- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

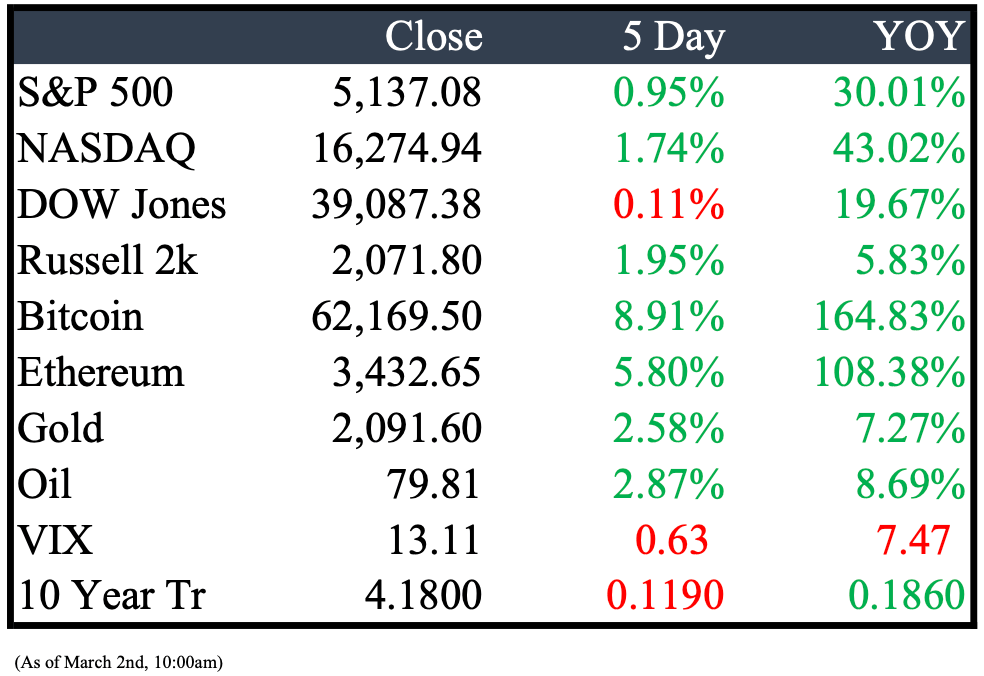

Market Recap

This Week’s Headlines

Economy & World News

Congress has passed temporary funding to avoid a partial U.S. government shutdown, sending the bill to President Joe Biden for his signature. The interim measure will extend funds for some departments through March 8 and others through March 22. This extension allows lawmakers more time to negotiate full-year spending packages for the fiscal year that began on October 1. (BBN)

The core personal consumption expenditures price index, which excludes food and energy, rose 0.4% for the month and 2.8% from a year ago, as expected. The headline PCE, including food and energy, increased 0.3% monthly and 2.4% annually, also in line with expectations. Personal income rose 1%, above the forecast of 0.3%, while spending fell 0.1%, compared to an estimated 0.2% gain. Initial jobless claims totaled 215,000 for the week ended Feb. 24, up 13,000 from the previous period and slightly higher than the estimated 210,000. (CNBC)

Hungary's parliament approved Sweden's NATO accession on Monday, marking a significant milestone for the Nordic country. Sweden, known for its longstanding neutrality through major conflicts including two world wars and the Cold War, has been in the process of shifting its security policy. Hungary's vote comes after months of delays and was preceded by a visit from Swedish Prime Minister Ulf Kristersson, during which an arms deal between the two countries was signed. (REU)

Harvard University is contemplating selling up to $1.65 billion in bonds, following other Ivy League schools in issuing debt this year. The move could offer insights into its financial situation after facing allegations of antisemitism on campus. The university plans to issue $750 million in taxable fixed-rate bonds in the week of March 4 and $900 million in tax-exempt bonds in April, as per a regulatory filing on Monday. (BBN)

Nigeria's central bank, in its first policy meeting since July, announced a significant increase in interest rates to address high inflation and stabilize the country's currency. Governor Olayemi Cardoso and the monetary policy committee raised the benchmark rate by 400 basis points to 22.75%, surpassing the 21.25% median estimate of economists surveyed by Bloomberg. (BBN)

Senator Mitch McConnell of Kentucky, the longest-serving Senate caucus leader in history, will step down as Republican leader in the Senate in November. Despite this, McConnell, 82, plans to keep his seat in the chamber, with his term ending in January 2027. He announced his decision in a Senate address and has had a complicated relationship with former President Donald Trump, who is seeking the GOP nomination this year. (CNBC)

Public Markets

Goldman Sachs Group Inc. has secured a $1 billion commitment from Mubadala Investment Co. to pursue private credit opportunities in Asia. The partnership between the Abu Dhabi sovereign wealth fund and Goldman's asset-management arm will focus on investments in the Asia-Pacific region, with a special emphasis on India. This agreement follows a previous mandate from the Ontario Municipal Employees Retirement System in September, highlighting Goldman's growing focus on private credit deals in the region. (BBN)

Chinese automaker BYD revealed a new electric supercar, the U9, capable of high speeds comparable to top models from industry giants like Ferrari. The U9 will be launched under BYD's luxury brand Yangwang, which debuted last year. BYD is a significant competitor for Tesla as competition in the global electric vehicle market intensifies. (CNBC)

Viking Therapeutics Inc. saw its shares double following promising results from a mid-stage trial of its weight-loss drug, VK2735. The trial suggested that VK2735 could be a strong competitor to weight-loss drugs from Eli Lilly & Co. and Novo Nordisk. Patients in the trial lost up to 14.7% of their body weight after receiving weekly doses of VK2735 for 13 weeks. Viking, based in San Diego, reported these findings in a statement on Tuesday. Following the news, Viking's stock surged by as much as 104%. In contrast, shares of Lilly, the maker of the Zepbound weight-loss injection, fell by 0.5%, while Novo, the maker of Wegovy, dropped by 1.2% in Copenhagen. (BBN)

Microsoft Corp. has entered a strategic partnership with the French startup Mistral AI, which is a competitor to OpenAI in Europe. As part of the deal, Mistral AI's latest artificial intelligence models will be accessible to customers of Microsoft's Azure cloud. Mistral AI develops algorithmic models for chatbots and other AI services, similar to those from OpenAI, but Mistral's models are open-source and shared openly. (BBN)

The US Federal Trade Commission (FTC) and a group of states are reportedly preparing to sue to block the merger between supermarket giants Kroger Co. and Albertsons Cos. The lawsuit could be filed as soon as next week, before the agreement not to close the deal between the companies and the FTC expires on Feb. 28. Several states are expected to join the suit alongside the federal antitrust enforcers. (BBN)

Google DeepMind CEO Demis Hassabis announced that Google plans to relaunch its image-generation AI tool in the next "few weeks." The tool was taken offline on Thursday following a series of controversies. The image-generation capability was originally introduced earlier in the month through Gemini, Google's main suite of AI models. (CNBC)

Fast-fashion company Shein is reportedly considering switching its initial public offering (IPO) from New York to London due to obstacles faced in the US listing process, according to sources familiar with the matter. Shein, originally founded in China but now based in Singapore, is in the preliminary stages of exploring the London option, as it believes it is unlikely that the US Securities and Exchange Commission (SEC) will approve its IPO. The sources requested anonymity as they are not authorized to discuss confidential information. (BBN)

Macy's Inc. plans to close nearly a third of its U.S. stores as it resists activist firms seeking to buy the company. The closures, with no estimate of affected employees, will incur a $50 million charge for termination costs. The company also aims to boost its higher-end brands by adding new Bloomingdale's and Bluemercury locations by 2026. (BBN)

Klarna Bank AB, once Europe's most valuable startup, is moving forward with plans for a potential US listing, aiming for one of the largest IPOs this year. The Swedish fintech company is in discussions with investment banks and considering a valuation of around $20 billion for the IPO, which could happen as early as the third quarter. (BBN)

Apple Inc. is reportedly canceling its decade-long effort to build an electric car, abandoning one of its most ambitious projects. The decision was disclosed internally on Tuesday, surprising nearly 2,000 employees working on the project. Chief Operating Officer Jeff Williams and Kevin Lynch, a vice president overseeing the effort, shared the decision with employees. (BBN)

Alphabet's Google is facing a 2.1-billion-euro ($2.3 billion) lawsuit from 32 media groups, including Axel Springer and Schibsted, alleging losses due to the company's digital advertising practices. The lawsuit caused Google's shares to fall more than 2%. The group of publishers from several European countries is taking legal action as antitrust regulators increase scrutiny on Google's ad tech business. (REU)

UnitedHealth Group confirmed that the cyberattack on its tech unit, Change Healthcare, was conducted by hackers from the "Blackcat" ransomware group. The attack, initially attributed to a suspected nation-state threat actor, has disrupted electronic pharmacy refills and insurance transactions across the U.S. healthcare system. (REU)

Alessandro DiNello, formerly CEO of Flagstar Bancorp Inc., has been named CEO of New York Community Bancorp, which acquired Flagstar in late 2022. DiNello takes over amid a crisis at New York Community Bancorp, triggered by the bank's stockpiling of cash to cover potential loan problems and the announcement of "material weaknesses" in loan risk tracking. The bank also reported a $2.4 billion goodwill impairment and replaced Thomas Cangemi as CEO with DiNello. (BBN)

The two largest pharmacy chains in the United States, CVS and Walgreens, will begin dispensing the abortion pill mifepristone this month, potentially improving access for some patients. Both chains have received certification to dispense mifepristone under FDA guidelines issued last year. Initially, the medication will be available in stores in a few states, and it will not be provided by mail. (NYT)

Real Estate

Former Detroit Pistons player Vinnie Johnson's company, Piston Automotive, may play a role in the redevelopment of the former Palace of Auburn Hills site. General Motors Co. has reportedly tapped Piston Automotive to operate a vehicle parts factory at the site, involving a $278 million investment and about 960 jobs. (CRAIN)

Detroit-based developer Broder Sachse Real Estate has acquired a significant site in Royal Oak for future retail development. The 5.63-acre property, located at 3200 W. 14 Mile Road, west of Coolidge Highway, was formerly owned by MacLean-Fogg Components Solutions. Broder Sachse Real Estate plans to demolish existing buildings on the site and construct new shopping space, although the purchase price has not been disclosed. (CRAIN)

A city-led initiative to develop an 80-acre site at Coleman A. Young International Airport in Detroit's east side has received a significant boost in funding. The Michigan Strategic Fund has approved an additional $12.45 million in Strategic Site Readiness Program funding for the Detroit Brownfield Redevelopment Authority. This funding will support the removal of the Crosswinds Runway at the airport. According to an MSF board briefing memo, the property is described as "one of the last remaining publicly owned large scale industrial sites" in Detroit. (CRAIN)

Mergers & Acquisitions

Ant Group has reportedly outbid Citadel Securities for Credit Suisse's investment bank venture in China. However, it's uncertain if Ant Group's offer will be successful. The bid, part of Alibaba Group's efforts to establish a securities business in China, is expected to undergo a thorough review due to Beijing's preference for a foreign buyer. (REU)

Broadcom is selling its end-user computing (EUC) unit, which enables users to access desktops and applications from any device, to private-equity firm KKR in a $4-billion deal. This move is part of Broadcom's strategy to streamline its portfolio following its $69-billion purchase of VMware last year. The EUC unit will operate as a standalone company under the leadership of its current management team, headed by Shankar Iyer, according to KKR's statement on Monday. (REU)

Exxon Mobil Corp. and Cnooc Ltd. are considering acquiring Hess Corp.’s stake in a Guyana oil development, potentially disrupting Chevron Corp.'s deal. Despite Chevron's confidence, Exxon is exploring its right of first refusal. Hess shares fell 3.3% to $144.96 in late New York trading. (BBN)

Boeing is in discussions to acquire Spirit AeroSystems, the troubled jet-fuselage supplier it spun off two decades ago, which has been involved in quality issues affecting 737 MAX jets. Spirit has hired bankers to explore strategic options and has had preliminary discussions with Boeing, its former owner. However, it is unclear if the talks will lead to a deal. (WSJ)

Earnings

Building Value Through Purposeful Investments.

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply