- Read Sunday Newsletter

- Posts

- Merry Christmas by Read Sunday☕️

Merry Christmas by Read Sunday☕️

Written by William Lemanske

Welcome to Read Sunday, your essential source for a concise and impactful weekly Business & Finance recap. Dive into the pivotal market highlights from the week, distilled for your convenience, and stay tuned for the thought-provoking editor's piece that rounds off your Sunday with insightful perspectives.

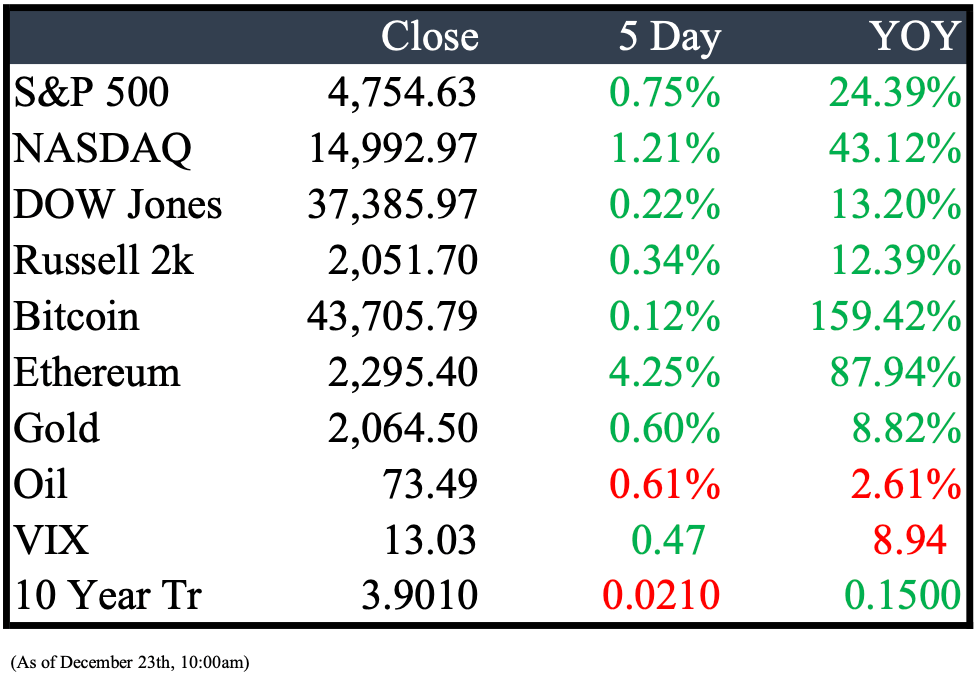

Market Recap

This Week’s Headlines

Public Markets

On Monday, a judge handed down a four-year prison sentence to Trevor Milton for his role in defrauding investors in Nikola, the electric-truck company he had founded. Trevor Milton, who is 41 years old, had been found guilty of multiple fraud charges last year. Witnesses during the trial testified that he had misled regular investors by providing false information about nearly every aspect of Nikola. (WSJ)

Starting this Thursday, Apple will temporarily halt sales of two of its latest Apple Watches due to an intellectual property dispute with Masimo concerning the Blood Oxygen feature. Online sales of the Apple Watch Series 9 and Apple Watch Ultra 2 will be suspended at 3 p.m. on Thursday, and in-store sales will cease after this Sunday. (CNBC)

On Monday, Google announced that it will permit developers on its Play app store to provide direct payment options to users. Additionally, the company disclosed that it will pay $700 million to settle an antitrust lawsuit initiated by state attorneys general. These actions represent Google's response to heightened regulatory scrutiny and an effort to address concerns regarding its market dominance. (NYT)

General Motors (GM) has significantly reduced the size of its Buick dealership network in the United States by around half through a voluntary buyout initiative. This reduction of 1,000 stores aims to boost efficiency and profitability at the remaining dealerships, as stated by Duncan Aldred, the global head of GM's Buick and GMC brands. Buick intends to maintain its buyout program, which has incurred approximately $1 billion in costs for GM up to this point, into the next year. (CNBC)

U.S. oil company ConocoPhillips (COP.N) has officially approved the $8 billion Willow oil and gas drilling project in Alaska. ConocoPhillips CEO Ryan Lance stated, "With this project authorization, we've begun winter construction." However, it's worth noting that environmental and indigenous groups had sought a temporary injunction from a federal court in Alaska in November to halt ConocoPhillips from proceeding with construction on the grounds of preventing immediate cultural and environmental damage. (REU)

Bayer has achieved victory in a trial against a California man who alleged that he developed cancer due to exposure to its Roundup weedkiller. This marks the end of a five-trial losing streak for the company in cases related to similar claims. (REU)

Nike, experienced an 11.83% decrease, has lowered its revenue outlook for the year due to growing concerns about consumer spending caution worldwide. The renowned sneaker and apparel company announced on Thursday that it expects a decline in sales during the second half of the year. In response to these challenges, Nike intends to reduce costs by as much as $2 billion over the next three years by streamlining its organization, workforce reduction, and other strategic actions. As a result of this news, Nike's shares saw a significant drop of nearly 11% in after-hours trading. (WSJ)

Panasonic, represented by the symbol PCRFY and experiencing a 0.72% increase, announced on Wednesday that it has opted not to proceed with the construction of a multibillion-dollar electric vehicle battery factory in Oklahoma. Panasonic is already in the process of building an EV battery plant in Kansas and had considered Oklahoma as a potential second location. The Japanese company also operates a joint-venture EV battery plant with Tesla in Nevada. (WSJ)

Economy

UK inflation fell more than expected, surprising economists who had anticipated a drop to 4.4% after it had already reached a two-year low of 4.6% in October. The decline was largely attributed to reduced prices in transport, recreation, culture, and food and nonalcoholic beverages, prompting speculation about potential interest rate cuts and impacting financial markets. (CNBC)

The University of Michigan has allocated $180 million to support a new venture capital fund led by Sam Altman, the CEO of San Francisco-based OpenAI and an investor. This investment from the university represents a significant commitment, with two substantial checks written for Hydrazine funds. The first was a $105 million investment in Hydrazine's second fund, followed by a recent $75 million investment into Hydrazine's fourth fund, marking two of the university's largest-ever contributions to venture capital funds. (CRAIN)

The ongoing crisis in the Red Sea, which has led to the diversion of 158 vessels carrying approximately $105 billion worth of ocean freight due to the risk of attacks by the Houthis, has caused a significant surge in cargo prices. Despite the recent progress in mitigating COVID-related supply chain disruptions, ocean freight rates are now on the rise, with some trade routes experiencing a 40 percent increase. Container prices have also soared to $10,000, raising concerns among logistics executives about possible "opportunistic" price gouging. Companies like IKEA, which have acknowledged potential delays in product deliveries to stores, are actively exploring alternative freight options. (CNBC)

Mergers & Acquisitions

On Monday, Nippon Steel of Japan successfully secured a $14.9 billion all-cash deal to acquire U.S. Steel, outbidding competitors such as Cleveland-Cliffs and ArcelorMittal for the renowned 122-year-old steel manufacturer. The agreed-upon price for the deal stands at $55 per share, a remarkable 142% premium over the closing price on August 11, which was the last trading day before Cleveland-Cliffs presented their $35-per-share cash-and-stock offer for U.S. Steel. This acquisition reflects a strategic gamble that U.S. Steel will reap the benefits of the spending and tax incentives outlined in President Joe Biden's infrastructure bill. (CNBC)

Adobe and Figma have decided to abandon their proposed merger due to regulatory challenges, as announced by the companies on Monday. "Adobe and Figma hold differing views on the recent regulatory assessments, but we have jointly determined that it is in our individual best interests to pursue independent paths," stated Adobe CEO Shantanu Narayen in a press release. As part of this decision, Adobe will provide Figma with a $1 billion breakup fee, as disclosed in a regulatory filing. (CNBC)

Chobani, the Greek yogurt manufacturer, announced on Friday its acquisition of the ready-to-drink coffee producer La Colombe for $900 million in a strategic move to enhance its presence in the beverage industry. To facilitate this acquisition, Chobani utilized a combination of funding sources, including a newly issued $550 million term loan, existing cash reserves, and the exchange of Keurig Dr Pepper's (KDP) minority equity stake in La Colombe, which was part of the transaction. (REU)

Bristol Myers Squibb (BMY) and Karuna Therapeutics, Inc. (KRTX) have officially announced their merger agreement. Bristol Myers Squibb will acquire Karuna for $330.00 per share in cash, amounting to a total equity value of $14.0 billion, or $12.7 billion after accounting for estimated cash acquired. This agreement has received unanimous approval from both the Bristol Myers Squibb and Karuna Boards of Directors. (BMY)

On Thursday, Harbour Energy in Britain reached an agreement to acquire Wintershall Dea's non-Russian oil and gas assets in a deal valued at $11.2 billion, comprising a combination of shares and cash. This transaction involves co-owners BASF and LetterOne and establishes one of the world's largest independent oil and gas producers. (REU)

Earnings

For the first time since 1997, there will be no corporations with analyst estimates reporting in the final week of the year.

Peridot Hedge

Dear Valued Subscriber,

I am thrilled to share some exciting news with our newsletter community! On January 1st, 2024, we are launching T.H.E. Fund by Peridot, a groundbreaking hedge fund with a focus on Technology, Healthcare, and Energy investments.

Under the expert leadership of Peridot's founder, William Lemanske Jr, T.H.E. Fund offers a unique investment approach. By concentrating on these three dynamic sectors, we aim to maximize returns while steering clear of fixed income assets and adhering strictly to our core principles.

Having personally integrated this investment structure into my own portfolio over the last four years, I have witnessed its potential first-hand. Especially in a market where the S&P 500's performance is significantly influenced by just a handful of companies, T.H.E. Fund presents a smart diversification strategy. Our approach involves sector weighting based on market conditions and market capitalization, employing a long strategy in equities, and capitalizing on short-term returns through options and futures during periods of volatility.

As subscribers to our newsletter, you have the exclusive opportunity to be among the first to explore potential investment opportunities with T.H.E. Fund. We are beginning to accept investments at the start of the year, and I would be delighted to engage in a more in-depth discussion with you about this.

I believe T.H.E. Fund could be a significant addition to your investment portfolio. If you are interested in learning more about our diverse investment classes and wish to discuss further, please feel free to reach out to me via email.

Now enjoy your Read Sunday,

Founder & CEO, Peridot

William Lemanske

Thanks for reading, see you next week!

Feel free to share with a friend!

Reply