- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

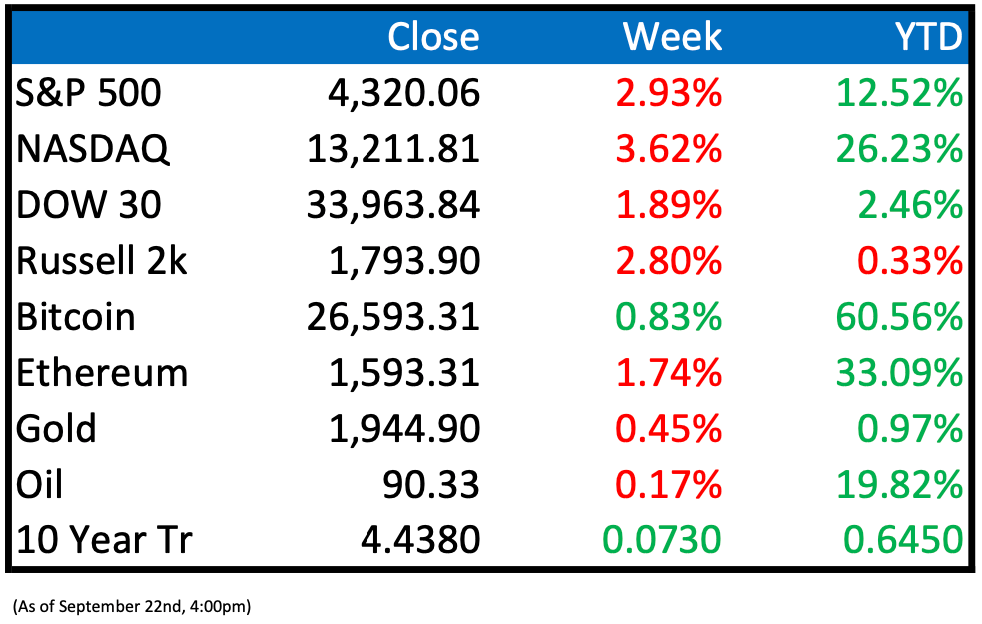

Market Recap

This Week’s Headlines

Public Markets

Federal Reserve officials decided to keep interest rates unchanged, a move influenced by the easing of inflationary pressures and aimed at allowing them additional time to evaluate their next course of action. Simultaneously, they indicated the possibility of another rate increase later in the year and extended their projections for interest rates to remain elevated for a longer duration than their earlier expectations. (NYT)

Rupert Murdoch, the influential conservative media mogul, is set to resign from his position as Chairman of both Fox Corp. and News Corp, owner of the Wall Street Journal and more.

The U.S. national debt has reached a milestone, surpassing $33 trillion for the first time in its history. (CNBC)

The United Auto Workers (UAW) is extending its strike against General Motors (GM) and Stellantis (formerly Fiat Chrysler). Ford has expressed its support for a deal, but GM and Stellantis are resisting the union's demands. The strategy of targeting all three Detroit automakers seems to be yielding results for the UAW. (BBG)

Economy

The prisoner exchange had been meticulously orchestrated, or so believed the American negotiators. After extensive negotiations with Iran, facilitated through intermediaries in the Persian Gulf region, key members of President Biden's team had ultimately reached an agreement on June 6th. This agreement would result in the release of four American detainees held in one of Iran's most infamous penitentiaries. In return, the United States would release $6 billion in previously frozen Iranian oil revenue and dismiss charges against Iranian individuals accused of breaching U.S. sanctions. (NYT)

In August, the construction of new homes in the United States experienced an 11.3% decline. Builders opted to reduce their efforts on initiating new projects and instead concentrated on finishing existing ones. This shift in construction momentum coincided with a rise in mortgage rates, which remained above the 7% mark, ultimately curbing the demand for home purchases. The last instance when the construction of new homes reached this level was back in June 2020. (MW)

Amazon is planning to hire an additional 250,000 seasonal workers, despite an overall slowdown in holiday hirings. (CNBC)

On Monday, the Marine Corps announced that it had successfully located the wreckage of an F-35B jet fighter that had gone missing after its pilot ejected in South Carolina on Sunday. (WSJ)

Mergers & Acquisitions

On Thursday, Cisco made a significant announcement regarding its acquisition plans. The company has revealed its intention to acquire Splunk, a software company specializing in security and observability, in a deal valued at $28 billion. This acquisition will involve paying $157 per share in cash for each Splunk share. (BAR)

In the realm of property debt, the Federal Deposit Insurance Corporation (FDIC) and its efforts to market Signature Bank's troubled $33 billion commercial real estate loan portfolio have garnered widespread attention. This week, Marathon Asset Management, led by CEO Bruce Richards, has announced its intentions to submit a bid for the loan portfolio. While the CEO did not disclose a specific bid amount, he did comment that the market has not yet experienced the full extent of its "real dislocation." Marathon Asset Management, a global firm managing $20 billion in assets, is positioning itself to participate in this significant transaction. (TRD)

TGS, a prominent provider of crucial data to the oil industry, has reached an agreement to acquire its struggling competitor, PGS, in an all-share transaction with a total valuation of 9.3 billion Norwegian crowns, equivalent to $864 million. This merger was jointly announced by the two companies, both of which are listed on the Oslo stock exchange. (RT)

Read Sunday - Opinion

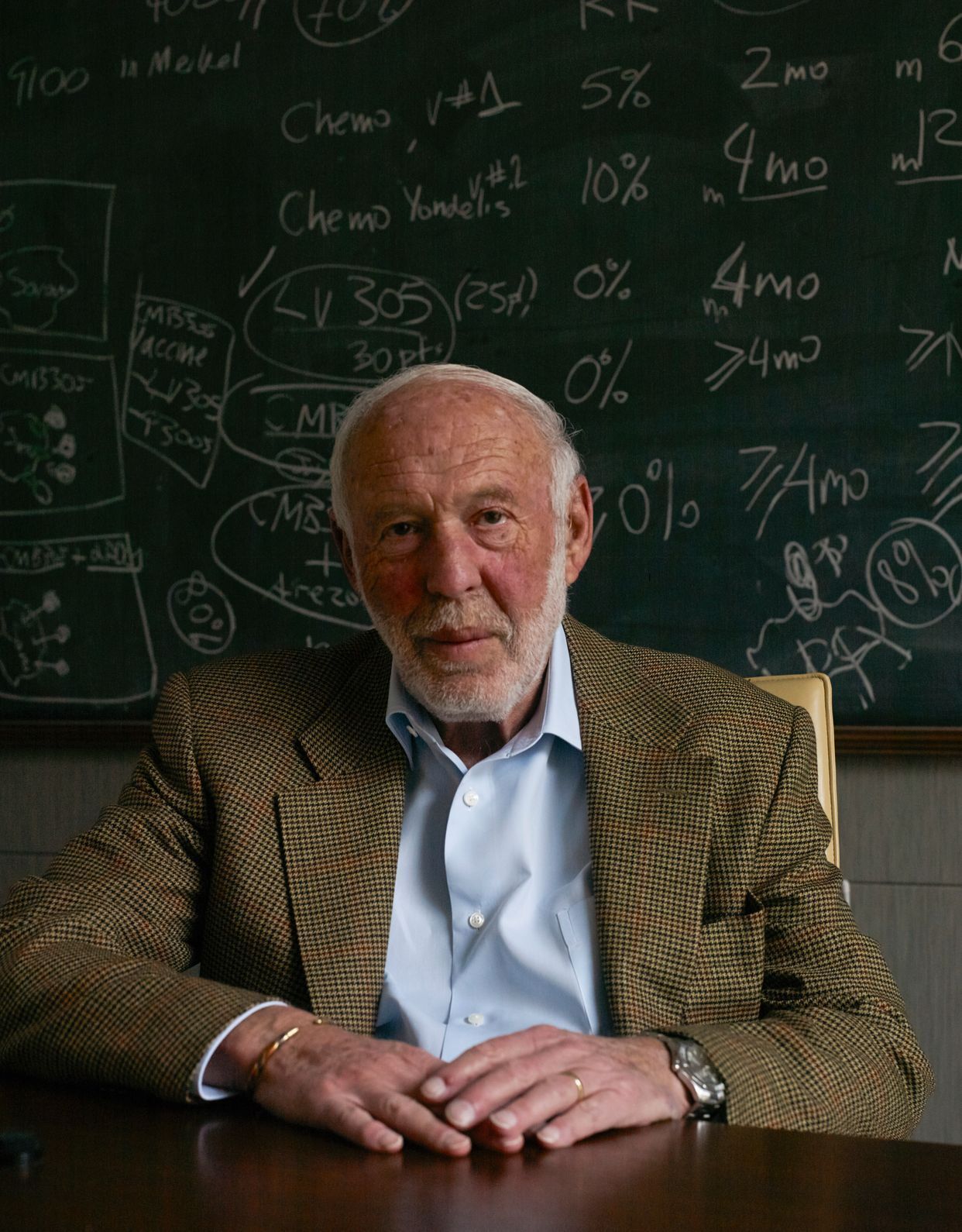

The Quant King

The Greatest Hedge Fund of All Time

Jim Simons, a name synonymous with innovation in quantitative trading, has reshaped the financial world through his pioneering work at Renaissance Technologies.

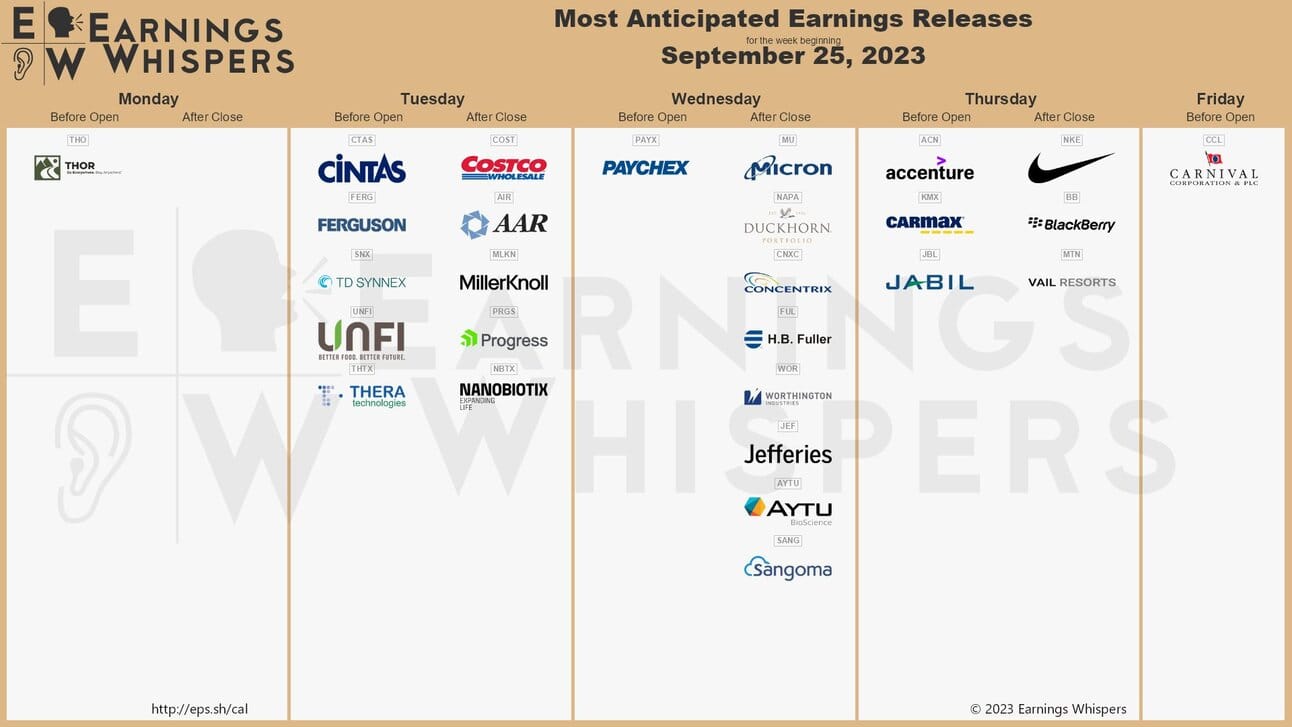

Earnings

Peridot Introduction

Discover the future of alternative asset management with Peridot Co. As a dynamic and innovative firm, we cater to both institutions and individuals, operating across a diverse spectrum of industries, including software, healthcare, energy, and real estate, to present unmatched investment opportunities.

Rooted in our unwavering principles of partnership, innovation, and long-term vision, we harness the power of advanced machine learning technology to inform our decisions, propelling the boundaries of alternative asset management strategies.

Our dedicated team scrupulously identifies and evaluates potential investments, ensuring meticulous risk management and alignment with our strategic goals. At the core of our success lies the bedrock of robust, trust-driven relationships with our partners, fueling the achievements of our investments.

Join us at Peridot Co and witness the evolution of alternative asset management—a journey that generates sustainable value across industries, ultimately leaving a positive imprint on your investment portfolio.

For more information reach out to:

Thanks for reading, see you next week!

Feel free to share with a friend!

Reply