- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

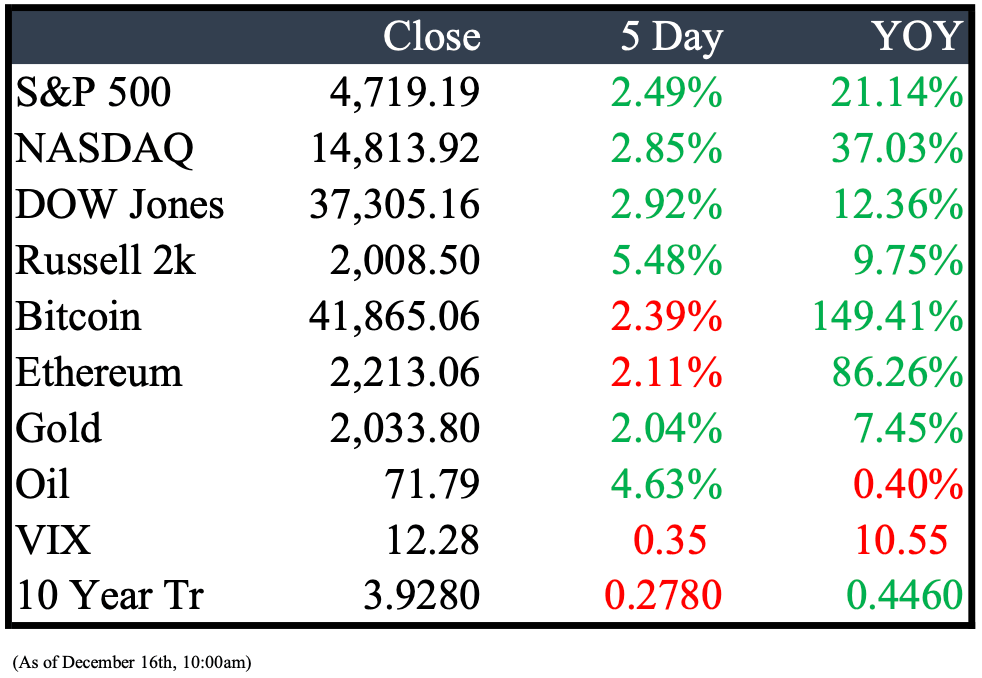

Market Recap

This Week’s Headlines

Public Markets

U.S. health insurer Cigna (CI) has abandoned its efforts to negotiate the acquisition of rival Humana (HUM) due to a failure to reach an agreement on the purchase price. This decision comes from two sources who are knowledgeable about the situation and was announced concurrently with Cigna's intention to repurchase $10 billion worth of its own shares. The proposed merger between Cigna and Humana had the potential to create a company with a total value exceeding $140 billion, based on their respective market valuations. However, this combination was bound to attract intense antitrust scrutiny, given the regulatory history. These discussions occurred six years after regulators thwarted previous mega-deals aimed at consolidating the U.S. health insurance sector. (RET)

Ford Motor is reducing the production of its all-electric F-150 Lightning pickup by about half for the coming year. This change comes after the company had initially planned to make more. The reason for this shift is that demand for electric vehicles has been slower than expected, mainly because prices and interest rates are high. It's important to note that, despite these challenges, sales of the F-150 Lightning have been steadily increasing this year. (CNBC)

Pfizer's shares declined following the company's announcement of its 2024 revenue and profit forecasts. This weaker outlook is primarily attributed to a sustained decrease in demand for Pfizer's COVID vaccine and Paxlovid treatment. In response to these challenges, Pfizer has decided to increase the target for its extensive cost-cutting initiative by an additional $500 million, bringing the total cost savings target to $4 billion. (CNBC)

Tesla is recalling over two million vehicles due to concerns raised by government authorities about the potential misuse of its Autopilot system by drivers. This recall comes as part of an ongoing investigation by the leading U.S. auto-safety regulator into accidents involving this driver-assistance technology. While this safety recall encompasses nearly all Tesla vehicles sold in the United States, it is not expected to incur significant costs for the company, and it will not significantly restrict drivers' access to Tesla's advanced driver-assistance features. (WSJ)

Cruise, the self-driving car company owned by General Motors, has laid off approximately 24% of its workforce, which amounts to 900 employees. This decision follows a series of safety incidents and permit suspensions that have adversely affected the company's operations. One of the notable incidents occurred in October when a self-driving Cruise vehicle was involved in a collision with a woman, dragging her for 20 feet after she had already been hit by another car. (WSJ)

Axel Springer, a prominent news-publishing company, has reached a multiyear licensing agreement with OpenAI, the creator of ChatGPT. This marks a significant development in the ongoing efforts of media companies to secure compensation for the utilization of their content in artificial intelligence tools. As part of this agreement, OpenAI will make payments for the use of content from Axel Springer's publications, which encompass well-known titles such as Politico and Business Insider in the U.S., as well as European properties like Bild and Welt. This content will be employed to generate responses in ChatGPT and to train OpenAI's artificial intelligence tools. (WSJ)

Leading shipping and logistics companies, A.P. Moller-Maersk and Hapag-Lloyd, have taken the precautionary measure of halting their vessels from entering the southern entrance of the Red Sea due to recent attacks on their ships. Maersk's decision was prompted by a near-miss incident involving the Maersk Gibraltar ship on Thursday and another attack on a container vessel that occurred on Friday. As a result, the company has instructed all Maersk vessels in the region, which are scheduled to pass through the Bab el-Mandeb Strait, to suspend their journeys until further notice. This action is taken to ensure the safety and security of their vessels and crews. (WSJ)

Economy

The Federal Reserve has opted to maintain its current interest rates for the third consecutive time. This decision suggests that the central bank's prolonged effort to combat high inflation may be nearing its conclusion. Additionally, policymakers have forecasted a series of three rate cuts in 2024.

In November, the consumer-price index (CPI) increased by 3.1% compared to the same month the previous year, representing a slight deceleration from the October figure but still above the 3% recorded in June. This data was reported by the Labor Department on Tuesday. Additionally, prices rose by 0.1% from the previous month, surpassing the steady expectations of economists. (WSJ)

In a closely contested vote on Wednesday, the House narrowly approved the initiation of an impeachment probe into President Biden. This development came shortly after President Biden's son, Hunter Biden, refused to testify on Capitol Hill in response to a congressional demand. This marks a significant escalation in the ongoing battle between the White House and Republicans. The House voted 221-212, with the vote largely split along party lines, to formally authorize the Republicans' impeachment probe. (WSJ)

Hungarian Prime Minister Viktor Orban has effectively delayed the European Union's proposed financial aid package for Ukraine, pushing the debate into early next year. This move comes at a time when the EU is grappling with concerns about the waning of Western support for Ukraine. While Kyiv achieved a notable political win when the EU unexpectedly agreed to begin membership talks, this success was overshadowed by the breakdown of negotiations regarding a €50 billion ($54 billion) package. It's worth noting that 26 out of the 27 EU member states were in favor of this package, but it was blocked by Hungary. (BBN)

During a recent call with Ernst & Young's U.S. partners and staff, a senior partner delivered a message usually reserved for clients – it's time to reduce costs. Dave Burg, EY's Head of Americas Cybersecurity, acknowledged the challenges in their business, including slowed growth and excess capacity. The firm is making the unusual move of laying off several U.S. partners, a strategy not commonly seen even among the Big Four firms. This decision follows similar job cuts, including partners, at KPMG earlier this year, where approximately 5% of the U.S. workforce was affected. (WSJ)

Mergers & Acquisitions

Occidental Petroleum Corp. has entered into an agreement to acquire CrownRock LP, a Texas-based shale drilling company, in a cash-and-stock transaction valued at approximately $10.8 billion. This acquisition is part of the ongoing consolidation trend in North America's highly productive oil basin. The deal is anticipated to be finalized in the first quarter of 2024, pending regulatory approvals, as confirmed by Occidental in a statement released on Monday. The company has secured $10 billion in committed bridge financing from Bank of America Corp., as outlined in an investor presentation. This bridge financing is expected to be replaced with more permanent financing, including term loans and bonds, at a later stage. (BBN)

Shari Redstone is considering selling her stake in the Paramount Global movie and TV empire, a move that could involve selling assets worth over $13 billion, including the CBS network. She has engaged in discussions with Hollywood producer David Ellison, the son of billionaire Larry Ellison, and RedBird Capital Partners regarding a potential acquisition of her family's stake in the company, as reported by sources familiar with the matter. (BBN)

Private-equity firm Veritas Capital is on the verge of finalizing a deal to sell a portion of its stake in Cotiviti to alternative-asset manager KKR. The proposed transaction would value the healthcare-technology company at approximately $11 billion. Pending the successful conclusion of negotiations, KKR could acquire a 50% stake in Cotiviti from Veritas in the coming weeks. (WSJPE)

Private equity firm Apollo Global is considering making an offer to acquire the UK's Pension Insurance Corporation (PIC) in a potential deal that could value PIC at approximately £5 billion ($6.26 billion), according to a report by Sky News. Neither Apollo Global nor PIC has responded to Reuters' request for comment on this matter. Earlier this month, Bloomberg News had also reported, citing insider sources, that PIC was exploring the possibility of a sale. (REU)

Apollo, Carlyle, and KKR are currently exploring independent bids for the acquisition of Pension Insurance Corporation (PIC) before an approaching deadline. This comes as major private capital firms seek entry into the flourishing UK market for corporate pension transactions. PIC, headquartered in London, has garnered a substantial customer base of over 300,000 policyholders through bulk annuity deals. In these arrangements, PIC assumes responsibility for pension fund liabilities and the corresponding assets, taking them over from the sponsoring companies. Notably, this year, PIC completed the largest-ever deal of its kind in the UK when it acquired £6.5 billion in liabilities from the general insurer RSA. (FT)

Star Bulk Carriers and Eagle Bulk Shipping have announced a merger agreement in an all-stock deal that will result in the creation of the world's fourth-largest commodities carrier. This merger aims to enhance the combined entity's appeal to large investors. Under the terms of the deal, Star Bulk, headquartered in Athens, Greece, will hold a 71% stake in the combined company, while Eagle Bulk shareholders will retain a 29% ownership stake. The merger values the new entity at approximately $2.1 billion, and it is scheduled to be finalized next year. (WSJ)

Davide Campari Milano has initiated exclusive negotiations with Beam Suntory for the potential acquisition of Courvoisier cognac's owner, a deal valued at up to $1.32 billion. This strategic move aims to significantly strengthen Campari's presence in the U.S. market and is anticipated to be the largest deal in the company's history. The Italian distiller disclosed on Thursday that discussions with Beam Suntory revolve around the acquisition of Beam Holding France, the entity that possesses Courvoisier. The agreed-upon purchase price for this deal is set at $1.20 billion, with no additional debt, and an extra payment of up to $120 million is anticipated in 2029, contingent upon achieving a net sales target in 2028. (WSJ)

E-signature company DocuSign is in the process of working with advisers to consider a potential sale. If this proceeds, it could become one of the largest leveraged buyouts in recent memory. Given DocuSign's current market capitalization, which exceeds $11 billion, the deal is expected to be significant in scale. (WSJ)

Australian drug supplier Sigma Healthcare has reached an agreement to merge with privately-owned pharmacy operator CW Group, resulting in the formation of a publicly-listed company valued at more than 8.8 billion Australian dollars (approximately US$5.79 billion). Under the terms of the merger, Sigma will pay A$700 million in cash and issue new shares, allowing CW Group, the operator of Australia's well-known Chemist Warehouse pharmacy chain, to hold an 86% stake in the combined entity. The remaining ownership will belong to Sigma shareholders, who currently have a market capitalization of A$810.4 million. (WSJ)

An investor group, consisting of Arkhouse Management, a real estate-focused investment firm, and Brigade Capital Management, a global asset manager, has presented a $5.8 billion offer to purchase Macy's. This proposal aims to take the renowned department-store chain private, as it has faced significant challenges from online competitors that have impacted its value. The offer involves acquiring the Macy's shares they do not already own for $21 per share, as reported by sources familiar with the matter. (WSJ)

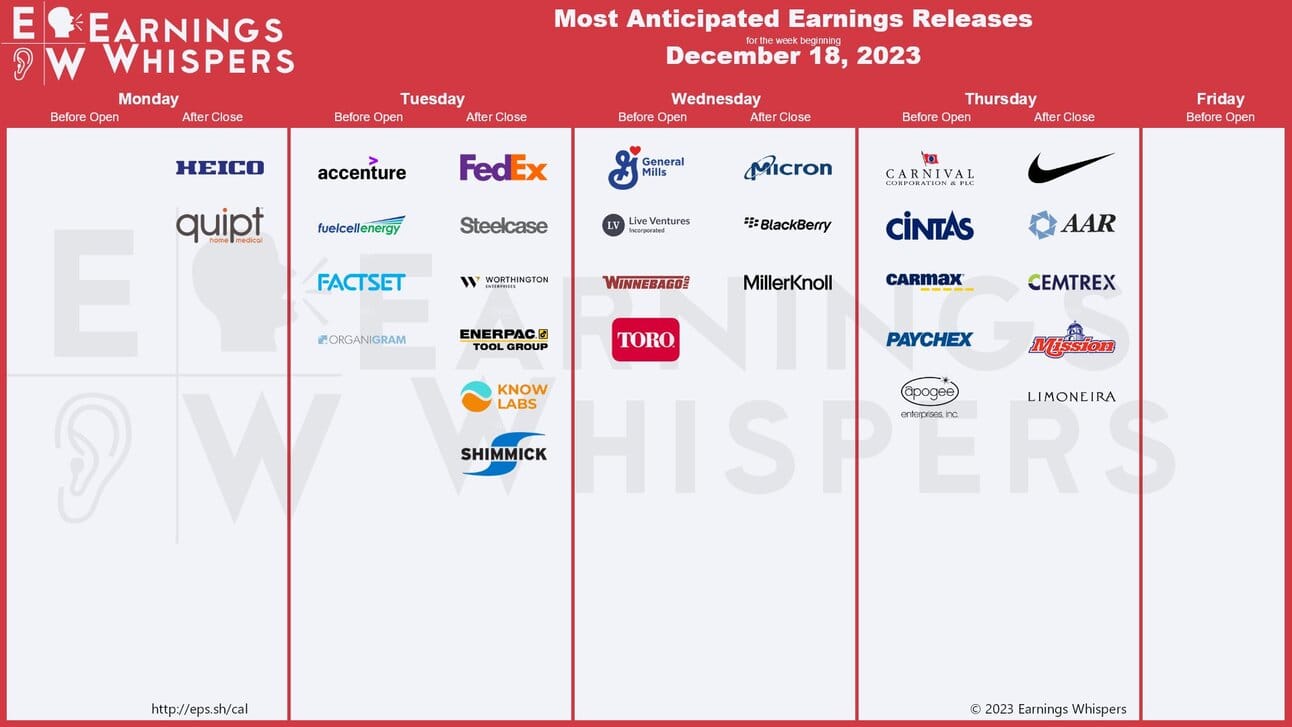

Earnings

Peridot Hedge

Dear Valued Subscriber,

I am thrilled to share some exciting news with our newsletter community! On January 1st, 2024, we are launching T.H.E. Fund by Peridot, a groundbreaking hedge fund with a focus on Technology, Healthcare, and Energy investments.

Under the expert leadership of Peridot's founder, William Lemanske Jr, T.H.E. Fund offers a unique investment approach. By concentrating on these three dynamic sectors, we aim to maximize returns while steering clear of fixed income assets and adhering strictly to our core principles.

Having personally integrated this investment structure into my own portfolio over the last four years, I have witnessed its potential first-hand. Especially in a market where the S&P 500's performance is significantly influenced by just a handful of companies, T.H.E. Fund presents a smart diversification strategy. Our approach involves sector weighting based on market conditions and market capitalization, employing a long strategy in equities, and capitalizing on short-term returns through options and futures during periods of volatility.

As subscribers to our newsletter, you have the exclusive opportunity to be among the first to explore potential investment opportunities with T.H.E. Fund. We are beginning to accept investments at the start of the year, and I would be delighted to engage in a more in-depth discussion with you about this.

I believe T.H.E. Fund could be a significant addition to your investment portfolio. If you are interested in learning more about our diverse investment classes and wish to discuss further, please feel free to reach out to me via email.

Now enjoy your Read Sunday,

Founder & CEO, Peridot

William M Lemanske Jr.

Thanks for reading, see you next week!

Feel free to share with a friend!

Reply