- Read Sunday Newsletter

- Posts

- Welcome to Read Sunday☕️ - 07.07.2024

Welcome to Read Sunday☕️ - 07.07.2024

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Today’s Newsletter is Brought to you by THE Fund I LP:

Peridot Hedge LLC, the management company behind THE Fund LP, brings expertise and strategic vision to the forefront of investment. THE Fund is a sector-focused hedge fund based in Detroit, Michigan, strategically investing in the Technology, Healthcare, and Energy sectors. Utilizing a mix of long equity positions and options, the fund optimizes returns and manages risk effectively. Led by William Lemanske Jr., THE Fund is proactive in enhancing shareholder value through activism, engages with companies early in their lifecycle to influence strategy, and employs an event-driven approach to identify value-unlocking catalysts in mergers, restructurings, and other special situations. The fund focuses on companies with strong leadership and significant growth potential.

“Building Value Through Purposeful Investments.”

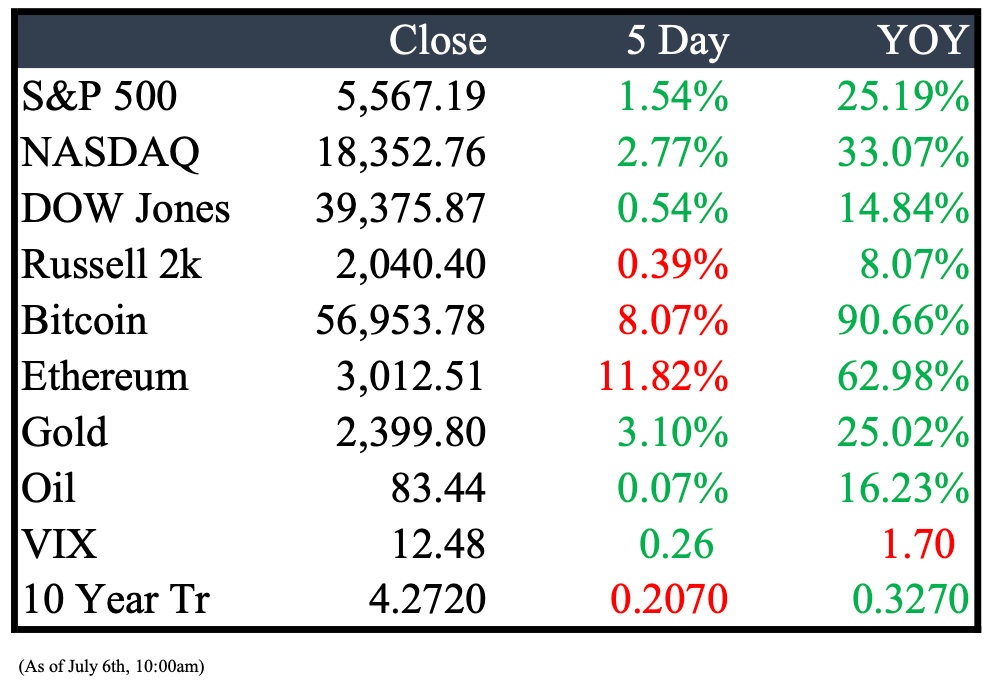

Market Recap

This Week’s Headlines

Economy & World News

Supreme Court Protects Social Media Content Policies: On Monday, the Supreme Court upheld that social-media platforms' content moderation policies are protected by the First Amendment, sidestepping a ruling on Texas and Florida laws restricting Facebook, YouTube, and others. Justice Elena Kagan noted that lower courts hadn't fully analyzed these laws' scope. (WSJ)

Supreme Court Ruling Challenges Federal Agency Authority: In a 6-3 vote, the US Supreme Court allowed a North Dakota store to sue over a 2011 debit-card swipe fee rule, despite opening in 2018, bypassing the six-year statute of limitations. This decision could expose longstanding federal regulations to new legal challenges under the Administrative Procedure Act. (BBN)

Euro Area Inflation Update: Headline inflation in the euro area fell to 2.5% in June, matching analyst expectations, while core inflation remained at 2.9%, slightly above the forecasted 2.8%. (CNBC)

Fed Officials Signal No Rush to Lower Interest Rates: At their June meeting, Federal Reserve officials noted that inflation is moving in the right direction but not quickly enough to lower interest rates. Minutes released Wednesday revealed policymakers' consensus to avoid hastily cutting rates due to insufficient confidence in inflation trends. (CNBC)

USPS Increases Stamp Prices Starting July 14: The price of first-class Forever stamps will rise from 68 cents to 73 cents on July 14, a more than 7% increase, with all services seeing price hikes over 7.5%. These changes are part of the USPS 10-year "Delivering for America" plan, aiming to generate $44 billion in additional revenue by 2031. (USA)

Ukraine in Talks to Supply EU with Azeri Gas: Ukraine is negotiating to supply the EU with natural gas from Azerbaijan to maintain its role as a transit country and enhance European energy security, President Zelenskiy said. This move aims to replace Russian gas, with the current transit agreement expiring at the end of 2024 and negotiations ongoing to utilize the pipeline with a new supplier. (BBN)

Labour Wins 34% of Vote, Conservatives 24%, Smaller Parties Gain 43%: Labour secured 34% of the national vote, while the Conservative Party garnered nearly 24%. Smaller parties, including the Liberal Democrats, Reform U.K., and the Greens, collectively took 43% of the popular vote but obtained less than 18% of the seats. (CNBC)

Disney Heiress Withholds Donations Until Biden Drops Out: Abigail Disney, an heiress to the Disney fortune, will withhold donations to Democrats until President Joe Biden drops out of the race, despite Biden stating he has no plans to withdraw. Additionally, Gideon Stein has paused $3.5 million in planned donations. (CNBC)

Nigel Farage Wins Seat in U.K. Parliament After Seven Attempts: Nigel Farage has finally won a seat in the U.K.'s parliament after seven failed attempts. Following his victory, Farage announced plans to build a national movement to challenge the general election in 2029. This win coincides with a strong performance by Reform UK, known for its hardline stance on immigration. (CNBC)

Nonfarm Payrolls Rise by 206,000 in June, Unemployment Rate Hits 4.1%: Nonfarm payrolls increased by 206,000 in June, surpassing the 200,000 Dow Jones forecast but below May's revised 218,000 gain. The unemployment rate unexpectedly rose to 4.1%, the highest since October 2021. Average hourly earnings grew 0.3% for the month and 3.9% year-over-year, matching estimates. (CNBC)

Iran Elects Reformist President Masoud Pezeshkian: In a significant turnout increase, Iranians elected Masoud Pezeshkian, a 69-year-old surgeon, as president with over 53% of the vote. Pezeshkian, a reformist advocating for re-engagement with the West and easing moral codes for women, defeated hard-liner Saeed Jalili. Turnout rose to 49.8%, up from 40% in the initial election, marking the first reform candidate win in two decades. (WSJ)

EU Labels Meta's Subscription Model as "Pay or Consent": The European Commission criticized Meta's ad-supported subscription model, where users either pay for ad-free access or consent to data processing for personalized ads. Introduced in response to privacy concerns, this model for Facebook and Instagram in Europe could result in Meta facing fines up to $13.4 billion if found in breach of EU antitrust rules. (CNBC)

France Faces Potential Political Turmoil with National Rally: Critics warn of a political catastrophe if the anti-immigration, nationalist, and eurosceptic National Rally wins a majority in the upcoming parliamentary election. Political analysts fear civil unrest if the far-right enacts policies penalizing certain groups, while ordinary voters are deeply concerned about the increasing polarization in French society and its impact on the country's future. (CNBC)

Public Markets

BYD Poised to Overtake Tesla in EV Sales in 2024: According to a new report, Chinese EV giant BYD is set to surpass Tesla in battery EV sales next year, highlighting the dynamic global EV market. Despite leading in total production last year, BYD lost the top EV vendor spot to Tesla in the first quarter. (CNBC)

Salesforce Investors Reject Executive Compensation: Salesforce investors declined to approve executive compensation, defying the board's recommendation, due to concerns about a second equity award for CEO Marc Benioff in January. The vote is nonbinding. (CNBC)

EU Charges Meta for Breaching Digital-Competition Law: The European Union charged Meta with violating its new digital-competition law, stating that the company's pay-or-consent model for Facebook and Instagram users doesn't provide adequate choice. Meta introduced this model to comply with the EU’s Digital Markets Act, but the European Commission deemed it insufficient on Monday. (WSJ)

Redbox Owner Files for Bankruptcy with $1 Billion Debt: Chicken Soup for the Soul Entertainment, owner of Redbox and various streaming services, filed for chapter 11 bankruptcy protection, citing nearly $1 billion in debt. The company, which owes creditors including Walmart, Walgreens, Warner Bros., and Sony Pictures, took on about $360 million in debt when it acquired Redbox in 2022. (WSJ)

Italian Raids Reveal Exploited Labor in Luxury Goods Production: Raids in Italy have uncovered the exploitation of foreign labor in factories producing handbags for Dior and Armani. Milan prosecutors found that Dior paid €53 ($57) to assemble a handbag sold for €2,600 ($2,780) and Armani bags were resold for €250 before being priced at around €1,800 in stores, highlighting the stark contrast between production costs and retail prices. (WSJ)

Delta Apparel Files for Bankruptcy, Plans to Sell Salt Life Brand: Delta Apparel filed for chapter 11 bankruptcy, announcing plans to sell its Salt Life brand for $28 million to FCM Saltwater Holdings. The company, facing market and liquidity challenges, warned shareholders of significant losses, with shares plummeting 33% to 39 cents before trading was halted. (WSJ)

Stellantis Temporarily Lays Off 1,600 Workers: Stellantis announced that its Warren Truck Assembly Plant near Detroit will operate on a single shift for at least the next month, leading to a temporary layoff of approximately 1,600 workers. (AN)

Toy Maker Basic Fun Files for Bankruptcy: Basic Fun, the maker of Lincoln Logs and Tinker Toys, filed for chapter 11 bankruptcy after financial struggles post-Toys 'R' Us closure and the Covid-19 pandemic. The Boca Raton-based company aims to restructure debts, with assets and liabilities estimated between $50 million and $100 million. (WSJ)

FDA Approves New Alzheimer's Drug from Eli Lilly: The FDA approved Eli Lilly's Alzheimer’s drug, donanemab (Kisunla), which has shown in trials to modestly slow memory and cognitive decline. The monoclonal antibody infusion, given every four weeks, targets brain amyloid and is approved for adults with mild cognitive impairment or early Alzheimer’s, providing an additional treatment option alongside last year's approval of Leqembi. (NBC)

Skydance Media Nears Acquisition of National Amusements: Skydance Media's acquisition of theater operator National Amusements, which controls Paramount Global, could be finalized by Monday. Parties are working through the weekend to complete the deal ahead of Allen & Co's annual tech and media summit starting Tuesday in Sun Valley, Idaho, typically attended by Paramount Global Chair Shari Redstone. (REU)

Meta's Threads Reaches 175 Million Users Ahead of First Anniversary: Meta Platforms' social media app Threads has surpassed 175 million monthly active users, CEO Mark Zuckerberg announced. Launched on July 5 last year to compete with X (formerly Twitter), Threads initially gained 100 million users in under a week, thanks to easy setup via Instagram, though some early users later dropped off. (REU)

Study Links Ozempic and Wegovy to Potential Eye Condition Risk: A study in JAMA Ophthalmology suggests that Ozempic and Wegovy users may face an increased risk of developing non-arteritic anterior ischemic optic neuropathy (NAION), a debilitating condition causing irreversible vision loss. Senior study author Dr. Joseph Rizzo likened NAION to a "stroke of the optic nerve," emphasizing the need for further research to confirm the connection. (CNBC)

Real Estate

Boyne Resorts Faces Price Gouging and Fraud Lawsuit: Over 100 condo owners at three Northern Michigan Boyne resorts filed a class action lawsuit on July 1 against Boyne USA Inc. and its management company, alleging price gouging and fraud. The plaintiffs seek over $5 million in damages, claiming Boyne enforced exclusive rental management contracts with unreasonable costs and high fees. (CRAIN)

Detroit Secures $20.7 Million Grant for Trail Connection: A $20.7 million federal grant will connect the Joe Louis Greenway in Detroit to the statewide Iron Belle Trail, providing a safe route for children to walk to school. Announced by the U.S. Department of Transportation, the project aims to unite communities and enhance local infrastructure. (CRAIN)

Starwood Capital's Withdrawal Limits Spark Investor Concerns in Real-Estate Funds: Starwood Capital Group's decision to tighten withdrawal restrictions on its $10 billion real-estate fund has caused a ripple effect across the $90 billion private real-estate fund industry. Following the announcement in May, similar funds saw a spike in redemption requests from investors fearing similar restrictions. However, firms like Blackstone have reported a stabilization in withdrawals, with June redemptions slightly below April levels, indicating an improvement after the initial surge in May. (WSJ)

Big Banks Bear Scars from Commercial Real Estate Woes: While commercial real estate troubles are often associated with smaller banks, larger banks are currently showing more significant impacts. Despite this, the stock market reflects a different trend, with the KBW Regional Banking Index down 12% this year, while the KBW Nasdaq Bank Index of larger lenders is up nearly 9%. Smaller banks hold over a quarter of U.S. commercial real estate and multifamily debt, more than double that of the top 25 banks. However, the complexity and variability of CRE loans make them challenging to assess uniformly across the banking sector. (WSJ)

Mergers & Acquisitions

Hoffmann Family Acquires Second Mackinac Island Ferry Service: The Naples-based Hoffmann Family of Companies completed the purchase of Star Line Mackinac Island Ferry Company, adding to their acquisition of Shepler's Ferry two years ago. Billionaire founder David Hoffmann, who hails from humble beginnings in Washington, Missouri, now controls both ferry services to Mackinac Island. (NDN)

Mod Pizza Hires Advisers for Potential Bankruptcy and Sale: Mod Pizza, known for its build-your-own pizza concept, has hired legal and financial advisers, including Latham & Watkins and Miller Buckfire, to explore options like a business sale or bankruptcy filing. Facing cash shortages, the Seattle-based chain is seeking financing, including a potential bankruptcy loan, to improve its capital structure. (WSJ)

Saks Fifth Avenue to Acquire Neiman Marcus for $2.65 Billion: Hudson's Bay Co., owner of Saks Fifth Avenue, is acquiring Neiman Marcus Group for $2.65 billion, merging America's top high-end department stores. Amazon and Salesforce will take minority stakes in the newly formed Saks Global, while HBC raises $2 billion from investors and affiliates of Apollo Global Management provide $1.15 billion in debt financing. (BBN)

BlackRock Acquires Preqin for $3.2 Billion to Boost Alternative Assets: BlackRock Inc. will acquire private capital database provider Preqin for £2.55 billion ($3.2 billion) in cash, enhancing its capabilities in alternative assets. The acquisition will expand BlackRock's Aladdin technology systems, improving risk oversight and data analysis in private markets. "We see data powering the industry across technology, capital formation, investing, and risk management," said Rob Goldstein, BlackRock COO. (BBN)

Earnings

Any suggestions please feel free to reply back to this email.

Thanks for reading, see you next week!

Feel free to share with a friend.

Reply