- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️09.22.2024

Welcome to Read Sunday☕️09.22.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Discover more about our sister corporation and alternative investment firm, Peridot Co., and its high-performing flagship fund, THE Fund L.P.

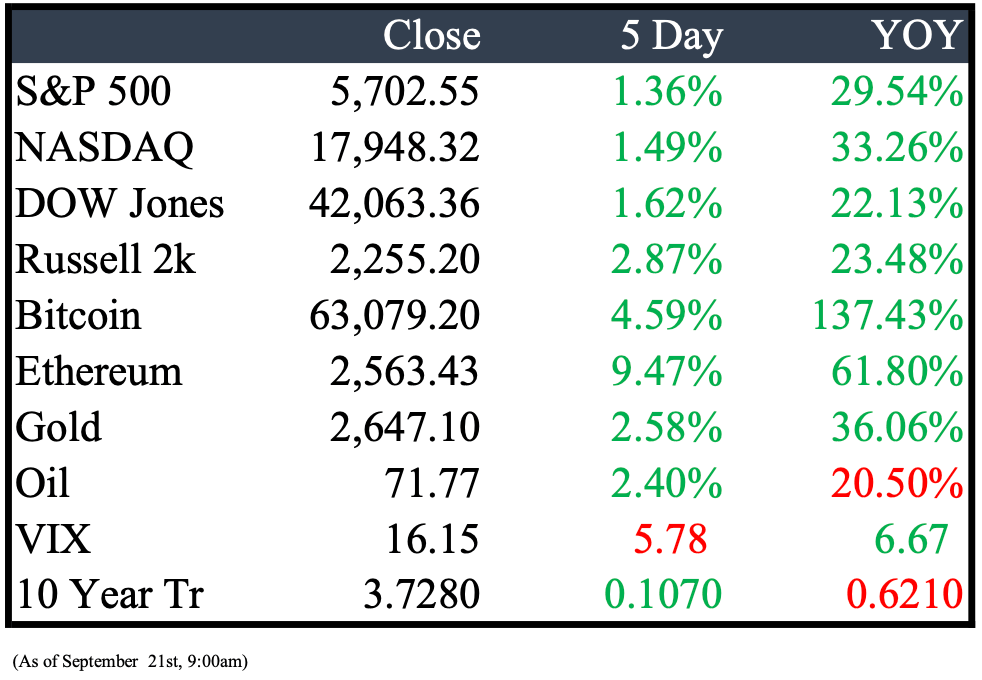

Market Recap

Last Week’s Headlines

Economy & World News

Ozempic Likely Target for Medicare Price Cuts Under New Legislation

Ozempic, the popular diabetes drug from Novo Nordisk, is "very likely" to face price cuts as part of Medicare's new drug price negotiation efforts under the Inflation Reduction Act. This legislation, which recently reduced the prices of 10 major medicines by 38% to 79% for 2026, allows the U.S. government to directly negotiate with drug manufacturers. The next round of 15 drugs subject to negotiations will be announced early next year, sparking speculation about which treatments will be affected.

Steve Cohen Steps Back from Trading to Focus on Growth and Talent Development

Billionaire hedge fund founder Steve Cohen has stepped away from trading clients' capital at Point72 Asset Management. While Cohen remains co-chief investment officer alongside Harry Schwefel, he's now focusing on the firm's growth and mentoring talent. Cohen, 68, has been a dominant figure in the hedge fund industry for over three decades, rebuilding his firm after an insider-trading scandal. Despite growing Point72 into a major player with over 185 trading teams, Cohen is now turning his attention to broader strategic efforts.

U.K. Inflation Holds Steady at 2.2% in August

U.K. inflation remained at 2.2% in August, according to data from the Office for National Statistics, aligning with analyst expectations and unchanged from July's reading. The consumer price index (CPI) has been consistent, following 2% readings in May and June, meeting the Bank of England’s target rate.

Bank of England Holds Rates, Signals Hawkish Stance with 8-1 Vote

The Bank of England’s Monetary Policy Committee voted 8-1 to hold interest rates steady, with one member advocating for a 0.25 percentage point cut. The central bank also announced plans to reduce its bond holdings by £100 billion ($133 billion) over the next 12 months through active sales and bond maturities.

Justice Department Sues Over Deadly Baltimore Bridge Collapse

The Justice Department has filed a lawsuit against the owner and operator of the containership that caused the fatal collapse of the Francis Scott Key Bridge in Baltimore. The vessel, the Dali, lost power and collided with the bridge in March, killing six construction workers and halting shipping traffic at the Port of Baltimore. The government is seeking over $100 million in damages from two Singaporean corporations, Grace Ocean and Synergy Marine, to recover federal response costs.

Bank of Japan Holds Interest Rate at 0.25%, Highest Since 2008

The Bank of Japan maintained its benchmark interest rate at 0.25%, the highest level since 2008, following a two-day meeting. The decision reflects the BOJ's cautious approach to normalizing monetary policy after years of ultra-easy measures, while aiming to avoid damaging the country's economy.

FTC Sues U.S. Health Companies for Inflating Insulin Prices

The Federal Trade Commission has filed a lawsuit against three major U.S. health companies: Optum Rx, Caremark, and Express Scripts. Accusing them of artificially inflating insulin prices to boost profits. These pharmacy benefit managers (PBMs), which negotiate drug prices, are alleged to have contributed to higher costs for patients. The FTC may also consider taking legal action against insulin manufacturers, including Eli Lilly, Sanofi, and Novo Nordisk, in the future.

Public Markets

Coffee Prices Reach 13-Year High Amid Supply Disruptions

The cost of premium arabica coffee beans has surged to its highest point since 2011, climbing 40% this year. Futures jumped 4.8% to $2.718 per pound, as ongoing supply shortages of cheaper robusta beans push demand for the pricier arabica variety. The rally is fueled by weather concerns in Brazil, where heat and dryness have impacted the latest harvest.

Boeing Furloughs Thousands Amid Worker Strike

Boeing began furloughs for thousands of employees in Washington State and Oregon after over 32,000 workers went on strike last week, bringing production of the popular 737 MAX and other jets to a halt. Members of the International Association of Machinists and Aerospace Workers received their final paycheck this week, as negotiations between Boeing and its largest union remain stalled.

Boeing Defense Chief Ted Colbert to Step Down, Replacement Pending

Boeing’s new CEO Kelly Ortberg announced that Ted Colbert, head of the company’s defense unit, is leaving. The defense division, which contributed roughly 40% of Boeing’s revenue in the first half of the year, will soon have a new leader, with a replacement to be named later.

Intel Secures AWS as Major Customer in AI Chipmaking Deal

Intel CEO Pat Gelsinger has landed Amazon's AWS as a key customer for Intel’s manufacturing business, marking a significant win for the embattled chipmaker. The two companies will co-invest in a custom semiconductor for AI computing, known as a fabric chip, under a "multiyear, multibillion-dollar framework." This collaboration will leverage Intel’s advanced 18A chipmaking technology and could bring substantial work to Intel’s new U.S. plants.

Microsoft Increases Dividend and Launches $60 Billion Stock Buyback

Microsoft announced a 10% increase to its quarterly dividend, raising it to 83 cents per share for shareholders as of November 21. The company also unveiled a new $60 billion stock buyback program, matching a similar repurchase plan from 2021. Shares gained up to 2.4% following the news, with the new buyback plan having no expiration date.

Three Mile Island Nuclear Plant Set for $1.6 Billion Revival, Microsoft to Buy Output

Constellation Energy Corp. plans to invest $1.6 billion to revive the Three Mile Island nuclear plant in Pennsylvania, with Microsoft agreeing to purchase all the plant's carbon-free electricity to power its AI-driven data centers. Constellation, the largest U.S. operator of reactors, aims to bring the plant back online by 2028. The site's other reactor, which shut down in 2019 due to economic challenges, will be reopened as part of the effort.

Amazon CEO Pushes for Full Return to Office and Corporate Restructuring

Amazon CEO Andy Jassy is now requiring corporate employees to work from the office five days a week, a shift from the previous three-day in-office policy. Additionally, Amazon is streamlining its corporate structure by reducing the number of managers across various teams.

JPMorgan in Talks to Take Over Apple’s Credit Card Program

JPMorgan Chase is in discussions with Apple about taking over its credit card program, following Apple's decision to part ways with its current issuer, Goldman Sachs. Talks began earlier this year and have progressed in recent weeks, though a final deal could take months as key details, including pricing, are still under negotiation. The partnership between Apple and Goldman Sachs, which also includes savings accounts, was set to end last year.

Google Wins Appeal Against €1.5 Billion EU Fine Over Online Ads

Google scored a legal victory against the European Union after the EU’s General Court in Luxembourg overturned a €1.5 billion ($1.7 billion) fine related to anti-competitive practices in online ads. The court agreed with regulators' findings but noted key errors in their investigation, particularly concerning the duration of the alleged misconduct. This win partially offsets Google’s recent loss in a separate case over abusing its monopoly powers.

EU Warns Apple to Open iOS to Rivals or Face Fines

The European Union has warned Apple to open its iPhone and iPad operating systems to rival technologies under the bloc’s Digital Markets Act. The EU's antitrust regulators have given Apple six months to comply with the new rules, which require operating systems to be fully functional with competing technologies. Failure to do so could result in significant fines for the tech giant.

Two Sigma Nears $100 Million Settlement with SEC Over Trading Scandal

Hedge fund giant Two Sigma is likely to pay up to $100 million to settle a Securities and Exchange Commission (SEC) investigation into a trading scandal. The firm faces scrutiny over its oversight of a former employee accused of unauthorized adjustments to trading models, resulting in significant financial losses and gains. While negotiations are ongoing and the final settlement could be lower, the five-member SEC commission must approve any agreement. Both Two Sigma and the SEC declined to comment on the matter.

Palantir Secures $100 Million Contract to Expand AI Targeting Tools for US Military

Palantir Technologies has won a $100 million contract to broaden access to its AI-powered targeting tools for more US military personnel. The company's Maven Smart System, a digital warfare platform, integrates US intelligence data and uses AI and computer-vision algorithms to provide a unified battlefield view across thousands of screens. The system has been instrumental in identifying targets for airstrikes in the Middle East this year.

GM Recalls Nearly 450,000 Trucks and SUVs Over Faulty Brake Warning Light

General Motors has issued a recall affecting nearly 450,000 trucks and SUVs due to a potential issue with the brake fluid warning light. The recall includes 2023 Chevrolet Silverado 1500, GMC Sierra 1500, as well as 2023 and 2024 models of the Chevrolet Tahoe, Suburban, GMC Yukon, Yukon XL, Cadillac Escalade, and Escalade ESV. The National Highway Traffic Safety Administration (NHTSA) reported that the electronic brake control module software may fail to display a warning light in the event of brake fluid loss.

Real Estate

German Supplier Laepple Automotive to Invest $78.8 Million in Detroit Stamping Plant

Laepple Automotive, a German automotive supplier, is set to invest $78.8 million in transforming a former Stellantis building in Detroit into a new stamping plant. The project at the Mount Elliott Tool and Die site on the city’s east side is expected to create 173 jobs, according to sources familiar with the deal.

Oyo Acquires Motel 6 for $525 Million in U.S. Expansion Push

Indian hotel giant Oyo has agreed to purchase Motel 6 for $525 million as part of its strategy to expand in the U.S. The iconic budget lodging brand, with around 1,500 locations across the U.S. and Canada, has been a staple for cost-conscious travelers for 62 years. New York investment firm Blackstone, which acquired Motel 6 in 2012, is the seller. The deal is expected to close in the fourth quarter of this year.

AI Boom Fuels Land Rush for Data Centers

The rise of artificial intelligence is driving a new wave of land speculation focused on developing data centers, which power AI, cloud computing, and other internet technologies. In a recent deal, Denver-based startup Tract paid $136 million for a 2,100-acre site near Phoenix, with plans to transform it into one of the largest data-center complexes in the U.S. over the next 15 years. The Buckeye, Arizona property could support $20 billion in data-center development, excluding the cost of servers, as part of Tract's larger acquisition of over 20,000 acres nationwide.

Dollar Stores Push Expansion Despite Slowing Sales and Competition

Dollar General and Dollar Tree, the largest dollar-store chains in the U.S., are on track to open over 1,300 new locations this fiscal year, despite facing slowing sales and weaker earnings. While this number is down from last year, it far surpasses other retailers' expansions. Dollar-store executives remain focused on new locations as a way to boost sales and gain market share. However, the chains are contending with reduced spending from core low-income customers and increased competition from other discount retailers, along with challenges in e-commerce.

M&A, IPO’s, Bankruptcies

Biotech IPOs Signal Investor Interest with Three Debuts

On Friday, hree drug developers went public, offering a key indicator of investor interest in biotech. Bicara Therapeutics, focused on cancer treatments, MBX Biosciences, which targets endocrine and metabolic disorders, and Zenas BioPharma, specializing in immunology, all upsized their offerings and debuted on Nasdaq. Their performance in the coming weeks will be closely watched as a barometer for biotech IPO demand.

Apollo Strikes $1 Billion Deal with BP for Natural Gas Pipeline Stake

Apollo Global Management has inked a $1 billion deal with British energy giant BP to acquire a non-controlling stake in the Trans Adriatic natural gas pipeline. The agreement will see Apollo take a share in BP's unit that holds a 20% stake in the pipeline, alongside other shareholders such as Azerbaijan's SOCAR, Italy's Snam, Belgium's Fluxys, and Spain's Enagas, each holding a 20% stake.

Apollo Secures $5 Billion from BNP Paribas to Expand Lending Business

Apollo Global Management has secured $5 billion from BNP Paribas as it seeks to grow its lending operations, stepping further into territory traditionally dominated by banks. The French bank is providing funding for investment-grade, asset-backed deals initiated by Apollo and its Atlas SP arm, which was acquired from Credit Suisse. BNP plans to increase its commitment over time.

EverBank to Acquire Sterling Bank & Trust for $261 Million

EverBank Financial Corp., based in Jacksonville, Florida, has agreed to purchase Sterling Bank & Trust, a subsidiary of Michigan’s Sterling Bancorp, for $261 million. The acquisition includes 24 branches in California, one in New York City, $900 million in loans, and $2 billion in deposits. The deal is pending shareholder and regulatory approval and is expected to close in early 2025.

Qualcomm Reportedly Approaches Intel for Potential Takeover

Qualcomm recently approached Intel about a potential takeover, according to sources familiar with the matter. Intel, with a market cap exceeding $90 billion as of Friday’s market close, saw its shares rise in extended trading following the news.

Tupperware Files for Bankruptcy Amid Sales Decline and Debt Struggles

Tupperware Brands Corp., known for its iconic plastic food storage containers, has filed for Chapter 11 bankruptcy after years of declining sales and increased competition. The 80-year-old company is seeking court approval to facilitate the sale of the business while continuing operations. The filing follows extended negotiations with lenders over managing more than $700 million in debt.

Red Lobster Emerges from Bankruptcy with New Leadership and Ownership

Red Lobster has officially exited Chapter 11 bankruptcy and is now under new ownership by RL Investor Holdings, led by Fortress Investment Group, along with co-investors TCW Private Credit and Blue Torch Capital. The struggling seafood chain is starting fresh under the leadership of former P.F. Chang’s CEO Damola Adamolekun, who aims to revitalize the brand with the support of experienced restaurant investors.

Alaska Airlines and Hawaiian Airlines Complete Merger with DOT Approval

Alaska Airlines and Hawaiian Airlines have finalized their merger after receiving approval from the U.S. Department of Transportation (DOT). As part of the deal, both airlines must maintain the value of their reward programs and preserve several key routes under specific conditions. These protections will remain in place for six years.

Nippon Steel Granted Extension to Pursue $14.1 Billion US Steel Purchase

A US security panel has allowed Nippon Steel Corp. to refile its $14.1 billion bid to acquire United States Steel Corp., delaying a final decision until after the November elections. Despite the extension, President Joe Biden remains firmly opposed to the politically sensitive deal, insisting that US Steel should remain American-owned. The extension resets the review process, keeping the proposed takeover alive, though the president has shown no signs of wavering in his opposition. Sources spoke anonymously regarding the review process.

Ampere Computing Explores Sale Amid Competitive Chip Market

Ampere Computing LLC, a semiconductor startup backed by Larry Ellison's Oracle Corp., is exploring a potential sale, according to sources. The Santa Clara-based chip designer has been working with a financial adviser to handle takeover interest. The move suggests Ampere may be shifting away from pursuing an IPO, as competition intensifies in the AI-driven chip market. Despite the AI boom, several large tech companies are now developing similar chips, making it a challenging landscape for Ampere.

Johnson & Johnson Subsidiary Files for Bankruptcy Amid $10 Billion Talc Settlement

A Johnson & Johnson subsidiary, Red River Talc, has filed for bankruptcy for the third time as the company seeks to finalize a proposed $10 billion settlement. This move aims to resolve over 62,000 lawsuits alleging that J&J's baby powder and other talc products caused cancer due to asbestos contamination. The bankruptcy filing in Houston's federal court temporarily halts these lawsuits as the settlement process moves forward.

Platinum Equity Acquires Majority Stake in Italian Food Producer Polli

U.S. private-equity firm Platinum Equity has acquired a majority stake in Italy-based pasta condiments and vegetable preserves producer Polli. The financial details of the deal were not disclosed. The Polli family, which founded the company in 1872, will retain a minority stake alongside CEO Marco Fraccaroli, who will continue to lead the business. Polli, one of the largest pesto producers in the EU, operates four plants, producing 29,000 tonnes of vegetables and over 190 million packages annually, serving customers in more than 50 countries.

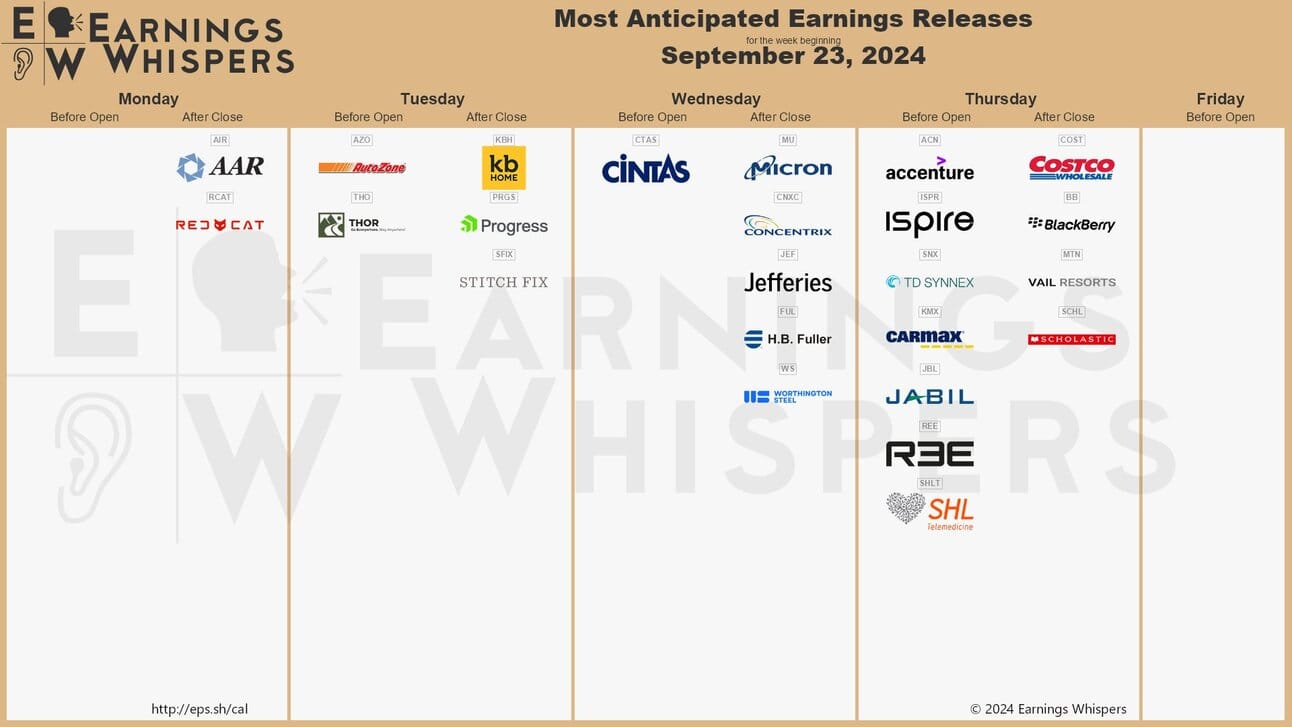

Earnings this week

Interested in writing for Read Sunday or one of our new newsletters soon to be launched? Send an email to [email protected]

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Reply