- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday🍾- 08.04.2024

Welcome to Read Sunday🍾- 08.04.2024

Writer William Lemanske's Birthday

Dear Read Sunday Subscribers,

Thank you for your incredible support and for reading Read Sunday over the past year. Your enthusiasm and engagement have been the driving force behind our success. We look forward to continuing this journey with you, bringing you the best in finance & business news every Sunday.

Celebrate our anniversary and my birthday. Here’s to many more Sundays together!

William M. Lemanske Jr.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

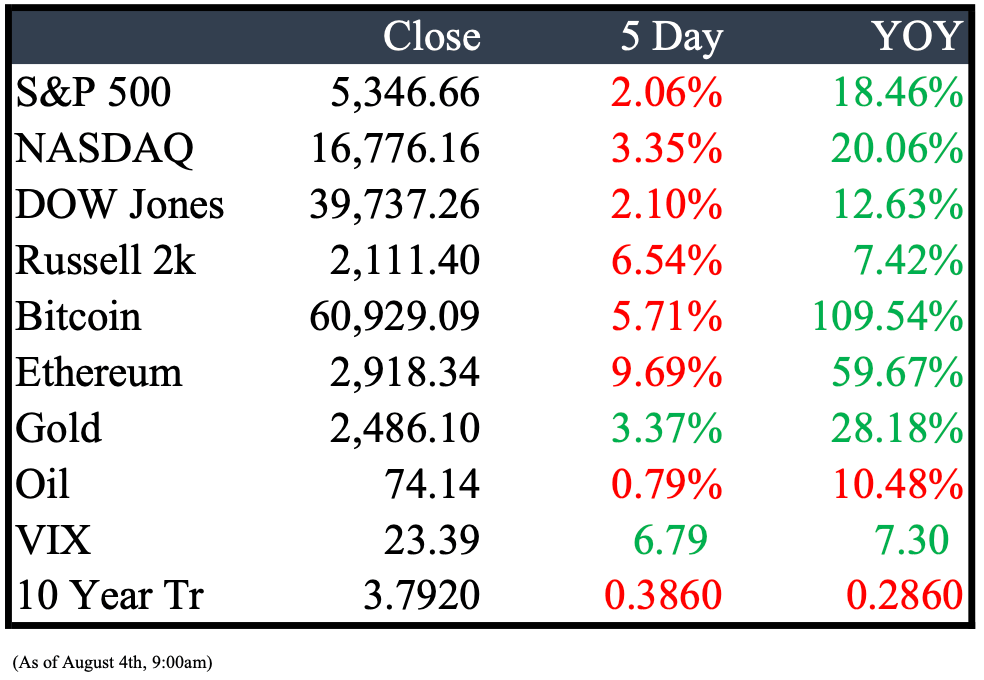

Market Recap

This Week’s Headlines

Economy & World News

Trump Pledges to Replace SEC Chair with Crypto-Friendly Regulators: Donald Trump promised to appoint crypto-friendly regulators and make the U.S. a "crypto capital" if re-elected, speaking at a Bitcoin conference in Nashville. (BBN)

Detroit Tigers Return to TV for Xfinity Customers: After months of negotiations, Diamond Sports Group and Comcast have reached an agreement to bring Bally Sports back to Xfinity customers starting August 1. The deal restores access to Tigers, Red Wings, and Pistons games. Xfinity's Ultimate TV subscribers can now watch these games on Bally Sports and via the Bally Sports app. (FREEP)

Euro Zone Economy Grows 0.3% in Q2 2024, Exceeding Expectations: The euro zone's economy grew by 0.3% in Q2 2024, according to flash figures from the EU's statistics office, surpassing economists' expectations of a 0.2% increase. However, Germany, the euro zone's largest economy, posted an unexpected 0.1% contraction in the same period. (CNBC)

USAntibiotics Struggles Despite Producing Crucial Amoxicillin Amid Shortage: The USAntibiotics factory in northeastern Tennessee, one of the last U.S. plants making the vital antibiotic amoxicillin, produces a million doses daily to combat shortages, especially for children. However, the plant struggles financially due to low prices set by overseas competitors, making it hard to cover overhead costs. Despite Rick Jackson's $38 million investment to save and refurbish the factory, the generic drug business remains a challenging environment for American manufacturers. (WSJ)

Eurozone Inflation Rises to 2.6% in July, Defying Expectations: Inflation in the eurozone unexpectedly increased to 2.6% in July, up from June, according to EU figures released Wednesday. This rise challenges policymakers seeking sustainable price stability and exceeds economists' forecasts for a slight decrease. Inflation rose in Germany, France, and Italy, the eurozone’s largest economies. Core inflation remained stable, contrary to expectations for a decrease, while services prices, a key focus for the European Central Bank, fell slightly. (WSJ)

Bank of Japan's Interest Rate Hike to Raise Mortgage Costs: The Bank of Japan's second interest-rate hike in nearly 20 years will increase borrowing costs for millions of homebuyers. Mitsubishi UFJ Financial Group, Japan's largest bank, plans to raise its short-term prime rate for the first time in 17 years in September, with other lenders likely to follow. About 75% of personal mortgages in Japan are floating-rate loans linked to these bank-set rates. (BBN)

Saudi Arabia's Economy Set for Turnaround After Slower Contraction: Saudi Arabia’s economy contracted by 0.4% year-on-year in Q2, improving from a 1.7% decline in the previous quarter, as the impact of OPEC+ oil production cuts begins to wane. Forecasts suggest the $1.1 trillion economy will grow nearly 4% in Q3, marking the biggest acceleration since late 2022. Standard Chartered economist Carla Slim expects this to be the last quarter of significant negative growth in the hydrocarbon sector. (BBN)

Ukraine Receives First Delivery of F-16 Fighter Jets from NATO Allies: Ukraine has received its first delivery of US-made F-16 fighter jets from NATO allies, potentially enhancing its defense against Russian attacks. The delivery met the end-of-month deadline, though the number of jets is small, according to sources. It's unclear if Ukrainian pilots, who have been training with Western allies, can immediately deploy the jets or if additional time is needed. (BBN)

Russia Releases Evan Gershkovich and Paul Whelan in Major Prisoner Swap: Wall Street Journal reporter Evan Gershkovich and former U.S. Marine Paul Whelan were released by Russia in a significant multinational prisoner swap involving two dozen individuals. The exchange also freed Russian-American journalist Alsu Kurmasheva, British-Russian activist Vladimir Kara-Murza, five German citizens, and seven Russian citizens, all previously imprisoned in Russia. President Joe Biden plans to meet with the families of the released Americans. (CNBC)

Ex-Glencore Oil Head Alex Beard Charged with Corruption by UK Fraud Agency: Alex Beard, former head of oil at Glencore Plc, has been charged with corruption by the UK's Serious Fraud Office, along with four other ex-employees. Beard, a high-profile figure who left Glencore in 2019, is accused of conspiring to make corrupt payments to benefit Glencore’s oil operations in West Africa. The charges involve payments to government officials and employees of state-owned oil firms in Nigeria (2010-2014) and Cameroon (2007-2014). (BBN)

Bank of England Cuts Interest Rate to 5%: The Bank of England lowered its key rate to 5%, the first cut in over four years, amid cooling inflation. Despite hitting the 2% target, services inflation remains high. (WSJ)

Japanese Stocks Plunge as Topix Sees Biggest Drop Since April 2020: The Topix index fell 3.2%, its largest decline since April 2020, due to a broad selloff sparked by the yen's sharp rally and a central bank rate hike. Property stocks led the losses, plummeting 7.3%, while automakers dropped 6.6%. The Nikkei 225 Stock Average, already in a technical correction, fell 2.5%. (BBN)

Nonfarm Payrolls Grow by 114,000 in July, Below Expectations: Nonfarm payrolls increased by 114,000 in July, missing the Dow Jones estimate of 185,000 and down from June's revised 179,000. The unemployment rate rose to 4.3%, the highest since October 2021, indicating a potential recession. Health care led job gains with 55,000, followed by construction (25,000), government (17,000), and transportation and warehousing (14,000). Average hourly earnings grew by 0.2% for the month and 3.6% year-over-year, both below forecasts. (CNBC)

Hawaiian Electric to Pay Half of $4 Billion Settlement for Maui Wildfire Victims: Hawaiian Electric has agreed to pay roughly half of a $4 billion legal settlement to compensate victims of the August 2023 Maui wildfires. The blazes killed over 100 people, destroyed Lahaina, and caused an estimated $5 billion in damage. Lawsuits claimed the utility failed to shut off power lines despite warnings of high winds that could spark wildfires. (REU)

Public Markets

Nasdaq Composite Falls 3.4% This Week, Worst Three-Week Stretch Since 2022: The Nasdaq Composite dropped 3.4% this week, culminating in an 8.8% decline over three weeks, the worst stretch since 2022. Investor concerns about forecasts for the year's second half fueled the sell-off, with Amazon, Intel, Microsoft, and Nvidia experiencing significant declines. (CNBC)

McDonald’s Reports First Sales Drop in Four Years, Plans New Promotions: McDonald’s Corp. saw a 1% decline in comparable sales in Q2, its first drop in four years, missing analyst expectations. Despite this, investors remained optimistic as executives pledged new promotions to boost customer visits. All geographic segments recorded sales declines. (BBN)

Tesla Recalls Over 1.8 Million U.S. Vehicles Due to Software Issue: Tesla is recalling more than 1.8 million vehicles in the U.S. because a software issue could cause the hood to fully open and obstruct the driver’s view. The National Highway Traffic Safety Administration noted the failure to warn drivers when the hood is unlatched increases collision risk. The recall affects certain 2021-24 Model 3, Model S, Model X, and 2020-24 Model Y vehicles. (WSJ)

Ford Shares Plunge 18.4% After Q2 Earnings Miss, Leading Decline in Auto Stocks: Ford's stock closed at $11.16 on Thursday, down 18.4%, marking its worst daily decline since 2008 and making it the second-worst performer among S&P 500 companies. The drop followed Ford's Q2 earnings miss. Shares of General Motors and Stellantis also fell after reporting their results this week. (CNBC)

Stellantis Struggles with Poor H1 2024 Results, Plans Workforce Cuts: Stellantis reported disappointing first-half 2024 earnings, with CEO Carlos Tavares citing a "challenging industry context" and "operational issues." Tavares emphasized the need for significant improvements, particularly in North America, to maximize long-term potential. To address losses exceeding 48%, Stellantis plans to reduce its workforce, with measures that the Detroit Free Press described as unsubtle. (TS)

Meta Settles Facial Recognition Lawsuit with Texas for $1.4 Billion: Meta has agreed to pay $1.4 billion to settle a lawsuit filed by Texas over the unauthorized use of users' biometric data from photos and videos on Facebook. Texas Attorney General Ken Paxton, who initiated the lawsuit in 2022, is also pursuing a similar case against Google owner Alphabet regarding biometric data. (CNBC)

Starbucks' Quarterly Revenue Misses Estimates Despite Meeting Earnings Expectations: Starbucks met earnings expectations for the quarter, but its revenue fell short of Wall Street estimates. Same-store sales in China dropped by 14%. The company reiterated its outlook, maintaining its reduced forecast from the previous quarter and predicting that the sales slump will continue. (CNBC)

ASML Shares Surge 10% on Potential Exemption from U.S. Export Restrictions: Shares of Dutch firm ASML rose up to 10% on Wednesday following a Reuters report suggesting the company might be exempt from expanded U.S. export restrictions on chipmaking equipment to China. The U.S. is considering broadening the foreign direct product rule, but key chipmaking equipment exporters like Japan, the Netherlands, and South Korea are expected to be excluded. (CNBC)

Boeing Hires Robert "Kelly" Ortberg as New CEO Amid Challenges: Boeing has appointed Robert "Kelly" Ortberg as its new CEO to navigate the company through manufacturing and regulatory issues after reporting another significant quarterly loss. Ortberg, a seasoned aerospace executive, previously led Rockwell Collins and built a strong reputation as a dealmaker before retiring in 2021. He takes over as Boeing faces quality issues, production slowdowns, labor negotiations, and a declining share price, with the company losing nearly $25 billion since 2020 and burning through over $1 billion monthly. (WSJ)

Delta CEO Says IT Outage Will Cost $500 Million: Delta CEO Ed Bastian announced that the recent IT outage, which stranded thousands of customers and led to the cancellation of over 5,000 flights, will cost the airline $500 million. The outage was caused by a failed CrowdStrike software update that took thousands of Microsoft systems offline globally. Bastian stated that Delta would seek damages for the disruptions, saying, "We have no choice." (CNBC)

Bill Ackman's Twitter Persona Falters as Support Dwindles: In January, hedge-fund billionaire Bill Ackman enthusiastically welcomed a fan on Twitter (X) who depicted him as a Roman general, reinforcing his combative online persona. As a prominent voice against campus "woke-ism," Ackman gained significant attention among his roughly 1 million followers. However, seven months later, his once-strong support base has largely deserted him. (BBN)

Applied Materials Denied Chips Act Funding for $4 Billion R&D Center: Applied Materials Inc. was informed by US officials that it will not receive Chips Act funding for its anticipated $4 billion research and development center in Sunnyvale, California. Despite the project aligning with the Biden administration’s goal of reviving the domestic semiconductor industry, the Commerce Department concluded it didn't qualify. This decision is notable given the high-profile nature of the project, though rejections are common due to the limited resources and high interest from over 670 firms. (BBN)

Intel Shares See Biggest Drop Since 1974 After Earnings Miss: Intel shares plunged on Friday, marking their largest drop since 1974, after the company reported a significant earnings miss for the June quarter and announced layoffs of over 15% of its employees. The stock is now at its lowest since 2013. The news also impacted other chipmakers, with Samsung, TSMC, and European firms like ASML closing lower. (CNBC)

Berkshire Hathaway Sells Nearly Half of Its Apple Shares, Boosts Cash Hoard: Warren Buffett's Berkshire Hathaway revealed it sold nearly half its Apple shares in Q2, after significant sales earlier in the year. The company sold a net $75.5 billion in stocks through June, increasing its cash hoard to a record $276.94 billion. Recently, Berkshire also trimmed its Bank of America investment, reflecting Buffett's challenge in finding low-priced investments amid a pricier stock market, with the S&P 500 trading at nearly 21 times projected earnings, above the 20-year average of 16 times. (WSJ)

Real Estate

30-Year Fixed Mortgage Rate Drops to 6.4% After Weak Employment Report: The average rate on a 30-year fixed mortgage fell by 22 basis points to 6.4% on Friday, according to Mortgage News Daily. This decline followed a weaker-than-expected employment report, causing bond yields to drop. The rate had peaked at 7.52% in late April, coinciding with a decline in home sales. (CNBC)

Mergers & Acquisitions

Detroit-Area Startups Attract $121 Million in Investments in 2024: Detroit-area startups have received $121 million in capital so far this year, according to PitchBook. In Q2, local venture capital firms completed 14 deals, with five startups securing over $79 million in investments. (CRAIN)

UK Government Cancels Retail Sale of NatWest Stake, Plans Private Sale in 2025: The UK government has scrapped plans for a retail sale of its nearly 20% stake in NatWest Group, opting instead for a private sale in 2025. Treasury Chief Rachel Reeves announced the decision in the House of Commons, citing the need to address a £22 billion overspend inherited from the previous Conservative administration. The government aims to fully exit its shareholding by 2026, continuing the process of returning the bank to private ownership after its bailout during the 2008-09 financial crisis. (WSJ)

Sixth Street Partners to Take Enstar Group Private in $5.1 Billion Deal: Private-credit firm Sixth Street Partners, along with private-equity firms including Steve Mnuchin’s Liberty Strategic Capital and J.C. Flowers, has agreed to take insurer Enstar Group private. Shareholders of Enstar will receive $338 per share in cash, about 3% below the company’s Friday closing price of $348.31. Following the announcement, Enstar's stock fell 6.2% to $326.62 in afternoon trading. (WSJ)

Héroux-Devtek to Be Acquired by Platinum Equity for $1.35 Billion: Héroux-Devtek Inc., a leading aerospace product and landing gear manufacturer based in Longueuil, Quebec, has agreed to be acquired by U.S. private equity firm Platinum Equity Advisors LLC for $1.35 billion. Under the deal, Platinum Equity will pay $32.50 per share in cash. This decision follows a strategic review by a special committee of independent directors, which concluded that the transaction is in the best interests of the corporation and its stakeholders. (CBC)

Ares Management Raises Nearly $34 Billion for Largest Direct Lending Fund: Ares Management Corp. has raised almost $34 billion for its latest direct lending fund, marking the largest dedicated pool in the private credit market. The Ares Senior Direct Lending Fund III secured about $15 billion in equity commitments, surpassing its $10 billion target. Including leverage and separately managed accounts, the fund’s total capital exceeds double the equity amount, according to Mitch Goldstein, co-head of Ares' credit group. This follows other significant deals in the private credit sector, including Goldman Sachs' recent $20 billion fundraise. (BBN)

BNP Paribas in Talks to Buy AXA Investment Managers for €5.1 Billion: BNP Paribas is in exclusive talks with French insurer AXA to acquire 100% of its AXA Investment Managers arm for €5.1 billion ($5.50 billion). This acquisition would significantly enhance BNP's asset management division, aiming to achieve economies of scale and reduce costs. For AXA, Europe's second-largest insurer, the sale aligns with its strategy to focus on core businesses such as life insurance, savings, property and casualty policies, and health insurance. (REU)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply