- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

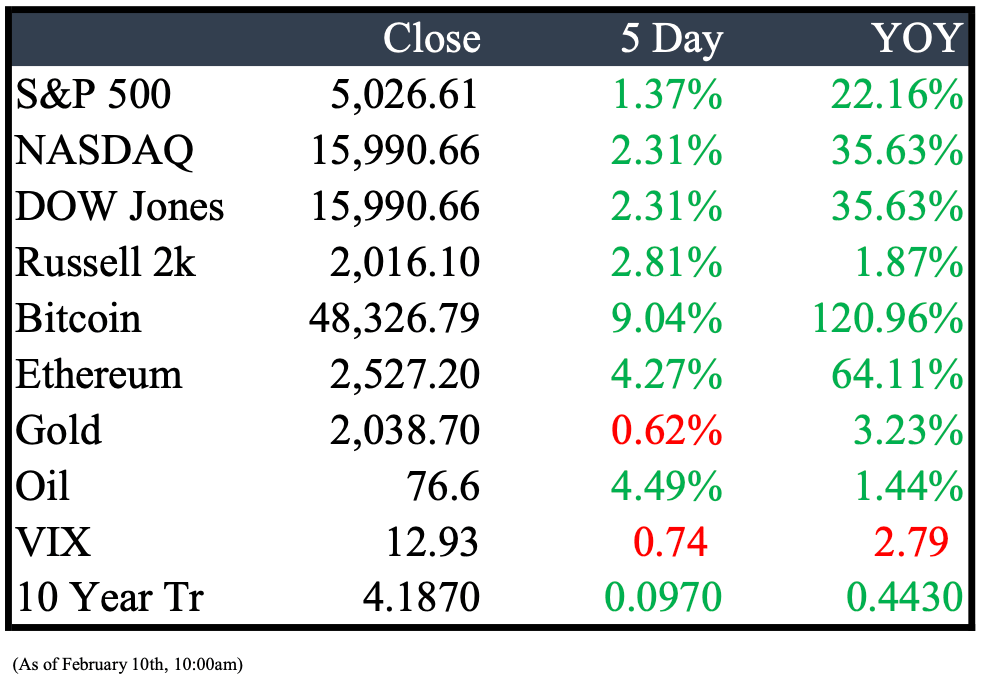

Market Recap

This Week’s Headlines

Economy & World News

China is increasing trading restrictions on domestic and some offshore investors to halt a stock market decline. This includes limiting cross-border total return swaps, a method used for short selling Hong Kong stocks, aiming to stabilize the market. (BBN)

Federal Reserve Chair Jerome Powell indicated that interest rate cuts might not happen until after March, as the Fed awaits more economic data to ensure inflation is moving towards their 2% target. This was stated in an interview on CBS's 60 Minutes, where Powell aimed to clarify the central bank's reasoning for potential future rate reductions to the general public. (BBN)

Israel plans to issue a near-record level of bonds to fund its conflict with Hamas, a move complicated by its first-ever credit rating downgrade by Moody’s to A2. Despite the downgrade, Israel remains in investment grade. The country aims to tap into the shekel debt market and increase sales of foreign-currency bonds through private deals to finance the military operations. (BBN)

Chile and Southern California, known for their temperate climates, are experiencing severe weather disasters. Wildfires in Chile have killed over 120 people, while record-breaking rains in Southern California have caused floods and mudslides. These events are fueled by climate change, which intensifies weather patterns, and El Niño, which amplifies extreme weather. In California, an atmospheric river driven by high Pacific temperatures led to warnings of unprecedented rainfall, with some areas facing the possibility of receiving a year's rain in a single day. (NYT)

Public Markets

Boeing is fixing 50 undelivered 737 MAX jets due to misdrilled holes in fuselages supplied by Spirit AeroSystems, causing potential short-term delivery delays. This issue, flagged by a Spirit employee, has not affected the operational safety of existing 737s. Spirit's shares dropped ahead of its quarterly earnings report. (WSJ)

Tony Spring began his tenure as Macy's new CEO on Sunday, transitioning from his previous role as CEO of Bloomingdale's. With a strong retail background and decades of experience at Bloomingdale's, Spring is recognized for his acute merchant skills and strong relationships with prominent national and global brands. However, he faces challenges ahead as he leads Macy's, a department store grappling with decelerating sales and pressure from activist investors. (CNBC)

ESPN, Fox Corp., and Warner Bros. Discovery are collaborating to launch a large sports-streaming service featuring content from all major leagues, aiming to transform the sports and media industry. This direct-to-consumer service, yet to be named, will allow streaming of sports content from these companies, as announced in a statement. Set to debut in the fall, the venture will be equally owned by the three companies, though pricing details have not been disclosed. (WSJ)

Moody's Investors Service downgraded New York Community Bancorp's credit rating to junk status, citing multifaceted financial risks and governance challenges. This decision came shortly after the regional bank reduced dividends and increased reserves for potential loan losses in its commercial real estate portfolio. The bank's long-term issuer rating was lowered to Ba2, two levels below investment grade. Moody's also indicated the possibility of further downgrades if the bank's conditions worsen. (BBN)

The hedge fund billionaire, Bill Ackman, is set to launch a closed-end fund focusing on 12 to 24 North American large-cap, investment-grade companies that demonstrate "durable growth," as detailed in a regulatory filing. Notably, Ackman's new fund will not include a performance fee. (CNBC)

Nvidia is establishing a new business division dedicated to creating custom chips for cloud computing companies and other sectors, with a focus on advanced artificial intelligence (AI) processors. According to nine sources familiar with the plans, Nvidia, a leading designer and supplier of AI chips globally, is aiming to secure a share of the rapidly expanding market for custom AI chips. This move is also seen as a strategy to protect its market position against the increasing competition from companies seeking alternatives to Nvidia's products. (REU)

Real Estate

Gestamp plans to build a 460,000-square-foot plant in Macomb County, employing 390 workers to supply parts to GM's Orion Assembly factory. Located in Chesterfield Township on a 42-acre plot, the facility has potential for a 300,000-square-foot expansion. (CRAIN)

Ian Jacobs, heir to the Reichmann real estate dynasty, is venturing into San Francisco's downtown real estate market, diverging from his past focus on stock investing. Despite the market's current unpopularity, Jacobs has gathered financial backing from family and wealthy investors to buy office buildings, aiming to disprove doubts about the viability of downtown office spaces in San Francisco. (WSJ)

In the 1980s, financier John Donahue was flying over Naples, Florida, when he noticed an untouched parcel of land along the Gulf of Mexico, located at Gordon Pointe. Inspired by the sight, he expressed his desire to visit the area to his wife, Rhodora Donahue. Fulfilling this wish, Donahue purchased the approximately 4.3-acre property for $1 million in 1985. At the time of purchase, the land was undeveloped, hosting only a small fishing cottage amidst mangroves. (WSJ)

Luxury retailers are making significant investments in real estate within the world's most prestigious shopping districts. In New York City, Prada has recently decided to purchase the building of its Fifth Avenue store and the adjacent building for over $800 million. Nearby, Kering, the parent company of Gucci, is acquiring a 115,000-square-foot retail space for nearly $1 billion. Additionally, LVMH Moët Hennessy Louis Vuitton is currently negotiating to buy the Fifth Avenue retail space hosting Bergdorf Goodman’s men’s store, showcasing the luxury sector's bullish approach to securing prime retail locations. (WSJ)

Mergers & Acquisitions

Novo Nordisk's parent company announced its plans to acquire Catalent, a drug manufacturer, in a deal worth $16.5 billion. This acquisition is expected to enhance the production of Wegovy, a popular weight loss injection, and Ozempic, a diabetes treatment, as Catalent is a key provider of fill-finish services for Wegovy. Additionally, as part of the agreement, Novo Nordisk will purchase three manufacturing sites from Catalent's parent company for $11 billion. (CNBC)

Merck will acquire Elanco Animal Health's aquaculture business for $1.3 billion, enhancing its aquatic health portfolio. Following the announcement, Elanco's shares jumped over 7% in premarket trading. This move builds on Merck's prior acquisitions in the aquatic health sector. (REU)

In 2017, Epic Games joined Disney's Accelerator program with aims to merge Disney characters into its games. Disney CEO Bob Iger recently announced a $1.5 billion investment to bring Disney, Marvel, Pixar, and Star Wars characters to Fortnite, acknowledging the gaming engagement of younger generations. (REU)

Adam Neumann, with investors like Dan Loeb's Third Point, is looking to buy WeWork Inc. out of bankruptcy. They've been gathering information and organizing a bankruptcy financing package for the co-working firm since December. (BBN)

The Flynn Group, recognized as the largest global franchisee operator of restaurants and fitness clubs, is considering the sale of a majority stake, potentially valuing the company at over $5 billion, debt included. The company manages franchises for well-known brands like Applebee's, Taco Bell, Panera Bread, Arby's, Pizza Hut, Wendy's, and Planet Fitness. To facilitate the sale process, Flynn Group is collaborating with Bank of America, according to insiders. (REU)

On Monday, it was announced that Everbridge, a software company, will be acquired by the U.S. private equity firm Thoma Bravo in an all-cash deal valued at approximately $1.5 billion. Thoma Bravo has proposed a purchase price of $28.60 per share to Everbridge shareholders, which is a 20% premium over the stock's last closing price. Following the announcement, Everbridge's stock price surged over 18% in premarket trading. Established following the events of 9/11, Everbridge specializes in aiding businesses and governments in preparing for, managing, and recovering from critical situations. (REU)

Earnings

Building Value Through Purposeful Investments.

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply