- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

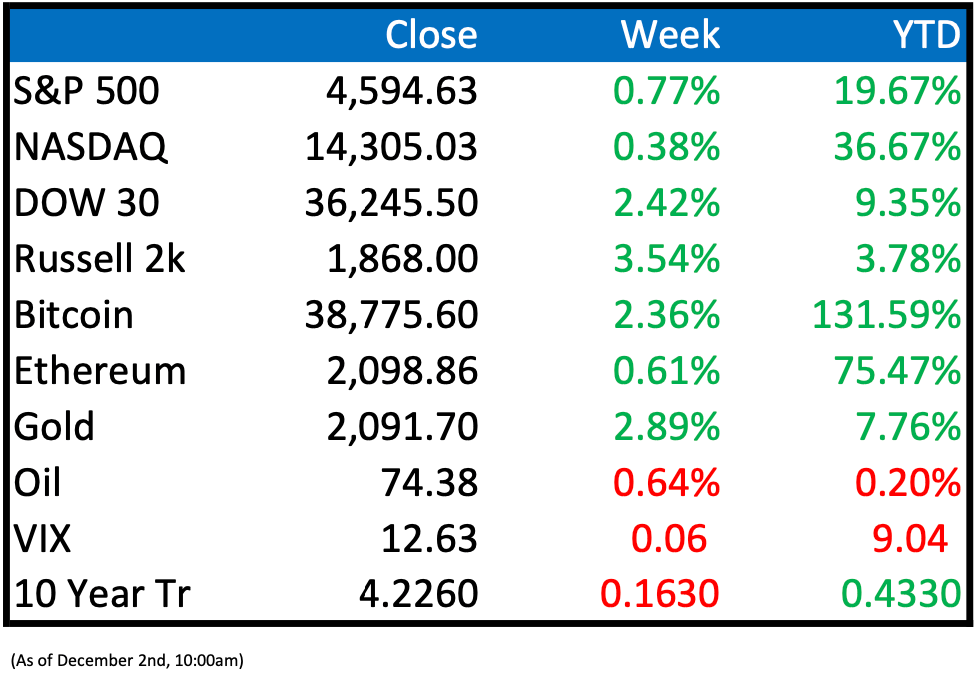

Market Recap

This Week’s Headlines

Public Markets

Charlie Munger, the renowned investing expert and longtime partner of Warren Buffett, has passed away at the age of 99.

Apple Inc. has taken the initial step toward ending its partnership with Goldman Sachs Group Inc. in the realm of credit cards and savings accounts by sending a term sheet to Goldman Sachs. (BBN)

On Tuesday, the competition regulator in Britain expressed concerns regarding Adobe's (ADBE) proposed acquisition of the cloud-based designer platform Figma for $20 billion. The regulator believes that this buyout has the potential to stifle innovation in software commonly used by the majority of digital designers in the UK.

The Competition and Markets Authority (CMA) conducted an extensive investigation into the matter after Adobe declined to provide any concessions to address the regulator's concerns. The findings of the investigation suggest that the deal would lead to a lack of competition and eliminate Figma as a significant competitor to Adobe's flagship products, Photoshop and Illustrator. (RET)

Our Next Energy (ONE), a battery startup based in Novi, Michigan, had a challenging start to the week as it had to make the difficult decision of laying off approximately one-quarter of its workforce. These layoffs were necessary as the company aims to conserve its financial resources while preparing to accelerate the production of its in-house lithium iron phosphate (LFP) cells in 2024. While staff reductions are never welcome, especially during the holiday season, there was also some positive news for ONE this week. The company received promising test results from a BMW iX equipped with a prototype of its innovative Gemini dual chemistry battery, which managed an impressive 608-mile range on a single charge. (FORBES)

Novartis (NOVN.S) has raised its sales growth target to 5% per year until 2027, attributing this increase to the strong demand for innovative drugs following the separation of its generics business. This medium-term sales growth goal, excluding the impact of foreign exchange fluctuations, is primarily bolstered by six key drugs, with Kisqali leading the way, according to a presentation by the Swiss pharmaceutical company on Tuesday. (RET)

General Motors Co. announced on Wednesday that the six-week strike led by the United Auto Workers (UAW) had a financial impact of approximately $1.1 billion on the company. Despite this setback, GM also reinstated its guidance for 2023, projecting earnings of nearly $10 billion. Additionally, the company revealed its intention to repurchase $10 billion worth of shares from stockholders. (CRAIN)

Pfizer announced on Friday that it would discontinue the development of the twice-daily version of its experimental weight loss pill. This decision came after obese patients in a mid-stage clinical study experienced significant weight loss but had difficulty tolerating the drug. During the study, Pfizer observed a high incidence of adverse side effects, primarily of a mild and gastrointestinal nature, among the patients. The drug was intended to provide a more convenient alternative to the widely popular weight loss injections. (CNBC)

Economy

In October, Americans exhibited a slowdown in their spending, and inflation showed signs of cooling as the economy shifted gears from a fast-paced summer. According to the Commerce Department, consumer spending increased by just 0.2% in October, a significant decline from the 0.7% rise observed in September. This October figure represents the slowest increase in spending since May. Economists attribute this deceleration to a combination of factors, including reduced income growth, higher interest rates, rising prices, diminished pandemic-related savings, and the resumption of student-loan payments. These factors are collectively diminishing Americans' capacity to sustain the rapid spending seen during the summer months. (WSJ)

Recurring applications for unemployment benefits in the United States have surged to their highest level in approximately two years, further indicating a slowdown in the labor market. Continuing claims, which serve as a proxy for the number of individuals currently receiving unemployment benefits, increased to 1.93 million during the week ending November 18. This number exceeded the expectations of all economists surveyed by Bloomberg. The steady rise in continuing claims since September suggests that individuals who are unemployed are facing increased challenges in finding new job opportunities. (BBN)

In November, annual inflation in the eurozone showed a decrease, falling to 2.4% from October's 2.9%, according to preliminary figures released on Thursday. Core inflation, a key metric closely monitored by the European Central Bank as it excludes the volatile components of energy, food, alcohol, and tobacco, also came in lower than expected. It dropped to 3.6% from 4.2% in October. (CNBC)

OPEC+ has reached an agreement to implement a substantial additional production cut of one million barrels per day, according to delegates. This decision is expected to maintain elevated oil prices, particularly in light of the ongoing conflict in the Middle East.

As part of this agreement announced on Thursday, Saudi Arabia has also committed to extending its existing production cut of one million barrels per day, which was originally announced in June. (WSJ)

A record number of price-conscious holiday shoppers are anticipated to turn to buy now, pay later services on Cyber Monday to ease the financial strain, as reported by Adobe Analytics. It is projected that shoppers will spend between $12 billion and $12.4 billion online on Monday, with approximately $782 million of those purchases being made through BNPL services such as Klarna and Affirm (AFRM). This represents a significant increase of nearly 19% compared to the previous year, according to data from the analytics company. (RET)

Mergers & Acquisitions

Rover Group, Inc. (ROVR), the global leader in online pet care marketplace services, has revealed that it is set to be acquired by private equity funds under Blackstone management in an all-cash deal valued at around $2.3 billion. According to the agreement, Rover shareholders will receive $11.00 per share in cash, signifying a substantial premium of approximately 61% over the volume-weighted average share price of Rover's Class A common stock during the 90 trading days leading up to November 28, 2023. (BX)

Cigna (CI) and Humana (HUM) merger? These two major health-insurance industry players are currently engaged in discussions about a potential combination that could reshape the landscape of the sector. This is rumored to be an all stock-and-cash deal, and if all goes according to plan, this merger could be finalized by the end of the year. The specific details regarding the structure and terms of the potential deal have not been disclosed. (WSJ)

Castlelake LP, a company with approximately $22 billion in assets under management, is considering various options, including a potential sale. The firm, co-founded in 2005 by co-Chief Executive Officers Rory O'Neill and Evan Carruthers, is exploring the possibility of selling a controlling stake in the company. It's important to note that no definitive decisions have been reached at this stage, and Castlelake may ultimately decide to continue operating independently. (BBN)

Elliott Investment Management, an activist investor, has disclosed a $1 billion stake in Phillips 66 and is actively seeking up to two board seats as part of an effort to enhance the company's performance. This announcement was made in a letter released by Elliott on Wednesday.

Following this news, Phillips 66's stock experienced a more than 4% increase in afternoon trading on Wednesday. The company, primarily engaged in crude refining, boasts a market capitalization of nearly $52 billion. (CNBC)

Earnings

Peridot Introduction

Discover the future of alternative asset management with Peridot Co. As a dynamic and innovative firm, we cater to both institutions and individuals, operating across a diverse spectrum of industries, including software, healthcare, energy, and real estate, to present unmatched investment opportunities.

Rooted in our unwavering principles of partnership, innovation, and long-term vision, we harness the power of advanced machine learning technology to inform our decisions, propelling the boundaries of alternative asset management strategies.

Our dedicated team scrupulously identifies and evaluates potential investments, ensuring meticulous risk management and alignment with our strategic goals. At the core of our success lies the bedrock of robust, trust-driven relationships with our partners, fueling the achievements of our investments.

Join us at Peridot Co and witness the evolution of alternative asset management—a journey that generates sustainable value across industries, ultimately leaving a positive imprint on your investment portfolio.

For more information reach out to:

Thanks for reading, see you next week!

Feel free to share with a friend!

Reply