- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

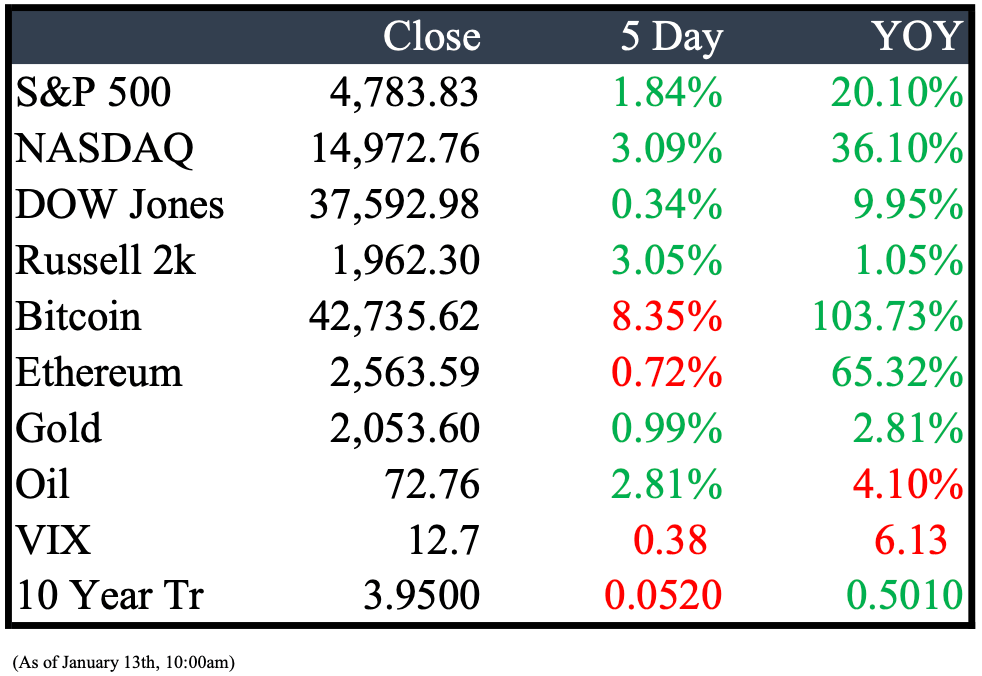

Market Recap

This Week’s Headlines

Economy & World News

Radio company Audacy Inc., owner of Detroit stations 97.1 The Ticket and WWJ-AM 950, filed for Chapter 11 bankruptcy in Texas. Under the proposed debt restructuring plan, creditors would take ownership in exchange for eliminating $1.6 billion of Audacy's $1.9 billion debt load. The deal would wipe out value for Audacy's publicly traded shares. The Philadelphia-based company is seeking court approval in Houston. (CRAIN)

Tiger Woods' longtime agent, Mark Steinberg, informed CNBC that the golfer chose not to renew his partnership with Nike, ending a 27-year collaboration. The future sponsor for Woods remains uncertain. (CNBC)

JetBlue announced on Monday that CEO Robin Hayes will step down next month, with the airline's Chief Operating Officer, Joanna Geraghty, set to assume the leadership role. This change in leadership occurs amidst JetBlue's ongoing efforts to acquire Spirit Airlines, a move valued at nearly $4 billion. JetBlue, based in New York, believes this acquisition will enable it to expand and more effectively compete with larger competitors like Delta and United. (CNBC)

The president of the National Association of Realtors (N.A.R.), Tracy Kasper, has resigned from her position, only four months into her term. This marks the second instance of an abrupt resignation by a president from N.A.R. She “recently received a threat to disclose a past personal, nonfinancial matter unless she compromised her position.” (NYT)

In December, the consumer-price index saw a 3.4% increase from the previous year, according to data released on Thursday by the Labor Department. This rise from November's 3.1% increase indicates that inflationary pressures have not been completely subdued. (WSJ)

In December, China saw a surge in export growth but continued to deal with deflationary pressures, suggesting the need for more policy easing to support the economy. Despite signs of improvement in global trade and possible lower borrowing costs, China faces challenges including a prolonged property crisis and geopolitical issues, indicating a potentially challenging year ahead for the world’s second-largest economy. (REU)

Early on Friday, the US and UK conducted approximately 70 airstrikes on Houthi targets in Yemen. This action was aimed at halting the Iran-backed group's attacks on shipping in the Red Sea. Despite these efforts, the Houthis have remained defiant, pledging to persist in targeting commercial vessels and announcing plans to escalate their campaign soon. They have declared all US and UK interests as legitimate targets. (BBN)

Microsoft briefly surpassed Apple as the world's most valuable company on Thursday, marking the first time since 2021. This change was driven by a decline in Apple's shares due to demand concerns, and a sharp rise in Microsoft's shares, boosted by its early investment in generative AI through OpenAI, the creator of ChatGPT. (REU)

NASA, in collaboration with Lockheed Martin, officially unveiled the X-59 quiet supersonic aircraft on Friday. This unique experimental aircraft is part of NASA's initiative to collect data that could transform the future of air travel. The goal is to pave the way for a new generation of commercial aircraft capable of traveling faster than the speed of sound. (NASA)

Lai Ching-te, from the Democratic Progressive Party, secures the presidency, outperforming rivals Hou Yu-ih from the Kuomintang and Ko Wen-je of the Taiwan People’s Party. This triumph marks a historic democratic achievement in Taiwan: the first instance where a political party secures three consecutive presidential victories. Despite this, the DPP did not retain a legislative majority, leading to a scenario where no single party holds sufficient votes for unilateral governance. (BBN)

Public Markets

3M Co. announced on Monday its intention to discontinue its pension plan for non-union U.S. workers in five years. This shift aligns with the company's gradual transition over several years from a traditional pension plan to a 401(k)-based retirement plan. 3M, a major player in the consumer, industrial, and healthcare sectors, stated that this move towards a 401(k) structure aims to offer employees greater flexibility and autonomy in planning their retirement investments. (MW)

Twilio Inc.'s stock rose over 6% on Monday following the unexpected announcement that co-founder and CEO Jeff Lawson is stepping down from his role. Lawson's impending departure comes as Twilio deals with pressure from two activist investors advocating significant changes at the company. (MW)

Johnson & Johnson announced its plan to acquire Ambrx Biopharma for $2 billion, gaining a foothold in the rapidly growing field of cancer treatment. This acquisition, revealed at the start of the annual JPMorgan Healthcare Conference, positions J&J among other pharmaceutical companies investing in antibody-drug conjugates (ADCs). The move is also part of J&J's strategy to address an impending revenue shortfall expected in 2025. (CNBC)

The conflict over grocery prices intensified on Monday when PepsiCo clarified that it was their decision, not Carrefour's, to terminate their partnership. PepsiCo announced they had chosen to stop supplying Carrefour's European stores due to the inability of both parties to agree on terms for a new contract. (WSJ)

Walgreens has reached a settlement agreement to pay $360 million to healthcare insurer Humana, resolving a lawsuit in which Walgreens was accused of overcharging for prescription drug reimbursements over several years. This settlement was disclosed in a court filing, leading U.S. District Judge Ana Reyes to dismiss the lawsuit in a Washington, D.C., federal court on Friday. The settlement amount was also reported in a filing with the U.S. Securities and Exchange Commission. (REU)

DTE Energy, a major utility based in Detroit, is offering voluntary buyouts to about 3,000 employees, which is roughly 30% of its workforce. The buyouts are mainly aimed at corporate and staff roles, with most participating employees expected to leave in March, as stated by spokesperson Dan Miner. (FREEP)

Citigroup has announced plans to eliminate approximately 20,000 jobs by the end of 2026, representing a significant phase in the bank's most extensive restructuring effort in years. This reduction will decrease Citi's workforce by about 10%, which stood at 200,000 in December, excluding the employees of a Mexico business currently being spun off. The cost-cutting strategy was detailed on Friday, alongside Citigroup's announcement of a fourth-quarter loss. (WSJ)

Hertz Global Holdings is selling about 20,000 electric vehicles, including Teslas, from its U.S. fleet, indicating a decrease in EV demand. The company, shifting its focus back to gas-powered vehicles, cited higher collision and damage costs for EVs. This move comes despite Hertz's earlier goal to electrify 25% of its fleet by the end of 2024. (REU)

Real Estate

The developer behind the Olara Residences is expanding its investment in West Palm Beach by proposing the construction of a new, substantial housing complex on adjacent land. An affiliate of the New York-based Savanna Fund is seeking approval from the city to build a 369-unit apartment complex. This development is envisioned to consist of twin towers, each rising 16 stories, located at 1830 N. Dixie Highway. In addition to the residential units, the project is planned to include nearly 8,000 square feet of commercial space. (PALM)

Mergers & Acquisitions

Novartis has recently pulled out of its acquisition plans for Cytokinetics, a heart-drug developer. This decision comes despite initial reports of an impending agreement, as the Swiss drug giant had been pursuing the South San Francisco-based company for several months. (WSJ)

Elliott Investment Management has acquired a substantial stake in Match Group and aims to encourage the online-dating company to take actions to improve its underperforming stock. The activist firm has established a position of approximately $1 billion in Match, the parent company of popular dating platforms such as Tinder and Hinge, based on information from individuals knowledgeable about the matter. (WSJ)

Boston Scientific, a medical device manufacturer, announced on Monday its agreement to acquire Axonics Inc for $3.7 billion. This acquisition allows Boston Scientific access to devices designed to enhance bladder function. This deal signifies Boston Scientific's foray into sacral neuromodulation, a minimally invasive treatment for overactive bladder and fecal incontinence, and represents a step in expanding its urology business. (REU)

Merck & Co announced on Monday its intention to acquire cancer drug developer Harpoon Therapeutics for approximately $680 million. This acquisition aims to strengthen Merck's oncology portfolio with advanced immunotherapies. As Merck's flagship immunotherapy, Keytruda, approaches the expiration of key patents, the U.S. drugmaker is focusing on developing new revenue sources to prepare for potential competition from biosimilars. Merck has proposed a purchase price of $23 per share in cash for the California-based Harpoon, which is a 118% premium over Harpoon's last closing stock price on Friday. (REU)

Platinum Equity has announced the signing of a definitive agreement to acquire Horizon Organic and Wallaby from Danone. Horizon Organic, renowned as the world's largest USDA-certified organic dairy brand, has been a trailblazer in the dairy beverage industry. It notably introduced the first organic milk available nationwide in the United States in 1991. The brand's range of organic dairy products encompasses milk, creamers, whiteners, yogurt, cheese, and butter. (PLAT)

Platinum Equity revealed the acquisition of Augusta Sportswear Brands ("ASB") and Founder Sport Group ("FSG"), both of which are key suppliers in the youth and recreational sports markets. They specialize in team uniforms, off-field performance wear, and fan apparel. The financial details of these private transactions were not disclosed. (PLAT)

Platinum Equity announced today that it has acquired E&A Scheer, a specialist in premium rum blending and the largest global blender and vendor of premium rum in bulk. The acquisition was made from The Riverside Company. The financial details of this transaction have not been disclosed. (PLAT)

Skydance Media CEO David Ellison is planning an all-cash bid for National Amusements, the parent company of Paramount Global, with financial support from investors including his father, Larry Ellison. This move could lead to the acquisition of a majority stake in National Amusements from the controlling Redstone family. (WSJ)

Chesapeake Energy and Southwestern Energy, two major natural gas producers in the United States, have announced their intention to merge in an all-stock transaction valued at $7.4 billion. The combined entity from this merger would emerge as one of the largest energy producers in the country, boasting a substantial operational footprint in Louisiana and Texas. (NYT)

BlackRock has agreed to purchase Global Infrastructure Partners for around $12.5 billion in cash and stock, marking a significant move into private-market investments. This acquisition, BlackRock's largest since buying Barclays's asset management business in 2009, includes GIP's diverse portfolio, such as a stake in London's Gatwick Airport. (WSJ)

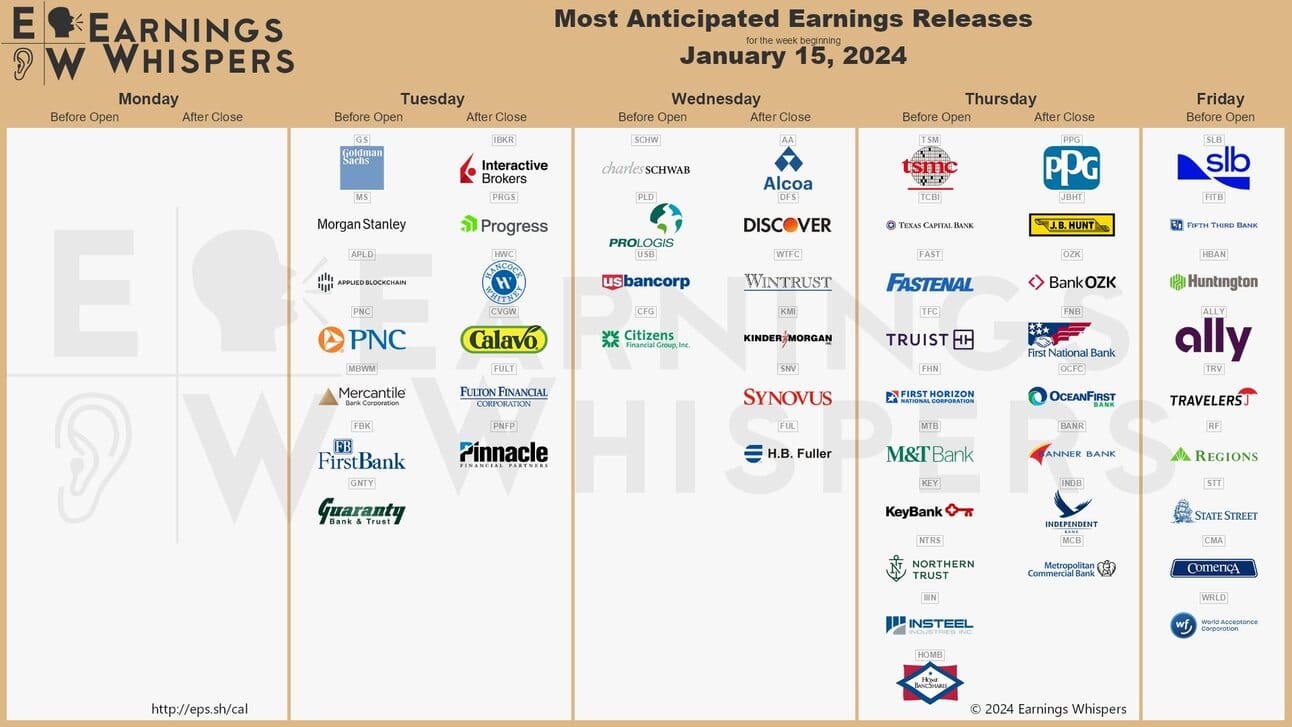

Earnings

Dear Valued Subscriber,

I am thrilled to share some exciting news with our newsletter community! On January 1st, 2024, we are launching T.H.E. Fund by Peridot, a groundbreaking hedge fund with a focus on Technology, Healthcare, and Energy investments.

Under the expert leadership of Peridot's founder, William Lemanske Jr, T.H.E. Fund offers a unique investment approach. By concentrating on these three dynamic sectors, we aim to maximize returns while steering clear of fixed income assets and adhering strictly to our core principles.

Having personally integrated this investment structure into my own portfolio over the last four years, I have witnessed its potential first-hand. Especially in a market where the S&P 500's performance is significantly influenced by just a handful of companies, T.H.E. Fund presents a smart diversification strategy. Our approach involves sector weighting based on market conditions and market capitalization, employing a long strategy in equities, and capitalizing on short-term returns through options and futures during periods of volatility.

As subscribers to our newsletter, you have the exclusive opportunity to be among the first to explore potential investment opportunities with T.H.E. Fund. We are beginning to accept investments at the start of the year, and I would be delighted to engage in a more in-depth discussion with you about this.

I believe T.H.E. Fund could be a significant addition to your investment portfolio. If you are interested in learning more about our diverse investment classes and wish to discuss further, please feel free to reach out to me via email.

Now enjoy your Read Sunday,

Founder & CEO, Peridot

William Lemanske

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply