- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 08.18.2024

Welcome to Read Sunday☕️ - 08.18.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

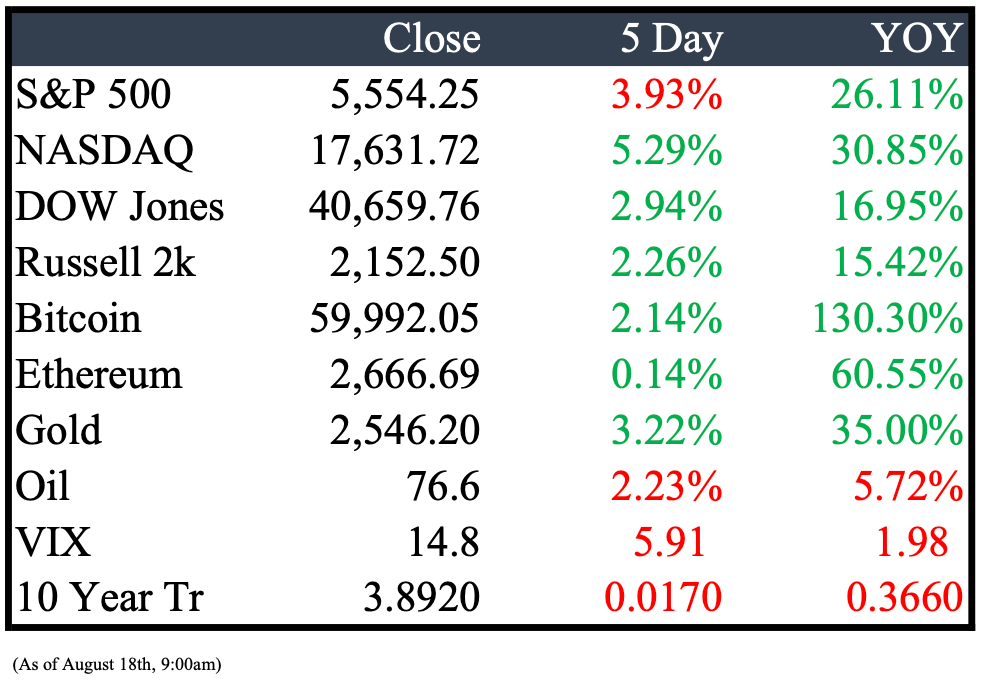

Market Recap

This Week’s Headlines

Economy & World News

Russia and Ukraine to Maintain Gas Flows to Europe Despite Conflict: Despite ongoing fighting near a key transit point, Russia and Ukraine plan to keep pipeline gas flowing to Europe through the Sudzha gas-intake station in Russia's Kursk region. Both sides have financial incentives to maintain the flow: Ukraine relies on gas transit fees, crucial for its war-torn economy, while Europe remains a major customer for Russian pipeline gas. Concerns over potential disruptions have already driven European gas prices to their highest levels this year. (BBN)

Fitch Downgrades Israel's Credit Rating to "A" Amid Geopolitical Risks: Fitch downgraded Israel's credit rating from "A-plus" to "A" on Monday, citing escalating geopolitical risks due to the ongoing war in Gaza. The agency also maintained a negative outlook, signaling the potential for further downgrades. Fitch anticipates that Israel will permanently increase military spending by nearly 1.5% of GDP compared to pre-war levels, which could put additional strain on the country's budget deficit and debt levels. (REU)

Producer Price Index Rises 0.1% in July, Below Expectations: The Producer Price Index (PPI), a measure of wholesale inflation, increased by 0.1% in July, below the 0.2% forecast. Excluding food and energy, the PPI was flat. On a year-over-year basis, the headline PPI rose 2.2%, down sharply from 2.7% in June. (CNBC)

UAW Files Complaints Against Trump and Elon Musk for Worker Intimidation: The United Auto Workers (UAW) Union has filed complaints with the National Labor Relations Board against Donald Trump and Tesla CEO Elon Musk, alleging worker intimidation. This follows Trump's remarks during a social media chat with Musk. The UAW, which endorsed Kamala Harris in July, is urging its 400,000 members to support her in the upcoming election, focusing on key states like Michigan. (REU)

U.K. Economy Grows Faster Than Expected in First Half of 2024: The U.K. economy expanded by 0.6% in the second quarter, down slightly from 0.7% in the first quarter, but still exceeding expectations. This stronger-than-anticipated growth supports the new government's efforts to combat high inflation and aims for a soft landing after a period of slow growth. The data, released by the Office for National Statistics, suggests the economy is performing better than most economists, including those at the Bank of England, had predicted. (WSJ)

Japan's Prime Minister Fumio Kishida to Step Down, Won't Seek Re-election: Prime Minister Fumio Kishida announced Wednesday that he will not run in the upcoming Liberal Democratic Party presidential election next month. This decision means he will step down as prime minister when the party elects a new leader, concluding his three-year term. (CNBC)

Consumer Price Index Rises 0.2% in July, Annual Inflation Hits 2.9%: The Consumer Price Index (CPI) increased by 0.2% in July, bringing the annual inflation rate to 2.9%, the lowest since March 2021. Core CPI, which excludes food and energy, also rose 0.2% monthly and 3.2% annually, in line with expectations. A 0.4% rise in shelter costs accounted for 90% of the overall inflation increase, while food prices rose 0.2% and energy costs remained flat. (CNBC)

Columbia University President Minouche Shafik has resigned, becoming the third Ivy League president to step down following campus protests over the Israel-Hamas war. (BI)

U.K. Economy Grew by 0.6% in Q2, Meeting Expectations: The U.K. economy expanded by 0.6% in the second quarter, matching economists' expectations, according to the Office for National Statistics. This follows a 0.7% growth in the first quarter. Economic growth was flat in June, also in line with predictions from a Reuters poll. (CNBC)

Retail Sales Surge 1% in July, Beating Expectations: Advanced retail sales jumped 1% in July, significantly outpacing the 0.3% estimate. Additionally, weekly jobless claims fell to 227,000, down 7,000 from the previous week and below the expected 235,000. These reports come in the same week as data showing a slight easing of inflation in July. (CNBC)

Public Markets

Starboard Value Takes Stake in Starbucks, Pushes for Stock Price Boost: Activist investor Starboard Value has acquired a stake in Starbucks and is urging the coffee giant to take steps to enhance its stock price, according to sources familiar with the situation. The exact size of Starboard's stake and its specific demands remain undisclosed. This development comes as Starbucks is also in discussions with another activist investor, Elliott Investment Management, which has reportedly built a significant position and is quietly advocating for changes within the company. (WSJ)

Starbucks Appoints Chipotle CEO Brian Niccol as New Leader: Starbucks has named Chipotle CEO Brian Niccol as its new CEO and executive chairman, effective September 9. This sudden leadership change comes as Starbucks aims to revitalize its business and address activist investor pressures. Current CEO Laxman Narasimhan has stepped down after 16 months in the role. The announcement boosted Starbucks shares by 25%, while Chipotle shares fell nearly 8%. (WSJ)

Yen-Centered Carry Trade Stages Comeback After Recent Collapse: A popular yen-centered carry trade, which faced a dramatic setback two weeks ago, is making a comeback. Since August 5, Japan's currency has weakened by more than 5% against the dollar, reversing after hawkish monetary policy moves in Japan, concerns over U.S. earnings, and a weak jobs report had pushed the yen to a seven-month high. (BBN)

Johnson & Johnson Secures Key Support for $6.5 Billion Baby Powder Settlement Plan: Johnson & Johnson has gained crucial backing for its $6.5 billion plan to resolve thousands of lawsuits alleging its baby powder caused cancer. More than 75% of claimants approved the proposal through secret balloting that concluded in late July, according to sources familiar with the matter. This support strengthens J&J's bid to confine liability to a specially created unit as part of its settlement strategy. However, the company still faces significant challenges in finalizing the resolution of these lawsuits. J&J spokesperson Clare Boyle declined to comment on the vote tally. (BBN)

Apple Developing High-End Home Device with Robotic Arm: Apple Inc. is advancing the development of a premium tabletop home device that combines an iPad-like display with a robotic arm. A team of several hundred people is working on the device, which features a thin robotic arm that allows the large screen to tilt and rotate 360 degrees. This product is Apple's unique take on home devices like Amazon's Echo Show 10 and Meta's discontinued Portal, as the company explores new revenue streams. (BBN)

Cisco to Lay Off 7% of Workforce; Stock Rallies on Cost-Cutting Plan: Cisco Systems announced plans to cut its workforce by 7%, or approximately 6,000 employees, as part of a cost-cutting initiative. The layoffs, revealed late Wednesday, aim to reallocate resources to growth areas such as AI, cloud computing, and cybersecurity. The restructuring will cost up to $1 billion in severance and related expenses. Despite the layoffs, Cisco's stock rallied after the company reported better-than-expected quarterly results, with revenue declining by 10%, less than anticipated, and guidance meeting Wall Street expectations. (WSJ)

Judge Temporarily Blocks Venu Sports Streaming Service Ahead of NFL Season: A U.S. judge on Friday temporarily halted the launch of Venu, a sports streaming service created by Warner Bros. Discovery, Fox, and Disney’s ESPN, just before the NFL season. The service, which was set to cost $42.99 a month, faced a lawsuit from internet TV bundle provider Fubo, alleging the venture was anticompetitive and would harm its business. (CNBC)

Real Estate

Monroe Blocks Development in Downtown Detroit Faces Likely Delay: The Monroe Blocks project at Cadillac Square in downtown Detroit is expected to face another delay. Dan Gilbert’s Bedrock LLC plans to request a “short extension” to begin construction on the project's first phase, which was originally set to start by September 1 under an agreement with the Downtown Development Authority, according to a Detroit Economic Growth Corp. spokesperson. (CRAIN)

Rite Aid Closing All 232 Michigan Stores, Leaving Landlords Scrambling: Rite Aid is shutting down all 232 of its Michigan locations by the end of next month, leaving landlords with millions of square feet to repurpose. While some stores have quickly been taken over by new tenants, landlords face challenges such as lower rent from replacements and the expense of subdividing spaces. (CRAIN)

Mergers & Acquisitions

Bank of Nova Scotia Invests $2.8 Billion in KeyCorp to Expand U.S. Presence: Bank of Nova Scotia is investing $2.8 billion in KeyCorp, enhancing its U.S. market position. CEO Scott Thomson highlighted the move as offering attractive returns and future opportunities in North America. KeyCorp, based in Cleveland, operates 1,000 branches across 15 states with $187 billion in assets. (WSJ)

Patrick Drahi Exits BT Group, Sells Stake to Bharti Global: Patrick Drahi is divesting his 24.5% stake in BT Group Plc after the investment lost nearly £1 billion ($1.3 billion) in value. Drahi's Altice UK will sell the stake, worth £3.18 billion as of Friday, to Bharti Global. Altice had acquired approximately 2.44 billion BT shares between June 2021 and May 2023, originally valued at about £4.17 billion. (BBN)

Atwater Brewery Acquired by Tilray Brands, Ending Four-Year Molson Coors Relationship: Detroit's well-known Atwater Brewery has been acquired by New York-based Tilray Brands Inc., along with three other craft breweries, from Molson Coors. This sale concludes Atwater's four-year affiliation with Molson Coors, where it was part of the Tenth and Blake Beer Co. craft division since 2020. (CRAIN)

Blackstone Acquires Majority Stake in Chartis to Boost Healthcare Advisory Growth: Chartis announced that Blackstone will make a majority investment to support its growth as a leading healthcare advisor. The investment, with continued backing from Audax Private Equity, will help expand Chartis’s strategic, digital, and clinical services, as well as its portfolio of companies, including HealthScape Advisors, Jarrard, and Greeley. (BW)

Mars to Acquire Kellogg Spin-Off Kellanova for $36 Billion: Mars, the owner of M&M, is acquiring Kellanova, a Kellogg spin-off, in a deal valued at approximately $36 billion, or $83.50 per share. Kellanova, formed after Kellogg's business split last year, oversees the company's snacking and plant-based brands. In 2023, Kellanova reported net sales exceeding $13 billion. (CNBC)

Rheinmetall Group to Acquire Loc Performance Products for $950 Million: German automotive and defense company Rheinmetall Group plans to acquire Plymouth-based Loc Performance Products LLC in a $950 million deal aimed at expanding its business with the U.S. military. The acquisition, signed Tuesday and pending regulatory approvals, unites two manufacturers with strong ties to the U.S. Department of Defense and a significant presence in Michigan. (CRAIN)

Edgar Bronfman Jr. Prepares Bid for Paramount Global and National Amusements: Media executive Edgar Bronfman Jr., former head of Warner Music and Seagram, is preparing a bid for Paramount Global and National Amusements, the company controlled by Shari Redstone. Bronfman is in discussions to partner with various individuals and companies, including Fortress Investment Group, Roku, and Hollywood producer Steven Paul, who has previously shown interest in National Amusements. This potential bid adds another twist to the complex media landscape. (WSJ)

The M Den, Longtime University of Michigan Retail Partner, Files for Bankruptcy: The M Den, the longtime retail partner of the University of Michigan, filed for Chapter 11 bankruptcy reorganization on Friday. The filing, under the name Heritage Collegiate Apparel Inc., comes a day after the announcement that The M Den business would be sold and that the university is seeking a new retail partner. Owner Scott Hirth stated that the company will no longer operate under the name The M Den. (CRAIN)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply