- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

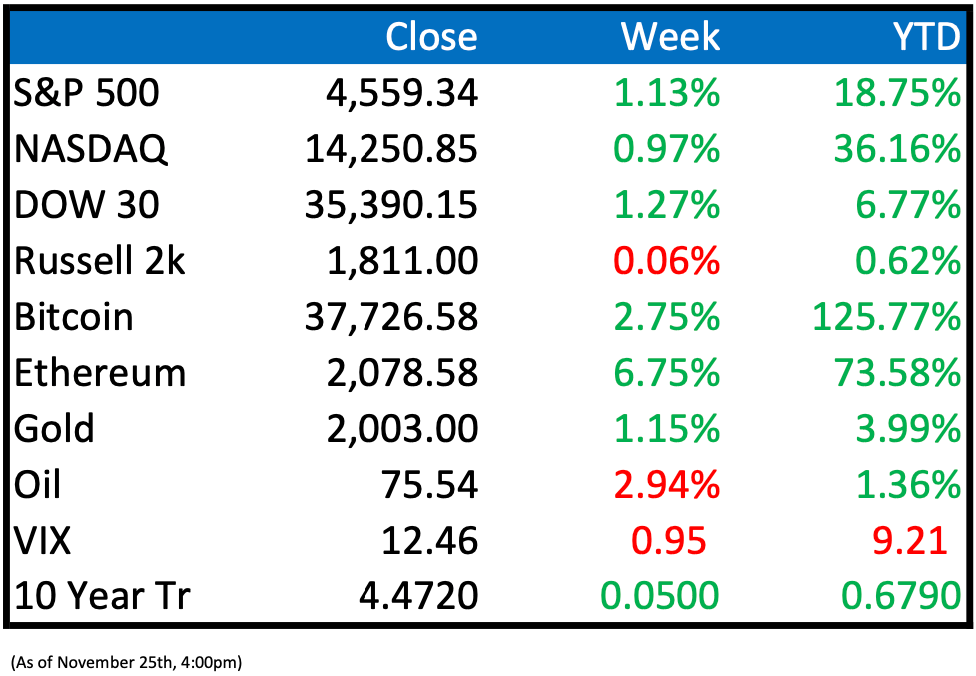

Market Recap

This Week’s Headlines

Public Markets

OPEC+ has announced that their postponed meeting will take place in an online format. The group is facing challenges in reaching a consensus regarding African quotas. On Wednesday, oil prices dropped by up to 4.9%, reflecting apparent disagreements within the organization. (BBN)

Binance CEO Changpeng Zhao has resigned and admitted guilt for violating U.S. anti-money laundering regulations as part of a $4.3 billion settlement, concluding a lengthy investigation into the world's largest cryptocurrency exchange, according to prosecutors' statements on Tuesday. This agreement, in which Zhao will personally pay $50 million, has been characterized by prosecutors as one of the most substantial corporate fines in U.S. history. It represents another setback for the cryptocurrency industry, which has been grappling with a series of investigations, and follows the recent conviction of FTX founder Sam Bankman-Fried on fraud charges. (RET)

Ford Motor Co. has decided to proceed with a downsized investment plan for an electric vehicle battery plant in southwest Michigan.

The company announced that work will resume on BlueOval Battery Park in Marshall, but Ford intends to reduce the battery capacity by 43% and eliminate 800 jobs from the lithium iron phosphate battery plant. As a result, the plant will now have a capacity of 20 gigawatt-hours and generate 1,700 jobs. This adjustment comes after Ford's initial plan for the plant included a $3.5 billion investment, 35 gigawatt-hours of capacity, and the creation of 2,500 jobs. (MLIVE)

The Strategic Organizing Center (SOC), a coalition of labor unions in North America, announced on Tuesday that it has put forward three candidates for board seats at Starbucks Corp (SBUX), a strategy commonly employed by activist shareholders. The individuals nominated for election to Starbucks' board include Maria Echaveste, Joshua Gotbaum, and Wilma Liebman, all of whom have experience working in the administrations of former U.S. Presidents Bill Clinton and Barack Obama, as outlined in the union's statement. (RET)

Economy

Hamas released 24 hostages on Friday during the first day of the war's initial ceasefire. These hostages included Israeli women and children, as well as Thai farm workers. This release occurred as the guns fell silent across the Gaza Strip for the first time in seven weeks. The hostages were safely transported out of Gaza and handed over to Egyptian authorities at the Rafah border crossing. This process was facilitated by eight staff members of the International Committee of the Red Cross (ICRC) in a four-car convoy, as reported by the ICRC. (RET)

Canada's real estate sector, which was once one of the hottest in the world and a significant contributor to the country's economy, is showing signs of vulnerability. Numerous prominent real estate developers are failing to meet loan obligations, purchasers are encountering difficulties in finalizing property purchases, and numerous condominium projects are being put on hold. According to developers, real estate brokers, and economists, the repercussions of these challenges could persist for years. This transformation could shift housing from being a driving force for the Canadian economy to a factor that hinders its growth. (WSJ)

Britain's minimum wage is set to experience a significant 9.8% increase, reaching £11.44 ($14.26) per hour starting from April 2024. This raise positions the UK's minimum wage among the highest, in terms of its proportion to average earnings, compared to other advanced economies. Finance minister Jeremy Hunt unveiled this wage hike on the eve of delivering a mid-year budget update, which is anticipated to include tax reductions and more stringent requirements for those not employed to actively seek employment or risk losing benefits. (RET)

Turkey's central bank took a significant step on Thursday by increasing its key interest rate to 40%. This move surprised economists as it was double their expectations, with many forecasting a 250-basis-point hike. The central bank's decision to raise the benchmark one-week repo rate by 500 basis points is perceived as a part of its ongoing efforts to combat high inflation and stabilize the declining Turkish lira. Inflation in Turkey had reached a staggering 61% in October, underscoring the urgency of these measures. (CNBC)

Mergers & Acquisitions

Blackstone has made a significant move by acquiring Civica, a software developer based in the United Kingdom. This marks the second substantial investment by Blackstone in Europe within a span of two days, indicating a resurgence in private-equity deal activity in the region. Although the exact value of the deal was not disclosed, earlier reports from The Wall Street Journal suggested that the transaction placed the overall worth of Civica, including its debt, at nearly $2.5 billion. (WSJ)

US private equity firm TPG Inc. is reportedly considering the sale of its stake in Singapore Life Holdings Pte, a company often referred to as Singlife. This potential transaction could value Singlife at approximately S$4 billion ($3 billion). TPG currently holds a 35% stake in Singlife. (BBN)

French oil giant TotalEnergies SE and Saudi Basic Industries Corp. are reportedly exploring the possibility of selling a large chemical plant in the United States. This plant produces chemical ingredients utilized in various products, including plastic packaging, disposable cups, and insulation materials. (BBN)

Computer chip and software manufacturer Broadcom has confirmed that it has successfully navigated all regulatory requirements and intends to finalize its $69 billion acquisition of cloud technology firm VMware on Wednesday. (CNBC)

A private equity consortium, which includes Permira and Blackstone (BX), has announced its intention to acquire Adevinta ASA, the online classifieds group backed by eBay, for approximately 141 billion Norwegian crowns ($13.1 billion). This deal represents one of the largest buyouts in Europe for the year. (RET)

The Federal Trade Commission (FTC) is reportedly conducting an investigation to determine if the $10 billion acquisition of Subway could result in a monopoly within the sandwich shop industry. This inquiry is based on information from sources familiar with the discussions, as reported by Politico. (BLN)

Earnings

Peridot Introduction

Discover the future of alternative asset management with Peridot Co. As a dynamic and innovative firm, we cater to both institutions and individuals, operating across a diverse spectrum of industries, including software, healthcare, energy, and real estate, to present unmatched investment opportunities.

Rooted in our unwavering principles of partnership, innovation, and long-term vision, we harness the power of advanced machine learning technology to inform our decisions, propelling the boundaries of alternative asset management strategies.

Our dedicated team scrupulously identifies and evaluates potential investments, ensuring meticulous risk management and alignment with our strategic goals. At the core of our success lies the bedrock of robust, trust-driven relationships with our partners, fueling the achievements of our investments.

Join us at Peridot Co and witness the evolution of alternative asset management—a journey that generates sustainable value across industries, ultimately leaving a positive imprint on your investment portfolio.

For more information reach out to:

Thanks for reading, see you next week!

Feel free to share with a friend!

Reply