- Read Sunday Newsletter

- Posts

- Read Sunday☕️ - Launch of Peridot Hedge

Read Sunday☕️ - Launch of Peridot Hedge

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

Market Recap

Peridot Hedge

Dear Valued Subscriber,

I am thrilled to share some exciting news with our newsletter community! On January 1st, 2024, we are launching T.H.E. Fund by Peridot, a groundbreaking hedge fund with a focus on Technology, Healthcare, and Energy investments.

Under the expert leadership of Peridot's founder, William Lemanske Jr, T.H.E. Fund offers a unique investment approach. By concentrating on these three dynamic sectors, we aim to maximize returns while steering clear of fixed income assets and adhering strictly to our core principles.

Having personally integrated this investment structure into my own portfolio over the last four years, I have witnessed its potential first-hand. Especially in a market where the S&P 500's performance is significantly influenced by just a handful of companies, T.H.E. Fund presents a smart diversification strategy. Our approach involves sector weighting based on market conditions and market capitalization, employing a long strategy in equities, and capitalizing on short-term returns through options and futures during periods of volatility.

As subscribers to our newsletter, you have the exclusive opportunity to be among the first to explore potential investment opportunities with T.H.E. Fund. We are beginning to accept investments at the start of the year, and I would be delighted to engage in a more in-depth discussion with you about this.

I believe T.H.E. Fund could be a significant addition to your investment portfolio. If you are interested in learning more about our diverse investment classes and wish to discuss further, please feel free to reach out to me via email.

Now enjoy your Read Sunday,

Founder & CEO, Peridot

William M Lemanske Jr.

This Week’s Headlines

Public Markets

McDonald's plans to increase its capital investment until 2027 to support the expansion of new restaurant openings. Additionally, the company aims to enroll 100 million new members into its loyalty program as a key component of its strategy to boost worldwide sales. (CNBC)

Google has unveiled its largest and most advanced AI model, Gemini, available in three different sizes. During the announcement on Tuesday, executives highlighted that Gemini Pro surpasses the capabilities of OpenAI's GPT-3.5, although they refrained from providing comparisons with GPT-4. Furthermore, Google intends to offer licenses for Gemini to customers via Google Cloud, enabling them to integrate it into their respective applications. Additionally, Gemini will play a vital role in enhancing consumer-facing Google AI applications, such as the Bard chatbot and Search Generative Experience. (CNBC)

Short-seller Carson Block has set his sights on a real-estate finance company overseen by Blackstone. Following the release of a 51-page presentation by Block's Muddy Waters Research, shares in the Blackstone Mortgage Trust, or BXMT, plummeted by as much as 9%. The presentation forecasted potential losses in BXMT's $23 billion portfolio of commercial real-estate loans. (WSJ)

Digital Realty (NYSE: DLR) and Blackstone Inc. (NYSE: BX) are forming a joint venture to develop four hyperscale data center campuses in three metro areas across two continents. Blackstone will acquire an 80% ownership stake in the venture with an initial investment of around $700 million, while Digital Realty will retain a 20% interest. These developments are expected to provide approximately 500 megawatts (MW) of IT load capacity upon full completion, and Digital Realty will manage the development and operations, receiving customary fees. (BX)

Santos, with a market capitalization of approximately 22 billion Australian dollars, recently announced its efforts to explore options for increasing its value during an investor briefing last month. Both companies have emphasized that discussions are still in their early stages, and there is no guarantee that any transaction will materialize at this point. These discussions are part of a broader trend of consolidation within the oil and gas industry. (CNBC)

Yellow has declined an offer to revive the bankrupt trucking company and rehire its thousands of former employees, effectively putting an end to the ambitious attempt to reverse the collapse of one of the nation's largest freight carriers. Lawyers representing Yellow conveyed to the group attempting to resurrect the company in a letter on Wednesday that their bid was deemed "not viable." Yellow is now proceeding with the sale of approximately 130 truck terminals, which garnered nearly $1.9 billion in a bankruptcy auction earlier this month. (WSJ)

Economy

The Biden administration has taken steps to exercise its authority to acquire patents for specific expensive medications. This initiative represents a fresh effort to reduce exorbitant drug prices and foster increased competition within the American pharmaceutical industry. The administration has introduced a new framework that outlines the criteria federal agencies should take into account when deciding whether to employ a contentious policy referred to as "march-in rights." (CNBC)

In November, nonfarm payrolls increased by 199,000, slightly surpassing the Dow Jones estimate of 190,000 and surpassing October's gain of 150,000. The unemployment rate dropped to 3.7%, lower than the expected 3.9%, with a slight rise in the labor force participation rate. Average hourly earnings, a crucial inflation gauge, rose by 0.4% for the month and by 4% compared to the previous year, aligning with expectations. The health care sector experienced the most significant growth, adding 77,000 jobs, while other notable gainers included government (49,000), manufacturing (28,000), and leisure and hospitality (40,000). (CNBC)

Apple and its suppliers are working towards manufacturing over 50 million iPhones in India each year within the next two to three years, with the potential to produce tens of millions more in the subsequent years, as indicated by individuals familiar with the matter. If these plans come to fruition, India would contribute a significant portion, amounting to a quarter, of global iPhone production, and this share is expected to grow even further by the end of the decade. However, China will continue to maintain its position as the largest producer of iPhones. (WSJ)

Mergers & Acquisitions

After emerging from Chapter 11 bankruptcy protection three years ago, the Pennsylvania Real Estate Investment Trust (PREIT) may find itself facing a second round of bankruptcy. The shopping mall operator is teetering on the brink of bankruptcy once again, as reported by Bisnow. PREIT is actively seeking funding to navigate a second Chapter 11 reorganization, a challenging situation brought about by the ongoing impact of the pandemic. (TRD)

AbbVie Inc. (NYSE: ABBV) is set to acquire Cerevel Therapeutics (NASDAQ: CERE), with the deal bringing Cerevel's robust neuroscience pipeline into AbbVie's portfolio. The acquisition, valued at approximately $8.7 billion, includes promising clinical-stage and preclinical candidates targeting psychiatric and neurological disorders, such as schizophrenia and Parkinson's disease. This move aims to address unmet patient needs in these areas, potentially transforming standards of care. AbbVie will host an investor conference call on December 7 at 8:00 a.m. CT to provide further details. (ABBV)

Danish food ingredient and enzyme manufacturers Novozymes and Chr. Hansen are likely to receive approval from EU antitrust authorities for their proposed all-share merger, valued at $22 billion. This approval is expected based on remedies that the companies have offered to address concerns related to competition. Two individuals with direct knowledge of the situation shared this information on Wednesday. (RET)

During the conclusion of the antitrust trial, a federal judge, U.S. District Judge William Young, who is evaluating the U.S. Justice Department's attempt to block JetBlue Airways' $3.8 billion acquisition of Spirit Airlines, suggested on Tuesday that he might consider allowing the deal to proceed if JetBlue agrees to divest more assets. Judge Young expressed concerns that the absence of Spirit Airlines, known for its no-frills, ultra-low-cost approach, could lead to an increase in airline fares, as Spirit plays a role in driving down prices by undercutting competitors. (RET)

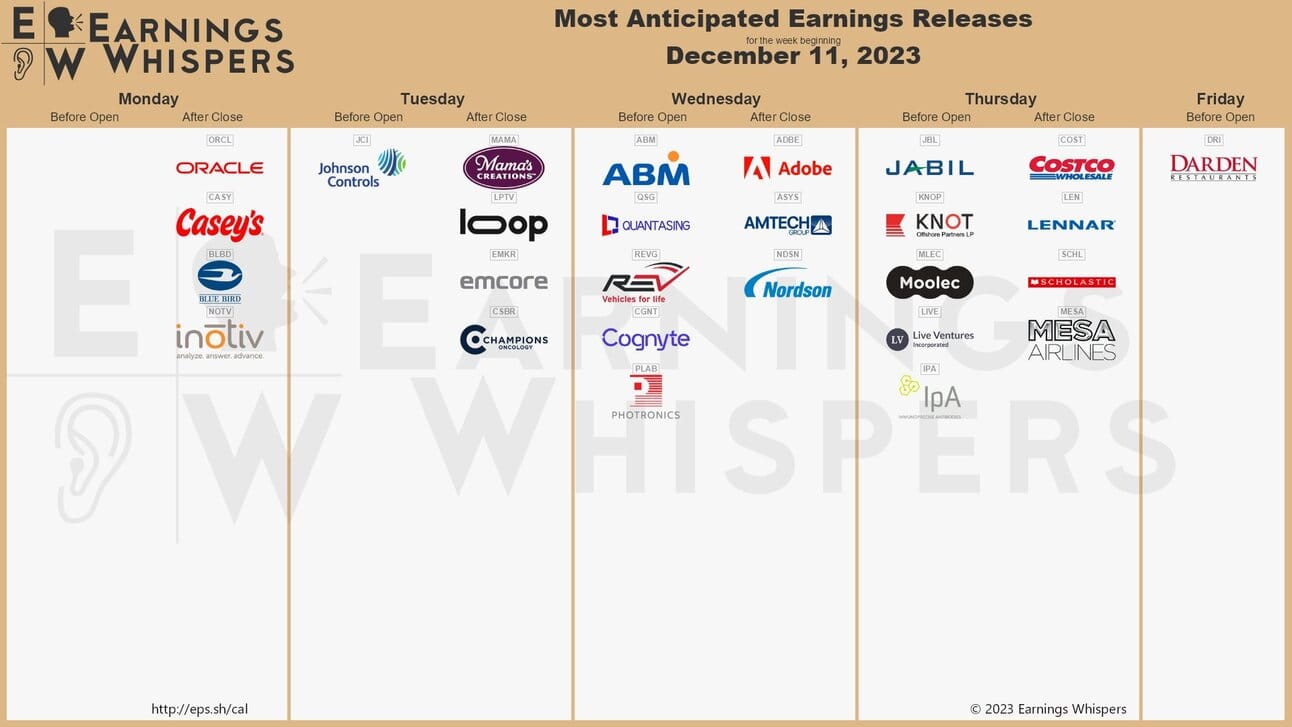

Earnings

Thanks for reading, see you next week!

Reply