- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️10.06.2024

Welcome to Read Sunday☕️10.06.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Forever Loved Les Schmidtke 10/04/2024

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

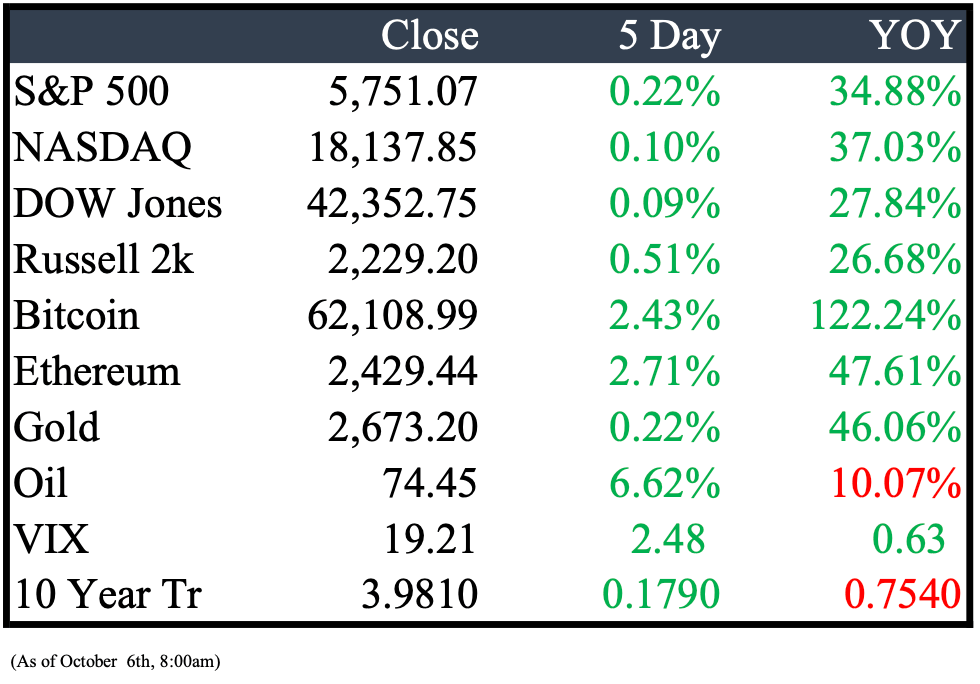

Market Recap

Last Week’s Headlines

Economy & World News

China's Manufacturing PMI Rises Slightly in September

China’s official manufacturing purchasing managers’ index (PMI) rose to 49.8 in September, up from 49.1 in August, slightly beating economists’ expectations of 49.5. Despite this improvement, the sector continues to face challenges from a prolonged economic slowdown and a property crisis, which has weakened domestic demand.

Euro Zone Inflation Drops to 1.8% in September

Euro zone inflation fell to 1.8% in September, below the European Central Bank's 2% target, according to flash data from Eurostat. This figure aligned with economists' expectations. Meanwhile, core inflation, excluding energy, food, alcohol, and tobacco, came in at 2.7%, slightly below forecasts.

Libya Resumes Oil Production After Political Standoff Eases

Libya resumed oil production on Thursday, adding hundreds of thousands of barrels per day back to global markets following the resolution of a political standoff. The eastern government, which had initially halted output, lifted the embargo, allowing all fields and export terminals to resume operations. This includes the Sharara field, the nation’s largest, which has restarted its 260,000 barrels per day production.

EU Votes to Impose Tariffs on Chinese Electric Vehicles, Escalating Trade Tensions

The European Union voted to impose tariffs of up to 45% on electric vehicles imported from China, sparking potential trade tensions as Beijing has vowed to protect its companies. Shares of European automakers rose following the vote. The European Commission now has the authority to implement the duties, which will last for five years. Ten EU member states supported the measure, while Germany and four others voted against it, with 12 abstaining.

U.S. Nonfarm Payrolls Surge by 254,000 in September, Beating Forecasts

Nonfarm payrolls jumped by 254,000 in September, surpassing the Dow Jones consensus forecast of 150,000 and up from August's revised 159,000. The unemployment rate dipped to 4.1%, as household employment showed a strong gain of 430,000. Additionally, average hourly earnings rose by 0.4% for the month and were up 4% year-over-year, both exceeding expectations.

Public Markets

Top U.S. Energy Companies Paid $42 Billion to Foreign Governments Last Year

The three largest U.S. energy exploration companies: Exxon Mobil, Chevron, and ConocoPhillips paid over $42 billion to foreign governments in 2023, significantly more than the payments made in the U.S., according to new regulatory filings. This marks the first year such disclosures were required under a new SEC rule.

Google to Invest $1 Billion in Thailand Data Centers

Alphabet Inc.'s Google plans to invest $1 billion in building data centers in Thailand, expanding its cloud and AI infrastructure in Southeast Asia. New facilities in Bangkok and Chonburi are expected to add $4 billion to Thailand’s economy by 2029 and support 14,000 jobs annually over the next five years, according to a Deloitte study.

Amgen Faces Class Action Lawsuit Over $10.7 Billion Tax Dispute

A federal judge ruled that Amgen must face a proposed class action accusing the drugmaker of delaying disclosure to shareholders about a potential $10.7 billion tax liability owed to the IRS for underreporting six years of taxes. U.S. District Judge John Cronan stated that shareholders plausibly alleged Amgen misled them by "recklessly" concealing the significant tax risk.

CVS Health Considering Strategic Options, Including Possible Breakup

CVS Health is conducting a strategic review that could lead to a potential breakup of the company. The board of directors has retained bankers to assist with the review, which has been ongoing for weeks. While no decisions are imminent, it remains possible that the company may choose to maintain its current structure.

CVS Health to Cut 2,900 Jobs in $2 Billion Cost-Saving Initiative

CVS Health plans to cut around 2,900 jobs as part of a multiyear effort to save $2 billion. The initiative aims to reduce expenses and increase investments in technology to enhance the company’s future growth and efficiency.

Boeing Considers $10 Billion Stock Sale Amid Cash Strain from Ongoing Strike

Boeing Co. is exploring the option of raising at least $10 billion through a stock sale to replenish cash reserves impacted by an ongoing strike, according to sources familiar with the matter. The company is working with advisers but is unlikely to move forward for at least a month, pending resolution of the strike involving 33,000 workers and a clearer understanding of its financial impact.

Pfizer Raises $3.2 Billion from Sale of Haleon Shares

Pfizer Inc. has raised approximately £2.4 billion ($3.2 billion) by selling 640 million shares of Haleon Plc, further reducing its stake in the UK consumer health company. The oversubscribed offering, priced at £3.80 per share, represents a 3.3% discount to Monday’s closing price, according to a statement released Tuesday.

Humana Loses Half Its Market Value Amid Major Setbacks

Humana Inc. has seen its market value cut in half this year as it faces a series of challenges. The latest blow came when the Centers for Medicare and Medicaid Services drastically lowered the insurer's quality ratings, slashing the percentage of members in highly rated, revenue-generating plans from 94% to just 25%. Investors are growing increasingly impatient with the company's ongoing struggles.

OpenAI Raises $6.6 Billion Amid Internal Turmoil

OpenAI has secured $6.6 billion in new funding, despite facing internal disruptions during complex negotiations with tech giants and private investors. The funding values the ChatGPT creator at $157 billion, placing it on par with publicly traded companies like Goldman Sachs, Uber, and AT&T.

OpenAI Secures $4 Billion Credit Line, Boosting Liquidity to $10 Billion

Alongside its recent $6.6 billion funding round, OpenAI has secured a $4 billion revolving credit line, bringing its total liquidity to over $10 billion. Major banks including JPMorgan Chase, Citi, Goldman Sachs, and Morgan Stanley participated in the credit line. OpenAI's latest funding round, which values the company at $157 billion, saw investment from Thrive Capital, Microsoft, Nvidia, and SoftBank.

Stellantis Sues United Auto Workers Amid Ongoing Labor Dispute

Stellantis has filed a lawsuit against the United Auto Workers (UAW), intensifying a months-long conflict between the automaker and the American union. The lawsuit also targets a local UAW chapter in California, according to an internal company message confirmed by CNBC.

Real Estate

Zillow Now Displays Climate Risk Data for All For-Sale Properties

First Street has launched a suite of climate risk data for every property listed on Zillow. Each listing now shows risk scores for flood, fire, wind, air, and heat, along with projections for 15 and 30 years into the future. A Zillow survey found that over 80% of buyers consider climate risk when purchasing a home, with flood risk ranking as the top concern, followed by fire.

Mortgage Rates Spike Following Strong Jobs Report

Mortgage rates surged after a stronger than expected jobs report showed nonfarm payrolls rose significantly in September. The robust employment data signals a resilient economy, increasing expectations for higher interest rates, which has pushed mortgage rates higher.

M&A, IPO’s, Bankruptcies

AT&T Sells Majority Stake in DirecTV to TPG for $7.6 Billion

AT&T has agreed to sell its majority stake in DirecTV to private equity firm TPG for $7.6 billion in cash. The deal includes $1.7 billion in pre-tax quarterly distributions this year, $5.4 billion in after-tax distributions in 2025, and a final payment of $500 million in 2029, according to a recent filing.

EchoStar in Advanced Talks to Sell Dish Network to DirecTV

EchoStar is in advanced negotiations to sell satellite TV provider Dish Network to rival DirecTV, according to sources familiar with the discussions. While the parties aim to finalize the deal by Monday, it’s not guaranteed and talks could still collapse. EchoStar is motivated by the need to pay off $1.98 billion in debt maturing in November, with just $521 million in cash and securities as of June 30.

Yelloh to Shut Down Frozen Meal Delivery Service After 72 Years

Frozen meal delivery service Yelloh (formerly Schwan's) announced it will cease all operations in November after 72 years, citing "insurmountable" business challenges and shifts in consumer lifestyles. Board member Michael Ziebell noted that the company struggled with nationwide staffing shortages and food supply chain disruptions caused by the pandemic.

AI Chip Startup Cerebras Systems Files for IPO

Artificial intelligence chip startup Cerebras Systems filed for an initial public offering (IPO) on Monday and will trade under the ticker symbol "CBRS" on Nasdaq. In the first six months of 2024, the company reported a net loss of $66.6 million on $136.4 million in sales, a significant improvement from the same period in 2023, where it posted a $77.8 million loss on just $8.7 million in sales.

Johnson & Johnson to Invest $2 Billion in New North Carolina Facility

Johnson & Johnson announced plans to invest over $2 billion in a new manufacturing facility in Wilson, North Carolina, to support the production of biologic medicines targeting cancer, immune-related, and neurological diseases. The company aims to launch or file for more than 70 new therapies and expanded treatment options by 2030.

KKR Considers Takeover Bid for Semiconductor Maker ASMPT

KKR & Co. is exploring a potential takeover bid for ASMPT Ltd., a $5 billion semiconductor and electronics equipment manufacturer, according to sources. The US alternative asset manager has made a non-binding, preliminary approach to take the Hong Kong-listed company private. Discussions are still in the early stages, and a transaction is not guaranteed. Other buyout firms may also express interest in ASMPT.

Miami Dolphins in Advanced Talks to Sell Minority Stake

The Miami Dolphins are in advanced discussions to sell a minority stake in the team, with potential buyers including Ares Management and billionaire Joe Tsai, according to sources. The deal would value the NFL team at $8.1 billion.

Spirit Airlines Faces Potential Bankruptcy as Debt Deadline Approaches

Spirit Airlines is facing an October 21 deadline to refinance debt due next year and is reportedly considering filing for Chapter 11 bankruptcy protection. The budget airline has been hit hard by a blocked acquisition by JetBlue, shifting consumer travel patterns, rising costs, and an engine recall, putting its financial stability at risk.

Tencent and Guillemot Family Weigh Buyout of Ubisoft After Market Value Plunge

Tencent Holdings and the Guillemot family, founders of Ubisoft Entertainment, are exploring options including a potential buyout of the French video game developer, following a sharp decline in its market value this year. The two parties have been consulting advisers to stabilize and boost Ubisoft's value, with one option being to take the company private, according to sources familiar with the discussions.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply