- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 09.08.2024

Welcome to Read Sunday☕️ - 09.08.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by Peridot:

“Prosperity through Peridot”

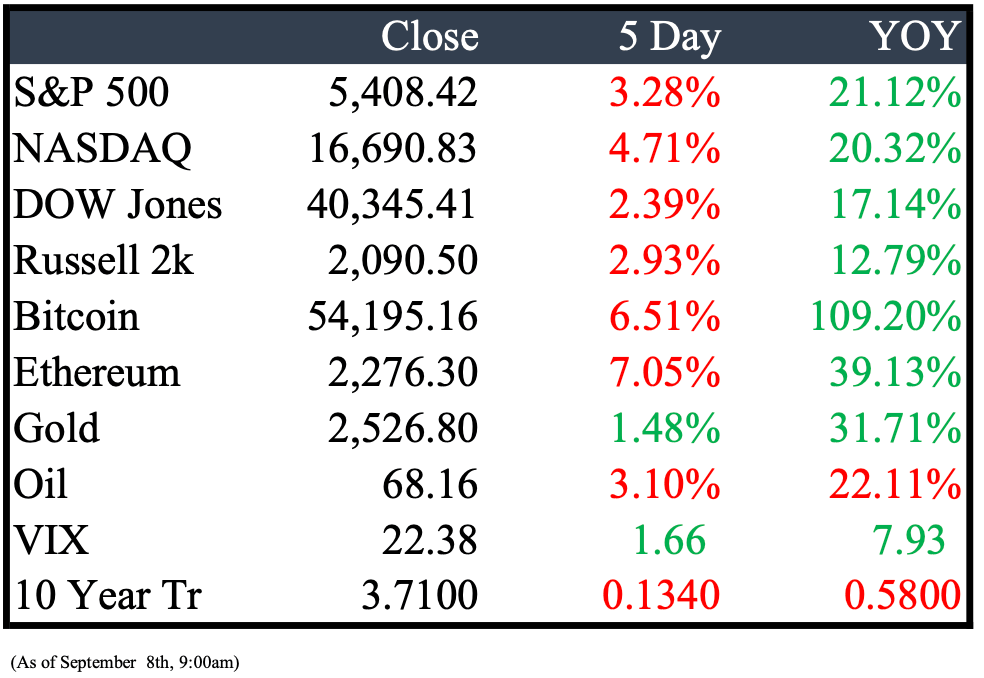

Market Recap

This Week’s Headlines

Economy & World News

Venezuela Orders Arrest of Opposition Candidate Amid Election Dispute: Venezuela has escalated its crackdown on opposition by ordering the arrest of presidential candidate Edmundo González following a controversial election. The move is expected to provoke further criticism from the US and other nations, which recognize González as the rightful winner of the July 28 vote. Venezuelan authorities, however, have declared President Nicolás Maduro the victor, without providing evidence to support the claim of his reelection for a third term. (More)

Michigan Marijuana Prices Hit Record Lows, Boosting Sales in July: Legal marijuana prices in Michigan dropped to an all-time low in July, contributing to the second-highest sales month since adult-use legalization in 2019. The average price for an ounce of cannabis flower was $79.70, according to the Michigan Cannabis Regulatory Agency. Total adult-use sales reached $286.4 million, just shy of the record set in March at $286.8 million. (More)

UAW Secures Major Wage Gains at Supplier Plants, Raising Concerns for Executives: The United Auto Workers union, driven by Shawn Fain's leadership, is achieving significant wage and benefit improvements at automotive supplier factories. Workers across Southeast Michigan and beyond are securing increases not seen in past contracts, marking a short-term win for employees. However, the gains are causing concern among executives, as suppliers face pressure to recover margins while dealing with cost-cutting mandates from their customers. (More)

Goldman Sachs Abandons Bullish Copper Position, Cuts 2025 Price Forecast by $5,000: Goldman Sachs has exited its long-term bullish stance on copper and significantly reduced its 2025 price forecast, slashing it by nearly $5,000 due to weakening demand in China. Once a strong proponent of the industrial metal, the bank now expects prices to average $10,100 per ton next year, down from the previous target of $15,000 set by former analysts Jeffrey Currie and Nicholas Snowdon. The shift reflects concerns over China's sluggish economic recovery, delaying an anticipated copper rally. (More)

Ex-Aide to NY Gov. Kathy Hochul Charged as Chinese Agent: Former aide Linda Sun was arrested on charges of secretly acting as an agent for China, using her government position for millions in payments. Her husband, Chris Hu, was also arrested in the scheme. Both face charges including money laundering and conspiracy, and have pleaded not guilty. Sun was released on a $1.5 million bond, Hu on a $500,000 bond. (More)

American Transit Insurance Co., Key NYC Taxi Insurer, Faces Insolvency: American Transit Insurance Co. (ATIC), which insures 60% of New York City’s commercial taxis and rideshare vehicles, is now insolvent. The family-owned firm, led by Ralph Bisceglia, has long dominated the city’s car insurance market but reported over $700 million in net losses in the second quarter. (More)

New Jersey Bids to Lure 76ers to Camden with New Complex: New Jersey is attempting to attract the Philadelphia 76ers to a proposed mixed-use complex in Camden after the team's downtown arena plans stalled. Governor Phil Murphy sent a formal offer to Harris Blitzer Sports & Entertainment, the team's owner, led by David Blitzer and Josh Harris. (More)

Hiring Slows as Companies Add 99,000 Jobs in August: Companies hired just 99,000 workers in August, down from 111,000 in July and below expectations of 140,000, according to ADP. The report confirms a slowdown in hiring compared to the post-Covid surge, though most sectors have not reported significant job losses. (More)

OPEC+ Delays Planned October Oil Production Increase: OPEC+ members have postponed a scheduled increase of 180,000 barrels per day in October, according to anonymous sources. The hike was part of a broader plan to gradually restore 2.2 million barrels per day, which had been voluntarily cut by eight alliance members. (More)

Hunter Biden Pleads Guilty to Federal Tax Charges, Avoiding Trial: Hunter Biden pleaded guilty to federal tax charges, avoiding a trial that could have exposed his past business dealings. His plea came as jury selection was set to begin, following an unusual proposal from his lawyer for Biden to maintain his innocence while acknowledging sufficient evidence for a guilty verdict. (More)

Biden Administration to Impose Export Controls on Critical Tech to Counter China: The Biden administration is set to implement export controls on technologies like quantum computing and semiconductors, aiming to curb advancements in China and other adversarial nations. The rules will target quantum computers, chipmaking tools, and related semiconductor technologies, with exemptions for allies like Japan and the Netherlands. More nations are expected to join the effort, according to the Commerce Department. (More)

Public Markets

Volkswagen Weighs Factory Closures in Germany Amid Struggles with EV Transition: Volkswagen AG is contemplating significant factory closures in Germany, potentially clashing with powerful unions as the country’s key automotive industry faces challenges. The company is also looking to end a 30-year-old agreement that guarantees job security for workers. Volkswagen’s primary focus is its struggling passenger car brand, which is facing pressure from low profit margins during its shift to electric vehicles and a slowdown in consumer spending. (More)

Cathay Pacific Cancels Dozens of Flights After Airbus A350 Engine Fault: Cathay Pacific Airways Ltd. grounded numerous flights on Tuesday after discovering an engine fault in one of its Airbus A350 aircraft. The issue was detected mid-flight, causing the Zurich-bound plane to return to Hong Kong, the airline's base, for safety precautions. (More)

Apple to Shift Entirely to OLED Displays for iPhones by 2025: Apple plans to transition all iPhone models to organic light-emitting diode (OLED) displays starting in 2025, phasing out liquid crystal displays (LCDs), according to Japan's Nikkei newspaper. OLED displays, favored by television and smartphone manufacturers, offer more vivid colors and sharper contrast, making them ideal for high-definition video quality. (More)

DOJ Sends Subpoenas to Nvidia in Antitrust Probe: The US Justice Department has escalated its investigation into Nvidia, issuing subpoenas to the chipmaker and others for potential antitrust violations related to AI processors. This follows earlier questionnaires, moving the DOJ closer to a possible formal complaint. (More)

Intel’s Financial Struggles Threaten Biden's Chipmaking Plans: The Biden-Harris administration's push for Intel to spearhead a US chipmaking revival is at risk due to the company's financial troubles. Questions are mounting about whether Intel will receive a $20 billion incentive package, jeopardizing key goals like securing chip supply for the Pentagon and producing a fifth of the world’s advanced processors by 2030. (More)

UBS Downgrades ASML Amid AI Growth Concerns: UBS Group AG has ended its two-year bullish stance on ASML Holding NV, downgrading the stock to hold from buy. The bank cited overhyped expectations for AI-driven earnings growth after the stock surged over 60% since its initial buy rating in August 2022. (More)

Constellation Brands to Book Up to $2.5 Billion Loss Amid U.S. Wine Market Slump: Constellation Brands, known for Corona and Robert Mondavi wines, plans to record a $1.5 billion to $2.5 billion loss due to ongoing challenges in the U.S. wine market. The company also lowered its full-year earnings outlook amid slowing sales and rising unemployment. This comes after a strong first quarter driven by beer sales. (More)

Volvo Scales Back EV Target Amid Cooling Demand: Volvo Car AB has dropped its goal of selling only electric vehicles by 2030, now aiming for 90% of sales to come from plug-in hybrids and battery-only models. This shift follows declining demand for EVs in Europe as countries reduce subsidies, mirroring moves by automakers like Mercedes-Benz and Volkswagen. (More)

SEC Drops Legal Battle Over Hedge Fund Fee Disclosures: The US Securities and Exchange Commission has ended its court fight over new hedge fund and private equity fee disclosure rules after a legal setback. The SEC missed the deadline to appeal to the Supreme Court, halting Chair Gary Gensler's push for more transparency in the private funds industry. The SEC had argued the rules would benefit investors. (More)

Qualcomm Teams with Samsung and Google on Mixed-Reality Glasses: Qualcomm CEO Cristiano Amon revealed the company is collaborating with Samsung and Google to develop mixed-reality glasses. Unlike Apple’s Vision Pro headset, these smart glasses are envisioned as a phone companion, with Amon aiming for widespread adoption among smartphone users. (More)

China's Currency Strategy Risks Billions in Bank Losses, Benefits Investors: China's use of foreign-exchange swaps to support the yuan is exposing its banks to potential billions in losses, while offering easy profits to investors. These swaps have become a key tool for state-run banks during heavy selling pressure, according to anonymous sources familiar with the situation. (More)

Trump’s Media Company Stock Plummets as Lockup Period Nears End: The stock price of Trump Media & Technology Group has plunged 69% since May, now valued at under $3.4 billion. With shares falling in 22 of the last 27 sessions, the selloff is expected to worsen as the lockup period from its blank-check deal ends on Sept. 19, allowing insiders to sell their equity. (More)

US Probes Major Airlines' Rewards Programs Over Consumer Impact: The US Department of Transportation is investigating the rewards programs of Delta, American, United, and Southwest Airlines. The carriers have 90 days to report on how consumers are affected by reward devaluation, hidden pricing, extra fees, and reduced competition, the agency announced Thursday. (More)

Dell and Palantir Shares Rise After S&P 500 Inclusion Announcement: Dell and Palantir saw a boost in extended trading after news of their addition to the S&P 500. Dell, previously a member of the index before going private in 2013, joins alongside Palantir after other tech firms like Super Micro and CrowdStrike were added earlier this year. (More)

Real Estate

Buffalo Bills Fans Offered Chance to Help Fund New $1.7 Billion Stadium: Bills Mafia, the Buffalo Bills’ most dedicated fans, who once cleared snow from the stadium before a playoff game, are now being invited to finance the team’s new stadium. Erie County will open a retail order period on Sept. 23, allowing individual investors and fans to purchase part of a $110 million municipal bond, a day before it becomes available to institutional investors. (More)

Morgan Stanley Affiliate Acquires Amazon-Used Warehouse in Michigan: An affiliate of Morgan Stanley now owns a 258,300-square-foot warehouse in Wixom, Michigan, used by Amazon. The building was sold to North Haven Net REIT, a Morgan Stanley-managed entity. Terms of the sale were not disclosed. (More)

Mergers & Acquisitions

Biden Set to Block $14.9 Billion U.S. Steel Takeover by Nippon Steel: President Joe Biden is expected to block Japan’s Nippon Steel’s $14.9 billion takeover of U.S. Steel, according to The Washington Post. U.S. Steel CEO David Burritt warned that blocking the deal could lead to plant closures and the company's headquarters relocating from Pittsburgh. (More)

Verizon to Acquire Frontier Communications for $9.59 Billion: Verizon Communications has agreed to buy Frontier Communications for $9.59 billion to boost its high-speed internet business. Frontier’s investors will receive $38.50 per share, a 37% premium. The deal values the Dallas-based company at $20 billion, including debt. (More)

7-Eleven Rejects $39 Billion Takeover Offer from Circle K's Owner: Seven & i Holdings, the Japanese operator of 7-Eleven stores, rejected a $39 billion acquisition bid from Canada's Alimentation Couche-Tard, the owner of Circle K. The company stated that the offer undervalued its business and didn't address regulatory challenges, particularly in the U.S., where both companies have substantial store networks. (More)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply