- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

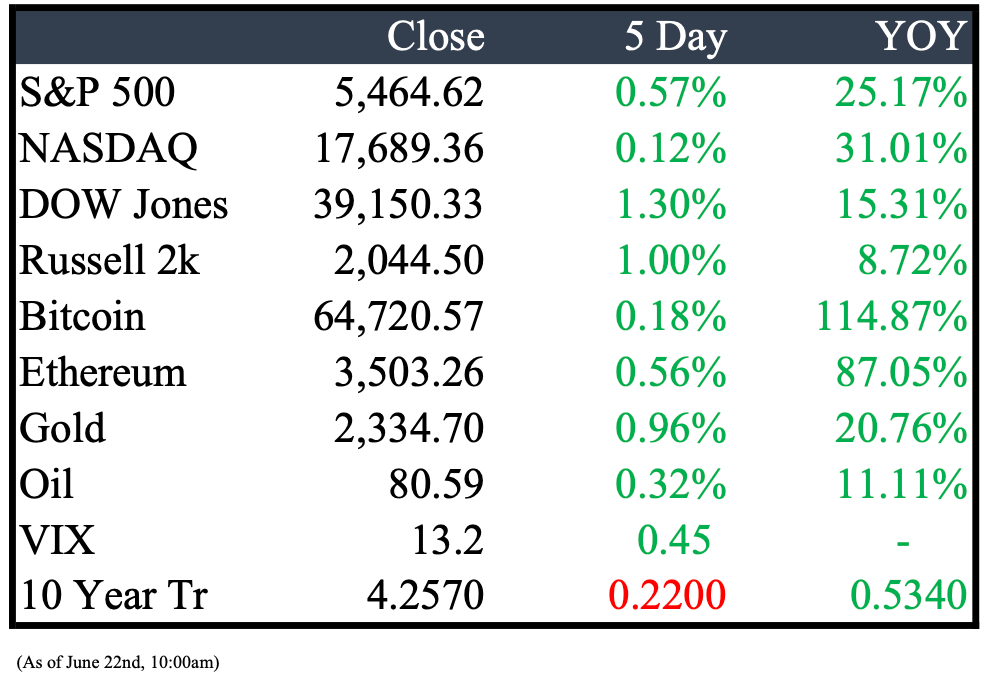

Market Recap

This Week’s Headlines

Economy & World News

The partnership between private-equity and pension funds in the U.S. is faltering, as dwindling payouts force managers to sell assets at a discount or borrow, damaging returns. This financial strain is evident as California’s worker pension pays more than it earns from these investments for eight years, and Cummins faced a 4.4% loss on its U.K. pension from selling assets cheaply. (WSJ)

Amid political turmoil, Paris has ceded its status as Europe's largest equity market to London, a title it had taken from the UK less than two years ago. This shift followed President Emmanuel Macron's unexpected call for a snap election, causing a market plunge that erased about $258 billion from French firms' values. France's equity market value now stands at approximately $3.13 trillion, slightly behind the UK's $3.18 trillion, with the CAC 40 Index wiping out all its 2024 gains after recently hitting record highs. (BBN)

George Norcross, a prominent Democratic political figure in New Jersey for many years, has been indicted on racketeering charges. His brother, Phillip Norcross, along with four other defendants, were also charged in the case, led by New Jersey Attorney General Matthew Platkin. (CNBC)

Inflation in the U.K. decreased to 2.0% in May, meeting the Bank of England's target, according to the Office for National Statistics. This decline from April's 2.3% rate comes just before the national elections in July. (CNBC)

On Wednesday, President Vladimir V. Putin of Russia and North Korea's leader, Kim Jong-un, reaffirmed a Cold War-era mutual defense pledge, intensifying their nations' security ties and asserting a united stance against the United States. The details of the new treaty were not released, but at a joint briefing in Pyongyang, Putin described the agreement as a commitment to mutual assistance in case of aggression against either country. Kim characterized the treaty as elevating their bilateral relations to an "alliance," though Putin did not specify if the pact required immediate military support similar to their 1961 agreement. (NYT)

The Detroit Pistons have terminated coach Monty Williams after a season ending with a league-worst 14-68 record, despite being early in a significant six-year, $78.5 million contract. Pistons owner Tom Gores cited the need for a new direction amidst a broader restructuring of the team's management, including new leadership roles and the exit of the general manager. (AP)

Auto dealers may face several more days without essential software services due to a second major cyberattack on CDK Global, a provider whose systems initially crashed on June 19. CDK Global has informed its customers that there is currently no estimated time frame for when services will be restored. Despite attempts to reach out, a CDK spokesperson has not immediately responded to inquiries regarding the situation. (BBN)

A group claiming to have hacked CDK Global, a software provider for thousands of North American car dealerships, is demanding tens of millions of dollars in ransom, according to a source. CDK plans to make the payment, though the situation is fluid and could change. The hacking group is believed to be based in Eastern Europe. Since CDK shut down systems on June 19 after discovering the breach, about 15,000 car dealerships have experienced significant disruptions, affecting sales, repairs, and deliveries during a critical end-of-quarter sales period. CDK has not commented on the incident. (BBN)

At its June meeting, the Bank of England decided to maintain interest rates, aligning with market expectations as UK inflation reached the central bank's target of 2%. Following this decision, traders anticipate a potential rate cut in August, given the central bank's description of the situation as "finely balanced" and concerns about renewed inflationary pressures. Ruth Gregory, deputy chief UK economist at Capital Economics, noted that recent developments suggest a rate cut may be imminent. (CNBC)

The White House announced that the Biden administration will expedite the delivery of air-defense interceptors to Ukraine by delaying shipments to allied nations. President Biden revealed this strategy during the Group of Seven meeting in Italy, indicating that countries expecting air-defense systems from the U.S. would face delays. National Security Council spokesman John Kirby confirmed that Ukraine is expected to receive these interceptors by the end of the summer. (WSJ)

Prime Minister Justin Trudeau's government is considering new tariffs on Chinese-made electric vehicles to align with the US and EU. Officials indicate public consultations on the tariffs will likely be announced soon. This move follows the US's plan to increase tariffs on Chinese EVs to 102.5% and the EU's recent decision to raise tariffs to as high as 48%. (BBN)

Public Markets

PG&E Corp. announced that new data centers in Silicon Valley could increase electricity demand by 3.5 gigawatts, exceeding the output of three nuclear power plants. This surge is driven by over two dozen projects set to unfold over the next five years, primarily around San Jose, in a region critical to tech giants like Meta Platforms Inc., Alphabet Inc., and Apple Inc. (BBN)

Starboard Value lost a lawsuit to prevent Autodesk Inc. from proceeding with a board vote next month, diminishing its chances to nominate its own directors after an accounting issue at the software company. Delaware Chancery Court Judge Paul Fioravanti ruled that Starboard, which owns a $500 million stake, failed to prove it would suffer irreparable harm by missing a March nomination deadline. This decision paves the way for a legal dispute over Starboard’s allegations that Autodesk executives did not adequately disclose operational issues before the nomination cut-off. (BBN)

Upon becoming CEO of Wells Fargo, Charlie Scharf aimed to expand the bank’s credit card sector, a move highlighted by a partnership with fintech startup Bilt Technologies in 2022. Together, they launched a credit card offering unique rent-payment benefits, attracting over one million accounts, predominantly from young adults. However, the initiative is reportedly costing Wells around $10 million monthly due to unforeseen customer behavior and internal miscalculations regarding revenue projections. (WSJ)

Apple announced on Monday that it has discontinued its buy-now-pay-later service, Apple Pay Later, which was launched last year. Instead, starting later this year, users worldwide will have the option to access installment loans through credit and debit cards, as well as lenders, during checkout with Apple Pay, according to a spokesperson speaking to CNBC. (CNBC)

Fisker, struggling to ramp up its Ocean SUV production, filed for bankruptcy in Delaware, planning asset liquidation including selling all 4,300 vehicles to a single buyer. The company, which had a $940 million net loss on $273 million in revenue in 2023, faces over $850 million in debt amid disputes among bondholders, complicating its financial recovery. (REU)

Rite Aid is shutting down 27 additional stores in Ohio and Michigan as part of its ongoing bankruptcy proceedings, according to a recent court document. Since filing for reorganization in October, the Pennsylvania-based drugstore has closed over 520 locations—about a quarter of its total operations. Most closures occurred in its home state and neighboring areas, with significant numbers in California as well. Struggling to compete with giants like CVS, Walgreens, and Target, Rite Aid's CEO Jeffrey Stein cited "unprofitable stores" as a key burden, with bankruptcy allowing for cheaper lease terminations. (CNBC)

Nvidia has become the world's most valuable public company, overtaking Microsoft, with its value increasing more than ninefold since the end of 2022. In early June, the chipmaker's market capitalization surpassed $3 trillion, joining Microsoft and Apple in this exclusive tier. This surge is largely attributed to Nvidia benefiting significantly from the recent boom in generative artificial intelligence. (CNBC)

Real Estate

Detroit Pistons owner Tom Gores is seeking development partners for a multifamily housing project in Detroit’s New Center area, as part of the broader $3 billion Future of Health initiative. The project, led by Palace Sports & Entertainment LLC, involves building over 660 apartments with an expected cost of $323 million. This effort is a collaboration with Henry Ford Health and Michigan State University and includes a new 21-story hospital tower among other developments. The state has supported this segment with a $231.7 million transformational brownfield package. Proposals are due by June 27. (CRAIN)

In May, the inventory of homes for sale increased by 6.7% from the previous month and was 18.5% higher than in May last year. The median price of an existing home sold reached a record high of $419,300, up 5.8% year over year. (CNBC)

Mergers & Acquisitions

Advent International and a unit of the Abu Dhabi Investment Authority are purchasing a minority stake in Fisher Investments, valued at $12.75 billion, for up to $3 billion. This investment, part of Ken Fisher's estate planning, allows the firm to maintain its operational independence. (BBN)

Coach USA, the owner of Megabus and various commuter bus lines, has filed for Chapter 11 bankruptcy in Delaware due to a pandemic-induced decline in ridership. The company, which connects Detroit with multiple Midwest cities, reports debts between $100 and $500 million. Despite ceasing operations in Michigan in 2020 and resuming in 2023 with expanded services, the company struggled to recover after a 90% drop in commuter ridership in 2020. Variant Equity Advisors had acquired Coach USA in 2019 from Stagecoach Group. (CRAIN)

Nvidia Corp. has agreed to acquire Shoreline.io, a startup specializing in software development tools, for about $100 million. The deal, recently finalized and not publicly disclosed due to its private nature, involves Shoreline.io, which is based in Redwood City, California. Founded in 2019 by former Amazon Web Services executive Anurag Gupta, Shoreline.io develops software for detecting and automating the repair of issues in computer systems. Nvidia, now the world's most valuable company, continues to expand its influence in the AI sector by acquiring startups like Shoreline.io, enhancing its capabilities in building essential computer systems for AI applications. (BBN)

Amazon announced plans to invest 10 billion euros ($10.75 billion) in response to growing demand for its cloud services and retail goods in Germany, Europe's largest economy. The company will allocate the majority of this investment, 8.8 billion euros, to expand the cloud infrastructure of its Amazon Web Services (AWS) unit by 2026, focusing on the potential of AI-driven technologies in Europe. (REU)

Platinum Equity has agreed to acquire Sunrise Medical, a leader in advanced assistive mobility solutions, from Nordic Capital. While financial details remain undisclosed, the transaction is set to close in Q3 2024, pending regulatory approvals. Sunrise Medical specializes in the design, manufacture, and distribution of various mobility products including wheelchairs, scooters, and therapeutic devices for different age groups, marketed under brands like Quickie, RGK, and others, with a distribution network spanning over 130 countries. (PLAT)

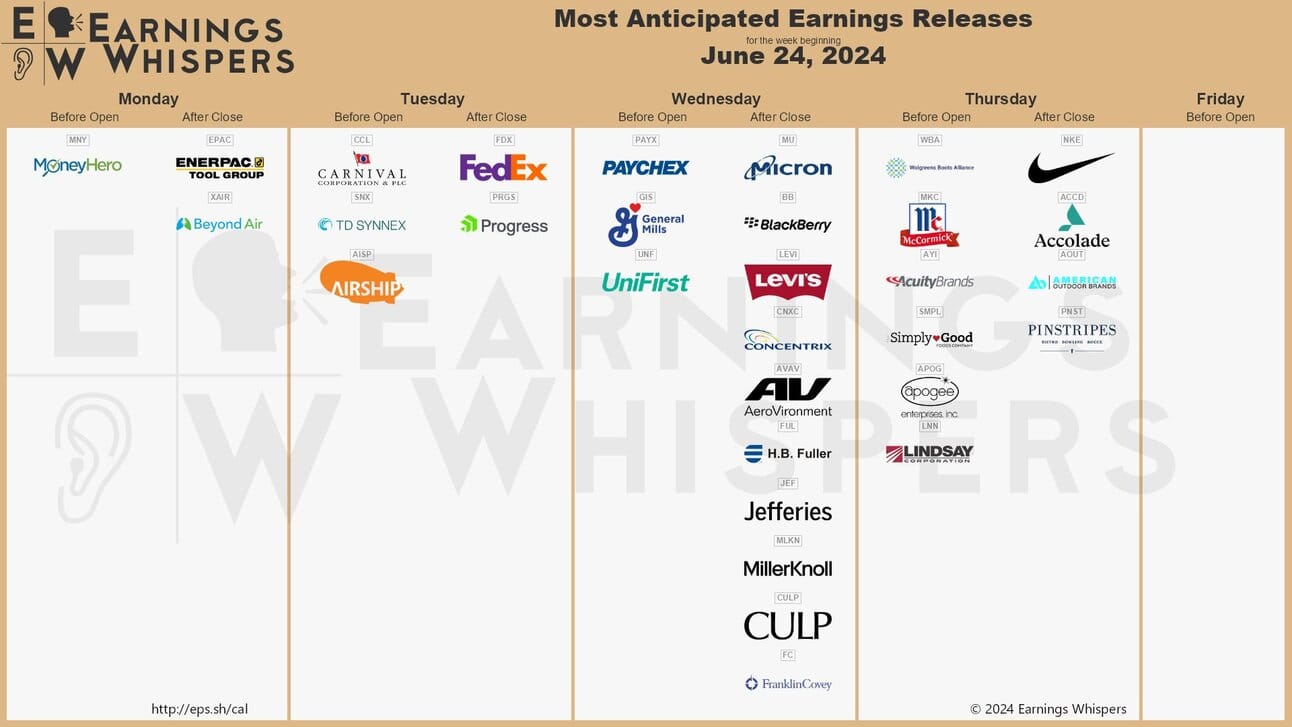

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply