- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 09.14.2024

Welcome to Read Sunday☕️ - 09.14.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Open a Checking Account in 2 Minutes

Chime’s fee-free overdraft can spot you up to $200 with Spotme ®*.

*SpotMe® on Debit is an optional, no fee overdraft service attached to your Chime Checking Account. To qualify for the SpotMe on Debit service, you must receive $200 or more in qualifying direct deposits to your Chime Checking Account each month and have activated your physical Chime Visa® Debit Card or secured Chime Credit Builder Visa® Credit Card. Qualifying members will be allowed to overdraw their Chime Checking Account for up to $20 on debit card purchases and cash withdrawals initially but may later be eligible for a higher limit of up to $200 or more based on Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. The SpotMe on Debit limit will be displayed within the Chime mobile app and is subject to change at any time, at Chime’s sole discretion. Although Chime does not charge any overdraft fees for SpotMe on Debit, there may be out-of-network or third-party fees associated with ATM transactions. SpotMe on Debit will not cover any non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. SpotMe on Debit Terms and Conditions.

Today’s Newsletter is Brought to you by Peridot:

“Prosperity through Peridot”

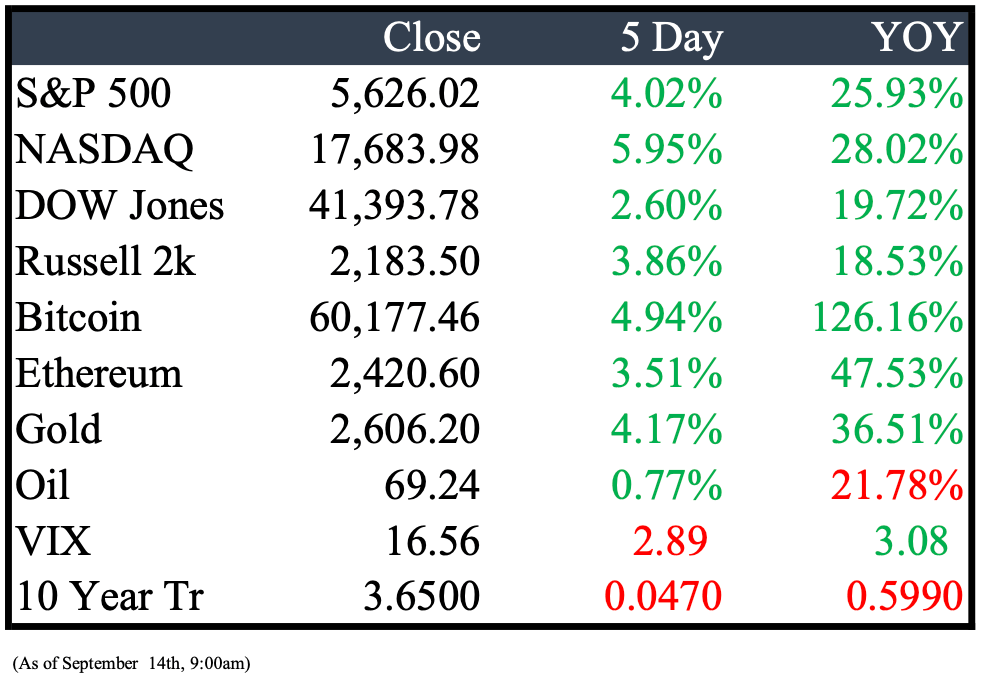

Market Recap

This Week’s Headlines

Economy & World News

China’s Inflation Misses Expectations in August: China reported a 0.6% year-on-year rise in its consumer price index (CPI) for August, falling short of the expected 0.7% forecast. The lower-than-expected CPI increase was driven by declines in transportation, home goods, and rent costs. Meanwhile, the producer price index (PPI) fell by 1.8% year-on-year, a steeper drop than the anticipated 1.4% decline. (More)

China's Exports Exceed Expectations in August, Imports Lag: China's exports grew by 8.7% in August compared to a year ago, surpassing expectations, while imports rose by just 0.5%, falling short of forecasts. The volume of China's rare earth exports declined by 1%, with imports dropping by 12%. (More)

Iraq's Dollar King Shut Down Over Money Laundering Suspicions: Ali Ghulam, once the top operator in Iraq’s ad hoc banking system, ran three banks that wired tens of billions abroad for imports. When the U.S. Federal Reserve investigated, it shut him down, suspecting his banks were funneling dollars to Iran and militia allies through front companies and falsified invoices. U.S. officials estimate up to 80% of daily wire transfers from Iraqi banks, amounting to $250 million, were untraceable, with some funds likely reaching Iran’s Revolutionary Guard. Ghulam denies the allegations. (More)

Chinese Stocks Plunge, Deepening Economic Concerns: A steep selloff in Chinese stocks is worsening the economic outlook for the world’s second-largest economy. The CSI 300 Index is down almost 7% this year, nearing its lowest levels since January 2019. Ongoing property crises and geopolitical tensions are adding to the pressure, with fears mounting that this market slump could further erode consumer and business confidence. Despite state-backed funds trying to stabilize the market, these efforts have had limited success, raising concerns about a deflationary spiral. (More)

SpaceX Launches Private Astronauts for Polaris Dawn Mission: Four private astronauts launched into space aboard a modified SpaceX Crew Dragon capsule, starting the five-day Polaris Dawn mission. The crew, which includes a billionaire entrepreneur, a retired military pilot, and two SpaceX employees, lifted off from NASA's Kennedy Space Center early Tuesday. The mission aims to test new spacesuit designs and conduct the first private spacewalk. (More)

China Pledges $50 Billion in Financial Aid to Africa: Chinese President Xi Jinping announced that China will provide 360 billion yuan (over $50 billion) in financial support to Africa over the next three years. The commitment was made during the ninth Forum on China-Africa Cooperation Summit, where new policies and agreements are expected to shape China-Africa relations for the coming years. (More)

Ireland Faces Challenge of Spending €13.8 Billion Apple Tax Windfall: Ireland is set to receive a €13.8 billion ($15.2 billion) tax payment from Apple, following the EU court's ruling that the country granted the company illegal tax benefits. This windfall, equivalent to 14% of the country's annual government spending, presents a unique challenge for how to allocate the funds. Despite the ruling, the Irish government has consistently argued that Apple didn’t owe these taxes. (More)

Inflation Eases to Three-Year Low, Fed Likely to Lower Rates: Inflation in August dropped to a new three-year low, with the consumer price index rising 2.5% from the previous year, down from 2.9% in July. Core inflation remained steady at 3.2%. This cooling trend sets the stage for the Federal Reserve to potentially reduce interest rates in its upcoming meeting. With inflation easing, the Fed's focus may shift toward concerns about a cooling labor market. (More)

ECB Cuts Interest Rates to 3.5% Amid Falling Inflation and Economic Risks: The European Central Bank (ECB) reduced interest rates by 0.25% to 3.5%, responding to declining inflation and concerns about the Eurozone's slowing economy. ECB President Christine Lagarde announced that the decision was unanimous, contrasting with June's rate cut, which faced opposition. This move aligns with other major central banks, such as the US Federal Reserve, which is also expected to lower rates soon as inflation pressures ease. (More)

Navient Reaches $120 Million Settlement, Banned from Servicing Federal Loans: Navient has agreed to a $120 million settlement with the CFPB, permanently barring it from servicing federal student loans. The settlement includes a $20 million penalty and $100 million in relief to affected borrowers, with eligible individuals receiving checks automatically. The exact payment amounts were not disclosed. (More)

China Suspends PwC for Six Months, Fines Firm Over Evergrande Audits: China has suspended PricewaterhouseCoopers (PwC) for six months and fined the firm 441 million yuan ($62 million) for auditing lapses related to China Evergrande Group's inflated financial reports from 2018 to 2020. The suspension includes the closure of PwC's Guangzhou branch, as announced by China's Ministry of Finance and the China Securities Regulatory Commission. (More)

Company linked to Chuck Rizzo Jr. may be hired for Oakland County waste collection services. The Sylvan Lake City Council approved a five-year, $1.45 million contract with Standard Waste Services LLC for 815 households. The deal follows challenges faced by the current provider, Priority Waste LLC, which is managing delayed trash pickups after expanding to serve 700,000 Southeast Michigan residents. (More)

Public Markets

Kering Shares Fall to Seven-Year Low Amid China Demand Concerns: Kering SA, owner of Gucci, dropped to its lowest point in seven years as concerns about weak demand in China hit the luxury sector. The stock fell as much as 4.3%, its steepest drop in seven weeks, after Barclays downgraded it from 'equalweight' to 'underweight.' (More)

Apple unveiled the iPhone 16 lineup, Apple Watch Series 10, and new AirPods at its Cupertino event. The announcements included the iPhone 16, 16 Plus, 16 Pro, and 16 Pro Max, along with the Apple Watch Series 10 featuring an updated design, new titanium option, and S10 chip. The Apple Watch Ultra 2 and AirPods 4 were also introduced, with updated AirPods Max featuring USB-C charging. Preorders for the iPhones begin Friday, with a Sept. 20 release date. Apple Intelligence features for iPhone 16 launch in beta next month. (More)

Goldman Sachs Cautious After Strong Stock Gains: Goldman Sachs is signaling caution to investors after strong stock performance this year. CEO David Solomon mentioned that the bank’s trading unit is expected to drop 10%, mainly due to declines in fixed-income trading. Additionally, the company will face a $400 million pre-tax loss as it scales back its consumer business, including a move away from its credit card partnership with General Motors and seller-financing operations. (More)

EU Court Rules Against Apple in $14.4 Billion Tax Case: Europe’s top court ruled against Apple in its decade-long legal battle over tax affairs in Ireland. The case dates back to 2016, when the European Commission ordered Ireland to recover up to 13 billion euros ($14.4 billion) in back taxes, claiming Apple received "illegal" tax benefits over 20 years. (More)

Google Loses Appeal Against $2.6 Billion EU Fine for Antitrust Violations: Google's attempt to overturn a €2.4 billion ($2.6 billion) fine imposed by the European Union was rejected by the EU’s Court of Justice. The 2017 ruling found that Google abused its search-engine dominance to prioritize its own shopping services, disadvantaging rival platforms. (More)

Henry Ford Health Launches $750 Million Campaign: Henry Ford Health has gone public with its largest-ever fundraising campaign, aiming to raise $750 million by 2027. The Detroit-based health system has already secured nearly two-thirds of the target. The funds will support Henry Ford’s expanded campus, its partnership with Michigan State University in Detroit, as well as capital projects, research, and programs across Southeast Michigan. (More)

Southwest Chairman Gary Kelly to Retire in 2025: Southwest Airlines' chairman, Gary Kelly, announced he will retire in 2025 under pressure from Elliott Investment Management. The board continues to support CEO Bob Jordan, who has been with the airline for nearly 40 years. (More)

BMW Cuts 2024 Profit Outlook Amid China Slowdown, Braking Issues: BMW slashed its 2024 profit margin outlook due to weak demand in China and problems with a braking system supplied by Continental, pushing its shares to a near two-year low. BMW shares dropped almost 12%, marking their largest intraday loss in over four years, while Continental shares fell over 10%, both dragging down European auto stocks. (More)

Stellantis Invests $406 Million in Michigan Plants for EV Production: Stellantis is investing $406 million across three Michigan facilities, including Sterling Heights, Warren Truck, and Dundee Engine plants. The Sterling Heights plant will receive $235.5 million to produce Stellantis' first fully electric vehicle in the U.S.—the 2025 Ram 1500 REV light-duty truck—set to launch in late 2024. The plant will also build a range-extended version, the Ram 1500 Ramcharger. CEO Carlos Tavares highlighted the transformation and innovation in Stellantis' Michigan operations. (More)

Microsoft Hires Carolina Dybeck Happe from GE: Carolina Dybeck Happe will join Microsoft’s senior leadership team from GE, where she oversaw the spin-off of its aviation and energy companies. Reporting to CEO Satya Nadella, she will work closely with finance chief Amy Hood and cloud/AI leader Scott Guthrie as Microsoft focuses on AI initiatives. (More)

30,000 Boeing Workers Strike After Rejecting Labor Contract: Over 30,000 unionized Boeing workers went on strike after rejecting a new labor contract with a 96% vote. The work stoppage halts production of key aircraft, including the 737 Max. While the proposed contract offered a 25% wage increase over four years, workers felt it did not adequately address rising living costs. (More)

Boeing Faces Potential Credit Downgrade Amid Worker Strike: Boeing risks losing its investment-grade credit rating as a prolonged worker strike threatens to further disrupt production and cash flow. Moody’s, which currently rates Boeing’s unsecured debt at Baa3, is reviewing the company for a possible downgrade. With over $45 billion in net debt and recent cash flow issues due to reduced output, Boeing may need to raise equity capital to bolster its liquidity. (More)

Intel Secures $3.5 Billion Federal Grant for Pentagon Chip Production: Intel has qualified for up to $3.5 billion in federal grants to manufacture semiconductors for military and intelligence use under a program called Secure Enclave. This initiative aims to establish advanced chip production across multiple states, including a facility in Arizona. Despite Intel being the frontrunner for the award, other chipmakers have pushed back, and funding disagreements in Washington have posed challenges to Intel’s total award. (More)

Disney and DirecTV Reach Agreement to End Blackout: Disney and DirecTV have reached a deal, ending a two-week blackout just in time for Saturday's college football games. The blackout had affected DirecTV customers, preventing access to live sports such as college football, the U.S. Open, and "Monday Night Football." The dispute highlights the importance of live sports to both media companies and pay-TV providers. (More)

Real Estate

Republican Leader Alleges Democrats Set Aside $300M for Renaissance Center Demolition: House Minority Leader Matt Hall claimed on Monday that Democrats reserved over $300 million in the next state budget to demolish Detroit's General Motors-owned Renaissance Center for redevelopment and light rail projects. GOP legislators suggested redirecting the funds toward school safety and mental health programs, which are seeing cuts in the upcoming fiscal year starting Oct. 1. (More)

Henry Ford Health Breaks Ground on $2.2 Billion Hospital Tower: One hundred and twelve years after the original hospital's groundbreaking, Henry Ford Health has started construction on a new $2.2 billion hospital tower in Detroit. The project, set to open in 2029, was celebrated by Henry Ford Health and community leaders. (More)

Eastern Market Adds First New Shed in Over 40 Years: Eastern Market Partnership is expanding with the purchase of a 45,000-square-foot building at 3445 Russell St. for $6 million. This marks the district's first new shed addition in more than four decades and reconnects the market with its historic roots. The building is located near the northern Mack Avenue border of the district. (More)

Mergers & Acquisitions

Big Lots Files for Chapter 11 Bankruptcy, Secures $707.5 Million: Three months after expressing doubt about its survival in an SEC filing, Big Lots has filed for Chapter 11 bankruptcy. The company secured $707.5 million to support its operations and a sale to private equity firm Nexus Capital. Facing liabilities between $1 billion and $10 billion, Big Lots attributed its troubles to pandemic-related challenges and macroeconomic factors like high inflation. Decreased consumer spending on home and seasonal products, which make up a significant portion of its revenue, worsened the situation. (More)

OpenAI in Talks to Raise $6.5 Billion at $150 Billion Valuation: OpenAI is reportedly seeking to raise $6.5 billion in a new funding round at a valuation of $150 billion, up from $86 billion earlier this year. In addition, the company is negotiating a $5 billion revolving credit facility from banks. If successful, this would solidify OpenAI's position as one of the world's most valuable startups. (More)

Sony Music in Talks to Acquire Pink Floyd's Music Catalog for $500 Million: Sony Music is in advanced negotiations to purchase the rights to Pink Floyd's recorded music for around $500 million. Internal conflicts between band members, particularly Roger Waters and David Gilmour, have complicated the sale, which has been anticipated for years. Previous bidders for the lucrative catalog included Hipgnosis, Warner Music, and BMG in 2022. (More)

Blackstone Explores Sale of Stake in VFS Global Amid Investor Interest: Blackstone Inc. is considering selling its majority stake in VFS Global, a visa outsourcing and tech services firm, following interest from potential investors. The US asset manager has held preliminary discussions on options, including a full or partial sale, which could value VFS at around $7 billion. One option may involve bringing in a minority investor to raise cash and drive growth. Sovereign wealth funds are among those showing interest in the asset. (More)

NFL Teams, Including Chargers and Dolphins, Explore Private Equity Investment: The Los Angeles Chargers and Miami Dolphins are in talks with private equity firms about selling stakes, with the Chargers' owners in advanced discussions with two buyout firms. The Philadelphia Eagles and Buffalo Bills are also reportedly considering similar moves. While deliberations are ongoing, no final decisions have been made by any team regarding stake sales. (More)

AT&T and TPG in Talks to Merge DirecTV with Dish: AT&T and joint-venture partner TPG are in early discussions to merge DirecTV with Dish, potentially creating the largest pay-TV provider in the U.S. Talks with Dish parent EchoStar Corp. are still in progress, and no agreement has been reached yet. (More)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply