- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

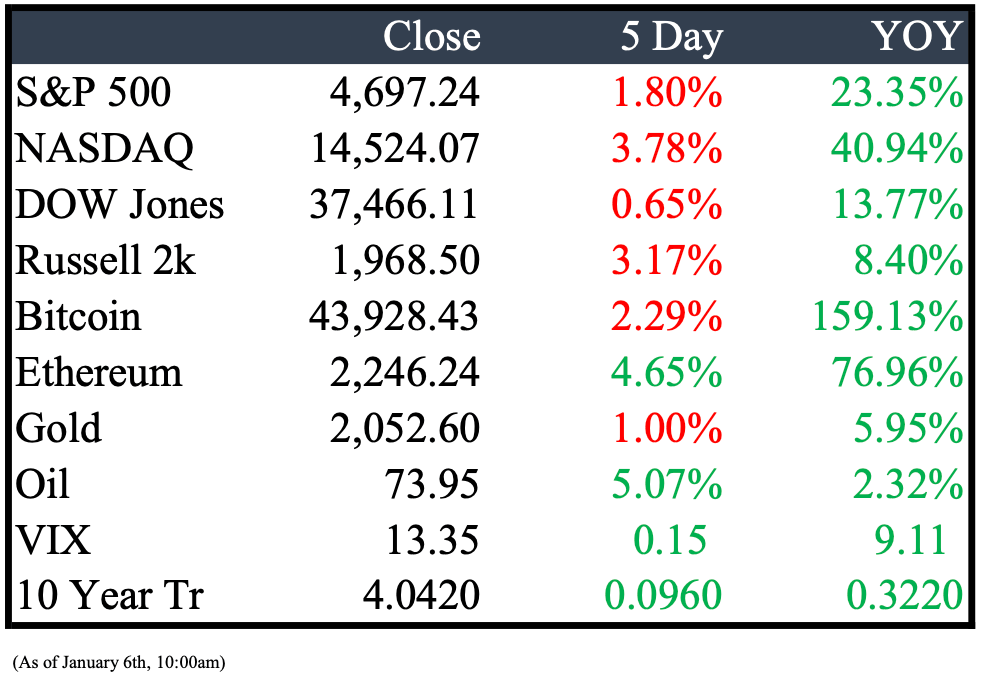

Market Recap

This Week’s Headlines

Economy & World News

As of Saturday, the death toll from the New Year's Day earthquake in Japan has risen to 110, with rescue efforts continuing into their sixth day. The 7.6 magnitude quake hit the west coast of Japan, causing significant destruction, including the collapse of buildings and damage to infrastructure. It also disrupted power supplies to 22,000 homes in the Hokuriku region. Rescue operations have been challenged by rain, complicating the search for survivors in the debris. Meanwhile, over 30,000 evacuees are in need of aid as they await assistance. (REU)

All 379 passengers and crew on a Japan Airlines aircraft safely evacuated after the plane collided with a Coast Guard aircraft at Tokyo's Haneda airport. The collision resulted in a fire on the larger aircraft and the tragic loss of five of the six crew members on the Coast Guard plane. The incident occurred on Tuesday. (REU)

Iran has deployed a warship to the Red Sea following the US Navy's destruction of three Houthi boats. This development heightens tensions and adds complexity to the United States' objective of securing a critical maritime route essential for global trade. The situation in the Red Sea has become increasingly volatile, prompting Maersk to suspend transit through the area in response to the recent US-Houthi conflict. (BBN)

Claudine Gay has announced her resignation from the position of president of Harvard University. Her tenure, which was brief and marked by controversy, faced issues including allegations of plagiarism and a campus dispute regarding antisemitism. In her statement, Gay mentioned that following discussions with members of the Corporation, she concluded that her resignation would be in the best interests of Harvard. This decision aims to allow the university community to concentrate on addressing the current significant challenges, focusing on the institution rather than on any individual. (BBN)

In November, the demand for workers in the U.S. dropped to its lowest point in over two and a half years, as indicated by the Labor Department's Wednesday report. The Job Openings and Labor Turnover Survey revealed a slight decrease in employment listings to 8.79 million, closely matching Dow Jones' estimate of 8.8 million and marking the lowest level since March 2021. The report also showed a decline of 62,000 in job openings, but the vacancy rate as a proportion of employment remained steady at 5.3%. Additionally, there was a decrease in both hirings and layoffs. (CNBC)

The FDA has approved Florida's request to import medications from Canada, offering them at much lower prices than in the U.S. This decision, overcoming long-standing pharmaceutical industry opposition, marks a significant policy shift and could aid efforts to reduce drug prices. This approval particularly enables Florida to purchase drugs in bulk for Medicaid, government clinics, and prisons. (NYT)

The Biden administration conducted its first known targeted drone strike against an Iranian-backed militia leader in Baghdad, killing Moshtaq Talib Al-Saadi and an associate. This marks a shift in U.S. strategy in Iraq, moving from a focus on minimizing escalation with Iran to taking more direct action against ongoing threats to U.S. forces. (WSJ)

Public Markets

The Federal Aviation Administration announced on Saturday that it will temporarily ground certain Boeing 737 Max 9 airplanes operated by U.S. airlines. This decision follows an incident where part of a wall seemingly detached from an Alaska Airlines flight while in the air. FAA Administrator Mike Whitaker stated, "Immediate inspections of specific Boeing 737 Max 9 planes are required before they can resume flying. Our focus on safety will guide our actions as we support the NTSB's investigation into Alaska Airlines Flight 1282." (CNBC)

Maersk, the Danish shipping conglomerate, has announced an indefinite suspension of its shipping operations through the Red Sea following an attack on one of its vessels by Houthi militants over the weekend. This decision extends a temporary 48-hour halt that was initially put in place immediately after the attack. The recurring assaults by Houthi militants on ships traversing the Red Sea have sparked concerns about potential disruptions to global trade, as this region is a crucial maritime route. In response to these heightened security risks, Maersk has decided to pause all shipping activities in both the Red Sea and the Gulf of Aden until further notice. (CNBC)

In 2023, BYD outproduced Tesla for the second year, manufacturing over 3 million new energy vehicles compared to Tesla's 1.84 million. While BYD offers a mix of lower-priced hybrids and battery-only cars, contributing to its higher total production, Tesla still leads in the specific category of battery-only vehicle production with BYD producing 1.6 million of such cars. (CNBC)

Eli Lilly is innovating in the pharmaceutical industry by launching a website for telehealth prescriptions and direct home delivery of certain drugs, like weight loss medications. This initiative, part of a direct-to-consumer approach, may not drastically alter the traditional drug supply chain, according to some analysts. However, it could inspire other drugmakers to adopt similar models, potentially simplifying the complex pharmaceutical industry. (CNBC)

Google is implementing significant changes in online user tracking by restricting cookie usage, a move that will heavily impact the $600 billion online-ad industry. Starting with a limited test on Chrome, their most popular browser, Google plans to phase out cookies for all Chrome users by year's end. This has left advertisers, marketers, and web publishers scrambling to adapt, with concerns that Google hasn't provided enough preparation for this major transition. (WSJ)

Perplexity, an AI-driven startup aiming to challenge Google's web search dominance, has received a notable $74 million investment from Jeff Bezos and venture capitalists. Despite being less than two years old and having fewer than 40 employees, Perplexity's "answer engine" already attracts about 10 million monthly users. This investment, one of the largest for a search startup in recent years, values Perplexity at $520 million, including the new funding, as confirmed by CEO Aravind Srinivas. (WSJ)

Exxon Mobil is expecting impairments of up to $2.6 billion in the fourth quarter for its upstream business, primarily due to idled assets in California. In a regulatory filing, the company projected impairments in the range of $2.4 billion to $2.6 billion, mainly related to the idling of its Upstream Santa Ynez Unit assets and associated facilities. (WSJ)

Last week, U.S. crude oil inventories dropped more than anticipated, falling by 5.5 million barrels to 431.1 million, which is about 2% below the five-year average for this period. In contrast, gasoline and distillate fuel stocks increased, indicating lower demand for these products. The decrease in crude oil stocks exceeded analysts' expectations of a 2.7 million barrel drop. Additionally, the Strategic Petroleum Reserve saw an increase of 1.1 million barrels, reaching 354.4 million barrels. (WSJ)

CVS Health announced on Friday that Shawn Guertin, its Chief Financial Officer and President of Health Services, will not be returning to the company. Guertin has been on a leave of absence since October due to family health reasons. He is set to leave the Woonsocket, Rhode Island-based healthcare-services giant at the end of May, following his resignation from his executive positions. (WSJ)

Real Estate

Fort Partners and Merrimac Ventures, two notable real estate developers from Florida, are venturing into the Rocky Mountains with an ambitious project. They are investing nearly $1 billion in the development of a new Four Seasons hotel and residential property in Telluride, Colorado. This project, located at the base of the mountain near where the ski gondolas start their climb, marks a significant shift from their previous focus on Florida's bustling beachfronts. Fort Partners is particularly known for their successful launch of four Four Seasons hotels in Florida, including the renowned Surf Club. (WSJ)

The SEC has frozen the assets of Florida real estate broker Rishi Kapoor and 22 entities, including Location Ventures LLC and Urbin LLC, for their involvement in a $93 million fraud scheme. From January 2018 to March 2023, they allegedly made false representations about Kapoor's background, contributions, and the companies' governance and use of funds. Kapoor is accused of misappropriating at least $4.3 million and improperly mingling $60 million of investor capital, as well as charging excessive fees and misrepresenting investor returns. (TRD)

Mergers & Acquisitions

Danone, a prominent French food group, announced on Tuesday that it has entered into an agreement to sell its high-end organic dairy divisions in the United States, including Horizon Organic and Wallaby, to Platinum Equity, an investment firm. This sale is a strategic move as part of Danone's portfolio review and asset rotation program, which was initially unveiled in March 2022. While the company has made this significant decision public, it has not disclosed the financial specifics of the transaction. (REU)

Southwestern Energy and Chesapeake Energy are on the verge of merging into a company worth about $17 billion, which would make it one of the largest natural gas producers in the U.S. The deal, potentially finalizing next week, has already influenced the market: Southwestern's market cap is around $7 billion, Chesapeake's over $10 billion, with their stocks rising 7.34% and 2.91% respectively after the news. (WSJ)

APA, an energy company, has agreed to acquire Callon Petroleum in a stock-swap transaction valued at about $4.5 billion, including debt. This deal is part of the ongoing consolidation trend in the energy sector. Under the terms of the agreement, APA will issue 1.0425 of its shares, valued at $38.31 based on its closing price on Wednesday, for each share of Callon. This offer represents a nearly 14% premium over Callon’s closing price. (WSJ)

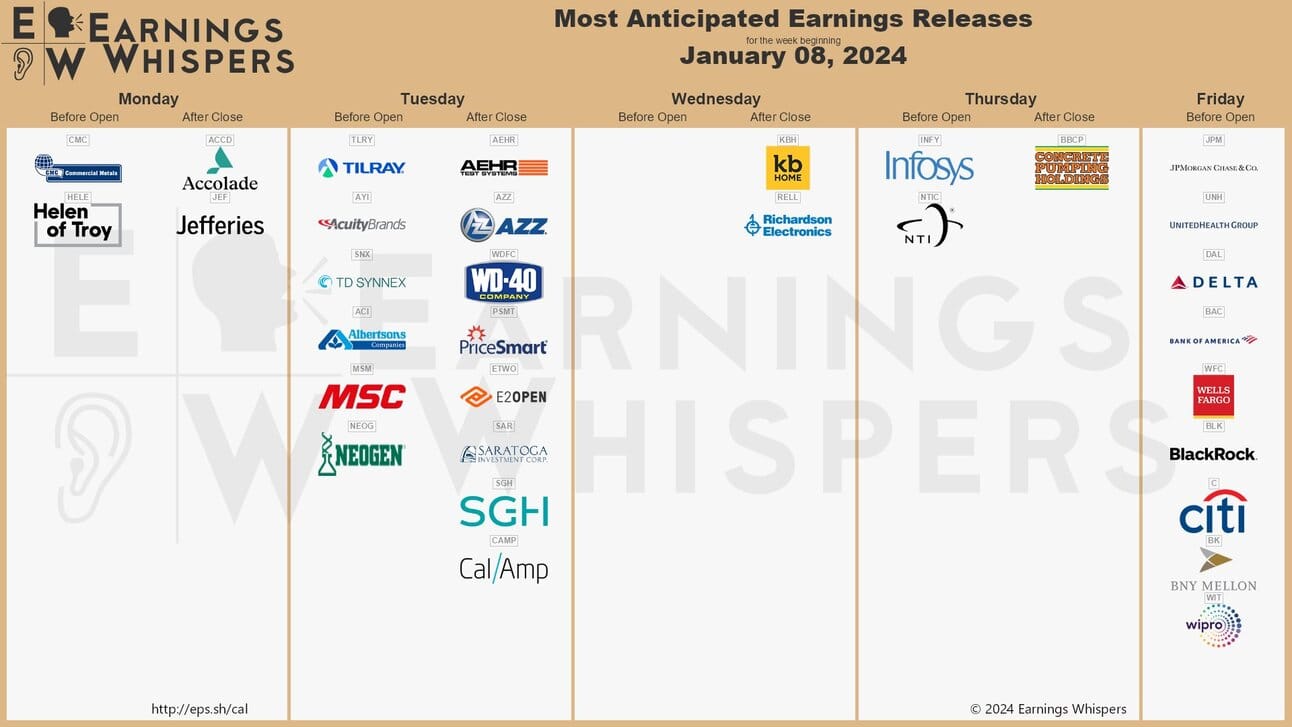

Earnings

Peridot Hedge

Dear Valued Subscriber,

I am thrilled to share some exciting news with our newsletter community! On January 1st, 2024, we are launching T.H.E. Fund by Peridot, a groundbreaking hedge fund with a focus on Technology, Healthcare, and Energy investments.

Under the expert leadership of Peridot's founder, William Lemanske Jr, T.H.E. Fund offers a unique investment approach. By concentrating on these three dynamic sectors, we aim to maximize returns while steering clear of fixed income assets and adhering strictly to our core principles.

Having personally integrated this investment structure into my own portfolio over the last four years, I have witnessed its potential first-hand. Especially in a market where the S&P 500's performance is significantly influenced by just a handful of companies, T.H.E. Fund presents a smart diversification strategy. Our approach involves sector weighting based on market conditions and market capitalization, employing a long strategy in equities, and capitalizing on short-term returns through options and futures during periods of volatility.

As subscribers to our newsletter, you have the exclusive opportunity to be among the first to explore potential investment opportunities with T.H.E. Fund. We are beginning to accept investments at the start of the year, and I would be delighted to engage in a more in-depth discussion with you about this.

I believe T.H.E. Fund could be a significant addition to your investment portfolio. If you are interested in learning more about our diverse investment classes and wish to discuss further, please feel free to reach out to me via email.

Now enjoy your Read Sunday,

Founder & CEO, Peridot

William Lemanske

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply