- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday 🥃 - 07.14.24

Welcome to Read Sunday 🥃 - 07.14.24

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

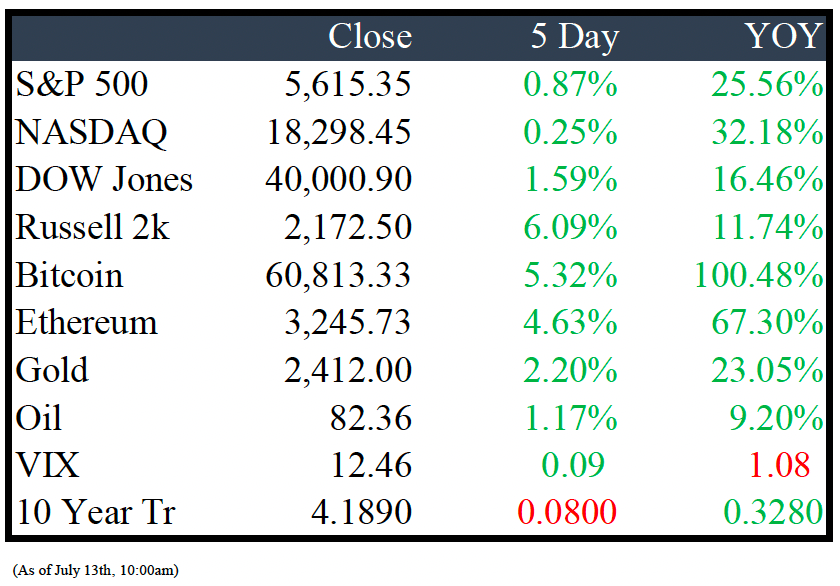

Market Recap

This Week’s Headlines

Economy & World News

Fed Chair Powell Warns Against Prolonged High Interest Rates: Federal Reserve Chair Jerome Powell expressed concern on Tuesday that maintaining high interest rates for too long could threaten economic growth. "Reducing policy restraint too late or too little could unduly weaken economic activity and employment," Powell stated in his remarks for Capitol Hill appearances this week. (CNBC)

FTC Criticizes Pharmacy Benefit Managers for Inflating Drug Costs: The Federal Trade Commission issued a scathing 71-page report on Tuesday, accusing pharmacy benefit managers (PBMs) of profiting by inflating drug costs and squeezing small pharmacies. This marks a significant shift under FTC Chair Lina Khan, as the agency intensifies scrutiny of PBMs like CVS Health’s Caremark, Cigna’s Express Scripts, and UnitedHealth Group’s Optum Rx, which collectively process 80% of U.S. prescriptions. While no enforcement action has been taken yet, the report could lead to investigations, lawsuits, or legislative efforts to regulate the industry. (NYT)

China's June Inflation Misses Expectations: China's consumer prices increased by 0.2% in June year-on-year, below the expected 0.4% rise. Core CPI, excluding volatile food and energy prices, rose by 0.6%. The producer price index fell by 0.8%, matching forecasts. (CNBC)

FTC Prepares to Sue Major Pharmacy-Benefit Managers Over Pricing Tactics: The Federal Trade Commission plans to sue the three largest pharmacy-benefit managers (PBMs) over their drug price negotiation tactics, including practices related to insulin pricing. Following a two-year investigation, the FTC aims to address business practices involving rebates brokered with drug manufacturers. The agency is also scrutinizing the role of insulin manufacturers in these negotiations. PBMs manage prescription-drug transactions for insurers and employers, negotiating discounts with drug manufacturers on their behalf. (WSJ)

NATO Condemns China's Support for Russia in Strongest-Ever Terms: During its 75th anniversary summit in Washington, NATO leaders issued a declaration labeling China as a "decisive enabler" of Russia's war against Ukraine, citing evidence of Beijing developing an attack drone and supplying dual-use materials for Russia's defense sector. The communique, based on US briefings, emphasized that China poses "systemic challenges to Euro-Atlantic security" through cyber activities, disinformation, and counter-space capabilities. NATO urged all nations to refrain from aiding Russia and condemned those facilitating the war in Ukraine. (BBN)

Producer Price Index Rises 2.6% Year Over Year: The producer price index (PPI) increased by 2.6% year over year in June, with higher service prices offsetting a decline in goods prices. This marks an uptick from May's revised higher figure. (CNBC)

Biden Administration to Shut Down $230 Million Temporary Gaza Pier: The Biden administration will soon permanently close the $230 million temporary pier built by the U.S. military for humanitarian aid to Gaza. National Security Adviser Jake Sullivan confirmed the impending shutdown. Efforts to reattach the pier, removed due to rough seas, failed due to "technical and weather-related issues," according to Pentagon press secretary Maj. Gen. Patrick S. Ryder. Recurring problems had already led military officials to warn aid organizations of the pier's potential dismantling by July. (NYT)

Major Democratic Donors Withhold $90 Million from Pro-Biden Super PAC: Key Democratic donors have put pledges worth approximately $90 million to Future Forward, the largest pro-Biden super PAC, on hold, contingent on President Biden remaining the nominee. This includes multiple eight-figure commitments, stemming from dissatisfaction with Biden's debate performance in late June. Future Forward has not commented on specific donor conversations or amounts, but an adviser anticipates donors will resume contributions once the ticket's uncertainty is resolved. Some donors have reported multiple solicitation attempts but are currently "holding off." (NYT)

Public Markets

TSMC Briefly Hits $1 Trillion Market Cap Amid Analyst Optimism: Taiwan Semiconductor Manufacturing Co. (TSMC) briefly surpassed $1 trillion in market capitalization after Morgan Stanley and other brokers raised price targets ahead of its earnings. TSMC ADR shares surged 4.8% in New York on Monday, marking an 80% increase this year, and the company recently became the world's eighth most valuable, overtaking Berkshire Hathaway. "Seeing TSMC ADRs approach $1 trillion is a feat, but tech advancements will continue into the 2040s," said Morningstar analyst Phelix Lee. (BBN)

Eli Lilly Acquires Morphic Holding for $3.2 Billion to Enhance Immunology Pipeline: Eli Lilly has agreed to buy biopharmaceutical company Morphic Holding for $3.2 billion, paying $57 a share, a 79% premium to Friday's closing price. Morphic, based in Waltham, Mass., is developing therapies for chronic diseases, including ulcerative colitis and Crohn’s disease. Eli Lilly, which recently received FDA approval for its ulcerative colitis treatment Omvoh, expects to complete the acquisition in the third quarter. Morphic shares surged 76% to $56.17 in premarket trading. (WSJ)

Michigan Cuts Ford EV Incentives Amid Project Scale-Back: Michigan has reduced Ford Motor Co.'s tax incentives package to $409.1 million from $1.03 billion after the automaker scaled back its electric vehicle projects to match demand. The revised incentives for Ford's EV battery plant in Marshall were approved by the Michigan Strategic Fund on Tuesday. (CRAIN)

Tesla's U.S. EV Market Share Falls Below 50% for First Time: Tesla's share of the U.S. electric vehicle market dropped to 49.7% in the second quarter, down from 59.3% a year earlier, despite record EV sales, according to Cox Automotive. This marks the first time Tesla's market share has fallen below 50%, as competitors like General Motors, Ford, Hyundai, and Kia gain ground. The decline indicates Tesla's waning dominance in the market it helped create with the 2012 launch of the Model S sedan. (NYT)

Microsoft and Apple Step Back from OpenAI Board Amid Regulatory Scrutiny: Microsoft has relinquished its observer seat on OpenAI's board, and Apple has decided not to take up a similar role, amidst increasing global regulatory scrutiny of Big Tech investments in AI startups. Microsoft, which invested $13 billion in OpenAI, stated its withdrawal is effective immediately. OpenAI will now host regular meetings with partners like Microsoft and Apple and investors Thrive Capital and Khosla Ventures. This shift follows antitrust examinations by EU and US authorities into the Microsoft-OpenAI partnership, reflecting broader competition concerns in the AI sector. (FT)

Costco to Raise Membership Fees for First Time in Seven Years: Starting September 1, Costco will increase annual membership fees in the U.S. and Canada by $5 to $10, marking the first hike since June 2017. The "gold star" and business memberships will rise by $5 to $65, while executive memberships will increase from $120 to $130. The fee hike will affect approximately 52 million memberships, with over half being executive members. (FB)

Bill Hwang Found Guilty in Archegos Collapse Case: A Manhattan federal jury found investor Bill Hwang guilty on 10 out of 11 charges related to the collapse of Archegos Capital Management, resulting in $10 billion in losses for major Wall Street banks. After a two-month trial and nearly two days of deliberation, the jury convicted Hwang, 60, on counts of securities fraud, wire fraud, conspiracy, racketeering, and market manipulation, though he was acquitted on one count of market manipulation. Hwang faces the possibility of spending the rest of his life in federal prison. (NYT)

Apple Targets 90 Million iPhone 16 Shipments in 2024: Apple Inc. plans to ship at least 90 million iPhone 16 devices in the latter half of 2024, aiming for a 10% increase over the 81 million iPhone 15s shipped in the same period in 2023. The company is banking on new AI features to drive demand for the new model, according to sources familiar with the matter. (BBN)

Pfizer Advances Obesity Drug Danuglipron with New Once-Daily Formulation: Pfizer announced the selection of its preferred once-daily modified release formulation of danuglipron, a significant milestone in the obesity drug's development. Danuglipron, an oral GLP-1 receptor agonist, will undergo dose optimization studies in the second half of 2024, which will guide registration-enabling studies. Chief Scientific Officer Mikael Dolsten emphasized the potential of the once-daily formulation to compete in the oral GLP-1 space, aiming to meet the ongoing medical needs of people with obesity. (ABC)

Dollar General to Pay $12 Million in Penalties and Improve Workplace Safety: The U.S. Department of Labor announced a settlement with Dollar General, requiring the retailer to pay $12 million in penalties and implement significant workplace safety improvements. This adds to over $21 million in fines from OSHA since 2017 due to safety violations such as blocked fire exits and excessive clutter. The settlement mandates inventory reduction and increased stocking efficiency to enhance safety. (CNBC)

Microsoft Mandates iPhones for Employees in China to Boost Security: Starting in September, Microsoft Corp. will require its employees in China to use iPhones for work, cutting off Android devices due to their inability to connect to Google’s mobile services in the country. This measure aims to enhance security by ensuring all staff use the Microsoft Authenticator and Identity Pass apps, which are available on Apple's App Store. This decision is part of Microsoft's global effort to fortify its products against hackers, following multiple cyberattacks, including a significant breach by Russia-linked hackers disclosed in January. (BBN)

Boeing Pleads Guilty to Fraud Charge Over 737 Max Crashes: Boeing has agreed to plead guilty to a conspiracy fraud charge related to the 737 Max crashes, resulting in a $243.6 million fine and the installation of a third-party compliance monitor. This deal allows Boeing to avoid a trial as it seeks to recover from its safety and manufacturing crises. (CNBC)

Real Estate

First Foundation Bank Receives $228 Million Investment to Stabilize CRE Exposure: Dallas-based First Foundation Bank, heavily exposed to commercial real estate, is getting a $228 million financial boost from investors led by Fortress Investment Group. The deal involves selling common and preferred shares, giving the investor group a 49% stake while existing shareholders retain 51%. With real estate loans making up 72% of its loan portfolio, this cash infusion aims to provide the bank time to offload certain loans and stabilize its finances. (TRD)

Detroit Apartment Conversion Secures Over $11.6 Million in Public Financing: The 80-unit Reckmeyer project by Basco of Michigan received $11.6 million in public financing, including an $8.22 million Michigan Community Revitalization Program loan and $3.46 million in brownfield tax-increment financing. The project will convert and expand three buildings on Broadway Street in downtown Detroit's Paradise Valley neighborhood into a new nine-story, mid-rise structure. (CRAIN)

Billionaire Stephen Ross Steps Down as Related Cos. Chairman for New Ventures: At 84, billionaire property mogul Stephen Ross is stepping down as chairman of Related Cos. to focus on his new company in West Palm Beach, already the largest owner of downtown commercial space there. Ross will also dedicate more time to his majority ownership of the Miami Dolphins and his financial interest in the city's Formula One race. "Doing something impactful. That's what I've always loved," he said. (WSJ)

Mergers & Acquisitions

FTC Blocks Tempur Sealy's $4 Billion Acquisition of Mattress Firm: The Federal Trade Commission's lawsuit to block Tempur Sealy International Inc.'s $4 billion purchase of Mattress Firm will shed light on how courts assess vertical deals between companies at different supply chain levels. The FTC aims to stop the merger of Tempur-Pedic, Sealy Posturepedic, and Stearns & Foster with Mattress Firm, a major U.S. retailer. This case, the first FTC challenge of a vertical deal since new merger guidelines were issued in December, could set a precedent on exclusionary practices that hinder rivals' access to distribution channels and key materials. (BBN)

Clearlake Capital Faces Scrutiny Over Recent Acquisitions Amid New Fundraising Efforts: Clearlake Capital Group, known for owning Chelsea Football Club, is raising funds for its latest venture while facing questions about acquisitions made during the buyout boom. Previously lauded for stellar returns, Clearlake raised over $7 billion for its sixth fund in 2020, investing heavily in high-valuation businesses. However, elevated interest rates are now impacting the profitability of these debt-laden assets, raising concerns among investors and creditors. (BBN)

HubSpot Shares Plunge as Alphabet Shelves Acquisition Interest: HubSpot shares dropped sharply following news that Alphabet is no longer pursuing an acquisition. According to Bloomberg, there were never "detailed discussions about due diligence," citing sources familiar with the matter. (CNBC)

Google in Advanced Talks to Acquire Cybersecurity Firm Wiz for $23 Billion: Google is reportedly in advanced negotiations to acquire cybersecurity firm Wiz for $23 billion, according to sources cited by The Wall Street Journal. If finalized, this acquisition would be Google's largest to date. (CNBC)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply