- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

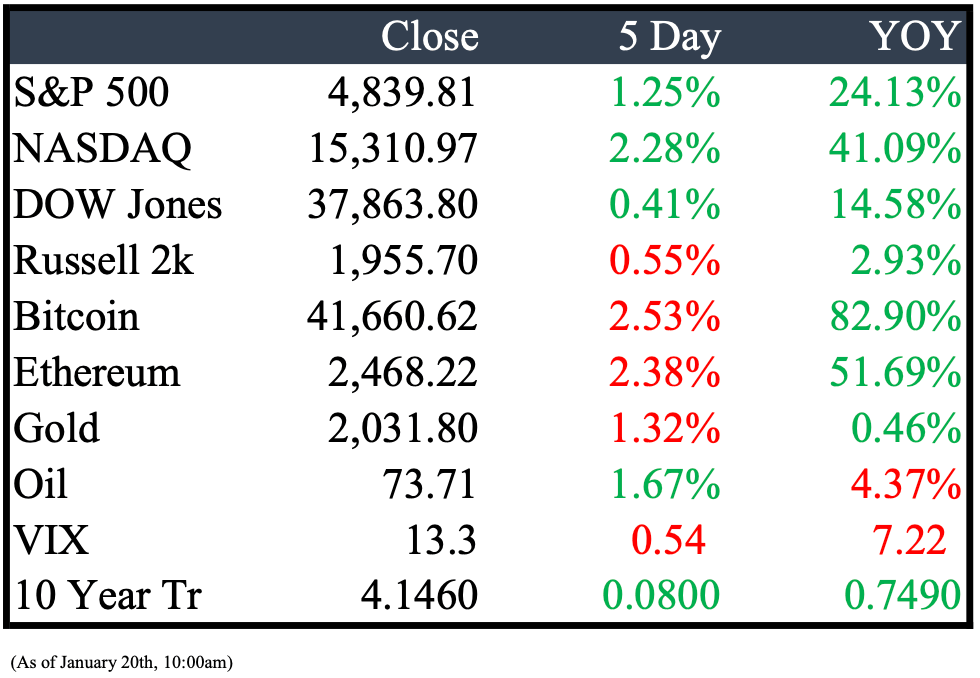

Market Recap

This Week’s Headlines

Economy & World News

The US-owned Gibraltar Eagle, under a Marshall Islands flag, was hit by a missile in the Gulf of Aden on Monday, with no injuries reported. This incident, attributed to Houthi militants, emphasizes the risks in key global trade routes, despite warnings from Western navies. The ship continued its journey post-attack. (BBN)

Venezuela has increased its minimum wage by 43% to an equivalent of $100 per month. This move is aimed at addressing the concerns of public sector workers and mitigating growing protests against the socialist government. (BBN)

In 2023, Michigan emerged as a leading state in the cannabis industry, recording nearly $3.06 billion in sales of medical and adult-recreational marijuana. This figure averages to about $305 in marijuana sales per person in the state for the year, based on data from the Michigan Cannabis Regulatory Agency. Remarkably, Michigan's cannabis sales for the year exceeded the gross domestic product of 51 countries, closely approaching the GDP of Burundi in Africa. (CRAIN)

The U.S. has disrupted Houthi missile attacks in Yemen for the sixth time in 10 days, targeting missiles aimed at Red Sea vessels. This consistent action, confirmed by National Security Council spokesperson John F. Kirby, is part of an ongoing strategy to weaken the Houthi militia. (NYT)

Vivek Ramaswamy has ended his bid for the 2024 Republican presidential nomination after placing fourth in the Iowa caucuses, subsequently endorsing former President Donald Trump. He acknowledged a lack of a viable path forward in the race. (AP)

Qatar and France have arranged a deal with Israel and Hamas to exchange urgent medication for around 45 Israeli hostages in Gaza for humanitarian aid to Gaza's civilians. The aid will travel from Qatar to Egypt on Wednesday and then cross into Gaza via the Rafah border. (REU)

Skepticism surrounds China's reported 5.2% economic growth in 2023, with some economists questioning the accuracy of official GDP data and offering a range of alternative estimates. This follows Beijing's claim of meeting its annual growth target of around 5%. (BBN)

UK inflation unexpectedly rose to 4% in December, the first increase in 10 months, causing a sell-off in gilts and affecting predictions on the Bank of England's rate cuts. This rise, mainly due to higher alcohol and tobacco prices, exceeded the 3.8% forecast by economists. (FT)

The Biden administration has revealed plans to forgive $4.9 billion in student debt for 73,600 borrowers. This debt relief stems from adjustments made by the U.S. Department of Education to its income-driven repayment plans and the Public Service Loan Forgiveness program. (CNBC)

Public Markets

Apple Inc. may remove the blood-oxygen feature from its Series 9 and Ultra 2 smartwatches to avoid a US ban amid a patent dispute with Masimo Corp. This change, approved by US Customs on January 12, aims to keep these models on the US market. (BBN)

Vodafone has formed a 10-year partnership with Microsoft to deliver AI and cloud services across Europe and Africa, targeting over 300 million users. The company will invest $1.5 billion in customer-focused AI using Microsoft's Azure OpenAI and Copilot, and plans to shift to Azure cloud services from physical data centers. (REU)

Shell has suspended its Red Sea shipments due to escalating tensions following U.S. and U.K. strikes on Yemen's Houthi rebels, who had attacked commercial vessels in the area. The Red Sea is a key route, handling around 12% of the world's seaborne oil trade. (WSJ)

Elon Musk, Tesla's CEO, is requesting a larger share and more control in the company, emphasizing his focus on robotics and AI. He's informed Tesla's board that he wants to own about 25% of the company to comfortably lead these initiatives, or else he might pursue these projects outside of Tesla. (WSJ)

Sheryl Sandberg, former Meta COO, has announced she will not seek reelection to Meta's board of directors, expressing gratitude and fond memories in a Facebook post. (CNBC)

The U.S. Justice Department is preparing to file an antitrust lawsuit against Apple Inc. as early as March. The suit alleges Apple restricts competition on its devices, a concern echoed by companies like Spotify and Tile. Details emerge from anonymous sources, citing discussions between Apple's lawyers and the Justice Department. (BBN)

Wayfair is cutting 13% of its global workforce, including 19% of its corporate team, in a restructuring effort aimed at streamlining the business and reducing management layers. This move is expected to save the company around $280 million and follows recent layoffs announced by Hasbro, Etsy, and Macy's. (CNBC)

Macy's is set to lay off 13% of its corporate staff and close five stores, cutting about 2,350 jobs or 3.5% of its total workforce, to reduce costs and improve customer experience. This plan was detailed in a memo to employees and confirmed by sources familiar with the situation. (WSJ)

Wendy's names Kirk Tanner, formerly of PepsiCo, as its new CEO, succeeding Todd Penegor who led since 2016. Despite surpassing Burger King in U.S. sales, Wendy's is grappling with a spending slowdown among low-income consumers. (CNBC)

Ford is reducing production of its F-150 Lightning electric pickup truck due to weaker demand for electric vehicles. Starting April 1, production at the Michigan Rouge Electric Vehicle Center will be cut to one shift. This comes after Ford previously announced a temporary reduction in one of the three shifts at the Michigan plant for the F-150 Lightning in October. (REU)

Real Estate

The opening of the Gordie Howe International Bridge, originally set for 2024, has been postponed by almost a year to September 2025 due to pandemic-related delays. This delay will also increase the project cost from $5.7 billion to $6.4 billion. (BRIDGE)

A penthouse on Billionaires' Row in New York City is in contract for about $115 million, significantly lower than its initial asking price. Developer Gary Barnett of Extell Development called it the most expensive residence they've ever sold but did not disclose the exact price or the buyer's identity. (WSJ)

Suffolk Construction and Fish and Weiner Ventures, specifically Stephen and Adam Weiner, have reached a settlement in the litigation related to their unsuccessful $800 million condominium project in Boston's Back Bay neighborhood. The parties released identical statements confirming the resolution, but the terms of the settlement were not disclosed. (TRD)

Blackstone Inc. is investing part of its record-breaking fund in the rental housing sector, an area it has expertise in. The company's $3.5 billion acquisition of Tricon Residential Inc., a Toronto-based landlord, will further establish Blackstone in the single-family rental industry, which it played a role in creating over a decade ago. This move underscores the continued appeal of the undersupplied housing market to investors as deal activity increases. (BBN)

Mergers & Acquisitions

Restaurant Brands International is set to invest approximately $1 billion to acquire Carrols, the largest U.S. franchisee of Burger King. This move follows over a year since the company announced its turnaround strategy for Burger King in the U.S. As part of the plan, Restaurant Brands intends to rapidly remodel 600 Burger King locations owned by Carrols within the next five years, before selling them back to franchisees. (CNBC)

Synopsys is set to acquire Ansys in a $35 billion deal, marking the biggest tech sector acquisition since Broadcom's $69 billion purchase of VMware. Ansys specializes in software for designing a wide range of products, including airplanes and tennis rackets. (REU)

Amazon will stream Detroit Tigers, Red Wings, and Pistons games in a partnership with Diamond Sports, which owns Bally Sports Detroit. This is part of Diamond's bankruptcy restructuring, and they hold rights to 37 professional teams across baseball, NBA, and NHL. (CRAIN)

JetBlue Airways and Spirit Airlines have announced their intention to appeal a recent federal judge's ruling that blocked their planned merger on antitrust grounds. The $3.8 billion deal, proposed in 2022, was halted by a U.S. District Court judge, citing concerns that it would eliminate Spirit as a budget carrier and lead to higher prices for consumers. Following the decision, Spirit's shares initially dropped but saw a recovery on Friday after the airline revealed plans to refinance some of its debt. (CNBC)

The EU is set to block Amazon's $1.7 billion acquisition of iRobot, maker of Roomba, due to competition concerns, leading to a drop in iRobot's shares. This follows a warning issued by the European Commission last November. (CNBC)

Earnings

Dear Valued Subscriber,

I am thrilled to share some exciting news with our newsletter community! On January 1st, 2024, we are launching T.H.E. Fund by Peridot, a groundbreaking hedge fund with a focus on Technology, Healthcare, and Energy investments.

Under the expert leadership of Peridot's founder, William Lemanske Jr, T.H.E. Fund offers a unique investment approach. By concentrating on these three dynamic sectors, we aim to maximize returns while steering clear of fixed income assets and adhering strictly to our core principles.

Having personally integrated this investment structure into my own portfolio over the last four years, I have witnessed its potential first-hand. Especially in a market where the S&P 500's performance is significantly influenced by just a handful of companies, T.H.E. Fund presents a smart diversification strategy. Our approach involves sector weighting based on market conditions and market capitalization, employing a long strategy in equities, and capitalizing on short-term returns through options and futures during periods of volatility.

As subscribers to our newsletter, you have the exclusive opportunity to be among the first to explore potential investment opportunities with T.H.E. Fund. We are beginning to accept investments at the start of the year, and I would be delighted to engage in a more in-depth discussion with you about this.

I believe T.H.E. Fund could be a significant addition to your investment portfolio. If you are interested in learning more about our diverse investment classes and wish to discuss further, please feel free to reach out to me via email.

Now enjoy your Read Sunday,

Founder & CEO, Peridot

William Lemanske

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply