- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Take a look at my investment firm, Peridot, and don't hesitate to get in touch if you'd like to find out more about our latest fund, THE Fund I.

- WL

Building Value Through Purposeful Investments.

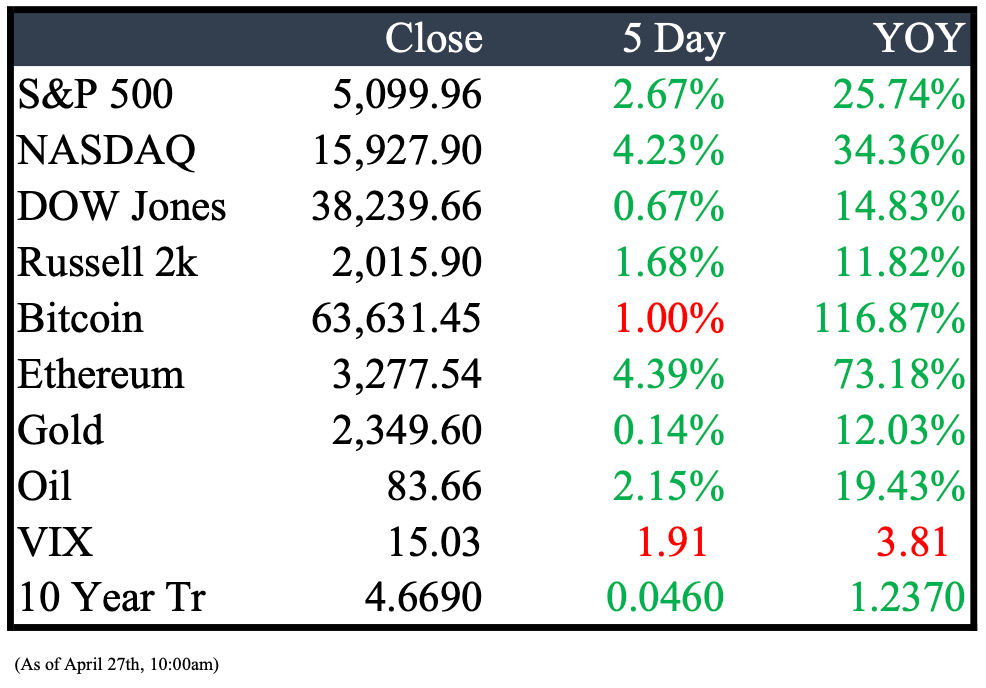

Market Recap

This Week’s Headlines

Economy & World News

In March, the core PCE price index held steady at a 2.8% increase from a year ago, matching February's figure and slightly exceeding expectations. Personal spending rose by 0.8%, outpacing the 0.5% increase in personal income. However, the personal saving rate declined to 3.2%, down 0.4 percentage points from February and 2 percentage points from a year earlier. (CNBC)

The U.S. gross domestic product (GDP) grew at a 1.6% annualized rate in the first quarter, falling short of the expected 2.4%. Meanwhile, the personal consumption expenditures (PCE) price index, a crucial inflation measure for the Federal Reserve, rose at a 3.4% annualized pace, marking its largest increase in a year. Consumer spending during the quarter rose by 2.5%, a decrease from the 3.3% growth in the previous quarter and below the 3% anticipated by Wall Street. (CNBC)

Despite a record $70 billion auction of 5-year U.S. Treasury notes, bond trading remained stable with demand similar to recent sales. The yield on the benchmark 10-year note stayed below session highs. Investors, anticipating potential market disruptions, are closely monitoring these large-scale auctions. Additional auctions, including a sale of 7-year notes and roughly $386 billion worth of bonds in May, are scheduled. (WSJ)

The UK's FTSE 100 Index reached a record closing high of 8,023.87 points, marking its highest close in over a year. This increase, driven by gains in energy stocks and a general optimism about easing geopolitical tensions, represents a 1.6% rise. Although it surpassed the previous record of 8,014.31 set in February 2023, it remains below the intraday high of 8,047.06. (BBN)

The Federal Trade Commission (FTC) has banned noncompete contracts to prevent workers from joining rival firms, a move approved by a 3-to-2 vote from its Democratic majority. This is the first significant regulatory action by the FTC in over 50 years aimed at broad economic reform in business competition. The decision is likely to face legal challenges from business groups. (WSJ)

Tennessee lawmakers have passed a bill permitting teachers to carry concealed handguns in schools, despite vocal opposition from protesters in the gallery. The bill was approved by a 68-28 vote in the Republican-majority Tennessee House, following its earlier passage in the state Senate. (REU)

The UK's Competition and Markets Authority (CMA) is intensifying its scrutiny of Amazon Inc. and Microsoft Corp.’s investments in artificial intelligence startups. This move reflects broader global regulatory efforts to address the influence of major tech companies on the rapidly growing AI market. Specifically, the CMA is investigating the potential competitive impacts of a $4 billion collaboration between Amazon and AI firm Anthropic in the UK market. (BBN)

The Justice Department is investigating consulting firm McKinsey & Company for its consultancy role in boosting opioid sales and potential obstruction of justice involving its records. This criminal probe has been active for several years. (WSJ)

U.S. Treasury yields increased on Thursday following the release of the first-quarter GDP report, which indicated slowing economic growth and rising consumer prices. The yield on the benchmark 10-year Treasury note rose by 4.8 basis points to 4.702%, and the 2-year Treasury yield increased by 6.1 basis points to 4.998%. Both yields reached their highest levels since November at their session peaks. (CNBC)

The yen hit a fresh 34-year low against the dollar as the Bank of Japan signaled continued easy monetary policy, fueling speculation of potential intervention to stem the currency's decline. Japan's currency dropped as much as 1.8% during the day, reaching a session low of 158.33 per dollar, with losses accelerating in late New York trading. The decline followed a BOJ policy meeting where Governor Kazuo Ueda's remarks offered little support for the yen. (BBN)

Columbia University's senate approved a resolution on Friday, calling for an investigation into the school's leadership. The resolution accuses the administration of violating protocols and undermining academic freedom. President Nemat Shafik has faced criticism for summoning the New York Police Department to campus and for her congressional testimony regarding free speech and disciplinary actions. (NYT)

Public Markets

Boeing CEO Dave Calhoun stated that despite a significant cash outflow and reduced production in the first quarter, the company is still on track to achieve its mid-decade goal of $10 billion in annual free cash flow. In an interview with CNBC, he mentioned a six-month delay but confirmed the target would be met within the 2025 or 2026 timeframe. (BBN)

Stellantis NV has laid off 199 employees at its Sterling Heights Assembly Plant, which manufactures Ram 1500 pickups, according to a union official. Michael Spencer, president of United Auto Workers Local 1700, described the layoffs in an email as "disappointing, disgusting, and a disservice" to the plant's workers. (DNEW)

Amazon has introduced a new grocery delivery subscription service in the U.S. for its Prime members and customers receiving government food assistance benefits. Priced at $9.99 per month, the service offers unlimited grocery deliveries for orders exceeding $35. The subscription covers purchases from Whole Foods Market, Amazon Fresh, and various local and specialty retailers like Save Mart, Bartell Drugs, Rite Aid, and Pet Food Express. (REU)

Walmart's majority-owned fintech startup, One, has begun providing buy now, pay later (BNPL) options for high-value items such as electronics and power tools at select U.S. stores, according to a source. This places One alongside Affirm as a BNPL option available to Walmart customers. As first reported by CNBC, promotional materials for both One and Affirm are prominently displayed in the electronics sections of Walmart stores, competing for consumer attention. (REU)

Kering SA announced that it expects its profit to drop by 40% to 45% in the first half of the year, primarily due to a significant decline at Gucci, its flagship brand. This forecast follows an 18% decrease in Gucci's sales in the first quarter, largely attributed to reduced demand in China. (BBN)

Tesla announced it will lay off 6,020 employees in Texas and California, as CEO Elon Musk prepares to address slowing demand and declining margins in the upcoming quarterly results. This follows a recent 10% workforce reduction globally, attributed to falling sales and intensifying competition in the electric vehicle sector. (REU)

Microsoft has secured a $1.1 billion, five-year deal with Coca-Cola to provide cloud computing and artificial intelligence services. The partnership will focus on developing AI technologies using Azure OpenAI, which allows the creation of chatbots and other AI services on Microsoft's Azure cloud platform. (REU)

Walgreens announced plans to collaborate directly with drugmakers to deliver cell and gene therapies to U.S. patients, marking an expansion of its specialty pharmacy services. As part of this initiative, Walgreens will open a newly licensed facility in Pittsburgh specifically for cell and gene therapy services. This move underscores the growing importance of specialty pharmacies in the U.S. healthcare system, particularly in managing chronic diseases. (CNBC)

Airbus SE is set to increase production of its A350 widebody jet to 12 units per month by 2028, exceeding the previously planned rate of 10 by 2026, amidst strong demand and ongoing issues at competitor Boeing. However, Airbus reported first-quarter earnings before interest and tax of €577 million ($619 million), missing the expected €814 million due to higher costs. (BBN)

Paramount Global is considering replacing CEO Bob Bakish with a committee of top executives on an interim basis as the company explores a sale. Under the plan, the board and controlling shareholder National Amusements would establish an "Office of the CEO" comprising division heads. (WSJ)

Real Estate

On April 24, 2024, the Ilitch family's real estate division, Olympia Development of Michigan, announced it is seeking co-developers for three properties in the District Detroit area. Interested developers have until June 26 to submit their qualifications for projects including the former Fine Arts Building façade on West Adams near Grand Circus Park, the Blenheim Building by the Columbia Street pedestrian walkway close to the Fox Theatre, and the Woodstock Apartments on Peterboro opposite the Detroit Shipping Co. food hall. (CRAIN)

Amazon Web Services (AWS) announced a plan to invest approximately $11 billion in Indiana, the largest capital investment in the state's history, expected to create at least 1,000 new jobs. With the support of Governor Eric Holcomb and the Indiana Economic Development Corporation, AWS will establish new data centers in St. Joseph County and contribute up to $7 million towards road infrastructure improvements in nearby areas. This investment will also support new workforce development programs and local community projects. (AMZN)

Honda Motor has announced plans to invest $11 billion in Ontario, Canada, along with yet-to-be-named joint venture partners, to develop a comprehensive electric vehicle (EV) value chain. This initiative will include the construction of new assembly and battery plants, as well as additional facilities to support the production of all-electric and fuel cell-powered vehicles. This move comes at a time when many automakers are scaling back their EV initiatives due to slower-than-expected adoption rates. (CNBC)

During a significant week in Detroit, Michigan Governor Gretchen Whitmer announced that the 2024 NFL draft set a new attendance record, surpassing the previous record set by Nashville in 2019. The event attracted over 700,000 fans, breaking the earlier record of 600,000 fans over three days. (ESPN)

Mergers & Acquisitions

The U.S. Federal Trade Commission (FTC) filed a lawsuit on Monday to prevent Tapestry, the parent company of Coach, from acquiring Capri, the owner of Michael Kors, in a deal valued at $8.5 billion. The FTC argues that this merger would eliminate significant competition between these leading luxury handbag manufacturers. Additionally, the FTC expressed concerns that the merger could lead to lower wages and benefits for the combined entity's approximately 33,000 global employees. (REU)

Blackstone has announced its acquisition of Tropical Smoothie Cafe from Levine Leichtman Capital Partners, marking the first deal from its latest private equity fund. This move aims to accelerate the expansion of Tropical Smoothie Cafe, which currently boasts over 1,400 locations across 44 states. The investment will focus on enhancing menu options, operations, and marketing. The brand, which started in 1997 in Destin, Florida, has rapidly grown and is a top-ranked franchise in the smoothie/juice category. (BX)

Data management firm Rubrik has started trading on the New York Stock Exchange. The company priced its initial public offering (IPO) at $32 per share, raising $752 million and achieving a valuation of $5.6 billion, surpassing initial expectations. Rubrik sold 23.5 million shares prior to its market debut. (CNBC)

Mining giant Anglo American has rejected a takeover bid from Australia-based BHP Group, stating that the offer significantly undervalues the company and its prospects. BHP had proposed an all-share takeover valuing Anglo American at £31.1 billion ($38.9 billion). Following the news, Anglo American's shares dropped by 0.8% in early trading in London. (CNBC)

KKR has agreed to purchase a portfolio of 19 student housing properties from Blackstone Real Estate Income Trust for approximately $1.64 billion. The portfolio includes over 10,000 beds across 14 four-year public universities in 10 states. Jacob Werner, co-head of Americas acquisitions for Blackstone Real Estate, highlighted the deal as beneficial for BREIT's investors and indicative of the strong market demand for high-quality assets. (REU)

Elliott Investment Management, led by Paul Singer, has acquired a stake worth approximately $1 billion in Anglo American Plc, the UK-listed miner currently targeted by Australia's BHP Group Ltd for a takeover. The activist hedge fund holds exposure to nearly 33.6 million Anglo American shares through derivatives, as confirmed by a UK regulatory filing on Friday, corroborating an earlier report by Bloomberg News. The acquisition of this 2.5% holding occurred over recent months, according to sources familiar with the matter. (BBN)

U.S. regulators have seized Republic First Bancorp and agreed to its sale to Fulton Bank, reflecting the difficulties regional banks face after the collapse of three peers last year. The Pennsylvania Department of Banking and Securities took control of Philadelphia-based Republic First after it ended funding talks with investors. The Federal Deposit Insurance Corp (FDIC) will oversee the sale, with Fulton Bank acquiring nearly all deposits and assets to protect depositors. (REU)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply