- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

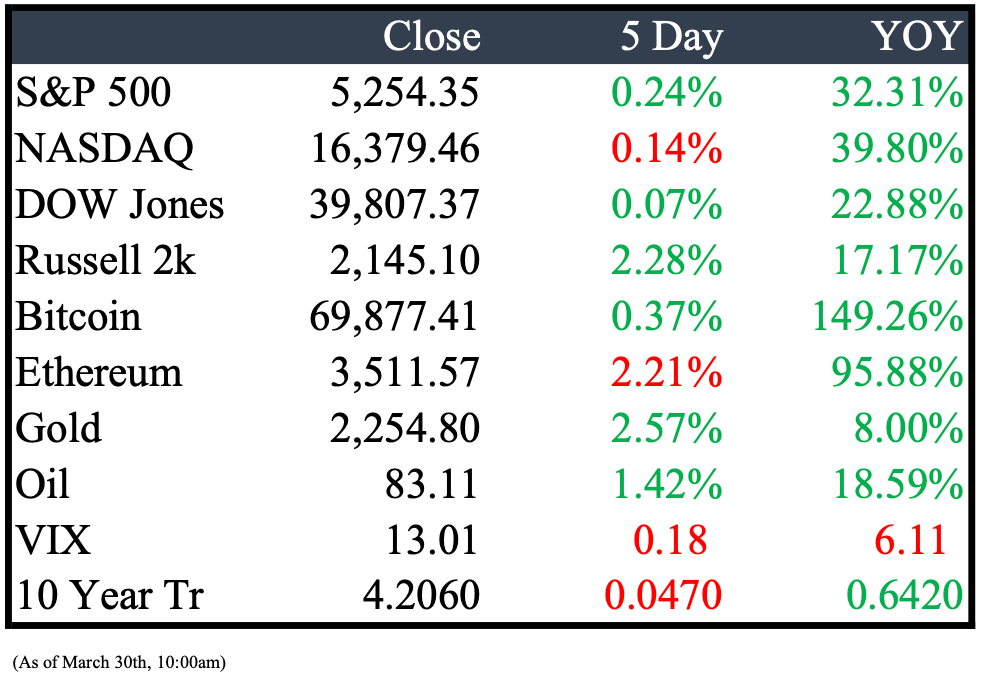

Market Recap

This Week’s Headlines

Economy & World News

The European Union launched its inaugural investigation under the new Digital Markets Act, targeting tech giants Apple, Alphabet, and Meta. The initial probes are centered on Alphabet and Apple, specifically examining their "anti-steering rules." Additional inquiries are scrutinizing Google's potential bias towards its services in search results, issues related to Apple's iOS, and Meta's "pay or consent" model. (CNBC)

U.S. and UK officials accused Beijing of a cyberespionage campaign targeting millions, including lawmakers and defense contractors, through a group called "APT31" linked to China's Ministry of State Security. Targets also included White House staff and critics of Beijing worldwide. (REU)

Zambia has reached an agreement with private creditors to restructure $3 billion of its international bonds, a significant move towards resolving its prolonged debt rework. The deal proposes converting Zambia's three existing bonds into two amortizing bonds, with one offering higher repayments if the country's economic outlook and debt management improve. (REU)

Cocoa prices soared, surpassing $9,000 per ton for the first time due to a supply shortage and high demand from chocolate manufacturers. Futures in New York continued to rise for the fourth consecutive day, fueled by news of funding challenges in Ghana, the world's second-largest cocoa producer. (BBN)

Japan issued a strong warning about potential intervention in currency markets as the yen reached its weakest level in about 34 years against the dollar. After dropping to 151.97 against the dollar, comments from government officials on their readiness to act helped the yen rebound to its strongest level of the day. (BBN)

A Russian fuel tanker bringing 715,000 barrels of crude to Havana will ease tensions in Cuba, facing unrest due to blackouts and food shortages. This is Russia's first oil shipment to the island in a year, amid protests and mass migration. (BBN)

FTX founder Sam Bankman-Fried was sentenced to 25 years in prison for securities fraud conspiracy related to his cryptocurrency exchange and the hedge fund Alameda Research. He was also ordered to pay $11 billion in forfeiture by a Manhattan federal court. Judge Lewis Kaplan expressed concern about the potential future risks posed by Bankman-Fried. (CNBC)

The US and UK are reviewing more than $20 billion in cryptocurrency transactions that passed through a Russia-based virtual exchange, Garantex. These transactions, using the cryptocurrency Tether, are under scrutiny for potential sanctions evasion supporting Vladimir Putin's war in Ukraine. Garantex was sanctioned by the US and UK over suspicions of enabling financial crimes and illicit transactions in Russia. (BBN)

Public Markets

Boeing CEO Dave Calhoun is set to step down at the end of 2024 as part of a significant management shakeup. Additionally, board chairman Larry Kellner will not seek reelection this year, and Stan Deal, CEO of the commercial airplane unit, has been removed from his position effective immediately. This restructuring comes amid heightened scrutiny from regulators and customers over quality control issues within the company. (CNBC)

Florida Governor Ron DeSantis signed a law that bans social media accounts for individuals under 14, even with parental consent. The law requires social media companies to close accounts used by minors under 14 and delete all associated information. (WSJ)

McDonald's and Krispy Kreme are extending their partnership to include all McDonald's U.S. locations by the end of 2026. The collaboration began with a test phase in late 2022, and this expansion will more than double Krispy Kreme's distribution to cover McDonald's restaurants nationwide. (CNBC)

Fisker shares plunged 28% to 9 cents after talks with a major automaker failed, disappointing investors. Later, the NYSE suspended trading in Fisker stock due to its abnormally low price, indicating it no longer met listing requirements. (BAR)

Apple Inc.'s iPhone shipments in China dropped by about 33% in February year-on-year, continuing a decline in its key overseas market. Official data indicated that foreign brands shipped only 2.4 million smartphones last month, with Apple being the primary contributor. This follows a 39% decrease in January, where Apple shipped approximately 5.5 million units. (BBN)

A new agreement between Visa Inc. and Mastercard Inc. and U.S. merchants allows for differential pricing based on the type of credit card used, potentially saving retailers at least $30 billion in swipe fees. This deal ends two decades of negotiations over fees that have become a $100 billion-a-year business for the networks and banks. (BBN)

In the 2024 season, two more NFL games will be exclusively available through a streaming service. The league announced on Tuesday that Peacock will stream the Week 1 game from Sao Paulo, marking the NFL's first contest in South America. The Philadelphia Eagles are confirmed to play in that game, with their opponent yet to be announced. (ESPN)

Blackstone announced a collaboration with Moderna, providing up to $750 million in funding for Moderna's flu program. This partnership aligns with Blackstone's strategy to support leading life science companies in advancing vaccines and medical technologies. (BX)

Amazon is investing an additional $2.75 billion in the artificial intelligence startup Anthropic, adding to its initial $1.25 billion investment. This move is part of Amazon's efforts to gain a competitive edge in the rapidly evolving technology landscape, as cloud providers ramp up spending to lead in what is seen as a new technological revolution. (CNBC)

Disney settled a lawsuit in Florida regarding the takeover of a tourism district including Walt Disney World, prompted by its opposition to the state's "Don't Say Gay" law. (CNBC)

AT&T disclosed a data breach affecting about 7.6 million current account holders and over 65 million former customers. The leaked data, including names and Social Security numbers, appeared on the dark web about two weeks ago but is believed to be from 2019 or earlier. AT&T is investigating the source of the breach. (WSJ)

Real Estate

A New York appeals court has offered former President Donald Trump a lifeline by reducing the bond required in his civil fraud case from nearly half a billion dollars to $175 million. (NYT)

MyMichigan Health, based in Midland, is acquiring three of Ascension Michigan's hospitals in the northern region of the state. The hospitals in Saginaw, Tawas, and Standish will become part of MyMichigan Health under the agreement. (CRAIN)

Plans for a new copper mine in the Upper Peninsula are advancing, with initial approval of a $50 million state grant, two months after being postponed due to a lack of dedicated financing. (CRAIN)

Insurers could face claims up to $3 billion due to the collapse of the Francis Scott Key Bridge in Baltimore, with Lloyd's of London market firms being the most exposed. Barclays Plc analysts estimate that claims for the bridge's damage alone could reach $1.2 billion, with additional liabilities of $350 million to $700 million for wrongful deaths and undetermined amounts for business interruptions caused by the blocked access to the city's port. (BBN)

The University of Michigan is acquiring 7.28 acres of vacant land at the former Kmart Corp. headquarters in Troy for a health care project. The university plans to construct a multi-specialty ambulatory center for clinical and diagnostic services as part of Michigan Medicine on the 40-acre property located at 3100 W. Big Beaver Road. (CRAIN)

Mergers & Acquisitions

Adam Neumann has made an unsolicited offer of over $500 million to buy WeWork out of bankruptcy, according to a source familiar with the situation. The bid could increase to $900 million following due diligence. This move comes weeks after reports surfaced that Neumann was interested in regaining control of the company he was removed from five years ago. (CNBC)

UBS has finalized the sale of Credit Suisse's securitized products business to Apollo Global Management as part of its strategy to divest non-core assets following its acquisition of the troubled bank. Apollo will acquire $8 billion of "senior secured financing facilities," according to UBS, which anticipates a net gain of approximately $300 million from the transaction in the first quarter of 2024. (REU)

Home Depot announced its acquisition of SRS Distribution in an $18.25 billion deal. This marks the company's largest and most significant effort to target sales from home professionals, such as contractors involved in major projects. The acquisition is the largest in Home Depot's history. (CNBC)

U.S. videogame publisher Take-Two Interactive Software has agreed to acquire Gearbox Entertainment from Sweden's Embracer for $460 million in stock. This move adds the popular first-person shooter game "Borderlands" to Take-Two's portfolio, which includes the "Grand Theft Auto" franchise. The deal, announced on Wednesday, comes at a steep discount in a market where consolidation is driving up prices for well-known game makers. (REU)

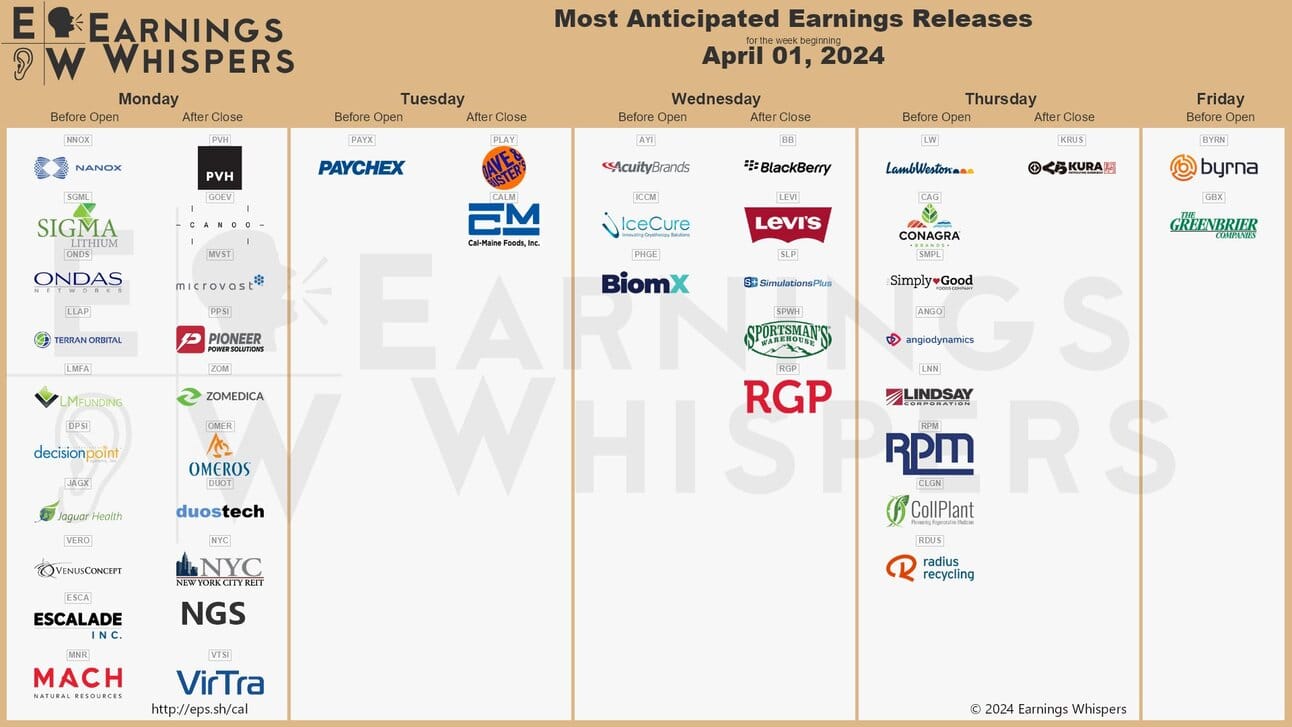

Earnings

Building Value Through Purposeful Investments.

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply