- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Building Value Through Purposeful Investments.

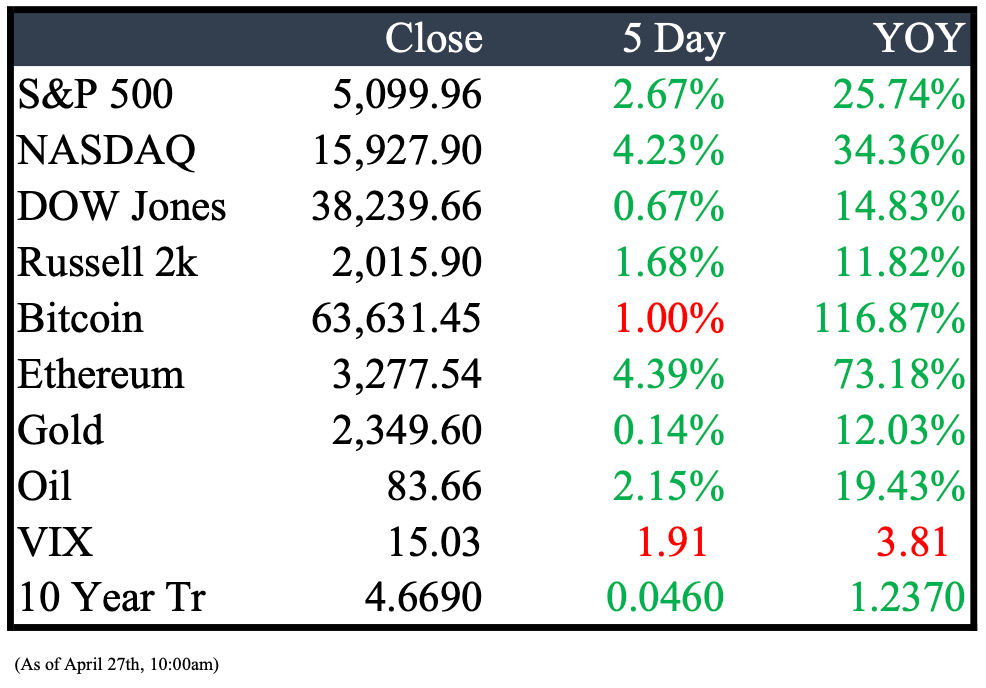

Market Recap

This Week’s Headlines

Economy & World News

Iranian President Ebrahim Raisi, Foreign Minister Hossein Amirabdollahian, and nine others, including the Governor of East Azarbaijan, Malek Rahmati, perished in a helicopter crash in northern Iran’s Varzaqan region, state media reported. The incident occurred last Sunday evening as Raisi was returning from the inauguration of a dam along the border with Azerbaijan. (CNBC)

FDIC Chairman Martin Gruenberg announced his resignation following an external investigation into widespread sexual harassment at the agency and criticism from bipartisan lawmakers. In an email, Gruenberg stated he would step down once a successor is confirmed, maintaining his role until then to help transform the agency's workplace culture. (WSJ)

A passenger died from a suspected heart attack and 30 others were injured when a Singapore Airlines flight experienced severe turbulence. The incident occurred while breakfast was being served on the flight from London to Singapore, leading to an emergency landing in Bangkok, according to the airport's general manager, Kittipong Kittikachorn. (REU)

The Biden administration is set to cancel $7.7 billion in federal student loans for 160,000 borrowers through various existing programs, elevating the total debt erased to $167 billion for nearly 5 million Americans. This latest relief targets borrowers who meet specific criteria in three categories, including those enrolled in both new and existing income-driven repayment plans and those eligible through the Public Service Loan Forgiveness program. President Biden emphasized his commitment to making higher education a gateway to the middle class rather than a barrier, despite opposition from some Republican officials. (AP)

Economists anticipate that the latest U.K. inflation data, set to be released on Wednesday, could bring the headline rate close to, or even below, the Bank of England's target of 2%. This expected decrease is primarily attributed to a significant drop in energy prices in April. Meanwhile, the financial markets are split on the possibility of an interest rate cut in June, with the level of services inflation likely playing a crucial role in the decision. (CNBC)

Spain, Norway, and Ireland have announced their recognition of an independent Palestinian state, signaling a diplomatic setback for Israel amidst its ongoing military campaign in Gaza. This move reflects Israel's growing global isolation and highlights the impracticality of awaiting a peace deal with Israel's current government, which opposes a two-state solution and continues its military actions. (NYT)

Nikki Haley, initially seen as a figure who could restore moral integrity to a Republican Party dominated by Donald Trump, has reversed her stance. Despite previously criticizing Trump as "unfit for office" and "unhinged," Haley announced on Wednesday that she would vote for him, reinforcing the perception held by many Americans that politicians, particularly those who support Trump, are untrustworthy. (BBN)

Norfolk Southern has agreed to a settlement exceeding $310 million related to the February 2023 derailment of a freight train in East Palestine, Ohio. The agreement, pending federal court approval, mandates the rail company to enhance safety measures and cover the costs of cleanup, health assessments, and environmental monitoring following the incident, which involved the derailment of 38 rail cars, including 11 carrying hazardous materials like vinyl chloride. This event led to significant evacuations and disruptions in the town, although there were no fatalities. (NYT)

The NCAA and the top five athletic conferences have reached a $2.77 billion settlement in a class-action lawsuit, marking a historic shift in college sports by allowing schools to directly pay athletes. This decision diverges from the NCAA's long-standing policy of maintaining amateur status for college athletes, preventing them from earning from endorsements or receiving a share of broadcast revenues. The settlement addresses claims dating back to 2020 for compensation that athletes were previously denied. (WSJ)

Steve Schwarzman, CEO of Blackstone Inc. and a prominent political donor, has announced his intention to fundraise for Donald Trump’s campaign, providing a significant boost to the presumptive Republican nominee as he expands his donor base. Although Schwarzman has been a major financial supporter of the Republican party, his specific endorsement of Trump had been uncertain until now. (BBN)

Public Markets

Gold prices reached a new record, peaking at $2,449.89 per ounce, driven by a combination of U.S. rate cut expectations, Chinese economic stimulus, and global political tensions, which also pushed silver prices to their highest in over 11 years. Factors like subdued U.S. inflation data fueling rate cut hopes and concerns over U.S. debt levels have created a "perfect storm" keeping gold markets buoyant, according to RJO Futures' senior market strategist, Daniel Pavilonis. (CNBC)

Ivan F. Boesky, a notorious figure from the 1980s Wall Street insider trading scandals, died at 87 in his La Jolla home. Boesky, who inspired the character Gordon Gekko in the film "Wall Street," faced a landmark insider trading charge in 1986, resulting in a $100 million penalty and significant repercussions across Wall Street. (NYT)

PepsiCo announced plans to enhance its fleet of electric vehicles in California by adding 50 Tesla Semi trucks and 75 Ford E-Transit vans over the coming months. This expansion is part of the company's strategy to transition its equipment services fleet to electric in California, aiming to achieve net zero emissions by 2040. (REU)

Amazon plans to launch an enhanced version of its voice assistant this year, which will be available for a monthly fee rather than included with Amazon Prime, according to sources. This move comes as competitors like OpenAI introduce advanced chatbots capable of two-way conversations, while Alexa remains popular for simpler tasks like setting timers and providing weather updates. (CNBC)

DuPont announced it will split into three publicly traded companies, focusing separately on its electronics, water businesses, and a diversified industrial company. This strategic move, which involves tax-free transactions, caused its shares to rise by 5% after trading hours. Additionally, DuPont appointed CFO Lori Koch as CEO effective June 1, with current CEO Ed Breen transitioning to executive chairman. (REU)

Goldman Sachs Group Inc. is the first Wall Street bank to respond to Saudi Arabia's directive requiring foreign firms to establish their Middle Eastern headquarters in the kingdom. The bank has secured a license from Saudi Arabia's Ministry of Investment to set up its regional base in Riyadh. (BBN)

Tesla is constructing a $200 million factory in Shanghai's Lingang area to produce Megapack energy storage batteries, marking its first battery facility outside the U.S. Set to start mass production in 2025, the plant aims for an initial capacity of 10,000 units annually, reinforcing Tesla's commitment to the Chinese market amidst global economic tensions. (AP)

The U.S. Department of Justice has filed an antitrust lawsuit against Live Nation, the parent company of Ticketmaster, alleging significant antitrust violations. This legal action stems from a DOJ investigation initiated in 2022, fueled by public outrage over a poorly managed ticket release for Taylor Swift’s Eras Tour. According to the lawsuit, Ticketmaster, through its affiliation with Live Nation, controls about 80% of the primary ticketing for major concert venues. (CNBC)

Real Estate

The nation's largest mortgage lender has introduced a new 0% down payment program, aimed at alleviating a significant barrier for many prospective homebuyers. However, opinions among local real estate experts vary, with some describing it as a "game-changer" and others cautious about its broad suitability and impact on the market. (CRAIN)

A new recreation facility and park, Merit Park, spearheaded by the nonprofit Give Merit, broke ground in a west-side Detroit neighborhood, aiming to transform community space and foster hope. The project, located at 10123 Grand River Ave near I-96 and Livernois, is led by David Merritt, a former University of Michigan basketball player and co-founder of Merit Goodness. (CRAIN)

U.S. sales of new single-family homes dropped significantly in April, falling 4.7% to a seasonally adjusted annual rate of 634,000 units, as reported by the Commerce Department's Census Bureau. This decline, steeper than expected, was influenced by rising mortgage rates and higher home prices, indicating a slowdown in the housing market as the second quarter progresses. The sales figures for March were also revised downward from 693,000 units to 665,000 units. (REU)

Mergers & Acquisitions

Henderson Park, an international private equity real estate firm, has purchased the Arizona Biltmore resort from Blackstone Real Estate for $705 million. The resort, known as the "Jewel of the Desert," features extensive amenities, including seven pools and a large spa, and will be managed by Pyramid Global Hospitality, with financing provided by Morgan Stanley, Deutsche Bank, and J.P. Morgan. (BX)

Anglo American has turned down a third takeover bid from BHP Group, valued at approximately £29.34 per share, while both companies agreed to extend their discussion deadline by an additional week. BHP's proposal, which included demands for Anglo to separate its platinum and iron ore assets in South Africa, was rejected by Anglo as being too complex and risky. (CNBC)

JPMorgan Chase & Co. is actively looking to acquire a private credit firm to enhance its $3.6 trillion asset management division, aiming to expand further into a highly popular sector on Wall Street. The bank's interest in bolstering its private capital business led to discussions with Chicago-based Monroe Capital earlier this year, although the talks did not result in a deal, according to sources who requested anonymity. (BBN)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply