- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️09.29.2024

Welcome to Read Sunday☕️09.29.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

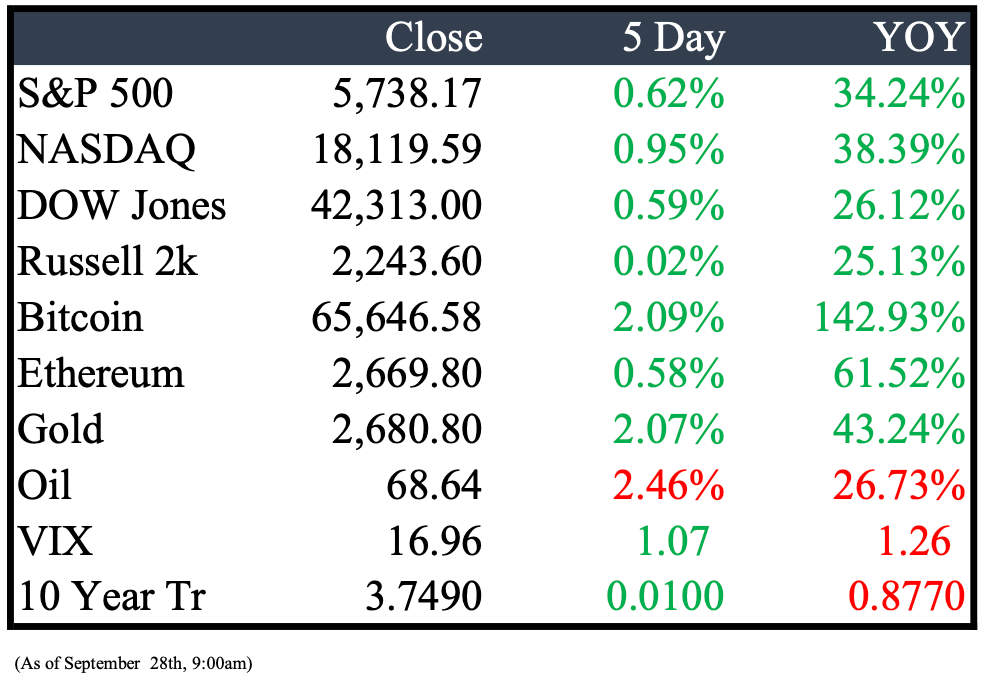

Market Recap

Last Week’s Headlines

Economy & World News

China Introduces Major Stimulus to Boost Economy

China's government unveiled extensive measures to prevent the economy from entering a deflationary cycle. The People's Bank of China lowered interest rates on one-year loans and loosened restrictions on second-home purchases. Additionally, the government provided cash handouts, introduced new subsidies for unemployed graduates, and committed to increased fiscal spending to stabilize property prices.

China’s Industrial Profits Plunge 17.8% in August

China's industrial profits dropped by 17.8% in August, the steepest decline in over a year, according to data from the National Bureau of Statistics. This follows a 4.1% profit increase in July. For the first eight months of 2024, profits grew by just 0.5%, down from a 3.6% increase over the first seven months.

Beijing Urges Companies to Buy Local AI Chips Over Nvidia

Beijing is increasing pressure on Chinese companies to purchase locally produced AI chips instead of Nvidia Corp. products, as part of its push to grow the domestic semiconductor industry and counter US sanctions.

Caroline Ellison Sentenced to Two Years in FTX Scandal

Caroline Ellison received a 24-month prison sentence for her involvement in the FTX collapse. Despite cooperating with prosecutors, aiding in the conviction of her former boss, Sam Bankman-Fried, the judge also ordered Ellison to forfeit $11 billion. Prosecutors argued for leniency in her sentencing.

Yuan Hits Year-High Following China’s Stimulus Measures

China’s yuan surged to its strongest level in over a year after Beijing introduced new stimulus measures to boost its slowing economy. Unlike the US Federal Reserve, which primarily uses a single interest rate, the People’s Bank of China (PBOC) employs a range of rates to manage its monetary policy.

Swiss National Bank Lowers Key Interest Rate to 1.0%

The Swiss National Bank reduced its key interest rate by 25 basis points to 1.0%, marking its third policy easing this year. The move comes in response to low domestic inflation and a strong Swiss franc. In March, the SNB became the first major Western central bank to cut interest rates.

US Offers $20 Billion for Ukraine Aid Package, Tied to EU Sanctions Adjustments

The US has pledged $20 billion to a Group of Seven-led Ukraine aid package, contingent on the EU adjusting its Russian sanctions regime to make it more predictable. While the US would still contribute to the $50 billion aid package even if the EU doesn’t make the changes, the contribution could be lower, according to sources familiar with the EU discussions.

NYC Mayor Eric Adams Indicted for Accepting Illegal Foreign Contributions

New York City Mayor Eric Adams has been indicted for receiving over $100,000 in illegal benefits, including free flights and luxury stays from Turkish nationals. Prosecutors allege Adams engaged in bribery, fraud, and solicitation of foreign contributions, and attempted to cover up his actions through fake documentation and deleted messages. Facing five felony counts, Adams denies wrongdoing and vows to stay in office, despite increasing calls for his resignation. The investigation is ongoing, with more individuals likely to face accountability, according to U.S. Attorney Damian Williams.

Moody's Downgrades Israel Amid Rising Conflict Costs

Moody’s downgraded Israel’s credit rating for the second time this year, lowering it two notches to Baa1 from A2, as economic losses mount from nearly 12 months of fighting in Gaza and escalating tensions with Hezbollah. The outlook remains negative, leaving Israel three steps above non-investment grade.

US Plans to Ban Chinese and Russian Tech in Connected Vehicles

The US Commerce Department is set to propose rules banning Chinese- and Russian-made hardware and software in connected vehicles, addressing security concerns surrounding smart cars, according to sources. The bans will target automated driving and vehicle communication systems, focusing mainly on software but also covering some hardware. The proposed rules are expected to be revealed as early as Monday.

Cards Against Humanity Sues SpaceX for Trespassing on Texas Land

The maker of Cards Against Humanity has filed a lawsuit against Elon Musk's SpaceX, accusing it of trespassing and damaging company-owned land in Texas. The suit seeks $15 million in damages, citing destruction of natural vegetation. The land, purchased in 2017 as part of a protest against plans to build a U.S.-Mexico border wall, is located near Brownsville, Texas, far from the company’s Chicago headquarters.

Public Markets

Study Suggests Ozempic May Lower Opioid Overdose Risk

Novo Nordisk's diabetes drug, Ozempic, may reduce opioid overdose risk in some patients, according to a recent study. The active ingredient, semaglutide, could offer a new treatment option for opioid use disorder, potentially aiding efforts to combat the opioid epidemic. This finding adds to the growing evidence that GLP-1 drugs, widely used for diabetes and weight loss, may offer additional health benefits.

Elliott Management Pushes for Special Meeting at Southwest Airlines

Activist investor Elliott Management announced plans to call a special meeting at Southwest Airlines, possibly as early as next week. While the usual shareholder meeting occurs in May, Elliott aims to expedite the election of a new 10-member board, composed of airline executives and former regulators, to bring changes to the company’s leadership.

Southwest Airlines to Reduce Service at Atlanta Airport in 2024

Southwest Airlines plans to scale back its service at Atlanta, the world’s busiest airport, next year. According to a memo, the airline could cut over 300 pilot and flight attendant positions. While no layoffs are planned, affected crew members may need to bid for assignments in other cities.

US Justice Department Sues Visa Over Debit Card Monopoly

The US Justice Department has filed an antitrust lawsuit against Visa Inc., accusing the company of illegally monopolizing the debit card market. The complaint, filed in Manhattan federal court, claims Visa controls over 60% of the $4 trillion in US debit transactions and has used agreements to penalize merchants who consider alternatives and paid competitors to stay out of the market. This marks the Biden administration’s first major antitrust case in the financial services sector.

OpenAI Board Considers Shift to For-Profit Structure Amid Leadership Departures

OpenAI is exploring a restructuring plan to transition into a for-profit business. This development follows the recent announcement by CTO Mira Murati that she will be leaving after six and a half years. Shortly after, CEO Sam Altman confirmed that Chief Research Officer Bob McGrew and VP of Research Barret Zoph are also departing the company.

Chevron Agrees to Exclude John Hess from Board to Secure Merger Approval

Chevron Corp. reached an agreement with the US Federal Trade Commission to exclude Hess Corp. CEO John Hess from its board, clearing the way for Chevron’s $53 billion acquisition of Hess. Although Chevron initially planned for Hess to join its board and become a major shareholder post-merger, this condition was necessary to move the deal forward, according to sources familiar with the discussions.

Microsoft Invests $14.7 Billion in Brazil for AI and Cloud Expansion

Microsoft is investing 14.7 billion Reais in Brazil over three years to expand cloud and AI infrastructure, including new datacenters in São Paulo. The investment aims to boost AI innovation and train 5 million people through its ConectAI program, supporting Brazil’s long-term competitiveness.

Alphabet to Invest $3.3 Billion in New South Carolina Data Centers

Alphabet plans to invest $3.3 billion in South Carolina to build two new data centers, according to CEO Sundar Pichai. The investment will support the growth of AI applications, with new campuses in Dorchester County and an expansion of the existing site in Berkeley County, per the South Carolina governor's office.

Trump Media Shares Rise 5.58% After Major Investor Sells Stake

Trump Media shares closed up 5.58% at $14.76 on Friday, following United Atlantic Ventures LLC selling nearly all its shares after a lockup agreement expired on Sept. 19. The stock had hit a new 52-week low during six consecutive days of losses but rebounded Tuesday, breaking the losing streak.

Boeing Offers 30% Pay Hike to Striking Workers, Union Rejects Vote

Boeing Co. proposed a 30% pay increase to striking workers in the Pacific Northwest, hoping to end a strike that has shut down its factories for over a week. However, union negotiators from the International Association of Machinists and Aerospace Workers refused to bring the offer to a vote, as it falls short of the 40% raise initially demanded. Boeing insists the offer is final and valid until the end of Sept. 27, increasing pressure on workers to accept.

Real Estate

Goldman Sachs’ Former Headquarters Transformed Into Luxury Apartments

Just steps from the New York Stock Exchange, the former headquarters of Goldman Sachs at 55 Broad St. has been converted into luxury apartments available for lease. Once home to financial giants like Drexel Burnham Lambert and J.P. Morgan, the area has evolved, with former finance-driven spaces now hosting restaurants and playgrounds. Today, for $4,000 a month, New Yorkers can live where Goldman Sachs once built its trading empire.

New Jersey Office Tower Doubles Occupancy Amid Northeast Vacancy Crisis

While Manhattan and Philadelphia struggle with record-high office vacancy rates, the 1 Tower Center office building in New Jersey has more than doubled its occupancy in five years. Developer American Equity Partners purchased the 24-story building for $38 million in 2019 and invested over $20 million in upgrades, transforming the once-dated property into a more appealing space with modern amenities, such as a gym, tenant lounge, and car-charging stations.

M&A, IPO’s, Bankruptcies

Blackstone and Vista Equity to Acquire Smartsheet in $8.4 Billion Deal

Blackstone and Vista Equity Partners will purchase Smartsheet for $8.4 billion in an all-cash deal. The $56.50 per share offer represents a 41% premium over the company's recent average share price. Smartsheet, a collaboration software firm, went public in 2018 alongside other enterprise software companies like DocuSign.

Citigroup and Apollo Partner on $25 Billion Private Credit Venture

Citigroup and Apollo Global Management have formed an exclusive partnership to tap into the rapidly growing private credit market. Over the next five years, they will collaborate on $25 billion worth of deals, primarily for corporate and private equity clients. The venture will include participation from Mubadala Investment Co. and Apollo’s insurance arm, Athene, with a focus on North American markets.

ADP in Talks to Acquire WorkForce Software for $1.2 Billion

Automatic Data Processing Inc. (ADP) is reportedly in advanced discussions to acquire WorkForce Software, a Livonia, Michigan-based company, for about $1.2 billion. The deal, backed by Elliott Investment Management and Insight Partners, could be announced in the coming weeks. However, sources caution that the negotiations, though advanced, could still face delays or fall through.

Detroit Pistons Owner Tom Gores to Purchase 27% Stake in Los Angeles Chargers

Tom Gores, owner of the Detroit Pistons, has agreed to acquire a 27% stake in the Los Angeles Chargers, according to sources. The deal includes a 24% share from Dea Spanos Berberian and smaller shares from other Spanos family members. NFL owners are expected to approve the purchase at their Atlanta meetings next month. Sports Business Journal first reported the transaction.

Apollo Global Management Offers Up to $5 Billion Investment in Intel

Apollo Global Management has proposed a multibillion-dollar investment in Intel Corp., offering a vote of confidence in the chipmaker’s turnaround strategy. The investment, potentially as much as $5 billion, comes as an alternative to a possible takeover by larger rival Qualcomm Inc., according to sources familiar with the discussions.

UniCredit Pushes for Major Stake in Commerzbank Amid European Banking Union Tensions

Italy's UniCredit has intensified its efforts to acquire a 21% stake in Germany's Commerzbank, aiming to become the largest investor in the country’s second-biggest lender. Having already secured a 9% stake, UniCredit’s move has surprised German authorities, marking a potential turning point for the region and highlighting the European Union’s unfinished banking union.

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply