private acquisition by Blackstone for $8.9 billion in 2022. The acquisition by Wynn, which is pending regulatory approval expected in the second half of 2025, marks a significant expansion into the UK market for the Las Vegas-based company.

M&A, IPO’s, Bankruptcies

Stryker Set to Acquire Inari Medical for $4.9 Billion

Stryker has announced plans to purchase Inari Medical for $80 per share, valuing the deal at approximately $4.9 billion. This acquisition aims to enhance Stryker's offerings in the neurovascular and endovascular segments, capitalizing on Inari's expertise in mechanical thrombectomy, a growing $6 billion industry.

Getty Images to Acquire Shutterstock in $3.7 Billion Deal

Getty Images Holdings Inc. has agreed to purchase Shutterstock Inc., forming a powerhouse in the stock-photo industry valued at around $3.7 billion, including debt. The deal allows Shutterstock shareholders to receive $28.85 per share in cash or 13.67 Getty Images shares, with options for a payment mix of cash and shares. Craig Peters will lead the merged company, which will see Getty Images holders owning about 54.7% and Shutterstock shareholders the remainder.

NXP Acquires TTTech Auto for $625 Million to Boost Automotive Capabilities

NXP, the leading chip manufacturer for automobiles, has agreed to purchase Austria's TTTech Auto for $625 million. This acquisition aims to enhance NXP's automotive operations by integrating TTTech Auto's safety-focused middleware, which facilitates the seamless integration of applications with car operating systems and ensures the reliable rollout of updates.

Cintas Makes $5.1 Billion Bid for UniFirst, Faces Rejection

Cintas, a prominent workplace products provider, has publicly announced a $5.1 billion offer to acquire uniform supplier UniFirst, which has repeatedly declined to engage in deal discussions. The offer of $275 per share represents a 60% premium over UniFirst's last closing price, significantly enhancing its equity value, yet UniFirst maintains that the proposal does not align with its shareholders' best interests.

Anthropic Nears $2 Billion Funding Round, Tripling Valuation to $60 Billion

Anthropic is poised to secure $2 billion in funding led by Lightspeed Venture Partners, boosting its valuation to $60 billion, a significant jump from last year's $18 billion. This deal would rank Anthropic as the fifth-most valuable U.S. startup, following giants like SpaceX and OpenAI, reflecting the rapid valuation surge in the AI sector.

SoftBank and Arm Consider Acquisition of Ampere Computing

SoftBank Group Corp. and Arm Holdings Plc are in discussions to acquire Ampere Computing LLC, a semiconductor company backed by Oracle Corp. The talks are preliminary and could still dissolve, or Ampere might choose another buyer. Ampere, known for designing chips based on Arm's technology, was valued at $8 billion during a 2021 investment round led by Japan’s SoftBank.

Constellation Energy to Acquire Calpine for $16.4 Billion Amid Rising Demand

Constellation Energy has agreed to purchase Calpine for $16.4 billion in a cash-and-stock deal, reflecting a total value of $26.6 billion including debt. This merger unites two of the largest U.S. electricity generators, driven by heightened demand from tech companies for power to support AI-driven data centers.

GSK in Talks to Acquire Biotech Firm IDRx for $1 Billion

GSK Plc is negotiating the potential acquisition of IDRx, a move that could significantly enhance its oncology portfolio. The deal could value the privately-held biotech company at up to $1 billion. IDRx is known for its development of an experimental drug targeting gastrointestinal stromal tumor. The outcome of these talks remains uncertain as both companies have declined to comment.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply