- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Market Recap

This Week’s Headlines

Public Markets

In a recent statement, it was announced that British billionaire Jim Ratcliffe has reached an agreement to purchase 25 percent of Manchester United's (MANU) Class B shares from the Glazer family and has the option to acquire up to 25 percent of the club's Class A shares. Under this deal, both the Glazer family and the Class A shareholders will receive an equal price of $33.00 per share. Furthermore, Ratcliffe's Ineos Group will assume control of the football operations of the club, and he has committed to inject $300 million for future investments into Manchester United's iconic Old Trafford stadium. (NDAQ)

China's Nio Inc introduced a premium smartphone specifically tailored for use with its electric vehicles on Thursday. This innovative device offers a wide range of integrated features, including the ability to command the car to autonomously park itself using the phone. The debut of the Nio Phone represents a significant milestone as it becomes the first automobile-specific phone to be offered by a Chinese company. This development underscores the impressive level of advancement in electric vehicle technology within the world's largest automotive market. Notably, electric cars now constitute over a third of total vehicle sales in China, emphasizing the growing prominence of this eco-friendly transportation option. (REU)

Billionaire investor Nelson Peltz has resigned from his role at the Simon Wiesenthal Center following the organization's call for a boycott of Ben & Jerry's ice cream. Peltz, a board member at Unilever, the parent company of Ben & Jerry's, officially stepped down from his position at the center on December 12, as confirmed by sources familiar with the matter. (WSJ)

The New York Times has filed a copyright infringement lawsuit against OpenAI and Microsoft, alleging that its published articles were used without authorization to train AI chatbots that now compete with the newspaper as information sources. This marks the first major legal action by an American media organization against these companies. (NYT)

Apple (AAPL) has been granted a temporary reprieve, allowing it to resume sales of its flagship smartwatches. This development comes after a U.S. appeals court temporarily halted a government commission's import ban on the devices, which was imposed due to a patent dispute concerning their medical monitoring technology. Apple had urgently requested the U.S. Court of Appeals for the Federal Circuit to intervene and pause the order from the U.S. International Trade Commission (ITC). The ITC had previously determined that Apple had violated the patents held by Masimo (MASI), a company based in Irvine, California. (REU)

Alphabet's Google (GOOGL) has reached a settlement in a lawsuit that accused the company of covertly tracking the online activities of millions of users who believed they were browsing in private.

U.S. District Judge Yvonne Gonzalez Rogers in Oakland, California, has temporarily postponed the scheduled trial date of February 5, 2024, in this proposed class-action lawsuit. This decision comes after Google and the consumers' legal representatives reported that they have reached a preliminary settlement. (REU)

Due to pricing concerns, asthma medication for children became unavailable earlier this year. Starting January 1st, pharmaceutical companies that significantly raised prices must now pay Medicaid for patients using their drugs. In response, companies like Eli Lilly, Novo Nordisk, Sanofi, and GlaxoSmithKline are cutting prices for various medications, with some insulin products seeing reductions of 70% or more. (WSJ)

Economy

The CSI 300 Index experienced a substantial 2.3% increase, marking its most significant single-day gain in five months. This surge was fueled by overseas investors, who net-purchased onshore equities amounting to 13.6 billion yuan ($1.9 billion) during Thursday's trading session. Particularly noteworthy was the remarkable performance of industrial stocks, which have been the worst-performing sector on the CSI 300 this year; they surged by almost 4%. Additionally, the Chinese yuan showed strength in both onshore and offshore markets, reflecting positive sentiment in the currency markets. (BBN)

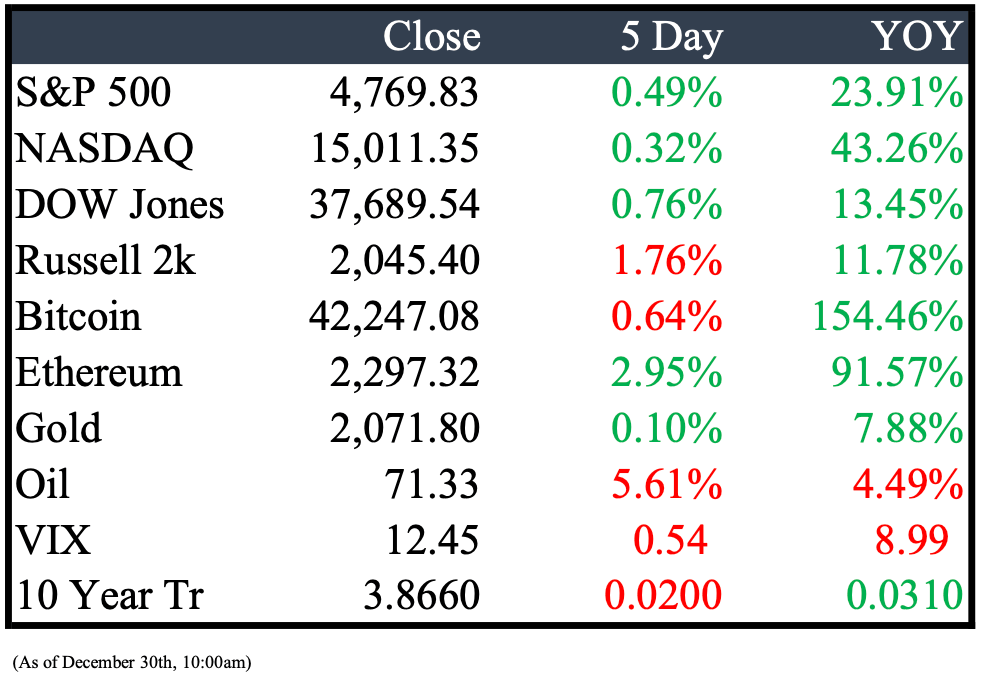

In 2023, the S&P 500 surprised with a 24% gain, thanks to slowing inflation, a strong economy, and signals of the Federal Reserve ending rate hikes. The S&P 500 had its best winning streak since 2004, and Big Tech stocks boosted the Nasdaq Composite to its strongest performance since 2020, driven by AI optimism. (CNBC)

U.S. President Joe Biden aimed to establish a robust international response to the Houthi attacks on Red Sea shipping through the creation of a new maritime force. However, one week after its initiation, several allies are reluctant to associate themselves with it, whether publicly or at all. Notably, two European allies, Italy and Spain, both listed as contributors to Operation Prosperity Guardian, have released statements that seem to indicate a distancing from the maritime force. (REU)

Delta Air Lines (DAL) is planning to hire approximately half as many pilots in the upcoming year as it did in 2023. This marks a notable slowdown in a pilot hiring trend that has been ongoing for over two years. Major airlines have been rapidly hiring pilots to meet the surge in travel demand following the Covid-19 pandemic. Last year, they hired over 13,000 pilots, and they are on course to hire nearly as many this year, as reported by FAPA, a pilot career advisory firm. However, Delta's reduced pilot hiring plans suggest a shift in this hiring spree. (WSJ)

Angola has officially announced its decision to withdraw from the Organization of the Petroleum Exporting Countries (OPEC), as reported by the official news agency Angop. This move comes after a recent dispute with the cartel over oil production quotas.

Angola, one of OPEC's significant African producers, was involved in a disagreement over production quotas that led to a four-day delay in the November OPEC meeting. (WSJ)

Mergers & Acquisitions

Bristol Myers Squibb (NYSE: BMY) and RayzeBio, Inc. (NASDAQ: RYZB) have officially confirmed a definitive merger agreement. According to the terms of the agreement, Bristol Myers Squibb will purchase RayzeBio for $62.50 per share in cash, resulting in a total equity value of roughly $4.1 billion. After accounting for the estimated cash that will be acquired as part of the transaction, the net value amounts to approximately $3.6 billion. It's important to note that this merger has received unanimous approval from both the Boards of Directors at Bristol Myers Squibb and RayzeBio. (BMY)

Luxury fashion conglomerate Golden Goose is preparing for an initial public offering (IPO) in Milan with the aim of raising approximately 1 billion euros ($1.1 billion), according to sources close to the matter who spoke to Reuters. Permira, the company's majority owner, has engaged seven banks to underwrite this IPO, which is expected to be one of the largest in Europe for the upcoming year. (REU)

A U.S. court has upheld a Federal Trade Commission (FTC) order preventing IQVIA (IQV) from acquiring DeepIntent, a healthcare advertising company, on the grounds that it could negatively impact competition. DeepIntent, a subsidiary of Propel Media, a digital advertising firm, had entered into an agreement with IQVIA, a U.S.-based healthcare data and analytics company, in 2022 with the goal of enhancing communication between patients and healthcare providers. However, the court's decision maintains the FTC's concerns about the potential anti-competitive consequences of this acquisition. (REU)

UnitedHealth Group (UNH) has announced an agreement to sell its Brazilian operations to José Seripieri Filho, the founder and former CEO of health insurance company Qualicorp. This move confirms earlier reports from Reuters about the sale of UnitedHealth's Brazilian health insurance subsidiary, Amil, to Seripieri, who departed from Qualicorp in 2019. According to sources, Seripieri's bid for the acquisition was estimated to be around 2.5 billion reais ($515.24 million). (REU)

AstraZeneca (AZN) has announced its intention to acquire Gracell Biotechnologies (GRCL) for a sum of up to $1.2 billion. This acquisition is part of AstraZeneca's strategy to expand its cell therapy efforts and strengthen its presence in China, the world's second-largest pharmaceutical market. The all-cash transaction will bring several experimental therapies into AstraZeneca's portfolio and values Gracell at $2 per ordinary share, or $10 per American Depository Share (ADS). This represents a substantial premium of 61.6% over Gracell's last closing price on December 22nd. (REU)

Harbour Energy (HBR) has announced its acquisition of most of the upstream assets of oil and gas producer Wintershall Dea for a total of $11.2 billion, paid in cash and shares. This transaction involves the purchase from Wintershall Dea's shareholders, BASF (BASFY) and LetterOne. The deal encompasses Wintershall Dea's upstream assets located in various countries, including Norway, Germany, Denmark, Argentina, Mexico, Egypt, Libya, and Algeria. Additionally, it includes the acquisition of carbon-dioxide capture and storage licenses in Europe. (WSJ)

Energy infrastructure firm Williams (WMB) has entered into an agreement to acquire a portfolio of Gulf Coast natural gas storage assets from an affiliate of commodities trading company Hartree Partners for $1.95 billion. This acquisition encompasses six underground natural gas storage facilities located in Louisiana and Mississippi, boasting a combined capacity of 115 billion cubic feet. Additionally, it includes 230 miles of gas transmission pipeline and connections to Transco, the largest natural gas transmission pipeline in the United States. (WSJ)

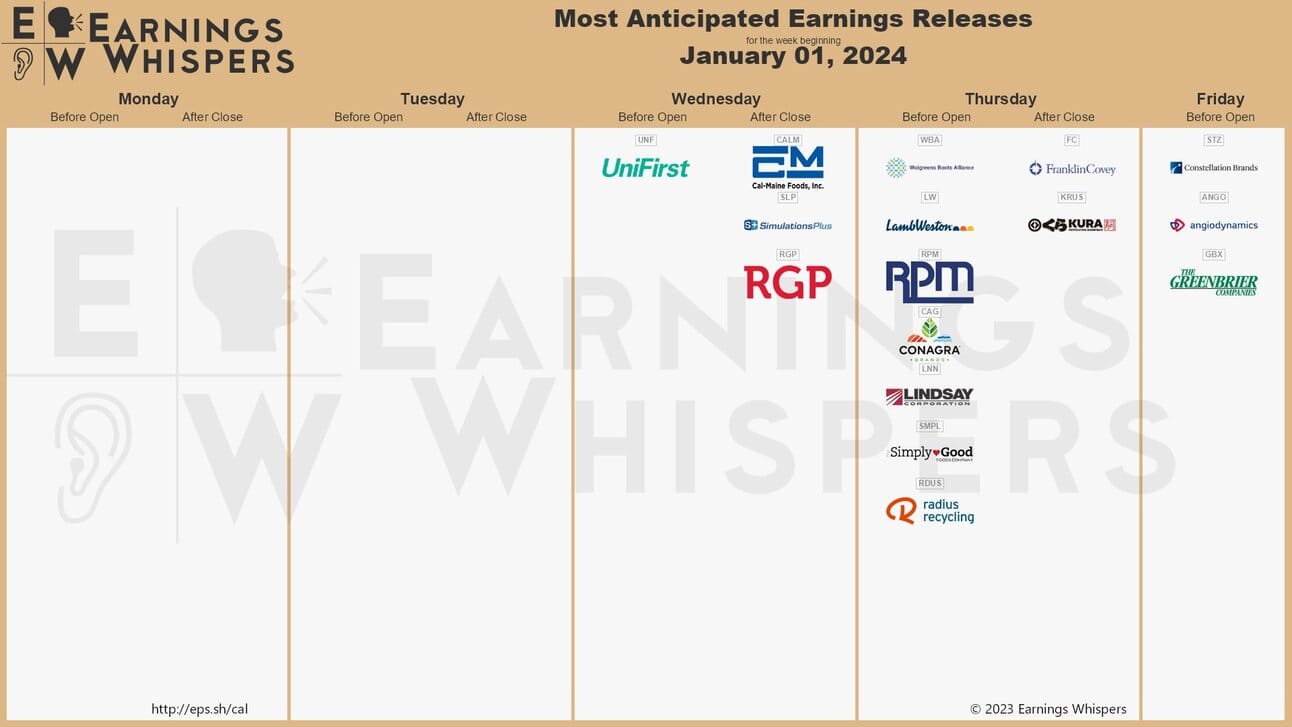

Earnings

Peridot Hedge

Dear Valued Subscriber,

I am thrilled to share some exciting news with our newsletter community! On January 1st, 2024, we are launching T.H.E. Fund by Peridot, a groundbreaking hedge fund with a focus on Technology, Healthcare, and Energy investments.

Under the expert leadership of Peridot's founder, William Lemanske Jr, T.H.E. Fund offers a unique investment approach. By concentrating on these three dynamic sectors, we aim to maximize returns while steering clear of fixed income assets and adhering strictly to our core principles.

Having personally integrated this investment structure into my own portfolio over the last four years, I have witnessed its potential first-hand. Especially in a market where the S&P 500's performance is significantly influenced by just a handful of companies, T.H.E. Fund presents a smart diversification strategy. Our approach involves sector weighting based on market conditions and market capitalization, employing a long strategy in equities, and capitalizing on short-term returns through options and futures during periods of volatility.

As subscribers to our newsletter, you have the exclusive opportunity to be among the first to explore potential investment opportunities with T.H.E. Fund. We are beginning to accept investments at the start of the year, and I would be delighted to engage in a more in-depth discussion with you about this.

I believe T.H.E. Fund could be a significant addition to your investment portfolio. If you are interested in learning more about our diverse investment classes and wish to discuss further, please feel free to reach out to me via email.

Now enjoy your Read Sunday,

Founder & CEO, Peridot

William Lemanske

Thanks for reading, see you next week!

Feel free to share with a friend!

Reply