- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

“Building Value Through Purposeful Investments.”

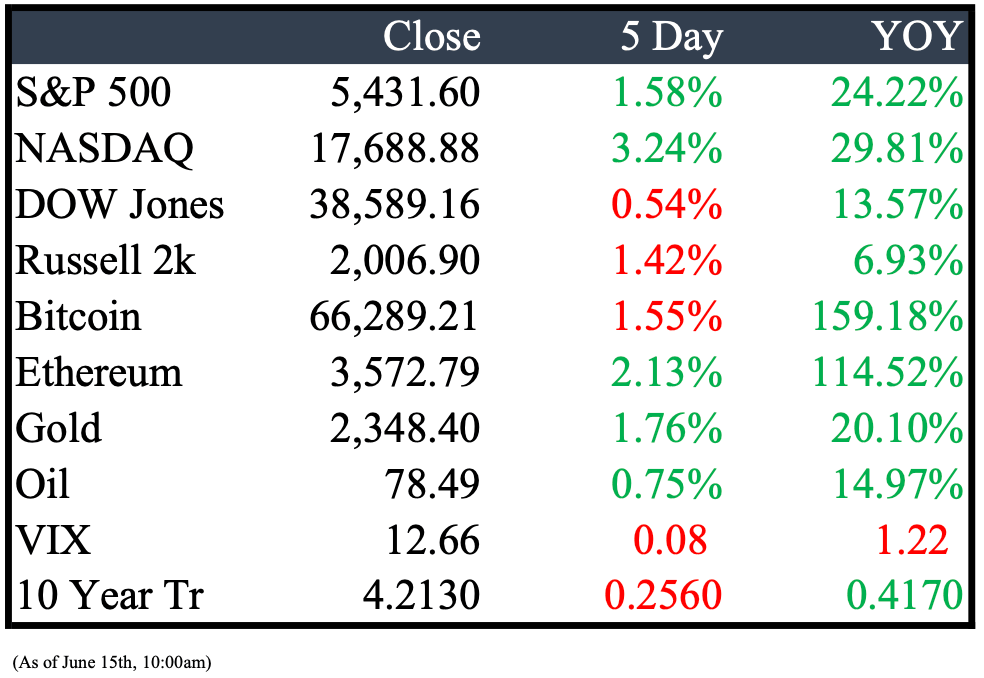

Market Recap

This Week’s Headlines

Economy & World News

United Auto Workers President Shawn Fain is being investigated by federal court-appointed monitor Neil Barofsky for potentially abusing his power in violation of a 2020 consent decree between the UAW and the U.S. Department of Justice, according to a recent court filing. This investigation comes amidst the union's ongoing national effort to organize nonunion automakers. (CNBC)

Hunter Biden was found guilty on all three criminal charges at his gun trial in Delaware, related to the purchase and possession of a handgun while being an acknowledged user and addict of illegal drugs. This verdict arrives shortly after Joe Biden’s opponent for the 2024 presidential race, Donald Trump, was convicted in a separate criminal case involving hush money in New York. (CNBC)

A federal jury in Florida found Chiquita Brands liable for the killings of eight men in Colombia, perpetrated between 1997 and 2004 by the right-wing paramilitary group AUC (Autodefensas Unidas de Colombia), to which Chiquita had given millions of dollars. This decision came even though the U.S. government had designated the AUC as a foreign terrorist organization. The families of the victims were awarded a total of approximately $38.3 million in damages. (NPR)

Tommy’s Boats LLC, a major boat dealer headquartered in downtown Grand Rapids, has been facing a turbulent financial period, now culminating in a bankruptcy filing amid ongoing legal battles. The company's troubles intensified over the past two months, involving three lawsuits with a supplier and two banks, with allegations of fraud and hundreds of millions at stake. On May 20, seeking to mitigate financial damages, Tommy’s Boats filed for Chapter 11 bankruptcy protection in the Northern District of Texas, aiming to find a buyer and repay creditors optimally. The company’s president, Matthew Borisch, attributes the dire situation to a primary supplier's alleged scheme to oversupply inventory, effectively forcing the bankruptcy filing. Additionally, the business is grappling with lawsuits from its two largest creditors, further complicating its financial recovery. (CRAIN)

Greece intends to make an early repayment of €8 billion ($8.6 billion) in bailout loans, signaling a significant recovery from its financial crisis, according to Prime Minister Kyriakos Mitsotakis. This advance payment, covering three years of installments, marks the third occasion Greece has accelerated the repayment of loans from its initial 2010 bailout program. This step represents the most substantial reduction in the Greek Loan Facility to date. (BBN)

The European Union announced on Wednesday that it will impose increased tariffs on Chinese electric vehicles. According to the EU's statement, a 38.1% tariff will be levied on battery-electric vehicle producers from China who did not cooperate with its investigation. Meanwhile, Chinese carmakers who complied with the investigation but were not "sampled" will face a lower tariff of 21%. (CNBC)

Federal Reserve officials have forecasted only one interest-rate cut for this year, suggesting a cautious approach to reducing rates despite recent data indicating an improvement in inflation last month. The central bank also maintained its benchmark interest rate steady at a range between 5.25% and 5.5%, a decision that aligned with market expectations. (WSJ)

India's retail inflation rate decreased marginally in May, with a reduction in fuel prices contributing to the slight easing, although food prices continued to stay high. According to government data released on Wednesday, the annual retail inflation for May was 4.75%, a slight drop from 4.83% in April and below the 4.89% predicted by 50 economists surveyed by Reuters. (REU)

Michigan's largest health insurer, Blue Cross Blue Shield, will stop covering GLP-1 obesity drugs from Novo Nordisk A/S and Eli Lilly & Co. in its fully insured large group commercial plans beginning in January. This change will affect nearly 10,000 individuals currently using medications like Novo’s Wegovy and Lilly’s Zepbound, which have become increasingly popular despite their high cost—over $1,000 per month per user. The insurer cited the drugs' effectiveness, safety, and cost as factors in their decision, though specific safety concerns were not detailed. This move reflects a broader trend where insurers are scrutinizing the cost-effectiveness of such treatments, especially as similar drugs are not covered by the US Medicare program for obesity, only for diabetes. (BBN)

Ascension has reported that an employee inadvertently downloading a file containing malicious code likely led to a cyberattack on their hospital system. This breach enabled criminals to access files that contained personal information. (KFF)

In a significant move, the U.S. and key allies decided to utilize profits from approximately 300 billion euros ($322 billion) of frozen Russian central bank assets to support Ukraine. This decision, supported by leaders of the G7 major democracies, aims to issue $50 billion in loans for Ukraine. (CNBC)

The Producer Price Index (PPI), which measures the average change over time in the selling prices received by domestic producers for their output, unexpectedly declined by 0.2% for the month, contrary to expectations of a 0.1% increase. This decrease was largely influenced by a significant 0.8% drop in final demand goods prices, marking the largest decline since October 2023. Additionally, economic concerns were heightened as initial claims for unemployment insurance rose to 242,000 for the week ending June 8, reaching the highest level since August 2023. (CNBC)

The Supreme Court, in a unanimous decision, dismissed a challenge from anti-abortion doctors against the abortion pill mifepristone, upholding its wide availability. The Court ruled that the challengers lacked legal standing to contest the Food and Drug Administration’s measures that facilitate access to the drug. In response, President Joe Biden emphasized that while the availability of mifepristone remains secure, the broader battle for reproductive rights persists following the overturning of Roe v. Wade two years ago. (CNBC)

The Bank of Japan (BOJ) announced that it might decrease its purchases of Japanese government bonds following its next monetary policy meeting, scheduled for July 30 and 31. During the period leading up to this meeting, the BOJ plans to gather opinions from market participants and will formulate a detailed strategy for reducing its bond purchases over the next one to two years. (CNBC)

Public Markets

Activist investor Elliott Management, now one of the largest shareholders of Southwest Airlines with a $1.9 billion stake, intends to advocate for leadership changes due to the airline's struggles, including issues like Boeing’s 737 Max delivery delays. (CNBC)

KKR, CrowdStrike, and GoDaddy are set to join the S&P 500 index during its quarterly rebalance, according to S&P Dow Jones Indices. Following the announcement, KKR's stock surged to an all-time high of over $110 per share, CrowdStrike climbed about 9% to surpass $382, and GoDaddy increased 2% to top $142, each reaching record highs, as inclusion typically leads index-tracking funds to acquire shares of the newly added companies. (WSJ)

Apple has announced its entry into the artificial intelligence competition with "Apple Intelligence," a new AI system designed to bring enhanced personalization to its 2.2 billion device users. By partnering with OpenAI, the maker of ChatGPT, Apple aims to enrich its voice assistant capabilities, allowing it to perform more complex tasks and handle advanced queries. This strategic move follows a period of stagnation in Apple's market value, partly due to its slower adoption of generative AI technologies compared to its competitors. (WSJ)

A committee of independent advisers to the FDA has unanimously endorsed Eli Lilly's new Alzheimer's drug, donanemab, concluding that its benefits outweigh the risks despite significant safety concerns such as brain swelling and bleeding. This recommendation comes amid the urgent need for treatments as Alzheimer's, which affects over six million Americans, has no cure and no existing treatments can reverse the memory loss and cognitive decline it causes. (NYT)

CVS Health Corp., the largest U.S. pharmacy, faced recalls of its store-brand children's medications, including pain and fever drugs made with contaminated water, overly potent medications, and nasal sprays produced on machines also used for pesticides. A Bloomberg analysis revealed that over the past decade, CVS's store-brand products have been recalled approximately twice as often as those from Walgreens Boots Alliance Inc., and three times more than Walmart Inc.'s products. Despite the recalls, both CVS and Walgreens offer over 2,000 store-brand health and wellness items, while Walmart's exact number remains unspecified, though its website lists a comparable range. (BBN)

General Motors has revised its production forecast for all-electric vehicles (EVs) downward due to slower-than-expected adoption rates in the U.S. Paul Jacobson, GM's Chief Financial Officer, announced that the company now expects to produce between 200,000 and 250,000 EVs this year, a reduction from the previously anticipated range of 200,000 to 300,000. This adjustment comes as the Detroit automaker launches its latest EV models, including the new entry-level Chevrolet Equinox EV. (CNBC)

Broadcom's stock soared 15% on Thursday due to a positive forecast driven by high demand for AI technology chips and a 10-for-1 stock split announcement. Over the past year, its shares have risen 76%, closing at $1495.5 on Wednesday, reflecting efforts similar to Nvidia's to make stock more accessible. (REU)

At Tesla's annual shareholder meeting, CEO Elon Musk secured shareholder support to reinstate his $56 billion pay package, initially voided by a Delaware judge as excessive. Tesla's general counsel, Brandon Ehrhart, announced the decision, although specific vote totals were not disclosed. This package was originally approved by shareholders in 2018. (CNBC)

Adobe outperformed expectations in both earnings and revenue, exceeding forecasts for new annualized Digital Media revenue. Following these strong results, management has raised its full-year financial guidance. (CNBC)

Mercury Marine, owned by publicly traded Brunswick Corporation (BC), is laying off nearly 300 workers in Fond du Lac due to a downturn in boat sales, affecting less than 10% of its workforce. The layoffs mirror broader industry trends, with similar reductions at companies like BRP and Alumnacraft, underscoring the economic challenges in the boating sector. (FOX)

Real Estate

Blackstone Real Estate and MRP Group have launched an all-cash tender offer through a Mexican trust for up to 100% of Terrafina's outstanding real estate trust certificates at Ps.38.50 each, a 21% premium over the price on December 4, 2023, and 5% higher than the June 7, 2024 closing price. This offer, which is the only all-cash bid, promises substantial value for shareholders with fewer closing conditions and avoids potential tax issues seen in other types of transactions. (BX)

DTE Energy Co. has initiated construction of a $460 million battery facility at the former Trenton Channel coal-fired power plant, anticipated to be the largest in the Great Lakes region with a capacity of 220 megawatts. The project, which will store and distribute electricity based on demand fluctuations, benefits from $140 million in tax credits via the 2022 Inflation Reduction Act and is expected to power nearly 40,000 homes upon completion in 2026. (CRAIN)

Just a year after Wynn Resorts Ltd. unveiled plans for a $4 billion luxury resort in the United Arab Emirates, the Marjan Islands in Ras Al Khaimah (RAK) have transformed into a bustling construction site teeming with workers building upscale resorts, retail spaces, and multimillion-dollar villas. Previously, these artificial islands remained largely undeveloped for a decade following the cancellation of a $1 billion football-themed resort and Real Madrid academy. Now, every plot on the islands is sold, and construction is rapidly progressing under the direction of at least 20 developers. Abdulla Al Abdouli, CEO of the state entity managing the development, anticipates most projects will be completed within six years, although the total investment cost remains uncertain. (BBN)

In Cape Coral, Florida, the acceptance of applications for the Foreclosure Prevention Program has been temporarily paused due to an overwhelming number of submissions. The pause allows staff to review applications and supporting documents to determine eligibility. Applicants are advised to await confirmation of their approval and eligibility for mortgage assistance before scheduling foreclosure prevention counseling sessions with Habitat for Humanity. (CAPE)

Mergers & Acquisitions

Noble, an offshore rig contractor, announced a cash-and-stock acquisition of its smaller competitor, Diamond Offshore Drilling, for $1.59 billion, marking another significant consolidation in the industry. This deal comes as major oil and gas firms, benefiting from strong oil prices, invest their record profits into expanding drilling inventories, which in turn has boosted Noble's prospects, evidenced by a 9.3% rise in Diamond Offshore's shares and a 4% gain for Noble. (REU)

Cognizant Technologies has announced the acquisition of digital engineering firm Belcan for approximately $1.3 billion in cash and stock, a move that will enhance Cognizant's presence in the aerospace, defense, space, and automotive sectors. Belcan, a Cincinnati-based company owned by AE Industrial Partners since 2015, employs 10,000 people across 60 global locations and serves high-profile clients like Boeing, General Motors, Rolls-Royce, NASA, and the U.S. Navy. (REU)

Edgar Bronfman Jr., with backing from Bain Capital, is reportedly interested in acquiring National Amusements, the movie-theater company that allows Shari Redstone to control Paramount Global, for an amount between $2 billion and $2.5 billion. This bid complicates ongoing negotiations where Redstone is considering selling a majority stake to Skydance Media, which would potentially lead to a merger between Paramount Global and Skydance, significantly altering the ownership structure of major entertainment assets like CBS and MTV. (WSJ)

Shari Redstone has decided to retain her controlling stake in Paramount Global, terminating discussions with Skydance Media about a potential sale and merger. This decision halts months of complex negotiations, during which Redstone had internally promoted the merger, viewing Skydance's team, including CEO David Ellison, as ideal leaders for Paramount's iconic assets like CBS and MTV. The talks, reported initially by The Wall Street Journal, ended without an agreement, leaving Redstone firmly in control of one of Hollywood's major entities. (WSJ)

Saudia Arabia's Public Investment Fund, in partnership with French private equity firm Ardian, is set to increase its ownership in London Heathrow Airport. Following additional shareholders agreeing to sell their stakes, the two firms will now collectively own 37.6% of the airport, as part of a £3.26 billion ($4.26 billion) transaction. This deal expands their initial plan to purchase a 25% stake from Ferrovial SE, Heathrow's largest shareholder. (BBN)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply