- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 08.11.2024

Welcome to Read Sunday☕️ - 08.11.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Take a demo, get a Blackstone Griddle

Automate expense reports so you can focus on strategy

Uncapped virtual corporate cards

Access scalable credit lines from $500 to $15M

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

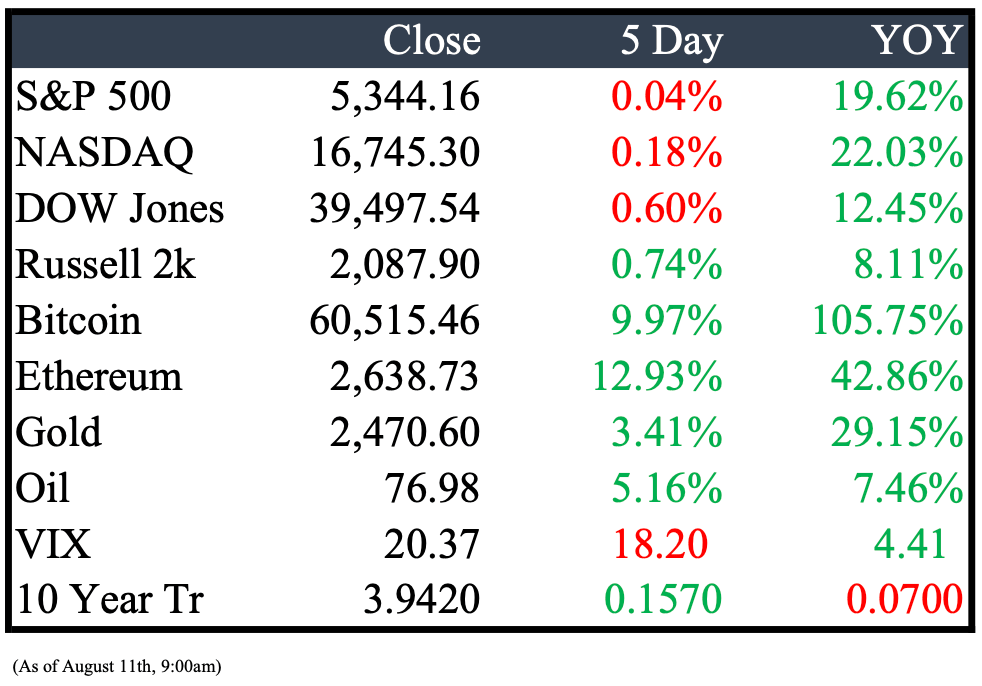

Market Recap

This Week’s Headlines

Economy & World News

Fannie Mae and Freddie Mac to Tighten Rules for Commercial-Property Lenders Amid Fraud Crackdown: Fannie Mae and Freddie Mac are set to introduce stricter rules for commercial-property lenders and brokers in response to a growing regulatory focus on fraud in the multitrillion-dollar market. The new guidelines will require lenders to independently verify financial information from borrowers of multifamily properties, ensure borrowers have adequate cash and a verified source of funds, and conduct due diligence on the appraised value of properties. Currently, lenders often take a more hands-off approach, relying on provided financials without rigorous audits to avoid deterring clients with excessive red tape. (WSJ)

Commonwealth/McCann to Lay Off 56 Employees in Downtown Detroit: Detroit advertising agency Commonwealth/McCann is laying off 56 employees following General Motors Co.'s decision to shift some advertising work to other agencies. According to a memo dated July 31, the agency notified the state of the layoffs, which are expected to be permanent and will take effect on October 1. (CRAIN)

New Venture Capital Fund Targets Michigan Startups: A new venture capital fund, Side Door Ventures Michigan Fund, is set to invest in homegrown Michigan startups with support from the Michigan Economic Development Corp. Co-founder Edward Kim announced that the $20 million fund is expected to close by the end of next year. The state of Michigan contributed $9.8 million to the fund in July. (CRAIN)

Biden-Harris Administration Allocates $2.2 Billion to Modernize U.S. Power Grid: The Biden-Harris Administration, via the U.S. Department of Energy (DOE), is investing $2.2 billion to modernize the nation’s power grid. Funded by the Bipartisan Infrastructure Law’s Grid Resilience and Innovation Partnerships (GRIP) Program, this initiative aims to enhance grid resilience against extreme weather events, lower energy costs, and increase grid capacity to accommodate the growing demand for renewable energy. (EN)

China's Imports Surpass Expectations in July, Exports Fall Short: China's imports grew by 7.2% in July, significantly exceeding the forecast of 3.5%, according to customs data. Imports from the U.S. saw a substantial year-on-year increase of 24%. However, export growth lagged behind expectations during the same period. (CNBC)

McLaren Health Care Confirms Cyberattack During Technology Outage: McLaren Health Care, based in Grand Blanc, confirmed that a cyberattack caused the technology outage affecting its 13 hospitals. While emergency services and surgeries continue, some non-emergent appointments are being rescheduled. The IT team, with external experts, is investigating the attack, with no current evidence of compromised patient or employee data. (CRAIN)

Jobless Claims Fall to 233,000, Beating Expectations: Initial jobless claims dropped to a seasonally adjusted 233,000 for the week, 17,000 lower than the previous week and below the Dow Jones estimate of 240,000. Following the news, stock market futures, initially in the red, turned sharply positive. (CNBC)

China's Consumer Prices Rise 0.5% in July, Exceeding Expectations: China's consumer prices increased by 0.5% in July from a year earlier, surpassing analysts' expectations of a 0.3% rise, according to data from the National Bureau of Statistics. Core CPI, which excludes food and energy prices, grew by 0.4% year-on-year, down from 0.6% in June. (CNBC)

Public Markets

Federal Judge Rules Google Illegally Maintains Search and Ad Monopoly: A U.S. federal judge ruled on Monday that Google has unlawfully maintained a monopoly in search and text advertising. The ruling focused on Google's exclusive search arrangements on Android devices and Apple’s iPhone and iPad. The Department of Justice, along with a bipartisan coalition of attorneys general from 38 states and territories, led by Colorado and Nebraska, filed parallel antitrust lawsuits against Google in 2020. (CNBC)

Nvidia Delays New AI Chips Due to Engineering Issues: Nvidia Corp. has faced engineering challenges that have delayed the release of its new Blackwell AI chips. The company is reworking one chip to better integrate with data centers designed for the Hopper H100, impacting a small segment of the market. (BBN)

Aramco Reports Decline in First-Half Net Income to $56.3 Billion: Aramco's net income for the first half of the financial year dropped to $56.3 billion, down from $62 billion in the same period last year. The company reaffirmed its second-quarter base dividend of $20.3 billion and announced a performance-linked dividend of $10.8 billion to be paid in the third quarter. Economists attribute the kingdom's four consecutive quarters of GDP contraction primarily to oil production cuts. (CNBC)

Airbnb Warns of Slower Growth Amid Shorter Booking Lead Times: Airbnb cautioned that it expects a moderation in year-over-year growth in its key "Nights and Experiences" category for the upcoming quarter. The company also noted shorter booking lead times globally and signs of slowing demand from U.S. guests. Despite these challenges, Airbnb reported its highest-ever second-quarter result, with users booking 125.1 million Nights and Experiences. (CNBC)

CVS Health Lowers Profit Outlook, Unveils $2 Billion Cost-Cutting Plan: CVS Health has cut its full-year profit forecast and announced a $2 billion cost-cutting plan over several years to counter rising medical costs impacting the company and the broader U.S. insurance industry. The plan includes streamlining operations and increasing the use of artificial intelligence and automation. Additionally, Aetna President Brian Kane, head of CVS's insurance unit, has departed the company effective immediately. (CNBC)

Eli Lilly Narrows Gap with Novo Nordisk in Obesity Market: Eli Lilly & Co. is closing in on rival Novo Nordisk in the competitive obesity market, bolstered by strong sales of its weight-loss drug Zepbound. The drug generated $1.2 billion in sales in the second quarter, far exceeding Wall Street’s estimate of $819 million. Lilly has now raised its full-year revenue forecast to between $45.4 billion and $46.6 billion, up from a previous high of $43.6 billion. (BBN)

Stellantis to Lay Off 2,450 Workers in Michigan as Ram 1500 Production Ends: Stellantis plans to indefinitely lay off up to 2,450 workers at its Warren, Michigan, plant later this year as it ends production of the older Ram 1500 pickup. No replacement vehicle has been announced, with layoffs expected to begin in October. (CNBC)

Nikkei Surges 10.23% for Largest Daily Gain Since 2008: The Nikkei soared 10.23% to close at 34,675.46, marking its biggest daily gain since October 2008 and the highest spike ever in terms of index points. The Topix also saw a significant rise, finishing up 9.3% at 2,434.21. Meanwhile, the Reserve Bank of Australia kept its cash rate steady at 4.35% following its Tuesday announcement. (CNBC)

Real Estate

Mortgage Rates Drop to Lowest Level in Over a Year: Mortgage rates have fallen to their lowest point in more than a year, offering potential relief to the struggling U.S. housing market. The average rate on a 30-year fixed mortgage dropped to 6.47%, according to Freddie Mac, marking the lowest rate since May 2023 and the steepest weekly decline in about nine months. (WSJ)

New 158-Unit Apartment Building Planned Near Royal Oak’s Business District: Champion Development Group LLC has proposed a five-story, 158-unit apartment building just east of Royal Oak's central business district. The project, located north of Lincoln Avenue between Troy and Main streets, will be reviewed by the Royal Oak Planning Commission on August 13. (CRAIN)

Investment Firm Loses Trump’s Former Washington, D.C. Hotel in Foreclosure Auction: CGI Merchant Group, the Miami-based investment firm that purchased the luxury Washington, D.C., hotel from Donald Trump’s family firm for $375 million, lost the property in a foreclosure auction on Monday, about two years after the acquisition. The firm had defaulted on its $285 million loan from BDT & MSD Partners in 2023. Despite a 45-day extension to cure the default, CGI failed to resolve the issue, leading the merchant bank to take over the property. (WSJ)

Comerica Park to Receive Major Upgrades for 25th Season: In celebration of Comerica Park's 25th season, the Detroit Tigers are introducing significant fan experience enhancements, including the new Home Plate Club. This exclusive, all-inclusive space beneath the stands will feature upgraded seating behind home plate, available by the home opener, with the full club experience rolling out during the season. (INH)

GSA Invests Over $53 Million in Sustainable Infrastructure in Michigan: The U.S. General Services Administration is investing more than $53 million in sustainable infrastructure improvements across Michigan, including $34.1 million for the Patrick V. McNamara Federal Building in downtown Detroit. These projects are funded by the federal Inflation Reduction Act, which allocates $3.4 billion to the GSA for building, modernizing, and maintaining high-performance, cost-efficient facilities nationwide. (CRAIN)

Joe Louis Arena Garage Sold for $30 Million After Default: The Joe Louis Arena parking garage in Detroit was sold for $30 million in late May after its previous owner defaulted on a land contract. The Detroit Regional Convention Facility Authority (DRCFA) bought the 3,000-space garage to support the Huntington Place expansion and nearby projects. The purchase was deemed more cost-effective than building a new structure. The previous owner, Foster Financial, had defaulted with an outstanding balance of $27.2 million. (CRAIN)

Mergers & Acquisitions

L’Oréal Acquires Minority Stake in Swiss Skincare Firm Galderma for $1.85 Billion: L’Oréal has agreed to purchase a minority stake in Swiss skincare company Galderma, valued at $1.85 billion, expanding its presence in the rapidly growing market for aesthetic injections like fillers. This deal marks L’Oréal’s return to Galderma, a company it co-founded with Nestlé over four decades ago but exited in 2014. The French cosmetics giant emphasized Galderma’s strong position in the skin-smoothing injection market, where its Dysport brand competes with AbbVie’s Botox, and noted that the investment opens opportunities for partnerships in this fast-growing sector. (WSJ)

Société Générale to Sell U.K. and Swiss Private Banking Divisions for €900 Million: Société Générale has agreed to sell its private banking divisions in the U.K. and Switzerland for approximately €900 million ($982.1 million) as part of its strategy to streamline operations by shedding noncore assets. France’s third-largest bank by market capitalization announced on Monday that it has signed agreements to sell SG Kleinwort Hambros and Société Générale Private Banking Suisse to Swiss lender Union Bancaire Privée. Combined, these units managed around €25 billion in assets as of December. (WSJ)

Woodside to Acquire Texas Ammonia Plant for $2.35 Billion in Move Toward Greener Assets: Woodside Energy has agreed to a $2.35 billion deal to acquire an ammonia plant under construction in Beaumont, Texas, as part of its strategy to diversify into greener assets. The project, which began construction in late 2022, is expected to produce 1.1 million metric tons of ammonia annually starting in 2025. Woodside's CEO, Meg O’Neill, highlighted that the acquisition supports the company’s goal of thriving through the energy transition. A key factor in the deal is agreements with Linde and Exxon Mobil, which will help Woodside mitigate its Scope 3 emissions. (WSJ)

Platinum Equity to Acquire GSM Outdoors from Gridiron Capital: Platinum Equity has agreed to purchase GSM Outdoors, a sporting-goods company, from private-equity firm Gridiron Capital. Based in Irving, Texas, GSM Outdoors owns over 50 brands, including SOG Knives, Stealth Cam wildlife surveillance products, and Walker’s hearing-protection devices. The terms of the deal were not disclosed. (WSJ)

Thrive Capital Raises $5 Billion Amid AI Boom: Thrive Capital has raised $5 billion for its largest-ever venture-capital funds, reflecting renewed investor enthusiasm driven by the AI boom. The New York-based firm, founded by Josh Kushner 15 years ago, announced the successful fundraising to investors on Sunday. This marks Thrive's biggest fundraising effort to date and one of the largest in the venture capital space this year. Thrive's prominence has grown, particularly in Silicon Valley, due to its close relationship with OpenAI, the company behind ChatGPT. Thrive first invested in OpenAI in April 2023 and has since poured hundreds of millions into the startup, as well as other AI ventures like Scale AI and non-AI companies such as A24. (WSJ)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply