- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

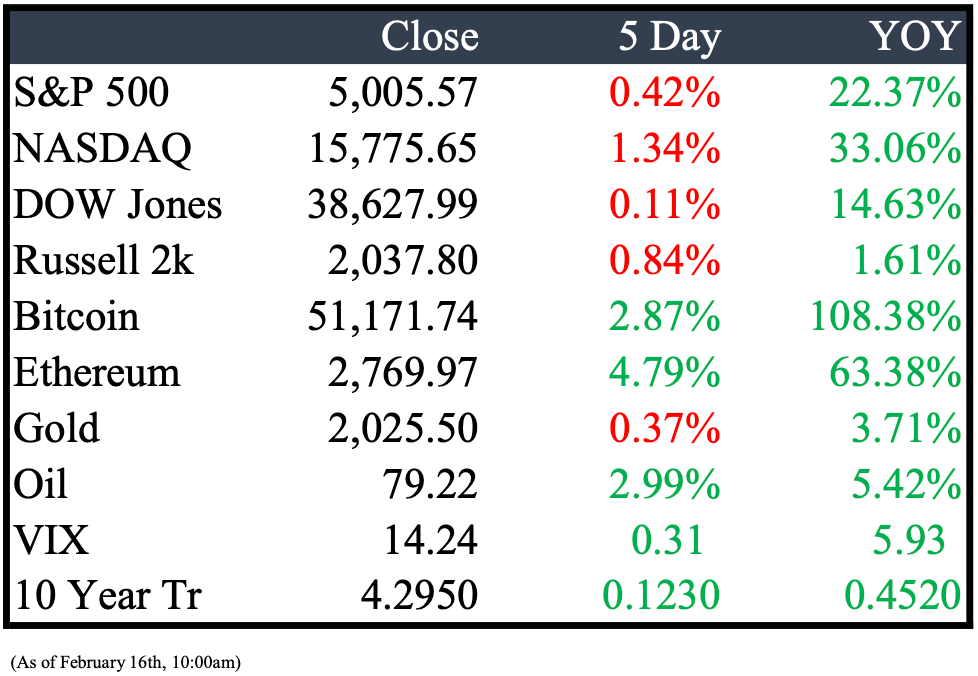

Market Recap

This Week’s Headlines

Economy & World News

The Senate approved a $95 billion aid package for Ukraine, Israel, and Taiwan with a 70-29 vote, despite opposition from conservatives and former President Trump. The bill now faces uncertainty in the House, where Speaker Mike Johnson is not supportive. However, 22 GOP senators voted in favor, indicating growing Republican support. (POL)

The Producer Price Index (PPI) increased by 0.3% last month, exceeding economists' forecast of a 0.1% rise. In December, the index had declined by 0.1%. Meanwhile, housing starts dropped by 14.8% to a seasonally adjusted annual rate of 1.3 million in January, falling short of the forecasted 1.45 million. (WSJ)

Elon Musk's Starlink has been granted a license to operate in Israel and parts of the Gaza Strip. The approval comes with measures to prevent Hamas from accessing its satellite internet services. The service will be available to certain authorities in Israel and is approved for use at a UAE-run field hospital in southern Gaza, as stated by the Israeli communications ministry. (BBN)

Japan's Nikkei share average reached its highest level in 34 years, closing up 1.21% at 38,157.94, driven by gains in chip-related shares. The index is now just 2% below its all-time high from 1989. (REU)

January's advance retail sales dropped by 0.8%, with notable declines in building materials, garden stores, and vehicle parts. Meanwhile, initial unemployment claims for the week ended February 10 fell to 212,000, below the estimated 220,000. (CNBC)

Rep. Virginia Foxx, the chair of the House education committee and a North Carolina Republican, has issued subpoenas to Harvard University officials as part of an investigation into antisemitism on campus. The subpoenas were directed to Harvard Corporation Senior Fellow Penny Pritzker, interim President Alan Garber, and Harvard Management Company CEO N.P. Narvekar, demanding a range of documents that Foxx claims the university has not provided. (POL)

Shortly after the U.S. received concerning intelligence about Russia's ability to target American satellites, the Pentagon launched a missile-tracking system into orbit. This move, though coincidental in timing, highlights the U.S.'s response to the advancements in Russian and Chinese space capabilities. It reflects a broader effort by the United States to innovate and protect crucial communications, surveillance, and GPS systems for future military operations in space. (NYT)

Since the discovery of massive oil reserves in 2015, Guyana has transformed significantly, with its economy quadrupling in size over five years. The oil boom has led to Guyana becoming the fastest-growing economy in the world for two consecutive years. The country now produces 645,000 barrels of oil per day, generating $1.6 billion in revenue in 2023. Projections suggest that Guyana could surpass Kuwait as the world's largest per-capita crude producer, accounting for 16% of the global oil supply growth through 2028. (BBN)

The provided text states that Alexei Navalny, a prominent opponent of Russian President Vladimir Putin, died suddenly after collapsing at the "Polar Wolf" Arctic penal colony, where he was serving a 30-year sentence. Navalny's death at the age of 47 leaves the Russian opposition without its most notable leader as Putin prepares for an election that could extend his presidency until at least 2030. (REU)

Public Markets

Shares of smaller AI firms surged on Thursday after Nvidia, the leading artificial intelligence chipmaker, disclosed investments in them, indicating its growth strategy. This rally highlights Nvidia's increasing influence in the AI sector, as its market value rapidly expands, making it the third most valuable U.S. company. Nvidia's most significant investment was $147.3 million in Arm Holdings, a chip designer Nvidia attempted to acquire for $80 billion two years ago, but the deal was blocked due to antitrust concerns. (REU)

Walmart is reportedly considering purchasing smart-TV manufacturer Vizio, a move that could help expand its advertising business and compete with Amazon. (BAR)

Sientra Inc., a breast implant manufacturer that recently filed for bankruptcy, received court approval to begin using a $90 million Chapter 11 loan from Deerfield Partners LP. The loan aims to support Sientra as it seeks to sell its business. Judge John Dorsey granted interim approval for the loan, which includes $22.5 million in new funds and allows for the roll-up of up to $67.5 million in existing company loans. Roll-ups are used in bankruptcy financing to prioritize existing debt repayment alongside new funding. (BBN)

Phillips 66 has appointed energy industry veteran Robert Pease to its board following pressure from activist investor Elliott Investment Management. Elliott, which revealed a $1 billion stake in Phillips 66 in November, criticized the company's refining operations and called for an overhaul of the board, including the addition of directors with refining experience. (REU)

Berkshire Hathaway reduced its stock holdings in Apple, Paramount Global, and HP in the fourth quarter, while increasing its investment in Chevron, according to its 13-F report. Berkshire sold 10 million shares of Apple, now holding 905 million shares valued at about $166 billion, nearly half of its equity portfolio. The company added 16 million shares to its Chevron holding, bringing the total to 126 million shares worth approximately $19 billion. This purchase followed a sale of about 13 million Chevron shares in the third quarter. (BAR)

The Biden administration is reportedly discussing granting over $10 billion in subsidies to Intel Corp., which would be the largest award under a plan to revive semiconductor manufacturing in the U.S. The package for Intel is expected to include loans and direct grants, although negotiations are ongoing and the details are not yet public. (BBN)

JPMorgan Chase & Co will pay approximately $350 million in civil penalties to regulators for failing to report complete trading data to surveillance platforms, as disclosed in a regulatory filing. The bank acknowledged that certain trading and order data from its Corporate and Investment Bank unit was not properly fed into its trade surveillance systems in response to government inquiries about its trading processes. (REU)

Real Estate

Governor Gretchen Whitmer's budget proposes an additional $150 million to reopen Michigan's Palisades nuclear plant, doubling the state's commitment to $300 million. This is part of an effort to preserve carbon-free energy, with a potential $1.5 billion federal loan also under consideration. (BM)

The liquidators of the now-collapsed Chinese property group Evergrande are considering a potential lawsuit against PwC, the Big Four accounting firm that audited Evergrande for over a decade. Eddie Middleton and Tiffany Wong, restructuring specialists from Alvarez & Marsal appointed as liquidators of Evergrande's Hong Kong-listed holding company, have reportedly consulted with at least two law firms about the possibility of bringing a negligence claim against the audit firm. (FT)

The commercial real estate market in the U.S., valued at $20 trillion, has been experiencing a delayed shakeout due to uncertainty over property valuations. The Covid-19 pandemic disrupted real estate use globally, leading to lenders hesitating to pressure borrowers facing rising interest rates and depreciating loans. This reluctance to sell at distressed prices has stalled transactions, allowing property owners to maintain the illusion of stability despite fundamental changes in the market. (BBN)

Mergers & Acquisitions

Diamondback Energy and Endeavor Energy Resources are merging to create an oil-and-gas company worth over $50 billion. The deal, announced by Diamondback, comes amid higher oil prices and a rush for prime acreage, fueling consolidation in the energy sector. (WSJ)

Lume Cannabis Co., a Michigan-based cannabis company, plans to take over a 56,000-square-foot marijuana growing and processing facility near Lansing, previously occupied by Green Peak Industries, operating under the brand name Skymint. Skymint went into receivership last year, and Lume Cannabis announced its plans to occupy the facility at 10070 Harvest Park on Wednesday. Skymint had begun construction of the facility over five years ago. (LSJ)

Activist investor Carl Icahn secured two board seats at JetBlue Airways shortly after revealing a nearly 10% stake in the airline. As part of a settlement agreement, two of Icahn's representatives, Jesse Lynn and Steven Miller, will join JetBlue's board. (WSJ)

Arevon Energy, Inc. and Blackstone Credit & Insurance have secured $350 million in financing for the Condor Energy Storage Project in Grand Terrace, California. The 200 MW/800 MWh project, expected to start in Q2 2024, will enhance grid reliability and support renewable energy integration. It features Tesla's Megapack 2 XL battery system, with Tesla providing maintenance services. Rosendin Electric, Inc. is the EPC contractor, and Arevon will own and operate the project long-term. (BX)

Altium has agreed to a US$5.91 billion takeover by Japanese chip maker Renesas Electronics, marking another Australian tech company entering foreign ownership. Altium's shares surged by 31% to a record high after announcing the binding agreement with Renesas, offering 68.50 Australian dollars (US$44.46) per share in cash. If the deal goes through, Altium, known for its printed-circuit board design software and parts search engine, will join other high-profile companies in exiting the Australian Securities Exchange's relatively small listed tech sector. (WSJ)

DraftKings is acquiring the lottery app Jackpocket for around $750 million in cash and stock. This move will allow DraftKings to enter the U.S. lottery market, enhance its sports betting and online gaming offerings, and improve customer acquisition and lifetime value. (WSJ)

Earnings

Building Value Through Purposeful Investments.

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply