- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

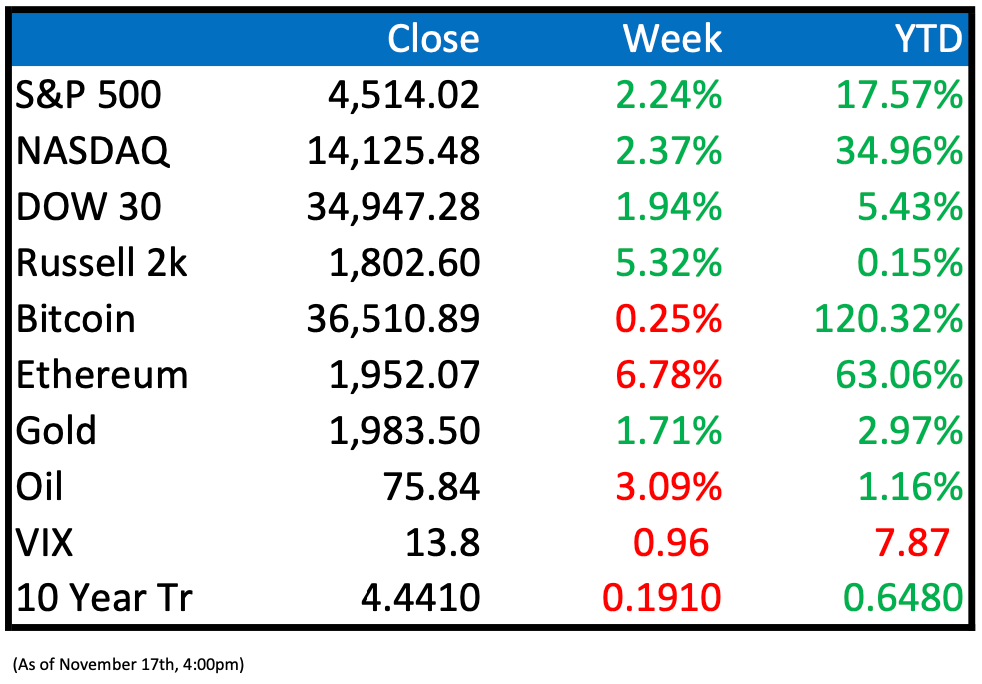

Market Recap

This Week’s Headlines

Public Markets

Microsoft has revealed its plans to replace Nvidia's chips with its proprietary in-house chip in certain AI applications. The company recently unveiled its Azure Maia AI Accelerator, a specialized chip specifically crafted for tasks such as generative AI, large language model training, and AI model inference, which involves generating responses from AI models. (BAR)

When a subsidiary of the world's largest lender contemplates settling trades through the transfer of data via a USB stick carried between New York trading floors by a human courier, it should raise significant concerns. This unusual scenario came up for discussion last week when ICBC Financial Services, the financial services division of the Industrial and Commercial Bank of China, fell victim to ransomware software. This malicious software disrupted its ability to finalize transactions in the $25 trillion US Treasury market. Ultimately, the hack was mitigated by isolating the affected systems, in addition to a $9 billion capital injection. (FT)

ValueAct Capital, based in San Francisco, has acquired a stake in Walt Disney Co., as per an individual familiar with the matter. This move adds to the activist pressure faced by the U.S. media and entertainment giant as it navigates significant industry changes. ValueAct has built a substantial position in Disney and has initiated discussions with the company. (BBN)

According to the main economics expert for Alphabet Inc., Google pays Apple Inc. a substantial 36% of the revenue generated from search advertising conducted through the Safari browser. This information was revealed during the expert's testimony as part of Google's defense in the Justice Department's antitrust trial. (BBN)

Bank of America Corp. has taken the lead in a $1.5 billion natural gas bond sale for the oil giant BP Plc. This move comes at a time when Texas politicians are deliberating whether to categorize specific Wall Street banks as "energy boycotters" due to their climate change policies. (BBN)

Amazon is planning to enable auto dealers to sell cars through its platform, with the initial partnership set to begin with the South Korean automaker Hyundai. While Amazon has gradually entered the car buying sector by establishing a digital showroom for consumers to explore and compare vehicles, this new development will allow shoppers to make car purchases on Amazon's platform, although the dealers themselves will be the ultimate sellers. (CNBC)

Economy

Here are the key highlights from the most recent Consumer Price Index (CPI) data:

1. CPI remained unchanged from September, which differs from the anticipated increase of 0.1% as per a survey of economists conducted by the Wall Street Journal.

2. On an annual basis, CPI increased by 3.2%, slightly lower than the expected 3.3% rise.

3. When excluding the volatile components of food and energy prices, core CPI registered a 4% increase over the past 12 months. This figure was slightly below the expected 4.1% rise. (WSJ)

On Tuesday, Speaker Mike Johnson found himself in the position of depending on Democratic votes to pass legislation aimed at maintaining federal funding until early 2024. This move was necessitated by the opposition of numerous Republicans to his plan to prevent a government shutdown by the end of the week. The final vote tally was 336 to 95, comfortably surpassing the two-thirds majority needed for approval. In the end, the bill received support from 209 Democrats and 127 Republicans, while 93 Republicans voted against it, along with two Democrats. (NYT)

Consumers scaled back their spending at various establishments including stores, dealerships, and gas stations in the past month, signaling a slowdown in economic growth just before the holiday shopping season. According to the Commerce Department's report on Wednesday, U.S. retail sales declined by 0.1% in October compared to the previous month. This marks the first drop since March, following a 0.9% increase in September and strong growth earlier in the summer. These retail numbers, coupled with reduced hiring and moderating inflation, suggest that the economy is tempering its pace after experiencing unexpectedly robust growth for much of this year. (WSJ)

Colombia has launched a new initiative aimed at sterilizing its invasive hippopotamuses, signaling its commitment to addressing the threat these animals pose to the country's biodiversity and local communities. The plan involves capturing, anesthetizing, and sterilizing an initial group of 20 hippos by the conclusion of 2023. This effort is part of a comprehensive strategy by the government to control the burgeoning hippo population that has established itself along Colombia's Magdalena River. (ST)

Spain's parliament has granted acting Prime Minister Pedro Sanchez the authority to form a government, after two unsuccessful attempts by right-wing opposition leader Alberto Núñez Feijóo.

Pedro Sanchez, the leader of the Spanish Socialist Workers' Party (PSOE), received 179 votes in favor, 171 against, and no abstentions, securing the necessary support to proceed with assembling a government. (CNBC)

Mergers & Acquisitions

Bain Capital is considering options for the sale or initial public offering (IPO) of Varsity Brands, a U.S. company specializing in sports uniforms and school yearbooks. This move could potentially value Varsity Brands at over $6 billion, taking into account its outstanding debt. (RET)

A consortium led by Glencore, represented by GLEN.L, has successfully secured one of the mining industry's largest deals in recent years. The consortium has agreed to acquire the steelmaking coal unit of Canadian miner Teck Resources, valued at $9 billion. (RET)

Japan's Tsuruha Holdings Inc, a drugstore chain operator, is exploring the possibility of selling the entire company for approximately $4 billion or potentially more. This consideration comes after a proxy battle with activist investor Oasis Management. Tsuruha Holdings is in collaboration with an advisor to facilitate the potential transaction and has reached out to several private equity firms to assess their interest. They are currently seeking non-binding bids for the company. (RET)

ByteDance, the company behind TikTok, is reportedly considering the sale of the gaming studio responsible for popular titles like Mobile Legends, known as Moonton. ByteDance had acquired Moonton in 2021 at an approximate valuation of $4 billion. Now, they are exploring the possibility of selling the gaming studio and are assessing potential interest from buyers. (BBN)

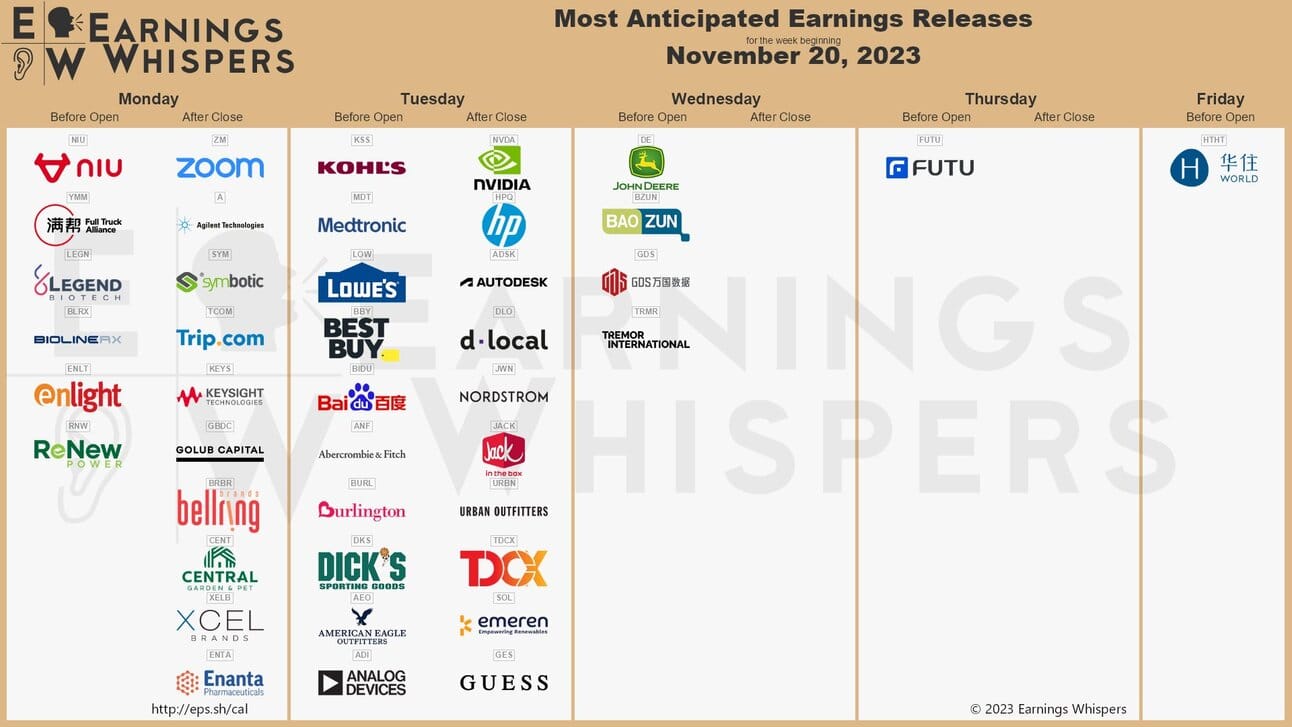

Earnings

Peridot Introduction

Discover the future of alternative asset management with Peridot Co. As a dynamic and innovative firm, we cater to both institutions and individuals, operating across a diverse spectrum of industries, including software, healthcare, energy, and real estate, to present unmatched investment opportunities.

Rooted in our unwavering principles of partnership, innovation, and long-term vision, we harness the power of advanced machine learning technology to inform our decisions, propelling the boundaries of alternative asset management strategies.

Our dedicated team scrupulously identifies and evaluates potential investments, ensuring meticulous risk management and alignment with our strategic goals. At the core of our success lies the bedrock of robust, trust-driven relationships with our partners, fueling the achievements of our investments.

Join us at Peridot Co and witness the evolution of alternative asset management—a journey that generates sustainable value across industries, ultimately leaving a positive imprint on your investment portfolio.

For more information reach out to:

Thanks for reading, see you next week!

Feel free to share with a friend!

Reply