- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

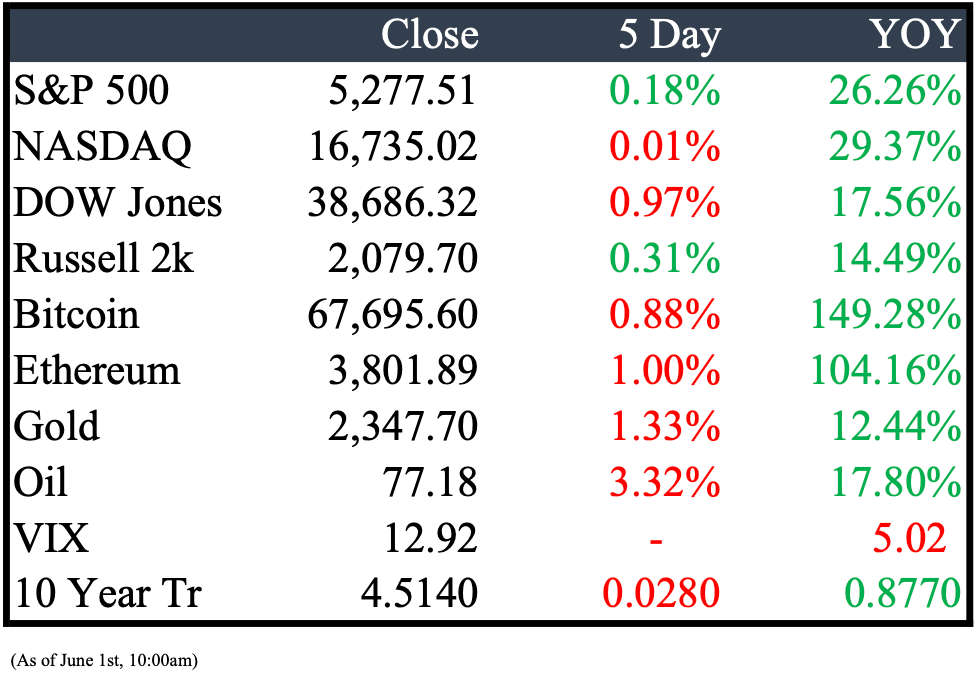

Market Recap

This Week’s Headlines

Economy & World News

China has established its largest semiconductor investment fund, amassing 344 billion yuan ($47.5 billion) to advance its domestic chip industry, in response to US restrictions. This fund, incorporated on May 24, includes contributions from the central government and state-owned entities like the Industrial & Commercial Bank of China Ltd. The Big fund III. (BBN)

Donald Trump has been convicted of 34 felonies by a Manhattan jury, marking him as the first former president to be found guilty of a crime. The charges relate to falsifying records to conceal hush money payments made during his 2016 presidential campaign, a verdict that could impact his potential 2024 White House run, despite stable poll numbers throughout the trial. (WSJ)

The U.S. economy's growth for the first quarter was revised down to a 1.3% annualized rate, lower than the initially reported 1.6%, due to weaker consumer spending on goods. According to the Bureau of Economic Analysis, personal spending, which is a key driver of economic growth, increased by only 2.0%, less than the previously estimated 2.5%. (BBN)

U.S. officials have temporarily restricted Nvidia Corp. and Advanced Micro Devices Inc. from exporting large-scale AI accelerators to the Middle East, pending a national security review of AI development in the region. The scope and duration of the review are currently unclear, with a particular focus on high-volume shipments to countries such as the United Arab Emirates and Saudi Arabia, which are seeking to import significant quantities of these chips for AI data centers. (BBN)

President Biden has authorized Ukraine to carry out limited strikes inside Russia using American-made weapons, as a defensive measure to protect its territory, particularly around Kharkiv. This marks the first time an American president has permitted such military actions against a nuclear-armed nation, emphasizing that these are strictly acts of self-defense. (NYT)

Inflation in the Euro zone rose to 2.6% in May, up from 2.4% in April, as reported by the European Union's statistics agency. Despite the increase, which was higher than expected for both headline and core inflation, markets are still anticipating an interest rate cut at the European Central Bank's upcoming June meeting, encouraged by consistent signals from policymakers. Additionally, services inflation, which is closely monitored by the ECB, increased to 4.1% from 3.7%. (CNBC)

The U.S. Food and Drug Administration has approved Moderna's vaccine for respiratory syncytial virus (RSV), targeting adults aged 60 and older. This new vaccine, which is 79% effective at preventing symptoms like cough and fever, represents a significant opportunity for Moderna to generate revenue from a second product. (REU)

Boeing's inaugural crewed flight of its Starliner spacecraft was abruptly canceled just minutes before the scheduled launch on Saturday. The specific reasons for the delay were not immediately disclosed. This postponement adds to the already years-long delay of Starliner’s crew debut, during which time SpaceX's Dragon capsule has been conducting regular astronaut flights for NASA since 2020. (CNBC)

Public Markets

Apple Inc.'s iPhone shipments in China rose by 52% last month, significantly rebounding due to extensive discounts offered by retail partners. This recovery follows previous sales declines and is bolstered by ongoing promotions aligning with China's June 18th shopping festival, countering competition from Huawei Technologies Co. (BBN)

Elliott, a $65 billion hedge fund known for its shareholder activism, has invested $2.5 billion in Texas Instruments, urging the company to boost its free cash flow by loosening its strict capital expenditure plan. Elliott criticizes the company's firm adherence to its 2022 capital expenditure plan as detrimental to shareholder returns. (CNBC)

BlackRock's iShares Bitcoin Trust (IBIT) has become the world's largest cryptocurrency fund, accumulating nearly $20 billion in assets since its U.S. launch in January, as reported by Bloomberg News. On Tuesday, the fund's holdings surpassed those of Grayscale Bitcoin Trust, reaching $19.68 billion compared to Grayscale's $19.65 billion. (REU)

Nelson Peltz, the activist investor, has sold his entire stake in Disney, following a proxy battle in early April where his firm, Trian, was unsuccessful in electing any board nominees, leading to the reelection of Disney's full slate of board members. (CNBC)

Carl Icahn has acquired a significant stake in Caesars Entertainment Inc., though he currently does not intend to engage in any activist efforts at the hotel and casino group. After advocating for the 2020 merger between Caesars and Eldorado Resorts Inc., Icahn remains supportive of the current management, particularly praising CEO Tom Reeg. Following the news, Caesars' shares saw a substantial rise, peaking at an 18% increase, the largest intraday gain since November 2022, and were up 11% in mid-afternoon trading in New York. (BBN)

Real Estate

Detroit is advancing efforts to repurpose the long-abandoned Packard Plant site for industrial and manufacturing uses. The city, along with the Detroit Economic Growth Corp., is inviting developers to submit proposals by July 12 for 37 acres of the deteriorating property, which includes 55 publicly owned parcels near I-94 and East Grand Boulevard. (CRAIN)

Blackstone Real Estate Debt Strategies (BREDS) has finalized the acquisition of a $1 billion senior mortgage loan portfolio from Deutsche Pfandbriefbank (PBB), featuring 11 loans across multifamily, office, and hospitality sectors in the U.K. and U.S. Steve Plavin, Senior Managing Director at BREDS, highlighted the acquisition's alignment with their strategy of becoming a trusted counterparty for financial institutions looking to optimize their balance sheets. (BX)

Blackstone Real Estate has agreed to sell Turtle Bay Resort for $725 million, having purchased it for $332 million in 2018 and investing heavily in its renovation. The sale, expected to close in the third quarter of 2024, reflects Blackstone's successful transformation of the property, enhancing its luxury offerings and adding jobs in O'ahu, where the resort is a major employer and community pillar. (BX)

The Fred A. and Barbara M. Erb Family Foundation has awarded a $7.5 million matching grant to Detroit Public Media, which operates Detroit PBS, to support their new headquarters in Detroit. This grant, which matches donations on a one-to-one basis, combined with proceeds from the sale of their former headquarters in Wixom, has brought the organization nearly two-thirds of the way toward their $30 million fundraising goal. (CRAIN)

Mergers & Acquisitions

Elon Musk's AI startup, xAI, has secured a $6 billion investment in its Series B funding round to compete with OpenAI, an organization he previously supported but later distanced himself from due to concerns about AI risks. This funding, announced on May 26, is one of the largest in the emerging AI industry and follows just months after xAI's initial launch. (BBN)

Shares of U.S. Cellular surged following T-Mobile's announcement on Tuesday of its plans to acquire a major portion of the company for $4.4 billion, aimed at enhancing rural coverage using U.S. Cellular's wireless spectrum. Despite the sale, U.S. Cellular will retain some of its spectrum and towers, and will lease space on at least 2,100 additional towers to T-Mobile. (CNBC)

Shareholders of Hess Corporation have approved a $53 billion acquisition by Chevron, overcoming a significant obstacle toward merging the two companies. This positive development follows a contentious dispute with Exxon Mobil, which challenges the deal due to a conflict over Hess's stake in a significant oil discovery in Guyana, a situation that continues to pose a threat to the merger's completion. (WSJ)

Merck has announced a $1.3 billion acquisition of Eyebiotech (EyeBio), marking its entry into the expanding eye-care market. The deal includes an initial cash payment with the potential for an additional $1.7 billion in milestone payments, as EyeBio progresses its lead drug Restoret, which targets age-related macular degeneration and diabetic macular edema. (WSJ)

ConocoPhillips' acquisition of Marathon Oil will expand its operations in shale fields across Texas, New Mexico, and North Dakota, adding 2 billion barrels of resources. The company plans aggressive shareholder returns, expecting to conduct $7 billion in share buybacks in the first year post-acquisition, with a total of $20 billion over the first three years, marking a significant move in an industry experiencing widespread consolidation. (CNBC)

BHP Group has opted not to pursue a firm offer for Anglo American Plc, withdrawing from potential negotiations just before a critical deadline, which would have resulted in the largest mining deal in more than ten years. This decision puts significant pressure on Anglo's CEO, Duncan Wanblad, to fulfill ambitious turnaround goals, while BHP must seek alternative avenues to achieve its desired copper expansion. (BBN)

Energy Transfer LP has announced its acquisition of WTG Midstream Holdings LLC for approximately $3.25 billion, a move that expands its natural gas pipeline and processing operations in the Permian Basin. The deal, including assets like eight operational gas processing plants and over 6,000 miles of gas gathering pipelines, is structured with a mix of cash and equity, and is expected to close in the third quarter of 2024, pending regulatory approvals. (ET)

Skydance Media has increased its merger offer for Paramount Global, proposing terms more favorable to both voting and nonvoting shareholders, amidst ongoing negotiations. This development follows an initial offer that favored controlling shareholder Shari Redstone, leading to significant corporate restructuring at Paramount and a competing $26 billion bid from Apollo Global Management and Sony Pictures earlier this month. (WSJ)

GFL Environmental Inc., based in suburban Toronto, is selling its residential waste collection business to Clinton Township-based Priority Waste LLC. The transaction, for which the price has not been disclosed, is set to finalize on June 30, affecting trash collection services in 75 Southeast Michigan communities. (CRAIN)

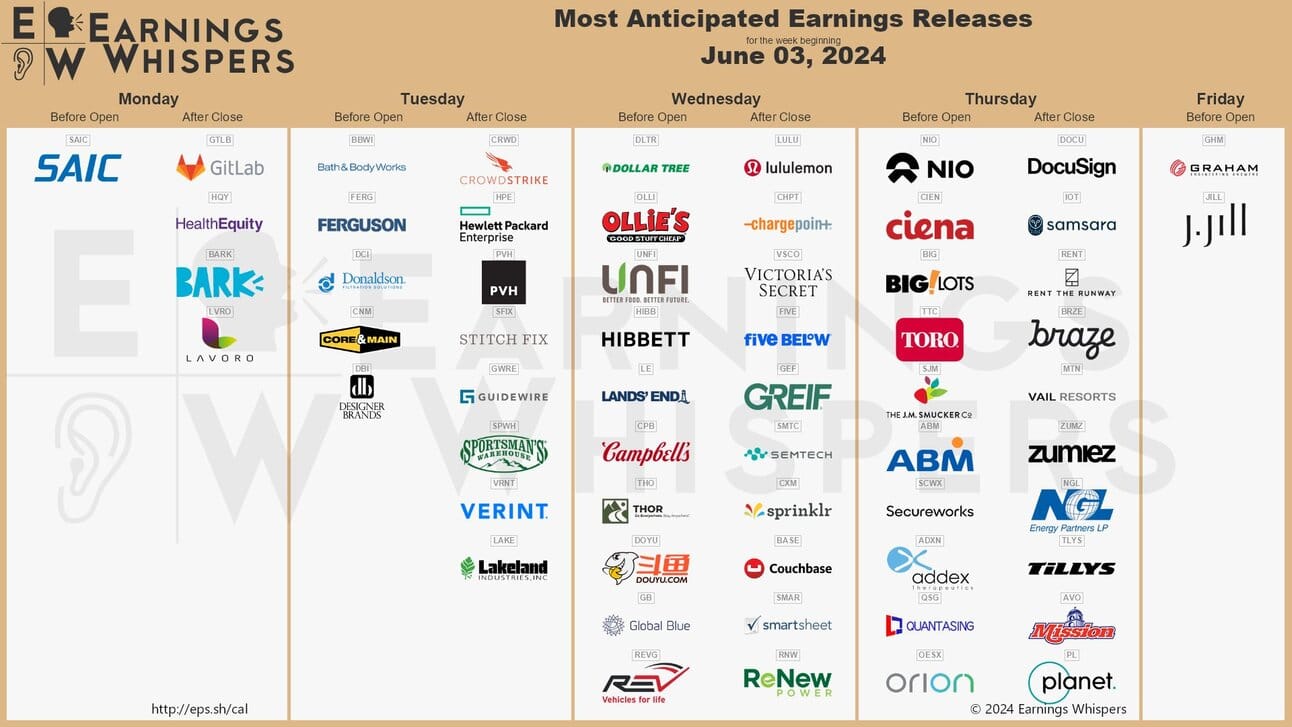

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply