- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Building Value Through Purposeful Investments.

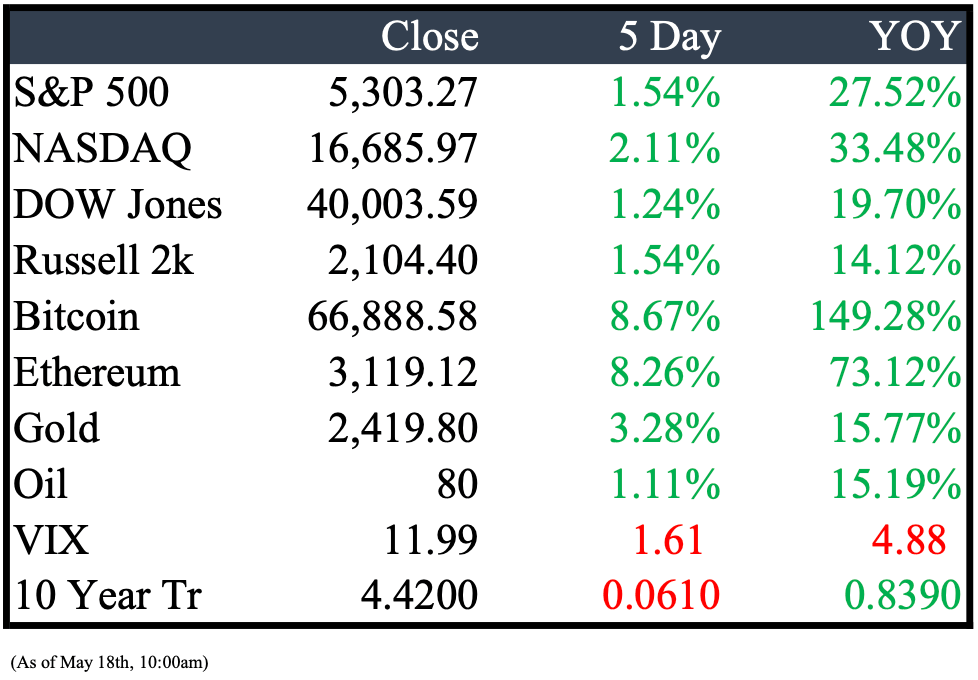

Market Recap

This Week’s Headlines

Economy & World News

President Vladimir V. Putin of Russia replaced his defense minister with economist Andrei R. Belousov to make Russia's war effort more economically sustainable. The former minister, Sergei K. Shoigu, was appointed to the security council, while Nikolai P. Patrushev will be moved to another position. (NYT)

SoftBank's Vision Fund reported a 724.3 billion Japanese yen ($4.6 billion) gain for the fiscal year ending in March, its first profit since 2021. Founder Masayoshi Son announced in 2023 that the firm would shift from a cautious approach to an aggressive investment strategy. (CNBC)

Beijing's economic stimulus is underway as China's Ministry of Finance plans to sell 1 trillion yuan ($138 billion) of special sovereign bonds to boost credit demand. This comes amid urgent economic challenges, with new home prices falling for the tenth consecutive month in April and annual growth in total social financing hitting a record low of 8.3%. (REU)

Illinois state treasurer Michael Frerichs urged Exxon Mobil shareholders to vote against the election of CEO Darren Woods due to the company's lawsuit against two shareholders, according to a filing on Monday. Frerichs also recommended voting against Lead Independent Director Joseph Hooley at the upcoming annual shareholder meeting on May 29. Exxon filed the lawsuit to block a vote on a climate proposal submitted by two small activist investors earlier this year. (REU)

The producer price index (PPI), which measures what producers receive for their goods, increased by 0.5% in April and 2.2% over the past year, marking the largest gain in a year. The core PPI also rose by 0.5%, exceeding the 0.2% estimate by Dow Jones. Services prices contributed significantly to the wholesale inflation, rising 0.6% and accounting for about three-quarters of the overall increase. (CNBC)

Nearly a week after Ascension discovered a ransomware attack within its systems, the St. Louis-based health system, the nation's sixth largest, remains operational, accepting cash payments and empty pill bottles. Ascension issued a statement late Monday to update patients on the ongoing challenges posed by the cyberattack. (CRAIN)

The U.S. Department of Education announced on Tuesday that the interest rates on federal student loans for the 2024-2025 academic year will be 6.53% for undergraduate loans, the highest rate in at least a decade, according to higher education expert Mark Kantrowitz. (CNBC)

The CPI report showed a 0.3% increase from March, according to the Labor Department’s Bureau of Labor Statistics. Inflation eased slightly in April, offering some relief for consumers. On a 12-month basis, the CPI rose 3.4%, meeting expectations. Core inflation, excluding food and energy, was 3.6%, the lowest since April 2021. (CNBC)

Wong, 51, will be Singapore’s first prime minister born after the country's independence in 1965. Several Cabinet changes were announced Monday as part of the planned leadership transition. Trade and Industry Minister Gan Kim Yong was promoted to deputy prime minister, while former Prime Minister Lee Hsien Loong will stay on as senior minister. (CNBC)

Slovakia's populist prime minister and longtime leader, Robert Fico, remained in critical condition Thursday morning after being shot multiple times at close range in what officials suspect was a politically motivated attack. The 59-year-old premier was shot in the city of Handlova, east of the Slovak capital, and the suspected gunman has been apprehended. (WSJ)

Arush Sehgal and Acaena Amoros Romero lost their life savings in the collapse of FTX. Despite a significant rebound in the crypto market, where Bitcoin's value surged over the next year and a half, potentially increasing their FTX holdings to at least $4 million, their funds remain tied up in bankruptcy court. Although FTX plans to pay back customers 100% of what they’re owed plus interest, the repayment will be in US dollars based on the value of their accounts when FTX went bankrupt in November 2022, causing them to miss out on the recent crypto bull run. (BBN)

President Biden and former President Trump agreed to participate in debates in June and September, hosted by CNN and ABC News, respectively, bypassing the traditional debate commission. The CNN debate will be on June 27 in Atlanta without an audience, and the ABC debate will be on September 10, also without an audience. This follows a public exchange where Biden proposed the dates, Trump accepted, and Biden's campaign informed the debate commission they would not participate in its proposed fall debates, preferring to coordinate directly with networks. (WSJ)

Overdose deaths in the United States declined slightly in 2023, marking the first decrease in five years, according to preliminary federal data. Researchers attributed the decline mainly to fewer deaths from synthetic opioids like fentanyl. However, deaths from stimulants like cocaine and methamphetamine rose, and states like Oregon and Washington saw sharp increases in overall overdose fatalities. The estimated total overdose deaths in 2023 were 107,543, down 3% from 111,029 in 2022, with opioid deaths dropping 3.7%, cocaine deaths rising 5%, and meth deaths increasing 2%. (NYT)

The Supreme Court ruled that the funding structure of the Consumer Financial Protection Bureau (CFPB) is legal, safeguarding the agency from potential budgetary blocks by a divided Congress. The CFPB, currently funded by the Federal Reserve system, faced an existential threat if Republicans blocked its annual appropriations. Justice Clarence Thomas wrote the 7-2 majority opinion, joined by Chief Justice John Roberts and Justices Brett Kavanaugh, Amy Coney Barrett, Sonia Sotomayor, Elena Kagan, and Ketanji Brown Jackson. (CNBC)

Retail sales in China increased by 2.3% in April compared to the previous year, according to the National Bureau of Statistics. Industrial production rose by 6.7% year-over-year in April, surpassing the expected 5.5% growth. However, fixed asset investment for the first four months of the year grew by 4.2%, falling short of the anticipated 4.6% increase. Additionally, China will begin a six-month program on Friday to issue long-term bonds for funding strategic projects. (CNBC)

Mercedes-Benz workers in Alabama have voted against union representation by the United Auto Workers (UAW), according to the National Labor Relations Board. This result is a setback for the UAW's organizing efforts, coming just a month after the union successfully organized around 4,330 workers at a Volkswagen plant in Tennessee. The Mercedes-Benz vote was anticipated to be more challenging, as the UAW had already attempted and failed to organize the Volkswagen plant twice in the past decade before their recent success. (CNBC)

Public Markets

Microsoft announced on Thursday that it plans to offer its cloud computing customers a platform of AMD artificial intelligence chips, competing with Nvidia components. Details will be revealed at Microsoft's Build developer conference next week, where they will also launch a preview of the new Cobalt 100 custom processors. Microsoft's Azure cloud service will feature clusters of AMD's flagship MI300X AI chips, providing customers with an alternative to Nvidia's H100 GPUs, which dominate the AI data center chip market but are often in short supply due to high demand. (REU)

OpenAI introduced a new AI model called GPT-4o and a desktop version of its popular chatbot, ChatGPT. OpenAI's technology chief, Mira Murati, stated in a live streamed event that this marks a significant improvement in ease of use. (CNBC)

Kraft Heinz is exploring a sale of its Oscar Mayer meats business, which could fetch between $3 billion and $5 billion, according to the Wall Street Journal. The Oscar Mayer brand, known for hot dogs, bacon, ham, and bologna, has faced declining consumer demand due to a shift toward healthier options. Additionally, Kraft Heinz wrote down the value of its Oscar Mayer and Kraft brands in 2019. (REU)

GameStop announced it will sell up to 45 million common shares in an at-the-market offering. The video game retailer also reported preliminary first-quarter results indicating a decline in sales. This news follows a recent surge in GameStop's stock, driven by posts from "Roaring Kitty" on X, briefly reviving the meme stock trade. (CNBC)

Comcast CEO Brian Roberts announced that a new streaming bundle, StreamSaver, will debut later this month at a significantly lower price than current market offerings, as reported by Variety. The details on pricing and plans for the bundle remain unclear, but StreamSaver will be available to all Comcast TV, broadband, and mobile customers. (FORBES)

Google parent Alphabet unveiled a new AI data center chip called Trillium, which is nearly five times faster than its previous version. Alphabet CEO Sundar Pichai highlighted the exponential growth in demand for machine learning computation, increasing tenfold each year for the past six years, and stated, "I think Google was built for this moment, we've been pioneering AI chips for more than a decade." (REU)

Federal prosecutors stated that Boeing violated a 2021 settlement that protected it from criminal prosecution over two fatal 737 Max crashes. The U.S. Department of Justice (DOJ) said Boeing failed to establish and enforce a compliance and ethics program to detect fraud law violations, and the company must respond to the DOJ by June 13. (CNBC)

CME Group, the world's largest futures exchange, plans to launch bitcoin trading to capitalize on increasing demand among Wall Street money managers for cryptocurrency exposure. The Chicago-based group is in discussions with traders about buying and selling bitcoin on a regulated marketplace. This move follows the US Securities and Exchange Commission's January approval of stock market funds investing directly in bitcoin. (FT)

Apple is developing a slimmer version of the iPhone, expected to be launched with the iPhone 17 in September 2025, according to a report by The Information. This new model, likely to be priced higher than the iPhone Pro Max, is still in the testing phase under the code name D23 and could feature Apple's latest-generation processor, likely called A19. (REU)

Real Estate

Developers have begun a major redevelopment of the Northville Downs racetrack site, with investments totaling hundreds of millions of dollars. The project includes 443 housing units, retail and commercial space, and 15 acres of publicly accessible green space and parks, featuring the "daylighting" of 1,100 feet of the previously covered Rouge River. (CRAIN)

Red Lobster is expected to file for chapter 11 bankruptcy as early as next week to reduce its debt load, according to sources. The largest U.S. seafood restaurant chain plans to file the petition in Orlando, Florida, before Memorial Day to negotiate with landlords and creditors, potentially trimming hundreds of millions in debt. Known for its cheddar biscuits and popcorn shrimp, Red Lobster recently closed dozens of its approximately 650 U.S. locations, including restaurants in Denver, San Diego, Indianapolis, San Antonio, and Orlando, where its U.S. headquarters is located. (WSJ)

Billionaire Frank McCourt announced he is organizing a bid to acquire TikTok's U.S. operations, following the passage of a law that could compel the platform's Chinese owner to sell. McCourt, a real estate mogul and former owner of the Los Angeles Dodgers, stated that his Project Liberty initiative is collaborating with investment bank Guggenheim Securities to build a consortium for the purchase. (WSJ)

China is considering a proposal for local governments to purchase millions of unsold homes to address the struggling property market, according to sources. The State Council is seeking feedback from several provinces and government entities on the preliminary plan, which would be much larger in scale than previous pilot programs using state funding. Local state-owned enterprises would buy the homes from distressed developers at steep discounts using loans from state banks, with many properties then converted into affordable housing. (BBN)

Detroit City FC plans to leave Keyworth Stadium in Hamtramck and build a new stadium in Detroit's Corktown neighborhood. The new stadium will be on the site of the former Southwest Detroit Hospital at Michigan Avenue and 20th Street, recently purchased for $6.5 million by an entity connected to Edward Siegel. The stadium is expected to open in 2027 and seat around 14,000 people, serving both the men's and women's teams. (CRAIN)

Detroit's population has increased for the first time in 1950. According to U.S. Census estimates released today, the city's population rose by 0.3% in 2023, marking the first year-over-year increase in 73 years. The Census Bureau estimates Detroit's population at 633,218, an increase of 1,852 from 2022, though still significantly lower than the 1950 peak of 1.85 million. (CRAIN)

Wayfair is opening its first large-format store, as CEO Niraj Shah believes the physical shopping experience can be better for customers than online shopping, he told CNBC. The online home goods retailer joins other digitally native companies like Warby Parker, Figs, Glossier, and Everlane in opening physical stores. In 2022, new retail store openings outpaced closures for the first time in five years, a trend that has continued into 2023 and 2024. (CNBC)

Mergers & Acquisitions

Anglo American rejected a raised takeover offer of 34 billion pounds ($42.67 billion) from BHP Group, stating that the offer "continues to significantly undervalue" the company. Previously, Anglo had dismissed BHP's initial $39 billion all-share proposal in April as opportunistic and potentially diluting shareholder value. Anglo shares closed down 2.3%, and the company will update investors on its standalone strategy on Tuesday. (REU)

Elon Musk's artificial intelligence startup, xAI, is in discussions with Oracle executives about a potential $10 billion deal to rent cloud servers over several years, according to The Information. This deal would position xAI as one of Oracle's largest customers, as Musk seeks to secure funding to compete with the AI services of OpenAI and Google. (REU)

Tylenol maker Kenvue announced that Johnson & Johnson will sell its remaining 9.5% stake in the company, roughly a year after spinning off its consumer health business. The sale of 182.3 million shares is valued at about $3.75 billion based on Kenvue's last closing price. Following the news, Kenvue's shares dropped 1.2% in premarket trading, while J&J shares remained largely unchanged. (REU)

Birmingham-based software company OneStream has confidentially filed with the U.S. Securities and Exchange Commission for an initial public offering (IPO) that could happen within a few months, according to sources. Backed by investment firm KKR & Co., OneStream aims for a valuation of up to $6 billion in the IPO. The company is collaborating with underwriters including Morgan Stanley, JPMorgan Chase & Co., and Citigroup Inc. (CRAIN)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply