- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️

Welcome to Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

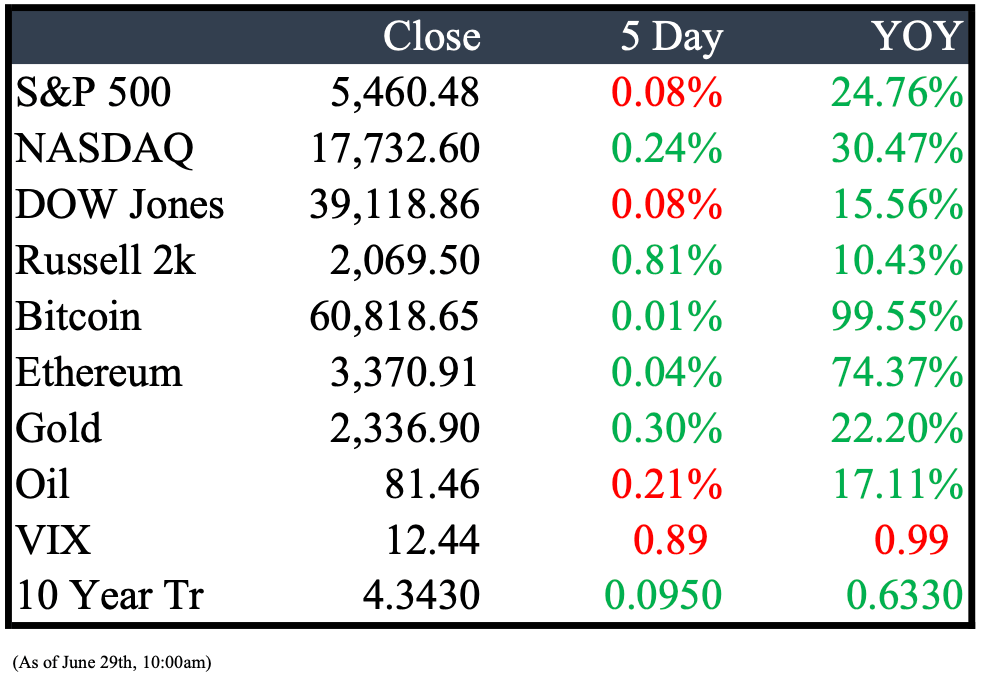

Market Recap

This Week’s Headlines

Economy & World News

U.S. prosecutors are recommending criminal charges against Boeing for violating a settlement related to two fatal crashes, according to sources. The Justice Department must decide by July 7 whether to proceed with prosecution. (REU)

Beijing has hinted that German luxury car manufacturers could benefit if Berlin persuades the EU to drop tariffs on Chinese electric-vehicle exports. China has proposed lowering its 15% tariff on large-engine cars in exchange for the EU scrapping planned EV levies on Chinese imports, according to confidential sources. (BBN)

Julian Assange is set to plead guilty this week to a felony charge of conspiring to obtain and distribute classified information in his U.S. espionage case, allowing him to walk free after more than a decade in London avoiding extradition. This plea relates to WikiLeaks' publication of thousands of confidential U.S. military records and diplomatic cables concerning America's actions in Iraq and Afghanistan in the 2000s. (WSJ)

The U.S. Supreme Court ruled on Thursday to temporarily allow abortions in Idaho for pregnant women facing medical emergencies. The 6-3 decision reinstated a federal judge's ruling that the 1986 Emergency Medical Treatment and Labor Act (EMTALA) supersedes Idaho's near-total abortion ban when the two are in conflict, requiring hospitals receiving Medicare funds to stabilize patients with emergency medical conditions. (REU)

The Supreme Court on Thursday restricted the Securities and Exchange Commission (SEC) and other federal agencies from imposing monetary penalties through in-house tribunals. The 6-3 decision, divided along ideological lines, ruled that the SEC's use of administrative proceedings to seek civil penalties violated the Seventh Amendment right to a jury trial. (WSJ)

A federal jury in California ruled against the NFL in a class-action antitrust lawsuit concerning its out-of-market broadcasts, awarding $4.7 billion in damages to consumers of the “Sunday Ticket” package. The NFL expressed disappointment with the verdict and plans to appeal. The damages, including $4.6 billion for residential subscribers and nearly $100 million for commercial users, could be tripled to over $14 billion under antitrust law if upheld. (WSJ)

The US Supreme Court invalidated Purdue Pharma's $6 billion opioid settlement, which would have funded opioid epidemic relief while protecting the Sackler family, Purdue's billionaire owners, from lawsuits. The 5-4 ruling determined the deal improperly shielded the Sacklers, who had agreed to relinquish company ownership and pay up to $6 billion. (BBN)

Public Markets

The European Union accused Apple of violating digital competition rules by restricting app developers on the App Store, risking billions in fines. This escalates the conflict between Apple and Brussels, potentially leading to operational changes under the EU's new Digital Markets Act. (BAR)

Target has partnered with Shopify to discover new brands and popular items for its third-party marketplace, aiming to boost online traffic and sales growth. This move could prove lucrative as Target earns a cut of sellers' profits and can offer ads or fulfillment services. (CNBC)

China's ByteDance is collaborating with U.S. chip designer Broadcom to develop an advanced AI processor, aiming to secure a steady supply of high-end chips amid U.S.-Sino tensions, according to sources. The 5-nanometer, application-specific integrated chip (ASIC) will comply with U.S. export restrictions and will be manufactured by Taiwan's TSMC. (REU)

In its efforts to advance in AI, Apple has been in discussions with longtime rival Meta about integrating Meta's generative AI model into Apple Intelligence, the AI system for iPhones and other devices, according to sources. Meta and other generative AI developers aim to leverage Apple's vast distribution network through its iPhones, similar to the reach provided by the App Store. (WSJ)

A U.S. bankruptcy judge approved Rite Aid’s restructuring plan on Friday, allowing the pharmacy chain to cut $2 billion in debt and transfer control to its lenders. The plan, which saved Rite Aid from liquidation, involved closing hundreds of stores, selling its pharmacy benefit company Elixir, and negotiating settlements with various creditors, including those suing over the opioid epidemic. Rite Aid will emerge from bankruptcy with about 1,300 of its original 2,000 stores. (CNBC)

Novo Nordisk’s weight-loss drug Wegovy has been approved for sale in China, targeting a market where adult obesity rates have more than doubled in the past two decades. The company announced the approval for long-term weight management but did not specify the launch date, pricing, or supply details, leading to a 2.1% rise in its Copenhagen-listed shares. (FT)

Amazon held a closed-door event for Chinese sellers, unveiling plans for a new budget storefront featuring low-cost apparel, home goods, and other items. This storefront aims to compete directly with popular e-commerce sites Temu and Shein. While the launch date is unspecified, Amazon plans to start accepting products this fall. (CNBC)

Early this year, a few camouflaged Audis arrived secretly from Germany at Rivian's California facility, where about 30 engineers replaced the electronics with Rivian's harnesses and modules. Intense testing at the Palo Alto facility followed, focusing on how Rivian's architecture and software, which control nearly every function, would perform in the German cars. (REU)

Walgreens' fiscal third-quarter earnings fell short of expectations, leading the company to lower its full-year adjusted profit outlook due to a challenging environment for pharmacies and U.S. consumers. Despite this, revenue estimates were surpassed, driven by strong performance in its health-care segment. Walgreens is implementing cost-cutting measures, including closing underperforming U.S. stores, to address these challenges. (CNBC)

Boeing is negotiating with the US Justice Department to resolve potential charges related to two fatal 737 Max crashes, with a settlement possibly announced next week, sources say. The deal may include a corporate monitor for Boeing. The discussions focus on a 2021 deferred-prosecution agreement, and DOJ prosecutors are considering bringing charges, though it's unclear if Boeing will plead guilty. Families of the crash victims are pushing for criminal charges to facilitate new lawsuits against the company. (BBN)

A top McDonald’s executive stated that the US test of its plant-based McPlant burger was unsuccessful in San Francisco and Dallas, concluding in 2022. Joe Erlinger, McDonald's US chief, mentioned that US consumers do not visit McDonald's for plant-based options, preferring traditional offerings. However, he noted that plant-based food has performed better in European markets. (BBN)

Real Estate

Southeast Michigan foundations are creating a $35 million fund to complete the Detroit riverfront project by fall 2025, amid a federal investigation into the alleged embezzlement of $40 million by the Detroit Riverfront Conservancy’s former CFO. The Community Foundation for Southeast Michigan will raise and administer the funds through a supporting organization, similar to its role in the Grand Bargain that helped Detroit emerge from bankruptcy. (CRAIN)

At least 44 Hooters locations have permanently closed due to "pressure from current market conditions," according to a statement from the restaurant chain. Despite these closures, Hooters emphasized its resilience and commitment to staff well-being, stating it plans to continue opening new locations both domestically and internationally and launching Hooters frozen products in grocery stores. The company did not specify which locations closed or provide a timeline for the closures. (USA)

A JW Marriott hotel is set to be built on the former Joe Louis Arena site. The luxury hotel, owned by Marriott International Inc., is part of a development agreement with Atwater & Second Associates LLC, a Detroit-based entity tied to The Sterling Group. The site also features The Residences at Water Square, a 25-story, nearly 500-unit luxury apartment tower that opened this past winter. (CRAIN)

A division of billionaire Stephen Ross' real estate company, Related Cos., has been chosen to co-develop a new mixed-income, high-rise apartment tower in downtown Ann Arbor. Related Midwest, based in Chicago, will collaborate with the Ann Arbor Housing Commission on a dual-tower project at 350 S. Fifth Ave., the former site of the Ann Arbor YMCA, which is currently a public parking lot. This follows a request for proposals issued by the Ann Arbor Housing Commission late last year. (CRAIN)

Mergers & Acquisitions

Global Infrastructure Partners and Italy’s Snam SpA are considering selling their stakes in Abu Dhabi National Oil Co.’s gas pipeline unit, Adnoc Gas Pipeline Assets LLC. GIP, the largest foreign shareholder, is working with advisers to assess interest, while Snam, which owns about 6%, is also contemplating an exit, according to sources. (BBN)

Bobby Jain has secured $5.3 billion in commitments for his new multistrategy hedge fund, the largest fundraising since ExodusPoint Capital Management’s debut. Backers include the Abu Dhabi Investment Authority and major banks like Morgan Stanley, Goldman Sachs, UBS, and HSBC, with Jain Global set to start trading on July 1. (BBN)

Electric vehicle battery startup Our Next Energy has formed a strategic partnership with Foxconn to stabilize its finances. The partnership aims to accelerate the scaling of the U.S. battery industry, making both companies significant players in the sector, according to sources familiar with the situation. (CRAIN)

Rochester Hills-based experiential marketing firm EEI Global Inc., known for creating exhibits at the Detroit Auto Show and other trade events, has filed for Chapter 11 bankruptcy. According to the filing in the U.S. Bankruptcy Court of the Eastern District of Michigan, EEI Global has estimated assets between $1 million and $10 million and liabilities between $10 million and $50 million. (CRAIN)

Temperature-controlled storage and logistics giant Lineage Inc. filed for an initial public offering, aiming to raise over $3 billion, potentially valuing the company at more than $30 billion. This IPO could be the largest first-time share sale of the year, as the market for new listings rebounds. Investment bank Renaissance Capital estimates Lineage could raise about $3.5 billion through the share sale.(CRAIN)

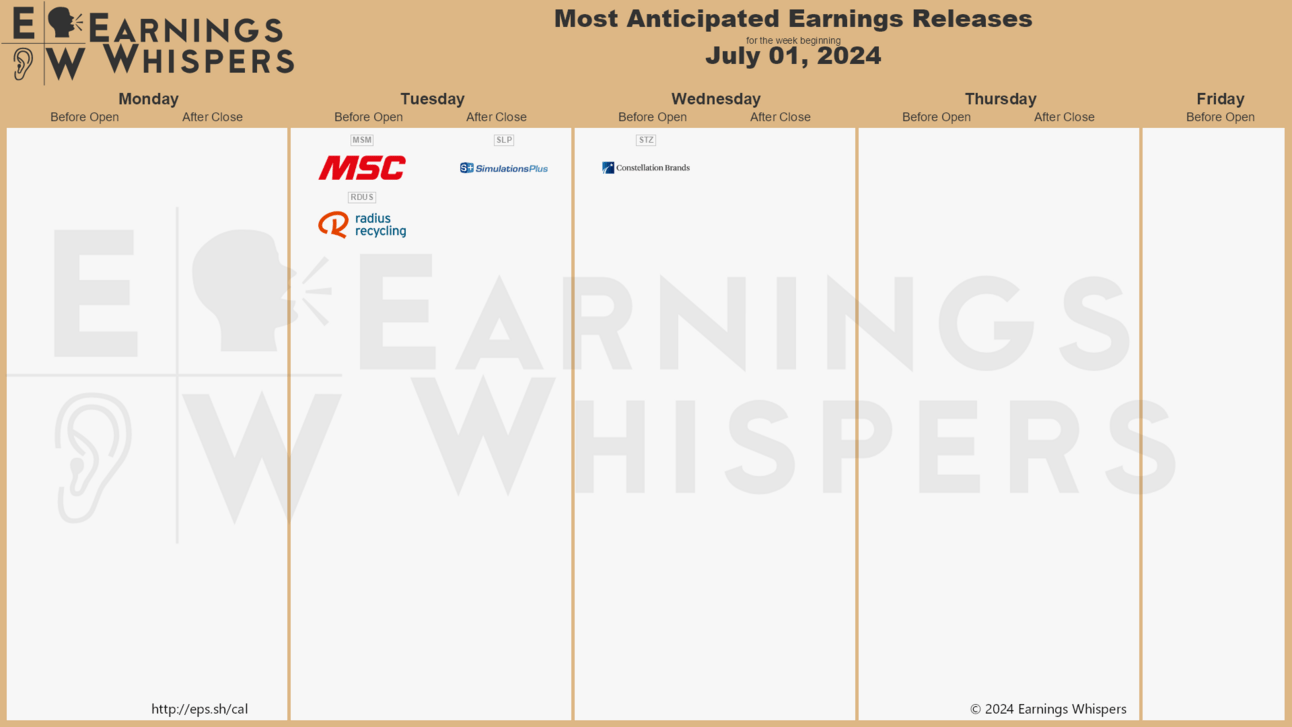

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply