- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

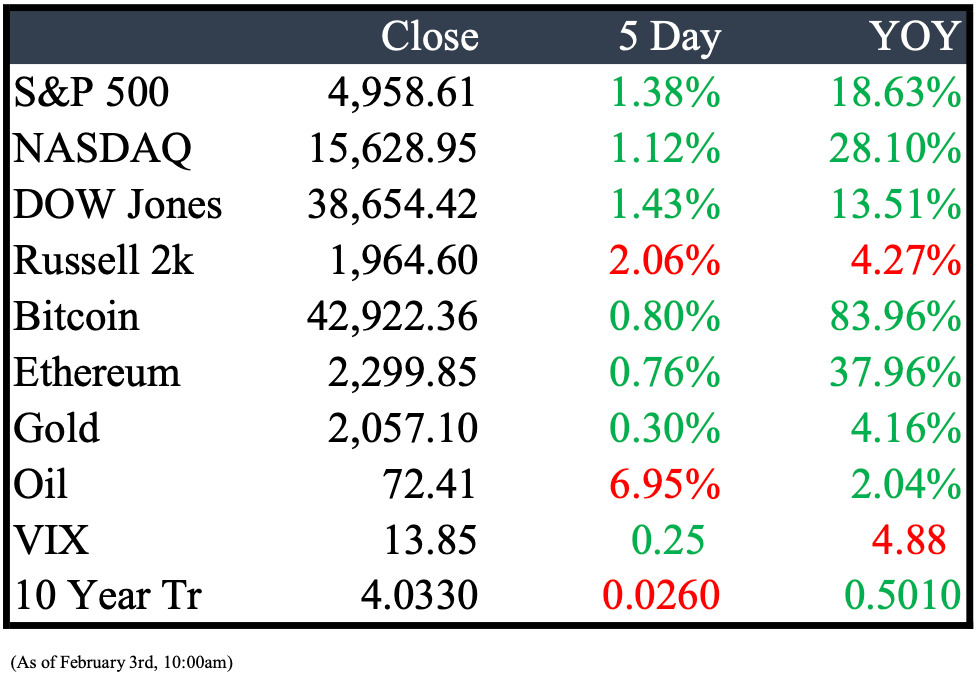

Market Recap

This Week’s Headlines

Economy & World News

In Shijiazhuang, a Chinese city, a "Happy Every Day" fence hides an unfinished apartment complex, a stark reminder of China Evergrande Group's default in 2021. The project is now seeking a new developer. (REU)

The Federal Reserve discussed the possibility of reducing interest rates at its first policy meeting of the year but suggested that an immediate rate cut is not on the horizon. They decided to maintain the benchmark federal-funds rate within the range of 5.25% to 5.5%, which is the highest it has been in over two decades. This decision reflects the central bank's cautious stance as it waits for more substantial evidence that the recent decline in inflation towards the end of last year is a lasting trend. (WSJ)

The Biden administration may reimpose sanctions on Venezuela's energy sector if they prevent an opposition candidate from running in the presidential election. This could affect recent efforts to improve relations. The US will let a six-month sanctions suspension expire in April if María Corina Machado, the opposition candidate, is blocked. Further actions are being considered, depending on Venezuela's actions before April, as stated by National Security Council spokesperson John Kirby. (BBN)

In December, US job openings unexpectedly reached 9 million, the highest level in three months, as reported by the Bureau of Labor Statistics. This exceeded all economist estimates in a Bloomberg survey. However, fewer Americans quit their jobs during this period, indicating increased caution among workers despite strong labor demand. (BBN)

In January, nonfarm payrolls increased by 353,000, surpassing the estimated 185,000. The unemployment rate held steady at 3.7%, against the expected 3.8%. Average hourly earnings rose by 0.6%, twice the estimated amount, and year-over-year wages surged by 4.5%, exceeding the forecasted 4.1%. Job growth was widespread, with professional and business services adding 74,000 jobs, and significant contributions from health care (70,000) and retail trade (45,000). (CNBC)

Mainland Chinese stocks hit a five-year low, while Australian stocks reached all-time highs on Wednesday. Australia reported a lower-than-expected fourth-quarter inflation rate. In contrast, China's CSI 300 index dropped to a five-year low, and Hong Kong's Hang Seng index also saw a decline. This was driven by China's manufacturing activity contracting for the fourth consecutive month in January. (CNBC)

The Federal Reserve, during its first policy meeting of the year, suggested that it was considering a potential interest rate cut in the future but did not indicate an immediate reduction. The central bank decided to maintain its benchmark federal-funds rate within a range of 5.25% to 5.5%, which is the highest level it has been in over two decades. This decision is based on the need for more compelling evidence that the recent decline in inflation towards the end of the previous year will persist. (NYT)

Britain's central bank is likely to maintain interest rates at their highest level in almost 16 years on Thursday. However, the possibility of inflation returning to the Bank of England's 2% target may lead investors to seek indications of potential future rate cuts. (REU)

In a positive development for American workers, the United States generated an unexpectedly large number of jobs last month, demonstrating the continued strength of the labor market after three years of growth. According to the Labor Department's report on Friday, employers added 353,000 jobs in January on a seasonally adjusted basis, while the unemployment rate held steady at 3.7 percent. (NYT)

Public Markets

Volkswagen is postponing plans to seek outside investors for its battery unit, citing sluggish electric vehicle demand and doubts about its own battery production capabilities. The company has also pushed back discussions with investors and is no longer prioritizing stake sales or a potential listing of its PowerCo business in the near term, according to unnamed sources. This reflects the challenges the automotive industry faces in the electric vehicle transition. (BBN)

General Motors saw a 12% increase in net income last year, even though it faced over $1 billion in losses due to a six-week autoworkers' strike. The company expects a slight improvement this year, despite planning for lower vehicle prices with increased discounts. CEO Mary Barra mentioned a shift in strategy, with General Motors reintroducing some plug-in gas-electric hybrid models in the U.S. This news boosted General Motors Co.'s shares, causing an 8.2% increase in early Tuesday trading. (GM)

UPS reported revenue figures that didn't meet Wall Street's expectations, with declines in both international and domestic shipping volume. As part of their resource alignment efforts for 2024, the company also disclosed plans for 12,000 layoffs. UPS's 2024 revenue outlook anticipates a range between $92 billion and $94.5 billion. (CNBC)

Activist investor Nelson Peltz, through Trian Fund Management LP, believes that Walt Disney Co. can make its streaming service profitable by bundling ESPN+ with a major player in the sports industry, potentially like Netflix Inc. Peltz's investment firm is planning to release a "white paper" outlining its investment thesis and recommendations for Disney shortly after the company's next earnings report on February 7, according to anonymous sources familiar with the matter. (BBN)

Short seller Fahmi Quadir has set her sights on Adtalem Global Education, a company with a $2 billion market capitalization. Adtalem is the successor to DeVry University, a for-profit education company that went public in 1991. In a recently obtained report, Quadir's firm describes Adtalem as "a toxic byproduct of an imperfect higher education system." (CNBC)

PayPal Holdings Inc. is reducing its workforce by around 9% as CEO Alex Chriss responds to heightened competition, profit pressures, and analyst downgrades. In a letter to employees, Chriss stated the need to "right-size" the company through both direct job cuts and eliminating open positions throughout the year. Approximately 2,500 workers will be affected by this move. (BBN)

Novo Nordisk A/S has become the second European company ever to surpass a market value of $500 billion. This achievement is driven by a positive outlook for its highly successful obesity drug. Novo Nordisk reached this milestone on Wednesday, joining the exclusive club alongside LVMH, the owner of Dior, as its shares continued to rise. (BBN)

Biogen is giving up ownership of Aduhelm, an Alzheimer's drug that faced controversy for its approval based on weak evidence. The company will also halt a clinical trial ordered by the FDA to confirm the drug's effectiveness in slowing Alzheimer's progression. Despite its initial high price and potential, Aduhelm failed to perform well in the market, prompting this decision by Biogen. (NYT)

Detroit Chassis LLC has made a round of layoffs at its manufacturing plant after customer Ford Motor Co. told the supplier its projection for commercial chassis orders declined 30% this year.

The Detroit-based company, which supplies chassis for Ford motorhomes and package delivery trucks, cut 64 employees indefinitely last Friday, according to a Worker Adjustment and Retraining Notification letter submitted to the state. (CRAIN)

Meta has declared that it will initiate its inaugural dividend payments. The company's recent earnings significantly exceeded expectations. Additionally, Mark Zuckerberg's social media conglomerate unveiled a $50 billion stock buyback plan. (BI)

Real Estate

Miami's Building Department has granted a phased vertical construction permit for the Baccarat Residences tower in Brickell, with John Moriarty as the contractor. The tower, planned to be 75 stories tall, making it the tallest condo tower in Miami, has already started construction. Another 44-story tower on the same property, with 506 apartments, is also under construction and has reached over 10 floors above ground. (TNM)

The United States may see its tallest building in an unexpected location, far from New York City. Real estate developer Matteson Capital have proposed the Boardwalk at Bricktown complex in downtown Oklahoma City. If approved, this skyscraper would stand at a height of 1,907 feet, making it the sixth tallest building in the world. (ABC)

The developer aiming to construct a convention-style hotel near Huntington Place in downtown Detroit is requesting a tax incentive package exceeding $90 million for the project. The proposed 600-room Hotel at Water Square, situated on the former Joe Louis Arena site, would receive public support in the form of $82.1 million in net Renaissance Zone benefits spanning 30 years and a Public Act 210 Commercial Rehabilitation Act tax break valued at $11.6 million over 10 years, totaling $93.7 million. (CRAIN)

Mergers & Acquisitions

Amazon and iRobot have mutually agreed to abandon their planned $1.7 billion acquisition due to insurmountable regulatory hurdles. The cancellation has led to a sharp decline in iRobot's stock price. In response, iRobot is set to lay off around 350 employees, and its founder and CEO, Colin Angle, will step down. The deal faced numerous regulatory examinations, which not only reduced the purchase price but ultimately resulted in its termination. (CNBC)

The PGA Tour has approved an investment of up to $3 billion by Strategic Sports Group (SSG) in a new commercial entity. SSG, led by Fenway Sports Group, will initially invest $1.5 billion, with the possibility of an additional $1.5 billion from its investor consortium. Discussions with Saudi Arabia's sovereign wealth fund are still ongoing. (BBN)

Media entrepreneur Byron Allen, making his second attempt in less than a year, is expressing interest in acquiring Paramount Global, home to CBS and the Paramount Hollywood studio. Allen Media Group has put forth a $14.3 billion offer to purchase Paramount Global. This offer follows a previous bid made in April, where Allen offered approximately $18.5 billion for the company. (WSJ)

Activist investor Elliott Management has made a "sizable" investment in e-commerce company Etsy. They have acquired a stake of approximately 13% in the company, according to a source familiar with the matter. Following this news, Etsy's shares surged by over 10%. (CNBC)

Earnings

Dear Valued Subscriber,

I'm delighted to share some exciting news with our newsletter community! Introducing T.H.E. Fund by Peridot Hedge—an innovative hedge fund actively managed by William Lemanske Jr and his dedicated team. Specializing in Technology, Healthcare, and Energy investments, T.H.E. Fund offers a distinctive approach to maximizing returns while avoiding fixed income assets, staying true to our core principles.

Under the skilled leadership of Peridot's founder, William, T.H.E. Fund has proven to be a valuable addition to investment portfolios. Over the past four years, I have personally integrated this unique investment structure into my own portfolio, witnessing its potential firsthand. In an ever-changing market where the S&P 500's performance is heavily influenced by a select few companies, T.H.E. Fund provides a strategic diversification solution.

Consider T.H.E. Fund as a great addition to your investment portfolio. If you are intrigued and would like to delve into the details of our diverse investment classes, please don't hesitate to reach out to me via email at [email protected] or give us a call at 313-670-2479. I look forward to discussing if Peridot Hedge can align with your investment goals and preferences.

Now enjoy your Sunday,

Founder & CEO, Peridot Corp

William Lemanske Jr.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply