- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

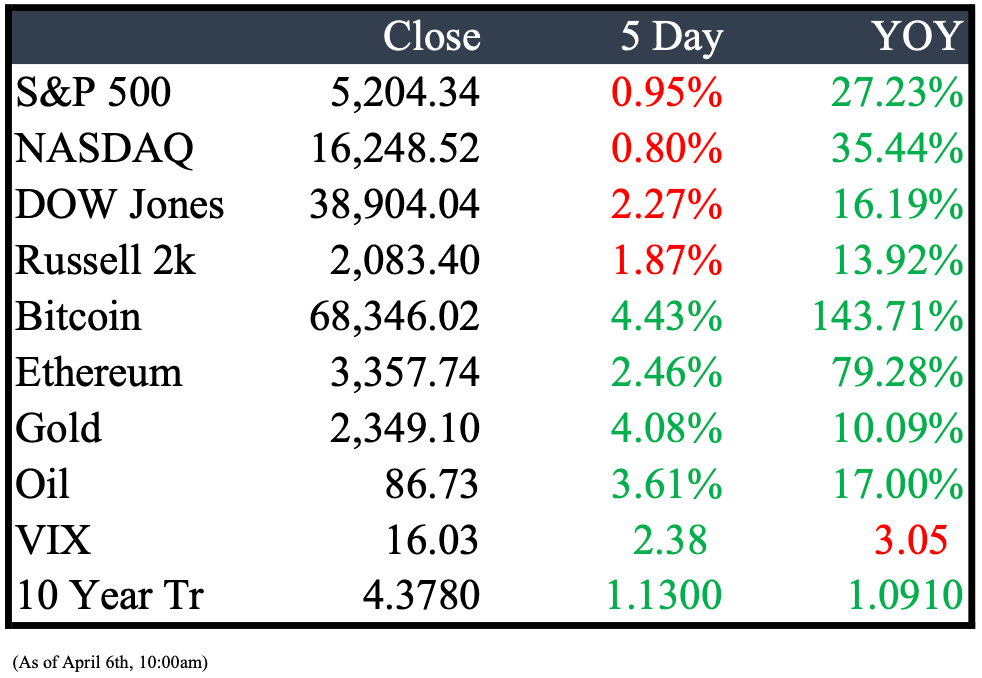

Market Recap

This Week’s Headlines

Economy & World News

Sanctions on Russian and Venezuelan oil have boosted US oil exports, allowing American suppliers to gain market share in regions once dominated by OPEC. The disruptions from Russia's invasion of Ukraine have further increased the global demand for US oil, positioning it as a major player in the export market. (BBN)

Donald Trump has obtained a $175 million bond to secure his civil fraud judgment during his appeal, potentially delaying any payment until after the presidential election. This adds to a $92 million bond for a defamation case, bringing his total appeal bonds to nearly $267 million. With the appeals court unlikely to rule until later this fall, any financial penalties are expected to be deferred until after the November election, where Trump is the Republican presidential nominee. (WSJ)

A powerful 7.4-magnitude earthquake hit Taiwan's eastern coast on Wednesday morning, as reported by the United States Geological Survey. The earthquake occurred at 7:58 a.m. Taipei time, approximately 11 miles southwest of Hualien City. (NYT)

Inflation in the 20-nation euro zone decreased to 2.4% in March, based on preliminary data released on Wednesday. This decline in inflation has raised expectations that interest rate cuts may start in the summer. Market forecasts indicate that the central bank is likely to begin reducing interest rates in June, a sentiment that aligns with recent statements from European Central Bank (ECB) officials. (CNBC)

On Tuesday, oil prices reached their highest level since October. Brent futures, which have mostly fluctuated between $75 and $85 per barrel since the beginning of the year, experienced a surge due to increased geopolitical risks and strong economic data. (CNBC)

According to the payroll processing firm ADP, companies added 184,000 workers in the month, marking an increase from the upwardly revised February gain of 155,000. Furthermore, ADP reported that wages for workers who remained in their jobs increased by 5.1% from the previous year. (CNBC)

Zimbabwe is introducing a new currency backed by gold and foreign currencies to replace its failing local currency, aiming for greater stability and lower inflation, according to the central bank. After a decade of using the US dollar, Zimbabwe reintroduced its own currency in 2019, but it failed to gain public confidence. Currently, over 80% of domestic transactions are conducted in foreign currency. (REU)

Public Markets

United Airlines is providing pilots with the option of taking unpaid leave in May and possibly extending through the summer, according to the pilots' union. The union attributes this decision to delays in Boeing aircraft deliveries. United's CEO, along with other airline executives, has expressed frustration with Boeing, whose CEO recently announced his resignation. (CNBC)

China's electric car market is highly competitive, as evidenced by Xiaomi's recent announcement that its SU7 model will be priced approximately $4,000 lower than Tesla's Model 3. In response to the intense competition, both Li Auto and Nio have revised their first-quarter delivery forecasts downward. Meanwhile, BYD continues to dominate the industry, with 139,902 battery-powered passenger cars sold last month. (CNBC)

Google has agreed to delete billions of data records to settle a lawsuit accusing it of secretly tracking private browsing. The settlement, filed in Oakland, California, requires court approval. The deal is valued between $5 billion and $7.8 billion, but Google won't pay damages. Users can still sue individually for damages. (REU)

Barclays Plc and AGL Credit Management are joining forces to enter the growing $1.7 trillion private credit market, with support from the Abu Dhabi Investment Authority. Under their cooperation agreement, AGL will have exclusive access to Barclays' private credit deal flow, allowing them to have the first opportunity to participate in every deal Barclays originates with a private credit option, without any obligation to do so. (BBN)

Tesla's market dominance is in question after a surprising drop in quarterly sales, raising concerns about Elon Musk's leadership. The decline contrasts with sales increases reported by competitors like BYD, Kia, and Hyundai, suggesting Tesla's issues aren't due to a broader downturn in electric vehicle demand. The company, once a pioneer in the electric vehicle market with its Model 3 and Model Y, now faces growing competition. (NYT)

At Disney's annual shareholder meeting on Wednesday, billionaire activist investor Nelson Peltz's high-profile proxy battle against the company reached a climax. While Disney successfully prevented Peltz from joining its board, the relative success of his campaign highlights the ongoing concerns of Disney investors. (FORB)

Apple Inc. is exploring a venture into personal robotics, a potentially significant new direction for the company. Engineers at Apple are working on a mobile robot that can follow users around their homes, as well as an advanced tabletop device that uses robotics to move a display. These projects are currently private, and the information comes from sources familiar with the matter. (BBN)

Amylyx Pharmaceuticals announced it would withdraw its newly approved treatment for amyotrophic lateral sclerosis (ALS), Relyvrio in the US and Albrioza in Canada, due to a lack of evidence of its effectiveness in a large clinical trial. As of Thursday, no new patients can start the drug, but existing patients can transition to a free drug program. The medication was one of the few treatments for ALS, and its approval by the FDA in September 2022 was controversial due to insufficient evidence of its benefits. (NYT)

Ford Motor is postponing the production of an all-electric SUV and pickup truck, choosing instead to concentrate on providing hybrid options across its entire North American lineup by 2030. While Ford remains committed to investing in electric vehicles (EVs), this strategic shift reflects a broader reassessment within the automotive industry regarding plans for electric vehicles. (CNBC)

United Wholesale Mortgage (UWM) has attracted attention from Hunterbrook Capital, a New York-based activist hedge fund, which has taken a short position on UWM's stock while holding a long position on its rival, Rocket Companies Inc. Despite this, industry experts remain skeptical about the significance of the hedge fund's actions. (CRAIN)

Real Estate

Better Made Snack Foods Inc., based in Detroit, is suing over a dozen Michigan cannabis operators for trademark infringement. The lawsuit, filed on March 27, targets IVP Holding LLC and several dispensaries, alleging that IVP's use of the brand "Better Smoke" with a label similar to Better Made's 94-year-old design causes consumer confusion and harms the snack company's brand. (CRAIN)

The Tropicana Las Vegas resort, known for its historic cabaret and decor, will close on Tuesday for demolition to make way for a new Major League Baseball stadium. The gaming floor closes at 3 a.m., and guests must check out by noon. The Athletics baseball team will use nine acres of the site for a 30,000-seat stadium, hosting the team's move from Oakland, California, starting in 2028. (NYT)

A development team is planning a $66 million apartment building in Detroit's Midtown, named The Landy, to honor the late eccentric developer who previously owned the land. Located at Woodward Avenue and Charlotte Street, the proposed seven-story building will feature 154 residential units, retail space, and two floors of parking. Additionally, it will incorporate part of an existing pre-World War I era building into its design. (CRAIN)

Mergers & Acquisitions

Lambda, an AI cloud provider, has secured a $500 million loan using Nvidia's chips as collateral, highlighting the growing demand for AI computing resources. This move reflects the increasing competition among companies to develop generative AI offerings and capture a share of the expanding AI market. (REU)

Alphabet, the parent company of Google, is considering making an offer for HubSpot, an online marketing software company valued at $35 billion, according to sources. If Alphabet proceeds with a bid, it would be a notable move for a major tech company to attempt a significant acquisition under the heightened regulatory scrutiny of the tech sector during U.S. President Joe Biden's administration. (REU)

Johnson & Johnson has agreed to acquire Shockwave Medical in a deal valued at $13.1 billion, including debt, to expand its cardiac health-focused medical devices business. J&J's offer is $335 per share in cash, valuing the equity at $12.5 billion. The offer represents a 17% premium to Shockwave's stock price in late March, just before reports of J&J's interest surfaced. Shockwave's shares are currently trading at $326.82. (REU)

Earnings

Building Value Through Purposeful Investments.

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply