- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 07.28.2024

Welcome to Read Sunday☕️ - 07.28.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

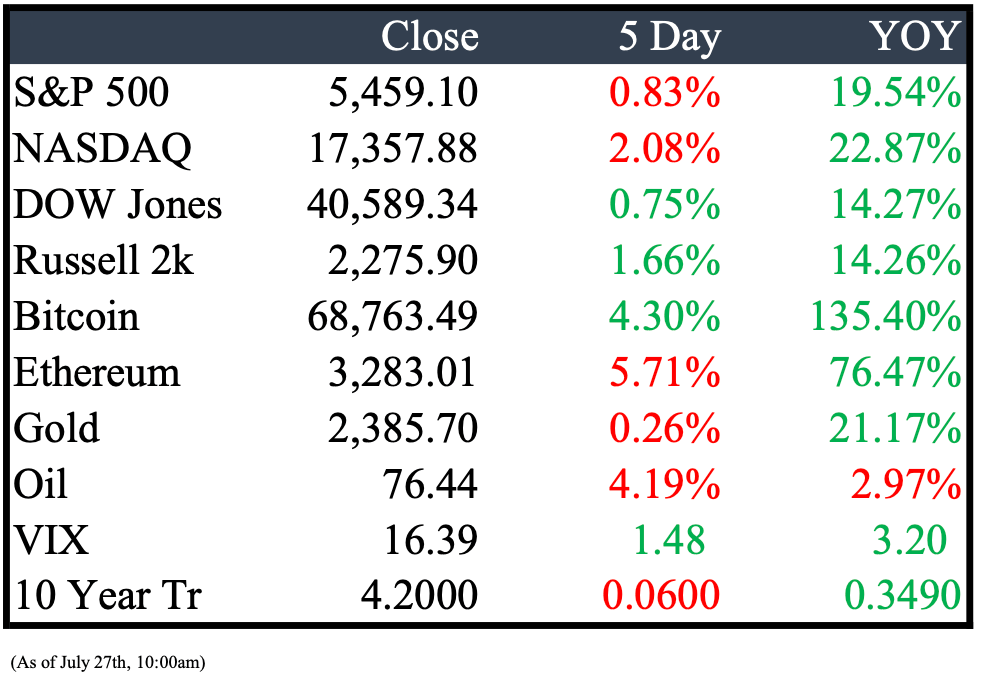

Market Recap

This Week’s Headlines

Economy & World News

Q2 GDP Grows 2.8%, Beating Forecasts; Key Inflation Measure Slows: Real GDP grew at an annualized pace of 2.8% in Q2, surpassing the 2.1% forecast. The personal consumption expenditures (PCE) price index, crucial for the Fed, rose 2.6%, down from 3.4% in Q1, while core PCE prices increased 2.9%, down from 3.7%. The personal savings rate fell to 3.5% from 3.8% in Q1. Initial jobless claims dropped by 10,000, but durable goods orders saw an unexpected decline. (CNBC)

Kamala Harris Raises $231 Million in Political Donations: US Vice-President Kamala Harris, a leading contender for the Democratic presidential nomination, has raised $231 million in political donations following President Joe Biden's decision to end his campaign. The funds have come from both small and large donors. (ET)

South Korean Court Reviews Arrest Warrant for Kakao Founder Brian Kim: A South Korean court began reviewing a prosecution request to arrest Brian Kim, the billionaire founder of Kakao Corp, on Monday for alleged stock manipulation during a 2023 acquisition. Prosecutors accuse Kim of manipulating the stock price of SM Entertainment in February 2023 to obstruct a competitor, Hybe, from acquiring the K-Pop agency. This follows a trial last year involving Kakao and an executive for similar allegations during the same acquisition. (REU)

Michigan Medicine Reports Cyberattack Affecting Nearly 57,000 Patients: Michigan Medicine has notified 56,953 patients that their health information, including medical records, addresses, birth dates, treatment details, and insurance data, may have been compromised in a cyberattack from May 23 to May 29. The breach occurred through compromised emails of three employees. Although the hospital system disabled the accounts and found no evidence that the information was the attack's target, they couldn't rule out the possibility of data compromise. (CRAIN)

Ford Foundation President Darren Walker to Step Down in 2025: Darren Walker, president of the Ford Foundation, announced he will step down at the end of 2025 after a transformative 12-year tenure. During his leadership, Walker shifted the foundation's focus to inequality and oversaw the distribution of $7 billion in grants. Reflecting on his role, Walker emphasized the importance of separating personal identity from his professional position. (NYT)

U.S. Secret Service Director Kimberly Cheatle Resigns Amid Scrutiny: U.S. Secret Service Director Kimberly Cheatle has resigned following widespread calls from lawmakers for her to step down after the assassination attempt on former President Donald Trump, according to sources. In her resignation letter, Cheatle acknowledged the intense scrutiny and took full responsibility for the security lapse. (NBC)

Ukraine Secures $11 Billion Debt Relief Deal Amid War Efforts: Ukraine has struck a preliminary deal with creditors, potentially saving more than $11 billion over the next three years, to help fund its ongoing war with Russia. After months of negotiations with a committee representing Western bondholders, including BlackRock and Pimco, the agreement addresses nearly $20 billion in international debt and additional interest bills. The path to the deal highlighted a shift in the financial industry's support for Ukraine, moving from unequivocal backing to a more pragmatic approach. (WSJ)

South Korea Wins Major Nuclear Power Deal in Czech Republic: South Korea’s nuclear power technology export ambitions received a significant boost as state-owned Korea Hydro & Nuclear Power Co. was selected to build two reactors in the Czech Republic, outpacing competitors. This victory positions South Korean companies for potential deals across Europe. Trade, Industry, and Energy Minister Ahn Duk-geun hailed the win, stating it establishes a "bridgehead" for exporting nuclear plants to Europe. (BBN)

Texas' Largest Public Pension Fund to Divest Nearly $10 Billion from Private Equity: The Teacher Retirement System of Texas, managing $202 billion in assets, has decided to move nearly $10 billion out of private equity investments. This decision is a significant setback for the private equity sector, which is facing increased scrutiny due to dwindling returns and slower exits for portfolio companies amid challenging dealmaking and fundraising conditions. (DALLAS)

Mexican Drug Cartel Leader "El Mayo" Zambada Arrested in U.S. Sting: Ismael “El Mayo” Zambada, a powerful Mexican drug cartel leader, was arrested in the U.S. after being deceived into boarding a plane, according to a U.S. law enforcement official. Zambada believed he was traveling elsewhere but was taken into custody upon arrival in the El Paso area. He was arrested alongside Joaquín Guzmán López, son of "El Chapo" Guzmán, who is serving a life sentence in the U.S. Details on who persuaded Zambada or his intended destination were not disclosed. (AP)

Trump Headlines Major Bitcoin Conference in Nashville, Fundraiser Tickets Reach $844,600: Donald Trump spoke at the Bitcoin 2024 conference in Nashville on Saturday, marking a significant shift from his previous dismissal of bitcoin while in the White House. As the Republican presidential nominee, he also held a fundraiser in Nashville with ticket prices as high as $844,600. Conference organizers mentioned brief talks to have Vice President Kamala Harris appear, but she ultimately declined. (CNBC)

China Considers Tenfold Fee Hike on High-Frequency Trading to Ensure Market Fairness: China is contemplating a significant fee increase on high-frequency trading as part of efforts to maintain fairness in its retail investor-dominated stock market. The China Securities Regulatory Commission and stock exchanges have proposed raising the current 0.1 yuan (1.4 cents) fee on buy and sell orders to at least 1 yuan for transactions classified as high-frequency trading. Exemptions may be granted for accounts with a monthly turnover rate lower than four times their total holdings, aimed at minimizing the impact on mutual funds utilizing automated trading. The final plan is still under revision and subject to change. (BBN)

Public Markets

Google Reverses Plan to Eliminate Cookies in Chrome: After four years of efforts, delays, and industry disagreements, Google has decided to keep cookies in its Chrome browser. Instead of eliminating cookies, Google will prompt users to decide whether to turn them on or off. This decision follows objections from digital-advertising companies and regulators to both the plan and Google's proposed replacement technologies. Chrome users can already choose to block cookies in the browser settings. (WSJ)

AMC Strikes $1.6 Billion Debt Restructuring Deal: AMC Entertainment Holdings Inc. has reached a restructuring agreement with creditors to delay repayment of over $1.6 billion in debt, providing time for a turnaround. The deal involves swapping $1.2 billion in term loans due in 2026 for new loans due three years later and a similar swap for $500 million in junior notes. Additionally, exchangeable notes could be swapped for stock, and some 2026 debt may be extended to 2029. (BBN)

U.S. Regulators Investigate Delta's Response to Tech Outage: U.S. regulators are probing Delta Air Lines for its slow recovery from a global technology breakdown and potential violations of federal rules regarding passenger treatment during cancellations and delays. Transportation Secretary Pete Buttigieg announced the investigation, noting the impact on over half a million passengers. Delta expects to resume normal operations by the end of the week. (AP)

Johnson & Johnson Nears $8 Billion Settlement in Talc Lawsuits: Johnson & Johnson is close to resolving mass-tort lawsuits involving its talc products, offering a settlement to around 100,000 women who claim the company's baby powder caused gynecological cancers. The proposed settlement, worth approximately $8 billion, hinges on using a bankruptcy filing to settle all current and future claims, a strategy that could expedite payments to cancer patients and shield J&J from jury trials. The company aims to gain support from plaintiffs with weaker cases to help neutralize higher-value lawsuits. (WSJ)

Southwest Airlines to Abandon Open-Boarding System for Assigned Seating: Southwest Airlines announced it will transition from its 50-year-old open-boarding system to assigned seating, aligning with other major airlines. After studying seating options and surveying customers, Southwest found that most travelers now prefer knowing their seat in advance. The open-boarding process, initially designed for faster boarding and operational efficiency, helped Southwest maintain profitability annually until the pandemic. (AP)

Meta's Reality Labs Division Reports Nearly $50 Billion Loss Over Four Years: Meta's Reality Labs division, which focuses on AR, VR, and the metaverse, has lost almost $50 billion in just over four years—equivalent to the combined market caps of Snap and Pinterest. Insiders attribute the massive cash burn not to innovation costs but to a "chaotic" culture marked by frequent reorganizations and leadership lacking AR or VR expertise. (YAHOO)

OneStream CEO Tom Shea Rings Nasdaq Opening Bell for IPO: OneStream, under the ticker (NASDAQ: OS), debuted as a public company on Wednesday, with founder and CEO Tom Shea ringing the opening bell at the Nasdaq MarketSite in Times Square. The company priced its IPO of 24,500,000 shares of Class A common stock at $20.00 per share. Trading began at 11:44 a.m., and demand quickly exceeded expectations for the Birmingham-based software company. (CRAIN)

Viking Therapeutics Shares Surge on Early Advancement of Weight Loss Injection Trial: Shares of Viking Therapeutics rose on Thursday following the company's announcement to advance its experimental weight loss injection, VK2735, into a late-stage trial earlier than anticipated. This moves Viking closer to entering the lucrative GLP-1 market, which analysts predict could reach $150 billion by the end of the decade. Viking had initially planned another mid-stage trial after positive results from a phase two study in February. (CNBC)

New York Community Bancorp Shares Drop 17% on Higher-than-Expected Loan Loss Provisions: New York Community Bancorp’s stock plummeted up to 17% after reporting second-quarter loan provisions of $390 million, exceeding the average analyst estimate of $193 million. The high provision reflects increased charge-offs, especially in office loans, and the ongoing impact of higher interest rates and inflation on the bank’s multifamily portfolio. (BBN)

Meta Faces First EU Fine for Alleged Market Abuse in Classified Ads: Meta Platforms Inc. is set to receive its first European Union fine for allegedly abusing its dominance by tying Facebook Marketplace to its social network. The forthcoming EU order may also require Facebook to create a standalone version of Facebook Marketplace, allowing users to access it without logging into the main social media platform, according to sources familiar with the matter. (BBN)

California Court Upholds Prop 22, Allowing Uber and Lyft to Classify Drivers as Contractors: Uber Technologies Inc. and Lyft Inc. can continue classifying California drivers as independent contractors after the state’s top court upheld Proposition 22. The unanimous ruling supports the voter-backed law from 2020, easing a major regulatory concern for the gig economy companies. Invalidating Prop 22 could have forced Uber and Lyft to reclassify drivers as employees, leading to substantial additional costs and potentially higher user prices in one of their largest US markets. (BBN)

3M Shares Soar 20% to Near Two-Year High on Strong Quarterly Results: 3M's shares surged to a near two-year high on Friday, rising as much as 20% and marking their best day ever. The industrial conglomerate's strong quarterly results highlighted its focus on high-growth businesses and product innovation. Additionally, 3M raised its full-year profit forecast, driven by significant cost cuts. (REU)

Real Estate

Home Prices Hit Record High in June Amid Unaffordable Market: In June, home prices reached a new high for the second consecutive month, highlighting the housing market's growing unaffordability. The typically busy spring home-buying season saw a decline in home sales for the fourth month in a row, as high prices and elevated mortgage rates deterred buyers and sellers alike. Despite this, low inventory has driven prices up, with the national median existing-home price rising 4.1% from a year earlier to $426,900, a record in data dating back to 1999, according to the National Association of Realtors. (WSJ)

Southland Center in Taylor for Sale After Loan Default: The 905,000-square-foot Southland Center shopping mall on Eureka Road is up for sale following a loan default. It is the latest Southeast Michigan mall to change ownership, following Fairlane Town Center in Dearborn and Oakland Mall in Troy. (CRAIN)

Zachry Holdings and Golden Pass Project Owner Reach Settlement to Resume $10 Billion Project: Bankrupt engineering firm Zachry Holdings and the owner of the Texas-based Golden Pass project have reached a global settlement, allowing the $10 billion natural gas project to move forward. If approved by the court, the settlement resolves all disputes between Zachry and the project's owner, affiliates of Exxon Mobil and QatarEnergy. Under the agreement, Zachry will cease work on the project, enabling the owner and joint-venture partners to revive construction. The owner will directly pay vendors up to a specified maximum amount. (WSJ)

Detroit Riverfront Conservancy Sues Former CFO to Recover $40 Million: The Detroit Riverfront Conservancy filed a civil lawsuit on Wednesday to recover $40 million allegedly embezzled by its former CFO, William A. Smith, over a dozen years. The suit, stemming from a board-initiated investigation, names Smith, his companies, and his mother, wife, and sister as co-conspirators. It also accuses Smith's friend, Darrell Greer, of attempting to hide assets once the conspiracy was uncovered. (CRAIN)

Mergers & Acquisitions

Wiz Walks Away from $23 Billion Google Deal: Wiz has ended talks with Google regarding a $23 billion acquisition. CEO Assaf Rappaport informed employees that the company will proceed with its original plan to pursue an IPO. (CNBC)

Krispy Kreme Sells Majority Stake in Insomnia Cookies for Over $170 Million: Krispy Kreme announced on Monday the sale of a majority stake in its cookie-delivery arm, Insomnia Cookies, to Verlinvest and Mistral Equity Partners for more than $170 million. The deal values Insomnia Cookies at $350 million, double its value since Krispy Kreme's initial investment in 2018. (WSJ)

Apollo to Acquire UK Parcel Delivery Company Evri for £2.7 Billion: US investment group Apollo has agreed to purchase UK parcel delivery company Evri from private equity firm Advent International for approximately £2.7 billion. Advent acquired Evri in 2020 in a €1 billion deal for the UK operations of Hermes parcel delivery group from German company Otto. This acquisition positions Apollo to compete with Royal Mail as Czech billionaire Daniel Křetínský aims to revitalize Britain's primary postal operator. (FT)

Edwards Lifesciences Announces $1.2 Billion Acquisitions Amid Revenue Miss: Edwards Lifesciences (NYSE: EW) revealed it will acquire JenaValve Technology and Endotronix for $1.2 billion, despite reporting a second-quarter revenue miss and reducing TAVR guidance. Following the announcement, EW shares dropped over 26% to $63.85, while the MassDevice's MedTech 100 Index experienced a slight decline. (MD)

Thoma Bravo Seeks Up to $2.74 Billion by Selling Half of Its Nasdaq Stake: Thoma Bravo aims to sell 41.6 million Nasdaq shares, potentially raising up to $2.74 billion, according to sources. The shares are offered between $64.80 and $65.80 each, a discount of up to 3.2% from Nasdaq’s Friday closing price of $66.96. Nasdaq shares have risen 15.2% this year. The private equity firm acquired the stake last year and is now looking to reduce its holdings. Details may change, and representatives for Nasdaq and Thoma Bravo have not commented. (BBN)

WeRide Inc. Files for Potentially Largest US IPO by Chinese Company Since Didi: Driverless technology startup WeRide Inc. has filed for what could be the largest US initial public offering by a Chinese company since Didi Global Inc.’s controversial 2021 listing. WeRide acknowledged potential "legal and operational risks" due to its operations in mainland China. The company, incorporated in the Cayman Islands, has not disclosed the number or price range for its American depositary shares. Bloomberg previously reported WeRide aimed to raise up to $500 million. Following Didi’s $4.44 billion IPO and subsequent Beijing crackdown on overseas listings of data-sensitive firms, such US listings by China-based companies had ceased. (BBN)

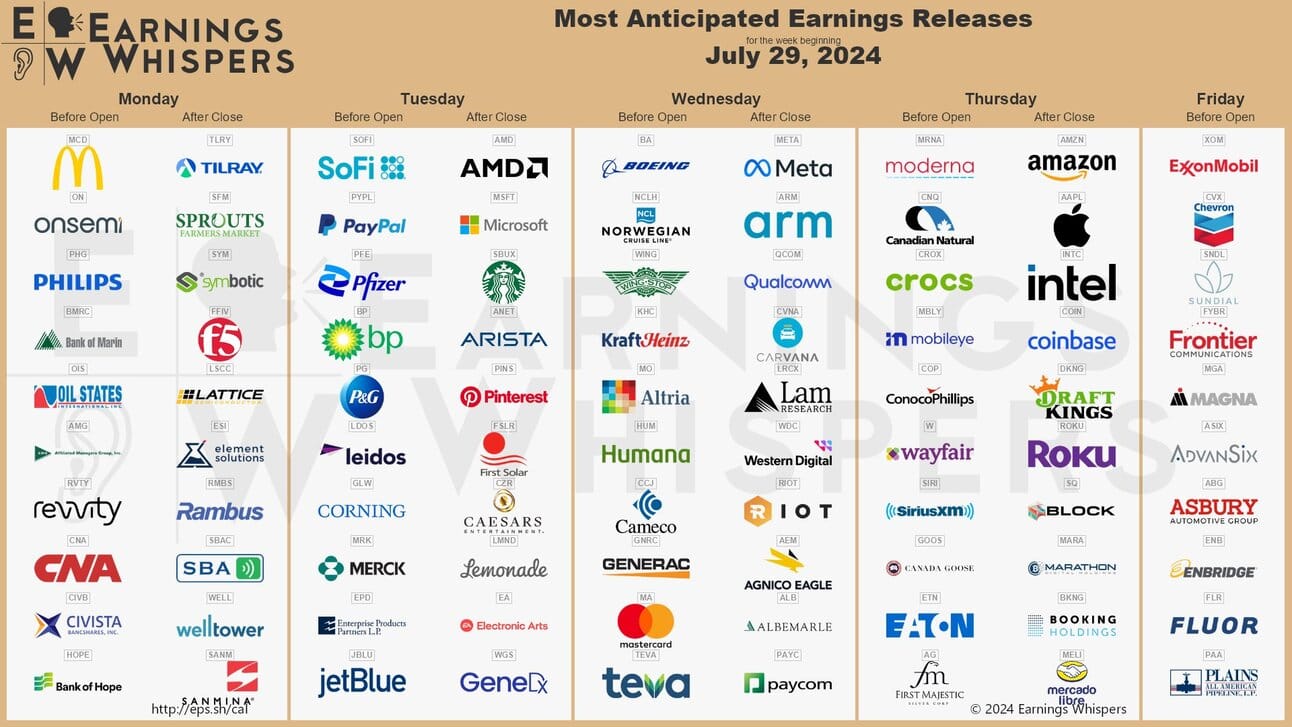

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply