- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 07.21.2024

Welcome to Read Sunday☕️ - 07.21.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

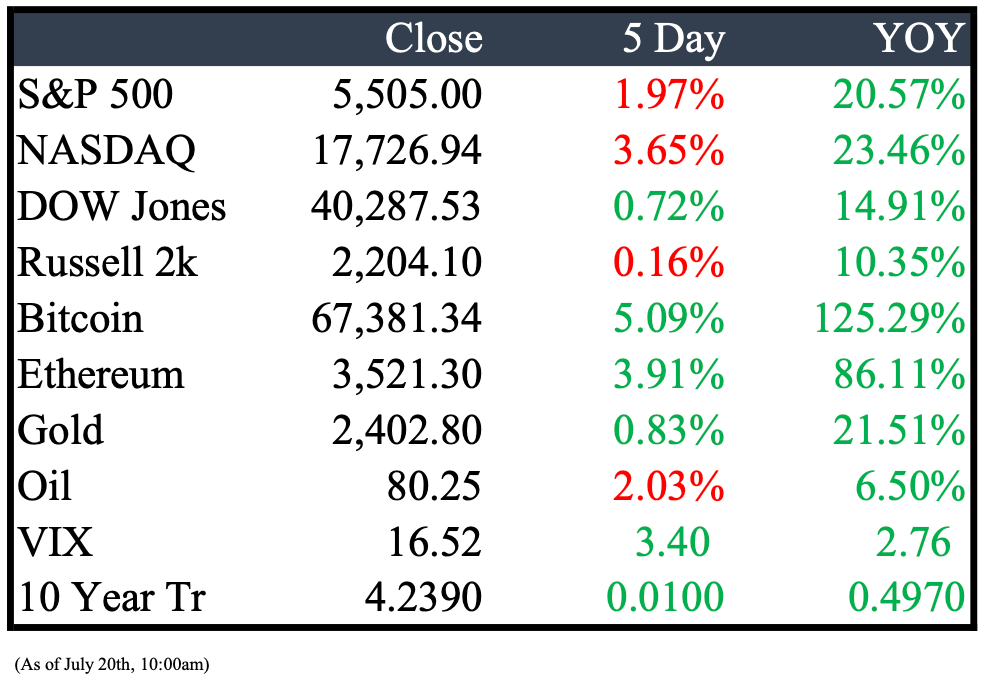

Market Recap

This Week’s Headlines

Economy & World News

Elon Musk to Fund Pro-Trump Super PAC with $45 Million Monthly: Elon Musk plans to commit around $45 million a month to America PAC, a super political-action committee supporting former President Donald Trump's presidential campaign. Other notable backers include Palantir co-founder Joe Lonsdale, the Winklevoss twins, and former U.S. Ambassador to Canada Kelly Craft and her husband, Joe Craft. Formed in June, America PAC aims to register voters and encourage early and mail-in voting in swing states, countering robust Democratic "get out the vote" efforts. (WSJ)

Senator Bob Menendez Found Guilty of Bribery and Acting as Foreign Agent: US Senator Bob Menendez, a New Jersey Democrat, was found guilty of bribery, extortion, and acting as a foreign agent of Egypt after a trial revealed evidence including 13 gold bars, nearly $500,000 in cash, and a Mercedes-Benz seized from his home. The jury convicted Menendez on all 16 counts, with prosecutors alleging he sold his influence to protect businessmen and promote Egypt’s interests. Facing up to 20 years in prison on the most serious charges, Menendez showed no emotion as the verdict was read. His wife, Nadine, implicated as a key intermediary, will face a separate trial. (BBN)

UK Inflation Steady at 2% in June, Exceeding Expectations: Official National Statistics data revealed that UK inflation held steady at the Bank of England's 2% target in June, surpassing the 1.9% forecast by analysts polled by Reuters. Both services and core inflation remained consistent with the previous month. (CNBC)

ECB Keeps Interest Rate at 3.75%, September Decision "Wide Open": The European Central Bank (ECB) has maintained its main interest rate at 3.75%, with President Christine Lagarde stating that the decision on a possible rate cut in September remains "wide open." The ECB's governing council decided to hold the rate steady amid concerns over geopolitical uncertainties and rapid wage increases driving up prices. Lagarde emphasized that future rate decisions will be based on incoming data and noted that the council, which reduced rates from a record high of 4% in June, agreed not to provide guidance on future rate moves. (FT)

Dutch University Caught in US-China Chip War Over ASML Talent: Eindhoven University of Technology, a key talent source for ASML, faces scrutiny as the US seeks to limit China's semiconductor production. University President Robert-Jan Smits noted increased American inquiries about Chinese students. The Netherlands, under US pressure, imposed restrictions on ASML's immersion DUV lithography machine exports to China, impacting the global chip supply chain. (BBN)

China's Q2 GDP Growth Misses Expectations at 4.7%: China's Q2 GDP rose by 4.7% year-on-year, below the expected 5.1% growth, according to a Reuters poll. June retail sales also missed forecasts, increasing by 2% versus the anticipated 3.3%. Oxford Economics now predicts China's 2024 GDP growth at 4.8%, up from December's 4.4% estimate. However, June industrial production outperformed expectations, growing by 5.3%, with high-tech manufacturing up 8.8%. (CNBC)

Public Markets

Lineage Plans Up to $3.85 Billion IPO, One of Year's Largest: Lineage, the world's largest refrigerated-storage company, aims to raise between $3.29 billion and $3.85 billion through an IPO, offering 47 million shares priced at $70 to $82 each. The Novi, Mich.-based company plans to list on Nasdaq under the symbol "LINE" but has not set a date. Lineage operates over 480 warehouses with about 84.1 million square feet across North America, Europe, and the Asia-Pacific, significantly outpacing its U.S. rival, Americold Realty Trust, in cold-storage capacity. (WSJ)

Chinese Tycoon Guo Wengui Convicted of Fraud by U.S. Jury: Guo Wengui, a self-exiled Chinese business tycoon and critic of the Communist Party, was convicted by a U.S. jury of a multiyear fraud scheme that defrauded his followers and American conservative allies. Arrested in New York in March 2023, Guo operated a racketeering enterprise from 2018 to 2023, deceiving thousands into bogus investments to fund his luxurious lifestyle. Convicted on nine of 12 criminal counts, including racketeering conspiracy, Guo's attorneys argued that the prosecution failed to prove any cheating, with one attorney declining to comment post-verdict. (AP)

Amazon Prime Day Sales Hit Record $14.2 Billion: U.S. shoppers spent a record $14.2 billion online during Amazon’s two-day Prime event, marking an 11% increase year over year, according to Adobe Analytics. Top categories included consumer electronics and back-to-school products. Amazon also reported "record-breaking" Prime Day sales but did not disclose specific figures. (CNBC)

Netflix Adds 8.05 Million Subscribers in Q2, Exceeding Expectations: Netflix Inc. extended its lead in the streaming market by adding 8.05 million customers in the second quarter, surpassing analyst expectations of 4.87 million. The growth included 2.8 million new subscribers in the Asia-Pacific region. Netflix also raised estimates for annual sales and profit margins, according to a shareholder letter released on Thursday. (BBN)

Global IT Outage Disrupts Businesses, CrowdStrike Identifies Update Issue: A major IT outage on Friday disrupted financial services, doctors' offices, TV broadcasters, and air travel worldwide. The issue originated from a recent tech update by cybersecurity giant CrowdStrike, affecting Windows hosts but not Mac or Linux. CrowdStrike CEO George Kurtz clarified that this was not a security incident or cyberattack, and the issue has been isolated and fixed. An expert suggested this might be the largest IT outage in history. Meanwhile, Microsoft restored its cloud services after an outage, though many users still reported issues. CrowdStrike shares closed down 11%. (CNBC)

Oracle to Pay $115 Million to Settle Privacy Lawsuit: Oracle agreed to a $115 million settlement in a lawsuit accusing the company of invading privacy by collecting and selling personal information. The preliminary settlement, pending a judge's approval, involves allegations that Oracle created unauthorized "digital dossiers" on hundreds of millions of people, including data on online browsing, banking, shopping, and credit card usage. Oracle denied any wrongdoing. The settlement covers individuals whose data was collected or sold by Oracle since August 19, 2018. (REU)

Apple's India Sales Surge 33% to Nearly $8 Billion: Apple's India sales jumped 33% to a record $8 billion in the year through March, driven primarily by iPhone sales, which accounted for over half of the total. In April, Bloomberg News reported that Apple assembled $14 billion worth of iPhones in India last fiscal year, with up to 14% of its marquee devices produced there. Apple has not commented on the report. (REU)

Burberry Warns of Potential Operating Loss, Shares Drop 16%: Burberry announced that if the recent trading slowdown persists, it anticipates an operating loss for the first half of the year and a full-year operating profit below current consensus. The British luxury brand's shares fell 16.08% in London. The company also suspended its dividend and appointed Joshua Schulman, formerly of Michael Kors and Coach, as the new CEO, with Jonathan Akeroyd stepping down immediately. (CNBC)

Real Estate

Stellantis NV Eyes Former Golf Course for New 2.7 Million-Square-Foot Mopar Parts Hub: Stellantis NV is considering a 230-acre site across from the old Ford Romeo Engine Plant in Macomb County for a new Mopar parts distribution center, consolidating aging warehouses in Centerline, Warren, and Marysville into a "mega hub" as outlined in its recent UAW labor deal. The proposed site includes former golf course land and farmland, pitched by San Francisco-based developer Prologis Inc. to Washington Township's planning commission. The three-building development, referred to as the 32 Mile Logistics Campus, would be part of a larger plan that includes a Meijer grocery store and a 308-unit apartment complex. Stellantis has not confirmed the plans. (CRAIN)

Detroit Metropolitan Airport Undergoes $38 Million Renovation: Detroit Metropolitan Wayne County Airport is upgrading its restrooms, baggage carousels, and jet bridges as part of a $38 million renovation plan, officials announced. The project includes renovating all 67 passenger restrooms in the McNamara Terminal by 2027 and replacing six of 13 jet bridges. The renovation of 18 baggage carousels in the terminal has already been completed. Funded mainly by a $28 million grant from the federal Bipartisan Infrastructure Law Airport Terminal Program, the remaining $10 million is covered by the Wayne County Airport Authority. CEO Chad Newton praised the improvements for enhancing the customer experience. (CRAIN)

University of Michigan and Michigan State University Partner for Neuroscience Care: The University of Michigan and Michigan State University have created the Neuro Care Network to enhance neurology and neurosurgery services in mid-Michigan. The partnership will provide services at MSU Health Care and U-M Health-Sparrow sites, with three U-M neurosurgeons working full-time in Lansing. (FREEP)

Mergers & Acquisitions

Thoma Bravo Completes $1.8 Billion Acquisition of Everbridge: Thoma Bravo has completed its $1.8 billion acquisition of Everbridge, Inc., a leader in critical event management and public warning solutions. Everbridge stockholders will receive $35.00 per share in cash, and the company's stock will be delisted from Nasdaq. Everbridge CEO David Wagner expressed enthusiasm for the partnership, highlighting plans to enhance product innovation and growth. Thoma Bravo's Hudson Smith and Matt LoSardo emphasized Everbridge's strong foundation and the firm's commitment to advancing Everbridge's mission and growth in the risk, compliance, and safety space. (TB)

Penske Automotive Acquires World's Largest Ford Dealership, Bill Brown Ford: Penske Automotive has purchased Bill Brown Ford, the world's largest Ford dealership, located in suburban Detroit. Founded in 1941 by the Brown family, the dealership is expected to add $550 million in annual revenue. The dealership will retain its name. (AN)

Michigan Welcomes New Venture Capital Fund, Hidden Venture Capital LLC: Hidden Venture Capital LLC, a Bloomfield Hills-based fund, launched on July 12, focusing on high conviction seed stage investments. Founded by General Partner Blake Robbins, the $60 million fund includes 27 investors, as per the Form D filed with the SEC. The U.S. saw a 72% increase in venture capital funding in Q1 2024, driven by tech, AI, energy, and healthcare investments. Robbins emphasized the importance of reputation and commitment in venture capital, aiming to support extraordinary founders in building enduring companies. (CRAIN)

Detroit's Venture Capital Scene Expands with 640 Oxford Fund I: 640 Oxford Fund I, based in Newlab at Michigan Central, is a new early-stage venture fund targeting "inefficient," "overlooked," and "unsexy" industries. Co-founded by Brandon Schram and Adam Gartenberg, the fund raised $16 million in Q1 2024, surpassing its initial $15 million goal. Schram and Gartenberg met at the University of Michigan, naming the fund after their former off-campus house at 640 Oxford Road. The fund has been investing nationwide while fundraising, with Schram bringing experience from Homedics and Alrig USA, and Gartenberg from Vengo Labs and Uber's Rider Innovation Team. (CRAIN)

Unilever Explores £15 Billion Sale of Ice Cream Business: Unilever Plc has begun discussions with buyout firms about selling its ice cream business, valued at up to £15 billion ($19.4 billion). Potential bidders include Advent International, Blackstone Inc., Cinven, CVC Capital Partners, Clayton Dubilier & Rice, and KKR & Co. Formal sale proceedings are expected to commence in the second half of the year, with no final agreements reached yet. (BBN)

Macy’s Ends $6.9 Billion Buyout Negotiations: Macy’s announced Monday that its board has unanimously decided to terminate negotiations with activist group Arkhouse and Brigade, who had been attempting to take the retailer private for approximately $6.9 billion. Macy’s is currently undergoing a turnaround effort led by CEO Tony Spring, who assumed the role in February. (CNBC)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply