- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

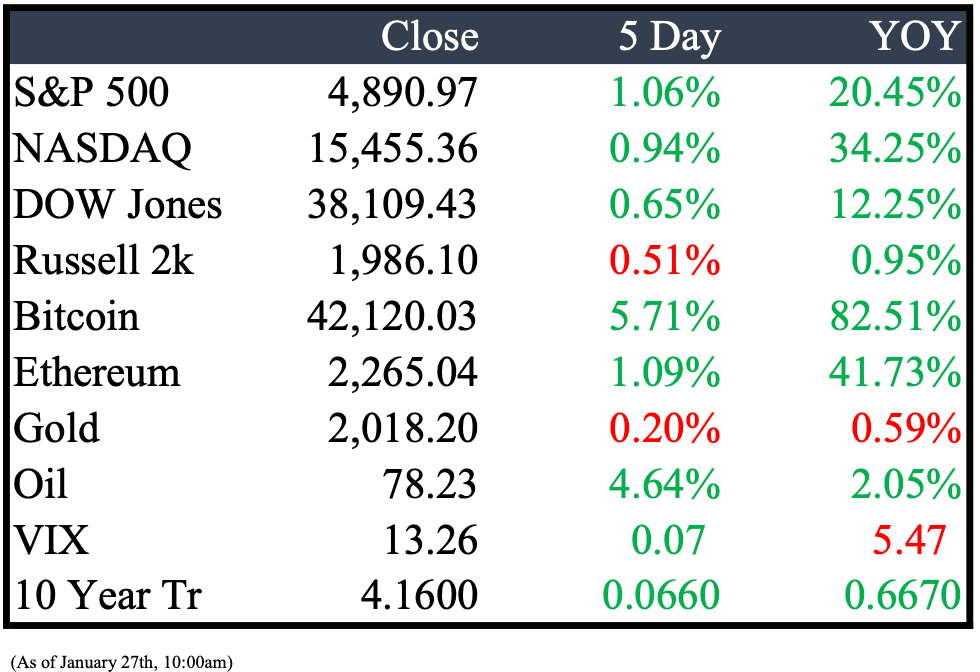

Market Recap

This Week’s Headlines

Economy & World News

Hungary's Prime Minister Viktor Orban pledged to advocate for Sweden's NATO membership but provided no timeline for a vote. Orban, despite controlling Parliament, emphasized that the final decision is not solely his, adding uncertainty to Hungary's prolonged hesitancy over NATO's expansion. (NYT)

The Bank of Japan (BOJ) announced on Tuesday that it will maintain its ultra-easy monetary policies but indicated a growing confidence in the conditions necessary for gradually phasing out its extensive stimulus measures. This suggests a potential end to negative interest rates in the near future. BOJ Governor Kazuo Ueda provided no explicit hints on whether the bank would lift short-term interest rates from negative territory in the upcoming meetings scheduled for March or April. (REU)

Commodities trader Trafigura is reevaluating the security risks of Red Sea voyages following a Houthi attack on the Marlin Luanda tanker. The company stated that no more of its vessels are currently transiting the Gulf of Aden. Trafigura is actively assessing risks in collaboration with shipowners and customers to prioritize the safety and security of the crew. (REU)

Chinese authorities are reportedly considering measures to stabilize the stock market by mobilizing approximately 2 trillion yuan ($278.53 billion) from offshore accounts of state-owned enterprises. The plan involves using the funds to establish a stabilisation fund and purchase shares onshore through the Hong Kong exchange link. However, investors have responded with skepticism to the news. (REU)

India's stock market capitalization has surpassed Hong Kong's for the first time, driven by India's growth prospects and policy reforms, making it an attractive destination for investors. As of Monday's close, the combined value of shares listed on Indian exchanges reached $4.33 trillion, exceeding Hong Kong's $4.29 trillion, according to Bloomberg data. India now stands as the fourth-largest equity market globally, with its market value crossing $4 trillion on December 5, with a significant portion of this growth occurring in the past four years. (BBN)

A renowned cancer center affiliated with Harvard, the Dana-Farber Cancer Institute in Boston, is set to request the retraction of six research papers and correction of dozens of others following revelations by British scientist and blogger Sholto David. David uncovered duplicated or manipulated data in studies conducted by top executives, including Dana-Farber's CEO Dr. Laurie Glimcher and COO Dr. William Hahn. The manipulated data involved images that were stretched, obscured, or spliced, suggesting intentional efforts to mislead. This move towards retractions reflects an increased scrutiny of scientific misconduct, as seen in other fields like Alzheimer's research and recent instances of manipulated results leading to resignations. (NYT)

China's central bank has taken early steps to boost bank lending to households and businesses, aiming to support growth following a lackluster 2023. The move, involving a reduction in banks' reserve requirements, signals a broader yet cautious effort by authorities to prop up the economy. Simultaneously, there are indications of increased government support for China's stock market, with state-linked entities engaging in share buying activities, suggesting a concerted effort to counter the recent market downturn. The measures reflect officials' recognition of the need to address both the stock market decline and overall economic support. (WSJ)

The Biden administration has temporarily halted the approval of new licenses for US liquefied natural gas (LNG) exports. This pause aims to assess the impact of these shipments on climate change, the economy, and national security. The Energy Department will conduct a study to update existing analyses used in evaluating proposals for increased LNG exports to non-US free-trade partners. This moratorium is likely to disrupt plans for multi-billion-dollar LNG projects. (BBN)

China's central bank, the People's Bank of China, has unveiled plans to guide funds into key sectors to bolster the economy. This comes after surprising investors with a larger-than-expected reserve requirement ratio (RRR) cut announced weeks in advance. The central bank is expected to further stimulate the economy by directing credit into specific areas, making modest reductions in bank reserve requirements, and implementing minor policy-rate cuts. (BBN)

Public Markets

Macy's rejected a $5.8 billion proposal from Arkhouse Management and Brigade Capital Management on Sunday, citing concerns about deal financing and valuation. The department store, grappling with competition from online and smaller brick-and-mortar rivals, is under pressure from Arkhouse and Brigade to explore a sale. (REU)

Google is implementing job cuts as part of Alphabet Inc.'s broader cost-efficiency initiative. Alphabet's technology lab, X, is laying off employees and seeking external investors for funding. Recent discussions with venture capitalists indicate X's shift towards a new structure, facilitating the spin-out of its projects as independent startups with support from both Alphabet and external backers. (BBN)

ExxonMobil is taking legal action against sustainable investment firms Arjuna Capital and Follow This to block a shareholder proposal. The proposal urges Exxon to set more aggressive emission reduction targets and address the broader emissions from its products used by customers ("Scope 3" emissions). (FORB)

One of Boeing Co.'s major customers, United Airlines Holdings Inc., has expressed a loss of confidence in the aircraft manufacturer's ability to address ongoing quality issues. United CEO Scott Kirby has reportedly shared frustrations with Boeing's management, specifically expressing concerns about the handling of the Max grounding, following recent quality lapses culminating in a mid-air emergency on an Alaska Airlines flight. (BBN)

The US Federal Aviation Administration (FAA) has issued a recommendation for airlines to inspect "door plugs" on an earlier version of Boeing 737 airplanes, following an incident where one blew out on the newer Max model during an Alaska Airlines flight. The FAA's guidance specifically targets airlines operating the Boeing 737-900ER model, urging them to visually inspect mid-exit door plugs to ensure proper security. These plugs cover the hole where a mid-plane exit would be located. (CNN)

Scott Stuber, the architect behind Netflix Inc.'s emergence as Hollywood's leading movie studio, is set to depart the streaming giant in March to launch his own company. Stuber will continue as global film chairman until at least the Academy Awards in March to conclude ongoing projects before embarking on producing films and TV shows independently. Sources indicate that Stuber has secured financing for his new venture. During his departure, Chief Content Officer Bela Bajaria will supervise the film team as Netflix searches for a replacement. (BBN)

Netflix Inc. has made a significant foray into live events by securing exclusive rights to Raw and additional programming from World Wrestling Entertainment (WWE). The streaming giant reportedly agreed to a 10-year deal, committing $5 billion to acquire these rights, according to anonymous sources. A Netflix spokesperson declined to comment on the deal. The move signals Netflix's entrance into live event content, expanding its offerings beyond traditional streaming. (BBN)

Apple Inc. is reportedly at a crucial juncture in its decade-long pursuit of building a car, and it has decided to shift to a less ambitious design to make progress toward launching an electric vehicle (EV). Previously considering a fully autonomous car, Apple is now focused on developing an EV with more limited features, as per sources familiar with the project. This shift indicates a strategic adjustment in Apple's approach to entering the electric vehicle market. (BBN)

Google has reached a settlement in a patent infringement lawsuit with Singular Computing, which had accused the tech giant of misusing its computer-processing innovations related to artificial intelligence (AI). The settlement, disclosed in a Massachusetts federal court filing on the day of scheduled closing arguments, remains confidential. Initially seeking $1.67 billion in damages, Singular Computing claimed Google violated its patent rights. While the details of the resolution are undisclosed, both companies confirmed the settlement, with Google asserting it did not infringe on Singular's patent rights. (BW)

The Federal Aviation Administration (FAA) has announced a halt to Boeing's planned expansion of its 737 Max aircraft production. However, the FAA has cleared the way for the ungrounding of the 737 Max 9 in the coming days, following inspections. The FAA had grounded the jets after a door panel incident on an Alaska Airlines flight earlier in the month. FAA Administrator Mike Whitaker emphasized that Boeing will not resume business as usual until the quality control issues identified during the process are adequately addressed. (CNBC)

In 2023, Apple became the leading smartphone vendor in China by shipments for the first time, securing a 17.3% market share, according to the International Data Corporation (IDC). Despite a 2.2% year-on-year decline in overall smartphone shipments, Apple's market share in China reached a record high. Honor, Vivo, Huawei, and Oppo followed in the rankings. Notably, Huawei re-entered the top five in the fourth quarter of 2023. The data indicates a 5% contraction in the overall smartphone market in China for the year. (CNBC)

Apple could face consequences if its App Store changes don't align with upcoming EU regulations, according to the bloc's industry chief. As part of compliance with the Digital Markets Act, Apple will allow developers to distribute apps through alternative stores on its devices, starting in early March. Developers can also opt out of Apple's in-app payment system, which charges commissions up to 30%. (REU)

Real Estate

Alro Steel Corp. is set to build a 250,000-square-foot metals distribution plant near the former Gibraltar Trade Center site in Mount Clemens. This significant project, a rarity for the Macomb County seat, gained approval from the city's planning commission in November. However, the Jackson-based steel and plastics distributor awaits clearance for engineering and construction documents before commencing construction, according to Brian Tingley, Mount Clemens' community development director. (CRAIN)

Conrad Orlando has officially opened within the Evermore Orlando Resort, a groundbreaking $1.5 billion project in the Lake Buena Vista area. This 1,100-acre property not only marks Conrad Hotels & Resorts' debut in Orlando but also serves as its second location in Florida. The resort, boasting 433 rooms, offers a range of amenities such as five dining venues, the Conrad Spa Orlando and Water Garden, Evermore Bay—an 8-acre crystalline lagoon and expansive pool complex—and over 65,000 square feet of indoor and outdoor meeting and event space, establishing itself as a unique beach paradise in the region. (OO)

Mergers & Acquisitions

The Israeli stock exchange revealed a secondary offering, comprising 18.5% of its market value. Bill Ackman, the CEO of Pershing Square Capital Management, known for supporting Israel, made the announcement. Despite the Oct. 7 Hamas-led terror attack, Ackman identifies as both pro-Palestinian and pro-Israeli, emphasizing that these stances are not contradictory. (CNBC)

Bilt Rewards, a startup offering a loyalty program that converts rental payments into points for rewards, has raised $200 million in an equity transaction. This funding round, led by General Catalyst and featuring participation from Eldridge, Left Lane Capital, Camber Creek, and Prosus Ventures, values the startup at $3.1 billion—more than doubling its previous valuation. Ken Chenault, former CEO of American Express and General Catalyst's chairman, will join Bilt as chairman. The success of Bilt reflects the growing appeal of its loyalty program among consumers. (BBN)

David Ellison has reportedly made a preliminary offer to acquire National Amusements Inc., the holding company of the Redstone family. This move is seen as a strategy to gain control of Paramount Global, a major media entity that owns brands like MTV and Nickelodeon. Additionally, Ellison has engaged in talks with Paramount regarding the potential merger of his film and TV studio, Skydance Media, into Paramount after assuming control. Both parties are said to have enlisted advisers and are in the process of sharing financial information. (BBN)

Earnings

Dear Valued Subscriber,

I'm delighted to share some exciting news with our newsletter community! Introducing T.H.E. Fund by Peridot—an innovative hedge fund actively managed by William Lemanske Jr and his dedicated team. Specializing in Technology, Healthcare, and Energy investments, T.H.E. Fund offers a distinctive approach to maximizing returns while avoiding fixed income assets, staying true to our core principles.

Under the skilled leadership of Peridot's founder, William, T.H.E. Fund has proven to be a valuable addition to investment portfolios. Over the past four years, I have personally integrated this unique investment structure into my own portfolio, witnessing its potential firsthand. In an ever-changing market where the S&P 500's performance is heavily influenced by a select few companies, T.H.E. Fund provides a strategic diversification solution. Our methodology involves sector weighting based on market conditions and capitalization, implementing a long strategy in equities, and seizing short-term returns through options and futures during periods of volatility.

As valued subscribers to our newsletter, you have an exclusive opportunity to explore potential investment opportunities with T.H.E. Fund. We are now accepting investments at the beginning of the year, and I would be delighted to engage in a more in-depth discussion with you about this exciting venture.

Consider T.H.E. Fund as a great addition to your investment portfolio. If you are intrigued and would like to delve into the details of our diverse investment classes, please don't hesitate to reach out to me via email at [email protected] or give me a call at 313-670-2479. I look forward to discussing how T.H.E. Fund can align with your investment goals and preferences.

Now enjoy your Sunday,

Peridot Corp, Founder & CEO

William Lemanske Jr.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply