- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 09.01.2024

Welcome to Read Sunday☕️ - 09.01.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by Peridot:

“Prosperity through Peridot”

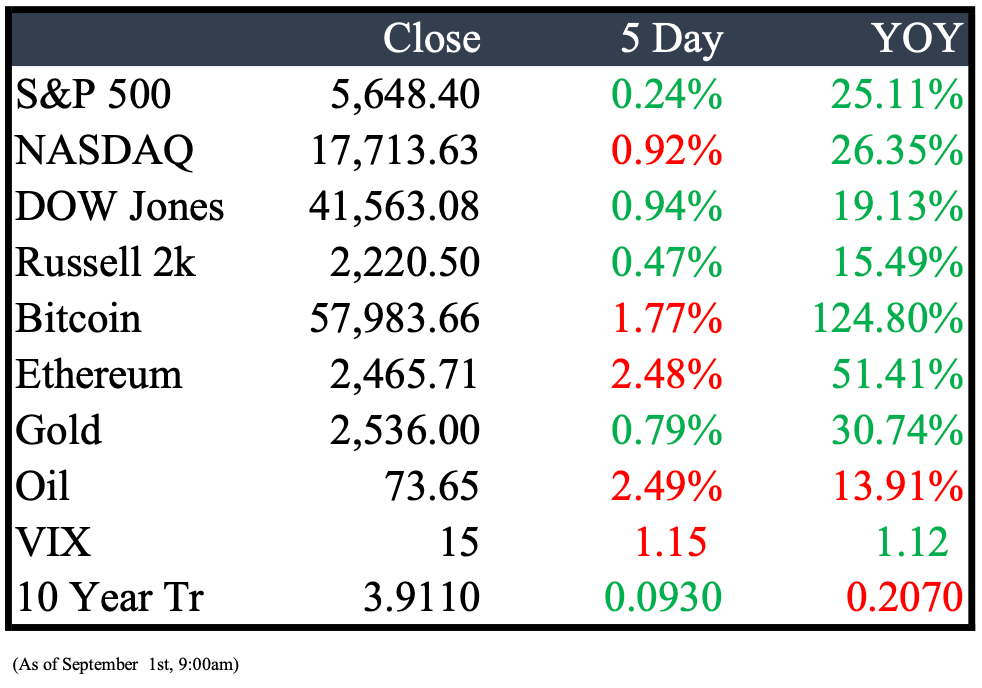

Market Recap

This Week’s Headlines

Economy & World News

Boeing's Starliner to Return Without NASA Astronauts; SpaceX to Handle Return Mission: Boeing's Starliner capsule will return from the International Space Station without the NASA astronauts it delivered to orbit. Instead, NASA is relying on SpaceX to bring back astronauts Butch Wilmore and Sunita "Suni" Williams. The two astronauts will remain at the ISS for about six more months and are scheduled to return home in February aboard SpaceX's Dragon capsule as part of the Crew-9 mission. (CNBC)

Canada to Impose 100% Tariffs on China-Made EVs, 25% on Steel and Aluminum Imports: Canada announced on Monday that it will impose a 100% import tariff on electric vehicles made in China, along with a 25% tariff on Chinese steel and aluminum imports. The move is intended to address what Canada describes as "unfair" competition from China, aiming to "level the playing field" for Canadian workers in these industries. (CNBC)

Canada Pension Plan Sues Lions Gate to Block Starz Separation via SPAC Merger: The Canada Pension Plan Investment Board, which manages nearly $700 billion in assets, filed a lawsuit against Lions Gate Entertainment Corp. on Tuesday in New York. The suit alleges that Lions Gate violated obligations to investors from a $1 billion note issued in 2021 by attempting to separate its profitable movie and television studio from the struggling Starz cable and streaming service through a special purpose acquisition company (SPAC) merger. (BBN)

Euro Zone Inflation Drops to 3-Year Low of 2.2% in August: Inflation in the euro zone fell to a three-year low of 2.2% in August, according to preliminary figures from Eurostat released on Friday. The core inflation rate, which excludes volatile items like energy and food, dipped slightly to 2.8% from 2.9% in July, in line with expectations. Markets are now fully anticipating the European Central Bank (ECB) to cut interest rates by another 25 basis points in September, following its first rate reduction in June, with an additional 25 basis point cut expected before the year ends. (CNBC)

Private Credit Managers Partner with Banks to Maintain Lucrative Fossil Fuel Contracts: In the private credit market, managers are increasingly collaborating with banks to maintain profitable contracts with high-risk oil, gas, and coal clients. This approach allows banks to continue participating in areas like commodity trade finance, where direct exposure might conflict with European regulations on fossil fuels and capital requirements. By sharing these risky exposures with private-credit managers, banks can comply with regulations while still tapping into lucrative commodities markets. (BBN)

Libya's Eastern Government Shuts Down Oil Production Amid Conflict Over Central Bank Control: Libya's eastern government announced it will halt crude output and exports as tensions escalate with its Tripoli-based rival over control of the central bank and the nation's oil wealth, raising the threat of renewed conflict. Brent crude prices surged by as much as 3.2%, reaching over $81 per barrel, after the eastern authorities declared a "force majeure" on all oil fields, terminals, and facilities. Waha Oil Co., which supplies the Es Sider export terminal, and Sirte Oil Co. have begun gradually reducing shipments and output. (BBN)

Trump Embraces Bitcoin After Months of Secret Lessons from Puerto Rican Friends: Three friends from Puerto Rico have been quietly educating Donald Trump about bitcoin for months. As a result, Trump has adopted a more pro-crypto stance this year, which coincided with a surge in donations and endorsements. His support for bitcoin and cryptocurrency culminated in a keynote address at the largest bitcoin event of the year in Nashville, Tennessee. (CNBC)

New Mexico's Lea County Boosts US Oil Dominance, Surpasses 1 Million Barrels per Day: In a remote area of New Mexico, about 100 miles east of Roswell, Lea County has rapidly emerged as a key player in the US oil industry. After lagging behind leading counties in Texas, Lea County has seen its crude output grow faster than anywhere else in the US, becoming the first county to produce more than 1 million barrels per day last year, according to Enverus. Neighboring Eddy County is also on track to reach the million-barrel-a-day milestone by September next year, as predicted by Novi Labs. (BBN)

Public Markets

Intel Weighs Major Changes Amid Challenging Times, Including Potential Business Split: Intel Corp. is consulting with investment bankers to navigate what is being described as the most challenging period in its 56-year history, according to sources familiar with the situation. The company is exploring various options, including the possibility of splitting its product-design and manufacturing businesses, as well as reconsidering which factory projects might be scrapped. These discussions are ongoing and have not been made public. (BBN)

Former Mental Health CEO Eric Doeh Joins Humana as Top State Executive: Two months after resigning as CEO of Detroit Wayne Integrated Health Network, Eric Doeh has taken on a new role as the state's top executive for insurance giant Humana Inc. Doeh, who spent seven years at Michigan's largest mental health service provider, which serves over 123,000 people in Wayne County, resigned from his previous position in June. (CRAIN)

Super Micro Computer Delays Annual Report Due to Internal Controls Review: Super Micro Computer Inc. will delay filing its annual financial report as a special board committee reviews internal controls. The company confirmed the delay, citing the "unreasonable effort or expense" of filing on time, following an earlier statement that led to its biggest stock drop in nearly six years. (BBN)

Dollar General Misses Earnings Expectations, Slashes Annual Outlook: Dollar General, the largest dollar-store operator in the U.S., reported disappointing quarterly earnings and lowered its full-year sales growth forecast to a maximum of 5.3%, down from up to 6.7%. The company cited economic strain on its customers, inventory damages, and theft as factors hindering growth amid its turnaround efforts. Following the news, Dollar General shares plunged 32% on Thursday, marking the largest percentage drop in the company's history. (WSJ)

Nvidia Posts Strong Results, But Growth Slows Amid AI Demand Surge: Nvidia reported strong quarterly results on Wednesday, with sales and earnings more than doubling year-over-year. However, the gains were smaller than in previous quarters, as booming demand for AI capabilities from major tech giants begins to level off. Additionally, the company's gross profit margins narrowed due to production issues with its next-generation Blackwell chips, which required a design adjustment. Nvidia shares fell 6.4% on Thursday following the news. (WSJ)

Eli Lilly Begins Selling Zepbound Weight-Loss Drug Vials for $399 in the U.S.: Eli Lilly announced on Tuesday that it has started selling vials of the lowest starter dose of its popular weight-loss drug Zepbound for $399 per month through its direct-to-consumer website. Unlike the typical auto-injector pens, these easier-to-manufacture vials will help increase the drug's availability to patients more quickly. (REU)

Super Micro Computer Shares Drop After Hindenburg Research's Short Report: Super Micro Computer Inc. shares fell on Tuesday after Hindenburg Research announced it was shorting the stock, citing an investigation that uncovered "glaring accounting red flags," undisclosed related party transactions, and other issues. The stock dropped as much as 8.7% following the report, before closing down 2.6%. The company's convertible debt also declined on the news. (BBN)

Berkshire Hathaway Reaches $1 Trillion Market Cap, First Non-Tech U.S. Company to Do So: Warren Buffett’s Berkshire Hathaway hit a $1 trillion market capitalization on Wednesday, becoming the first nontechnology company in the U.S. to achieve this milestone. The Omaha-based conglomerate's shares have surged over 28% in 2024, significantly outpacing the S&P 500's 18% gain. The milestone was reached just two days before Buffett, known as the "Oracle of Omaha," turns 94. Berkshire Hathaway's shares were up 0.8% to $696,502.02 on Wednesday, according to FactSet. (CNBC)

Two Sigma Founders Step Down as Co-CEOs Amid Ongoing Feud: The founders of the $60 billion hedge fund Two Sigma, John Overdeck and David Siegel, are stepping down as co-chief executives following years of intense and distracting disagreements that hindered decision-making at the firm. The friction between the two had escalated from "irritation to cold war to hot war," according to a source familiar with the situation. The discord was so severe that Two Sigma felt compelled to inform investors about the internal strife. (WSJ)

Real Estate

Icahn Enterprises Shares Plunge to 20-Year Low Amid $400 Million Offering Announcement: Shares of Carl Icahn's Icahn Enterprises closed at a more than 20-year low on Monday after the firm announced plans to sell up to $400 million in depository units through an "at-the-market" offering. The stock dropped as much as 14.3% to $13.62, the lowest level since November 2003. (WSJ)

Mergers & Acquisitions

Edgar Bronfman Jr. Exits Bid for Shari Redstone's Media Empire, Clearing Path for Skydance Media: Edgar Bronfman Jr. has withdrawn his bid for Shari Redstone's media empire, potentially paving the way for a sale to David Ellison's Skydance Media. Bronfman's group informed Paramount's special committee of directors on Monday that they are exiting the "go-shop" process. In his statement, Bronfman praised Paramount Global as an "extraordinary company" with exceptional brands, assets, and people. (WSJ)

Seven & i Seeks Government Approval Requirement for Large Share Purchases, Potentially Complicating Couche-Tard’s Buyout Bid: Seven & i Holdings Co., the operator of 7-Eleven stores in Japan, is requesting the Japanese government to require prior notification for any purchase of its shares exceeding 10%, according to sources. This move, if approved, could pose a challenge to Alimentation Couche-Tard Inc.'s buyout proposal. Seven & i is seeking to be designated as a "core" company under the Foreign Exchange and Foreign Trade Act, upgrading its current "non-core" status. (BBN)

NFL Approves Private Equity Investment in Teams, Allowing Firms to Acquire Up to 10% Stakes: NFL owners voted on Tuesday to permit select private equity firms to invest up to 10% in team stakes. The approved firms include Ares Management, Sixth Street Partners, Arctos Partners, and a group featuring Dynasty Equity, Blackstone, Carlyle Group, CVC Capital Partners, and Ludis. The NFL is the last major sports league to allow private equity investment, a move prompted by rising team valuations that make ownership more challenging. (CNBC)

OpenAI in Talks to Raise Funding, Valuing Startup Over $100 Billion: OpenAI is in discussions to raise a new funding round that would value the artificial intelligence startup at more than $100 billion, CNBC reports. Thrive Capital is expected to lead the round with a $1 billion investment, according to a source familiar with the matter. (CNBC)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply